The UK’s Green List for Travel

Polite words and phrases such as “a step in the right direction” have been made by every UK-based airline and airport CEO in the last week in a shared image of unity when they must be fuming with the UK Government's approach to reopening scheduled air services.

Millions of people who had planned trips overseas have also been frustrated by a list of twelve countries to which unrestricted travel is allowed; many of which are closed for entry and some are inaccessible unless via a red list transit point, so Portugal is the winner.

For airlines and particularly the network and operational planning teams, last week became a scramble to move capacity across Europe as they were tripped up by final changes to the “Green List”. Advanced whispers of what would and what would not be on the list were either a deliberate diversionary tactic or some last-minute bottling took place. So, how did the airlines adjust their schedules and what were the movements by country?

Everything Is Changing…..And We Do Know Why!

Using the weekly snapshot feature in the OAG Schedules Analyzer we have compared the planned schedules for this week (as filed on the 10 May) with those now filed to see what has changed. We have only focussed on scheduled services to Europe; after all, flying anywhere else is amber at best!

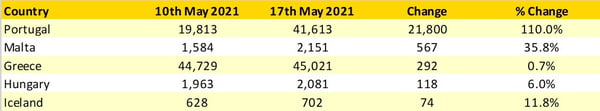

It is always nice to have a table of winners, well in this case just Portugal really. A doubling of capacity highlights just how quickly a change in restrictions can impact a destination's attractiveness, especially when other markets remain partly restricted. The other “Green List” destination to see any change has been Iceland where Icelandair has swapped in a B767 service on one of their three times weekly services.

Table 1 - Top Five Changes in Scheduled Capacity to European Markets

Source: OAG Schedules Analyzer

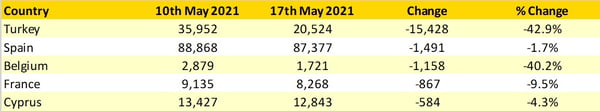

Although Turkey looks like it is the largest loser a spike in Covid-19 cases and restrictions of travel and curfews are as likely to explain the capacity cuts as the traffic lights not working. Spain has seen a small reduction in capacity but perhaps the most revealing point is that a country currently classified as “Amber” continues to have twice as much capacity as Portugal, the clear winner in the “Green List”, work that one out!

Table 2 - Top Five Losers in Scheduled Capacity From the UK

Source: OAG Schedules Analyzer

Ryanair Start to Recover Their Losses

Waking up to a US$989 million loss, Ryanair will be delighted to have added more capacity back to the UK market quicker than any other carrier week-on-week. Adding back more than half of the original planned capacity is some achievement and other airlines have clearly not been as quick to respond; in truth stimulating demand in less than a week would be challenging for most carriers, but perhaps not for Ryanair.

Perhaps the surprise is TAP Air Portugal who presented with a once-in-a-lifetime opportunity appears to have missed at least the first week of that opportunity, and the airline has actually dropped one planned service but upgraded some operations.

Table 3 - Top Five Airline Winners to European Markets

Source: OAG Schedules Analyzer

It’s no surprise that Turkish Airlines lead the list of capacity losers; if the country is top of the list, then the national carrier is likely to be close behind. British Airways are in second place, and Sun Express dropped out of the market completely due to the impact of the pandemic.

Table 4 - Top Five Losers to European Markets

Source: OAG Schedules Analyzer

Early Days & Early Insights

Given that this was the first week of the UK’s green list and that travellers would have had less than a week to make their travel plans, it is no great surprise that there has been little movement as a direct result of the UK Government's announcements. For the airlines trying to understand the algorithm that the policymakers used to identify Green List countries will be important to how they plan ahead of the next scheduled announcement of the list in two week’s time. Given the clarity shared with the industry post the first announcement that may be a very hard challenge for any airline.

.jpg)

.png)