AIRLINE FREQUENCY AND CAPACITY STATISTICS

AIR TRAVEL DATA FROM THE EXPERTS

Which is the biggest airline in the world? Which country pairs have most capacity this month? How many flights are there per day, worldwide and what are the latest airline statistics? And how many airlines and airports are in operation? Our Airline Frequency and Capacity Statistics answer all these questions and more with key facts and figures about air travel and global capacity, using flight data from OAG's Schedules Analyser; a cutting-edge platform for airline schedule analysis.

Key Points From February's Airline Frequency and Capacity Data:

- Global capacity is expected to be 459.4m seats in February 2026, a 4.2% increase on last year.

- Mexico – USA remains the largest international country pair in February 2026, with 4.1m seats scheduled this month.

- The USA remains the largest domestic market with 77.5m seats.

- American Airlines remains the world’s largest airline by frequency with 171,121 flights scheduled.

- Emirates is the largest international airline based on Available Seat Kilometers (ASKs)

SCHEDULED FLIGHT COUNTER

FLIGHTS IN THE SCHEDULE 29TH DECEMBER 2025 - 1ST MARCH 2026

Our flight frequency counter shows the number of (one-way) flights in the schedule from Monday 29th December 2025* to the end of the current week. With 6,325,008 flights in total to the end of this week, the average number of commercial flights per day is 102,016.

*The 'year' runs from Monday 29th December 2025 when week one of the schedule starts.

WEEKLY AIRLINE CAPACITY DATA

HOW MUCH AIRLINE CAPACITY IS SCHEDULED THIS WEEK?

This chart shows the most recent weekly global (domestic + international) , domestic and international airline capacity. The dotted line represents capacity in the airlines' future schedules for the next 11 weeks, helping you monitor changes in worldwide airline capacity.

SIGN UP TO WEEKLY CAPACITY UPDATES

We provide a weekly email update on Global, International & Domestic airline capacity, alongside a summary of our popular blogs with expert travel & aviation industry analysis. Sign up for a weekly digest of the best from OAG.

AIRLINE AND AIRPORT COUNT | FEBRUARY 2026

hOW MANY AIRLINES ARE THERE IN THE WORLD?

- In February 2026, there are 718 airlines operating worldwide.

- There are currently 3,920 airports in operation.

TOP TWENTY AIRLINES (FREQUENCY) | FEBRUARY 2026

- American Airlines remains the largest airline in the world by flight frequency and is scheduled to operate 171,121 flights this month—38,808 more than Delta Air Lines, the second-largest airline globally by frequency.

- The fastest-growing carriers this month are China Southern Airlines and Air China, with year-on-year capacity increases of 11.4% and 8.0%, respectively.

- In contrast, five major carriers are showing a year-on-year decline in capacity this month: British Airways (-0.9%), All Nippon Airways (-0.9%), Japan Airlines (-1.4%), IndiGo (-1.5%) and Deutsche Lufthansa (-8.6%).

TOP TWENTY INTERNATIONAL AIRLINES (ASKS) | FEBRUARY 2026

- Emirates is ranked as the largest international airline in the world based on Available Seat Kilometers (ASKs) and is expected to operate 29.7 billion ASKs this month, which is 49% higher than Qatar Airways, the second largest based on international ASKs.

- The three airlines showing ASK growth rates above 20% this month compared to February 2025 are Etihad Airways (+24.7%), China Southern Airlines (+23.1%) and China Eastern Airlines (+20.3%).

- Deutsche Lufthansa AG is the only airline in the Top 20 which is showing a decline in ASKs compared to last year, the airline is down 3.8% to 10.1 billion international ASKs this month.

Count Down Last Month's Most Punctual Airlines

DOMESTIC MARKETS | FEBRUARY 2026

WHERE IS MOST DOMESTIC CAPACITY THIS MONTH?

