CHINA AVIATION MARKET

Flight Data for China

Explore Chinese Flight Statistics | February 2026

Flight data insights and aviation analysis focused on China's airline market , with data powered by OAG's Schedules Analyser.

Here's an overview of the top statistics from China's aviation market this month:

- The busiest airport: Baiyun International (CAN)

- Top Chinese airline (domestic): China Southern Airlines

- The busiest domestic air route in China: Beijing Capital Airport to Shanghai Hongqiao (PEK-SHA)

- China's biggest city for air capacity: Beijing

- The top country Chinese travellers fly to: Thailand

- Scroll down for more data from each category.

The data is updated monthly. Seats are calculated as departing seats (one-way). The data displayed in the charts below is available to download here.

TOP 10 BUSIEST AIRPORTS IN CHINA | FEBRUARY 2026

Which are China's biggest airports?

- Baiyun International (CAN) remains China’s busiest domestic airport with 3.2m seats, up 15.5% vs last year.

- Shenzhen (SZN) and Beijing Capital (PEK) rank second and third, with 2.8m and 2.7m seats respectively.

- Shanghai Hongqiao (SHA) was the only major airport to see a decline in capacity, down 0.5% vs February 2025.

- READY TO VIEW: The World's Busiest Airports of 2025

WE'LL LET YOU KNOW WHEN NEW DATA IS ADDED

Add your name to the list and we'll email you once a week with a round-up of the new aviation data added to our dashboards, the latest in-depth analysis from our air travel experts, travel technology news, easy to digest infographics and more.

TOP 10 DOMESTIC AIRLINES IN CHINA | FEBRUARY 2026

What are China's Top Airlines?

- China Southern Airlines remains China's busiest airline, holding a 15% share of the domestic market with 10.8 million seats in February 2026.

- In second place is China Eastern Airlines, which also holds a 15% share of the domestic market, with 10.3 million seats.

- Spring Airlines recorded the largest percentage growth, with a 23.8% increase in domestic capacity vs February 2025. Beijing Capital Airlines made the second largest percentage increase, growing by 14.8% vs last year to 1.6m seats.

TOP 10 BUSIEST AIRLINE ROUTES IN CHINA | FEBRUARY 2026

Which are the Most Flown Airline Routes in China?

- Beijing Capital – Shanghai Hongqiao (PEK–SHA) remains the busiest route with 480,700 seats, despite a 10.1% capacity reduction.

- Shanghai Hongqiao – Shenzhen (SHA–SZN) is now the third busiest route, with capacity down 3.7% to 467,300 seats in February 2026.

- Guangzhou Baiyun – Shanghai Pudong saw the fastest growth among the Top 10 routes, up 9.8% vs last year.

CHINA'S BUSIEST CITIES BY AIRLINE CAPACITY | FEBRUARY 2026

Which Chinese Cities are Key For Air Travel?

- Beijing remains the busiest city with 5.1m seats across its two main airports, representing 7% of the market.

- Shanghai ranks second with 4.5m seats, accounting for 6% market share.

- Guangzhou recorded the fastest city-level growth, with capacity up 16% vs last year.

DOMESTIC VS INTERNATIONAL AIRLINE CAPACITY | FEBRUARY 2026

How Much of Chinese Airline Capacity is Domestic?

- Domestic capacity accounts for 83% of all seats to, from and within China this month, with 71.2m seats.

- Overall capacity grew by 8% vs last year, with domestic capacity increasing by 7% and international capacity increasing by 12%.

DISTRIBUTION OF CHINA'S INTERNATIONAL AIRLINE CAPACITY BY COUNTRY | FEBRUARY 2026

Which Countries do Chinese Travellers Visit?

- In contrast with previous months, international capacity to Thailand increased by 23% vs last year, as Chinese carrier capacity is redeployed from Japan. This means Thailand returns to the top spot as the largest international market this month, with 859,800 seats.

- The Republic of Korea is the second busiest international market with 780,300 seats, up 15% vs last year.

- Capacity to Japan fell sharply again, down 47% to 531,300 seats, making it now the 6th busiest international market.

- International capacity increased at the fastest rate to Vietnam and Malaysia by 41% and 38% respectively year-on-year.

TOP 10 PROVINCES BY SEAT CAPACITY | FEBRUARY 2026

The table shows domestic capacity by Chinese Province for this month and the same month last year.

China's Largest Provinces for Air Capacity

- Guangdong Province remains the largest province for scheduled domestic airline capacity, with 7.9 million seats - 11% of all scheduled departing capacity in February 2026. This is 2.8 million more seats than Beijing Province.

- This month, Guangdong also recorded the fastest capacity growth, up 12% year-on-year. Zhejiang, Yunnan and Fujian followed closely, each increasing capacity by 11% compared to last year.

