Latin America Aviation Market

Monthly Latin American Airline Data Updates

Discover the Busiest Airports and Airlines in Latin America This Month | march 2026

How much airline capacity is there in Latin America? Find out with new data each month.

Here are some of the top statistics from Latin America's aviation market this month:

- Overall capacity: 55.6 million seats (+2.8% vs last year)

- Largest airline: LATAM Airline Group (9m seats)

- Busiest airport: Bogota (2.6m seats)

- Largest international destination region: Lower South America (18.1m seats)

Airline Capacity in Latin America | march 2026

In Latin America this month there are 145 airlines with scheduled capacity and 504 airports

How much airline capacity is there in latin america?

- Overall capacity for Latin America has increased by 2.8% to 55.6 million seats in Mar 26.

- Domestic capacity grew by 3.5%, whilst international capacity grew by 2% vs last year.

- Mainline carriers represent 64% of the market and grew by 2.8% vs Mar 25, whilst LCCs grew by 2.6% year on year and account for 19.9 million seats.

*As of July 2025, international capacity is reported on a two-way basis (previously one-way departing).

WE'LL LET YOU KNOW WHEN NEW DATA IS ADDED

Add your name to the list and we'll email you once a week with a round-up of the new aviation data added to our dashboards, the latest in-depth analysis from our air travel experts, travel technology news, easy to digest infographics and more.

Country Aviation Markets in Latin America | march 2026

Which Latin American Country Has The Most Airline Capacity (Domestic + International)?

- Brazil remains the largest country market with 12.5m seats, growing by 7.9% vs last year.

- Capacity in Panama grew at the fastest rate of 10.2% vs last year, followed by Brazil which grew by 7.9% and Argentina by 7.8%.

- Volume wise capacity in Chile reduced most again this month by 96,700 fewer seats this month.

Which Latin American Country Has THE Most DOMESTIC Airline Capacity?

- Brazil is the largest domestic market with 10.8 million seats, increasing capacity by 7.7% (775,000 additional seats) vs last March.

- Domestic capacity in Venezuela decreased again this month by 5.2% (15,000 fewer seats) vs March 25.

- Domestic capacity declined by 108,800 seats in Bolivia vs last year and by 83,400 seats in Chile.

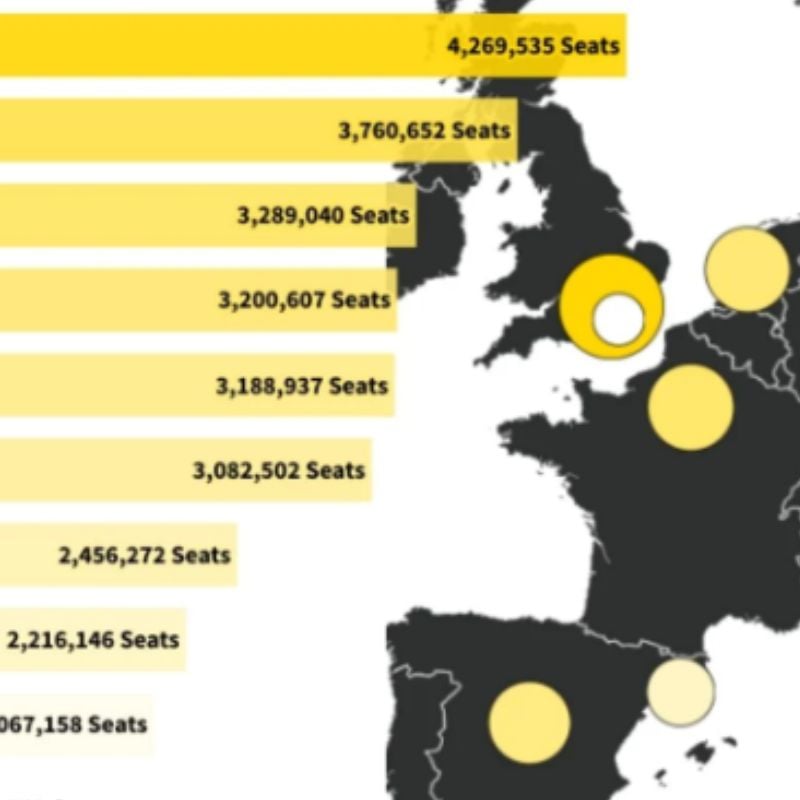

Top Ten Busiest Airports by Departing Seats in Latin America | March 2026

Which is the Busiest Airport in Latin America?