- The USA remains the largest domestic market in February 2026, with 77.5m seats scheduled - 6.3m more than China, the second-largest domestic market with 71.2m seats.

- The Chinese domestic market is expected to increase by 4.9m seats (+7.4%) this month compared to February 2025, as a result of Chinese New Year moving from the 29th January last year to the 17th February this year, therefore moving the peak domestic demand for travel into February.

- The market showing the largest growth rate on last year is Vietnam, where seats have increased by 14.5%.

- The only Top 10 domestic market with lower capacity than last year is Japan, where seats are down 2% to 10.5m.

TOP TWENTY COUNTRY PAIRS FOR TRAVEL | FEBRUARY 2026

WHICH TWO COUNTRIES VISIT EACH OTHER MOST?

- Mexico – USA remains the largest international country pair in February 2026, with 4.1m seats scheduled this month. This is 1m more seats than the second-largest pair, Spain - UK, which has 3.1m seats.

- The country pair in the Top 20 showing the largest rate of decline is Canada - USA, which is down 10% on last year. This decline in capacity is a result of weakening demand for travel from Canada to the US due to ongoing geopolitical tensions.

- China - Japan has dropped out of the Top 20 country pairs due to a decline of 47% in capacity versus February 2025. This change in capacity is a result of China advising citizens to avoid travel to Japan.

AIRLINE CAPACITY BY REGION | FEBRUARY 2026

WHICH WORLD REGION HAS MOST FLIGHT CAPACITY?

- This month, global capacity is projected to reach 459.4m seats - a 4.2% increase on last year, adding 18.7m seats compared with February 2025.

- The region showing the largest volume growth in capacity compared to last year is North East Asia, which is up 7m seats, with 4.9m of that growth due to an increase in domestic Chinese capacity for the Chinese New Year celebrations.

- Southern Africa continues to record the highest growth rate amongst the IATA regions compared to last year, up 11.8%.

- Meanwhile, the Caribbean is the only one of the 17 IATA regions where capacity has declined, with seats down 1.2%.

FAQs ABOUT AIRLINE FREQUENCY AND CAPACITY STATS

Where are the Frequency and Capacity statistics sourced from?

All data is sourced from OAG Schedules and is for the current month and previous months stated per chart. This global airline industry data is unadjusted for the leap year effect.

How are the frequency and capacity categories on this page defined?

- The scheduled flight counter shows the number of flights in the schedule from the first day of the year up until the end of the current week.

- Weekly airline capacity shows total global (international + domestic) capacity, international capacity and domestic capacity, measured in seats. It is plotted weekly with a forward view of filed scheduled capacity for the 11 weeks ahead, showing the overall 3 months forward-looking position.

- Top 20 Airlines are the 20 largest global airlines by flights based on the current month.

- Top 20 Country Pairs are those international country pairs with most seat capacity based on the current month.

- Domestic Markets are the 10 largest markets by seats.

- Seats by Region is seat capacity for the current month to, from and within each global sub region.

What is airline frequency and why does it matter?

Airline frequency is the number of flights scheduled on a route over a set period. It plays a key role in meeting passenger demand and improving travel convenience. OAG’s air travel statistics show how frequency patterns shift with market trends.

What is airline capacity?

Airline capacity is the number of seats an airline makes available for sale. They will adjust this over time based on demand and trends in the aviation industry.

How does airline capacity differ from passenger numbers?

The exact number of passengers flying will differ from the number of seats available, though we can assume an average load factor (how many seats are filled) of around 83%, although this will be higher for Low Cost Carriers who tend to operate with an average load factor of 90%. Capacity data and passenger numbers will tend to follow the same trend.

What factors influence frequency and capacity planning?

Airlines consider global aviation growth, market demand, route distance, airport slot restrictions, and more to decide how often aircraft should operate, and what size of aircraft to operate on routes.

How do seasonal trends impact airline frequency and capacity?

Seasonal demand surges, such as holidays, or major events can cause spikes in planned airline capacity, while in off-peak periods airlines may reduce both capacity and frequency.