MORE RESOURCES FROM OAG

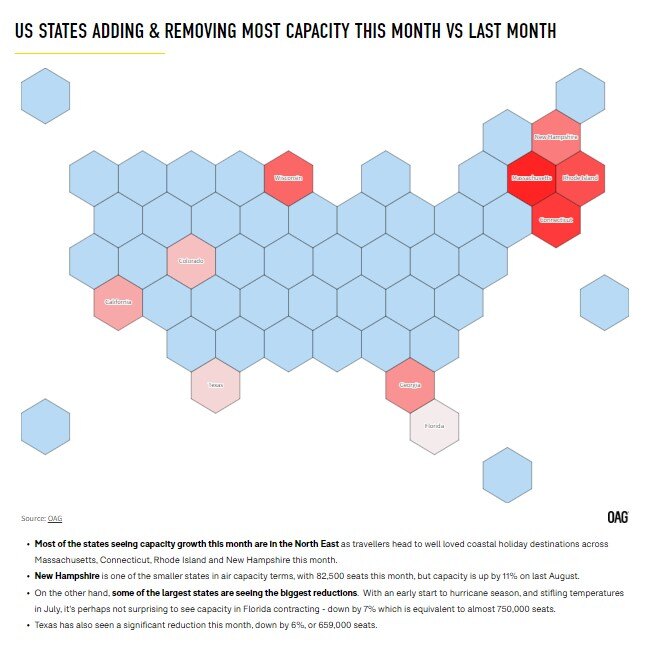

US Aviation Market Data

This month's leading airlines, airports, states and more from the US market.

View Data

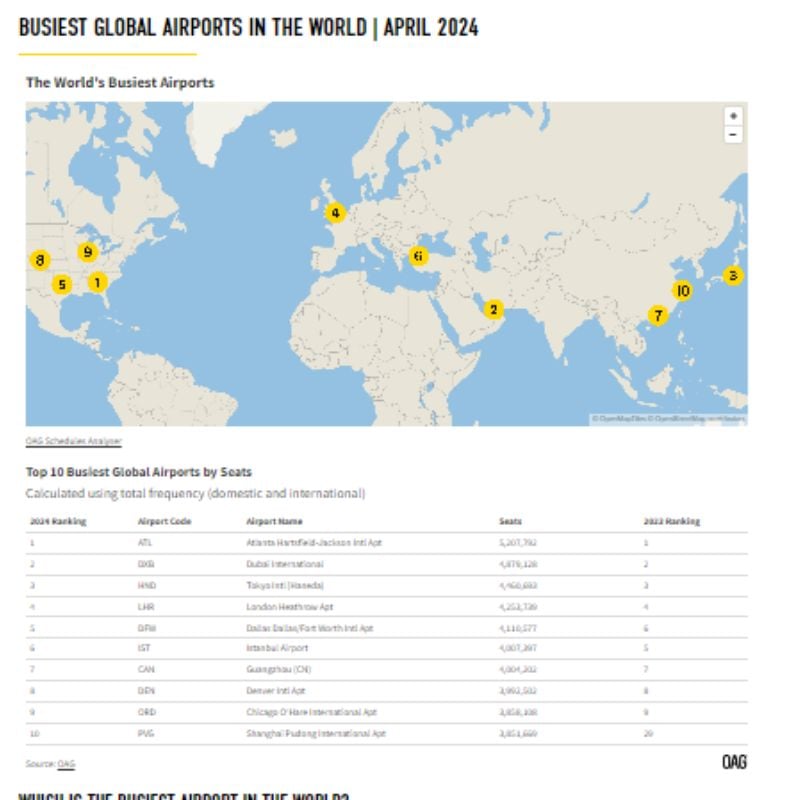

Busiest Airports

Data and analysis on the busiest global, international and regional airports, updated monthly.

View Data

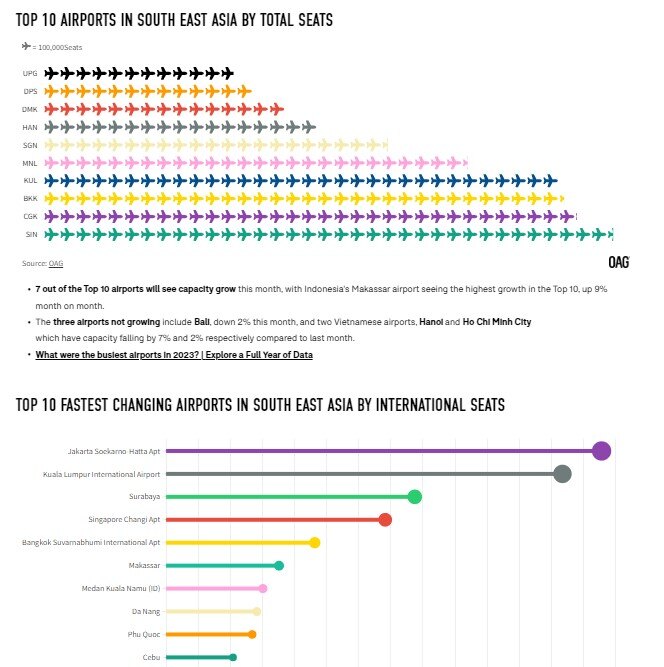

South East Asian Aviation Market Data

SE Asia's biggest country markets, airports, airlines and more are updated each month.

View Data

Aviation Market Analysis

Analysis of the latest data and developments in the aviation world.

Read Now

.jpg)

.png)