- Bogota remains the busiest airport in Latin America with 2.6m seats.

- Strongest growth within the top 10 largest airports in the continent came again from Rio de Janeiro with 18% vs Mar 25, followed by Panama with an increase of 11.1%.

- There are 516 Latin American airports this month with scheduled capacity, and 152 airlines operating in Latin America.

- READY TO VIEW: The World's Busiest Airports of 2025

Airline Capacity by Region | March 2026

Which Region of Latin America Has Most AIRLINE Capacity?

- Lower South America is the largest market with capacity to/ from the region of 18.1m seats. Year on year it has increased by 6.2%, equivalent to an increase of 1m seats.

- Central America is the second largest market, adding 471,300 seats to reach 13.3m seats in Mar 26.

- Connectivity Across the Continent: A Deeper Look at Latin America | Read Now

Where do flights from Latin America go?

- North America is the largest market with 13.9m seats, 375,500 additional seats vs Feb 25.

- Capacity within Latin America is the next largest market with 6.5m seats, increasing by 345,200 seats vs last year.

- Whilst remaining small markets, international capacity to the Middle East grew, and Asia Pacific and Africa grew at the fastest rates of 26%, 234% and 15% respectively vs last year.

Top Ten Airlines in Latin America (Departing Seats, One-way) | march 2026

Which is the biggest airline in Latin America?

- The LATAM Airline Group remains the largest airline with 9m seats, and increased capacity this month by 6.9% (584,600 additional seats).

- Jetsmart made the largest percentage increase in capacity again this month of 29.2% (383,900 additional seats). Followed by Copa Airlines and GOL with a 13.5% and 11.7% increase respectively.

- Azul Airlines continue to reduce capacity by 0.3% (11,400 fewer seats) vs Mar 25.

MORE RESOURCES FROM OAG

China Aviation market Data

The busiest airports, largest airlines, biggest cities for airline capacity and more

View Data

US Aviation Market Data

This month's leading airlines, airports, states and more from the US market.

View Data

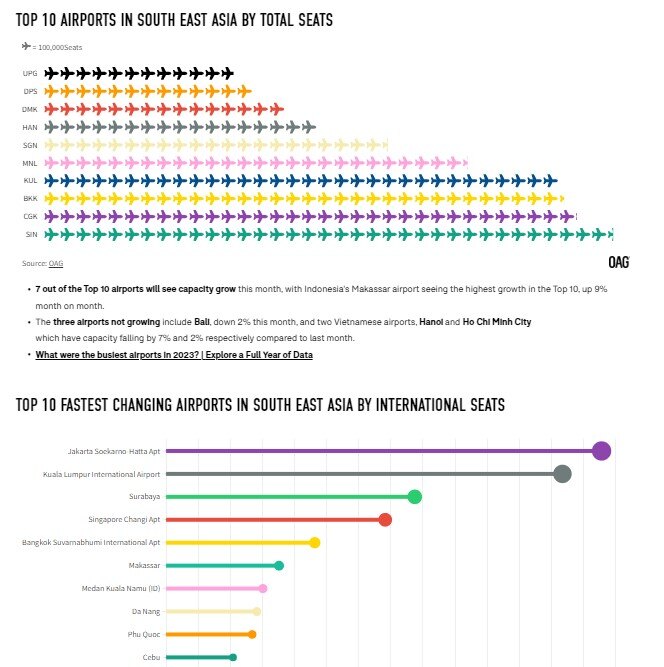

South East Asian Aviation Market Data

SE Asia's biggest country markets, airports, airlines and more are updated each month.

View Data

Aviation Market Analysis

Analysis of the latest data and developments in the aviation world.

Read Now

.jpg)

.png)