MORE RESOURCES FROM OAG

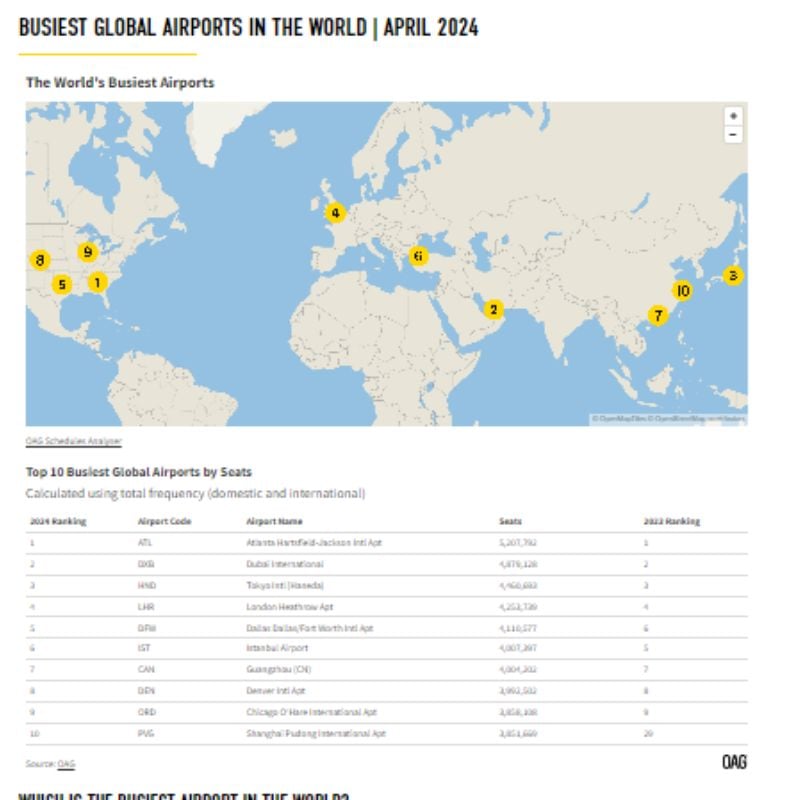

Busiest Routes

Data and analysis on the busiest global, international and regional airports, updated monthly.

View Now

Aviation Market Analysis

Analysis of the latest data and developments in the aviation world.

Read Now

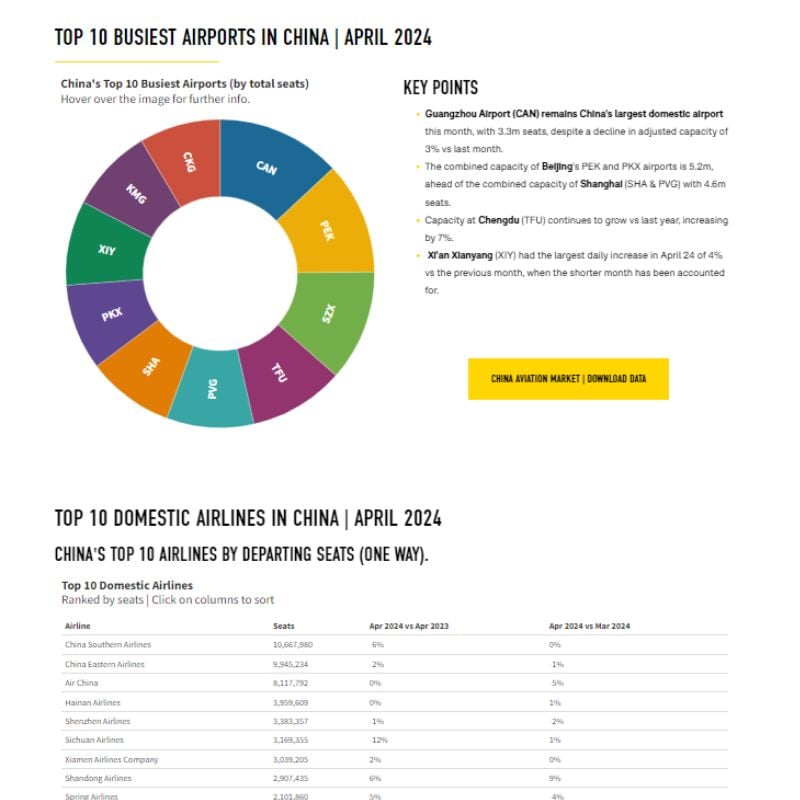

China Aviation market Data

The busiest airports, largest airlines, biggest cities for airline capacity and more

View Data

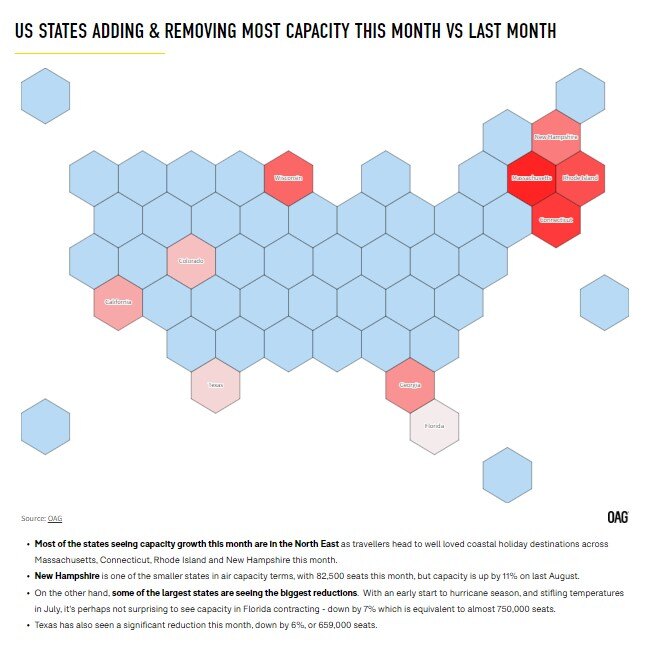

US Aviation Market Data

This month's leading airlines, airports, states and more from the US market.

View Data

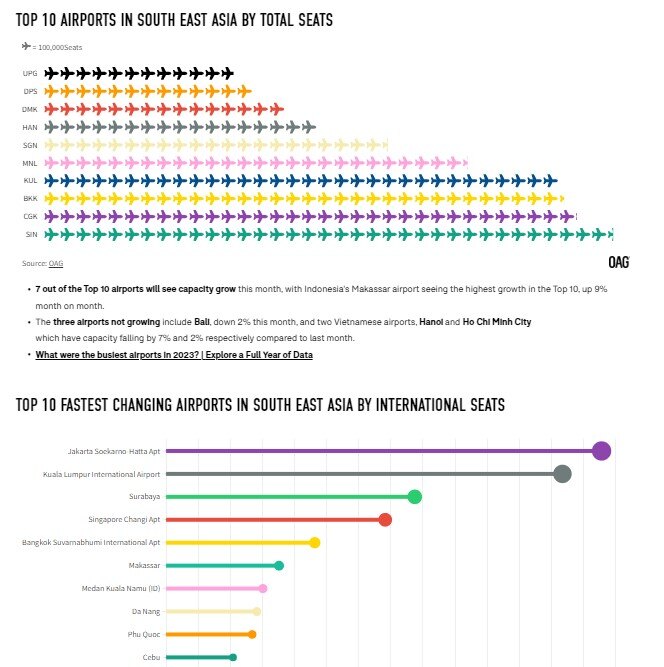

South East Asian Aviation Market Data

SE Asia's biggest country markets, airports, airlines and more are updated each month.

View Data

.jpg)

.png)