This article is the first in a series of monthly posts decoding the fundamental technology transition currently underway in the airline industry. We hope the insights garnered in this series will help industry professionals across the entire airline tech ecosystem, including airline managers, innovation managers at travel IT providers, and startup founders of emerging Travel Tech companies, see the emerging opportunities coming with this exciting shift.

In the airline value chain, there is a major transition taking place.

At the moment, two systems are running in parallel:

One is a historically-grown legacy system that the industry has relied on for decades. While it is still relatively strong and necessary, this system was created for an older generation of technology users and is complete with outdated user interfaces and limited flexibility. Some legacy components in use today date back to the 1970s, making them less functional in today’s industry and presenting a possible risk for data security and IT outages, see the Southwest failure. Additionally, this system can be challenging to update or replace when newer technologies emerge, requiring significant effort and resources to operate correctly. Finally, this legacy system may not be able to integrate with newer third-party software solutions that airlines need to remain competitive in today’s market.

Another is a modern, dynamic, and adaptive system that will enable a better future for airlines and travelers alike. This modern system offers improved usability, scalability, and cost savings compared to its legacy counterpart. It is designed with today’s users (airlines) and end-users (travelers) in mind - those who expect intuitive user interfaces and features, such as customization options and detailed analytics. The system runs on modern, cloud-native software solutions that can easily integrate with other business applications so airlines can gain real-time insights into customer behavior or make decisions based on data-driven analytics results. Finally, the new system is easier to maintain than its legacy counterpart, which can save airlines time and money in the long run by avoiding costly repairs or upgrades down the road.

Two Major Trends Are Driving This Transition

This new system, which doesn’t just refer to the airline industry’s IT infrastructure, as we will explore later on, is driven forward by two underlying trends that are closely intertwined:

- New technologies allow airlines to offer products in more flexible ways. One example is NDC (New Distribution Capability), which enables more individualized inventory packaging through indirect channels. However, there are many more instances out there, such as modern software solutions that leverage machine learning and enable better techniques to predict and serve traveler demand. A company like Hopper, for example, analyzes billions of historical price points associated with flights to accurately predict future air travel ticket prices. In turn, such a company outperforms the forecasting abilities of many airlines, which continue to use classical ways of modeling passenger demand.

- Changing customer needs is another major trend. Nowadays, travelers expect new products, such as CO2 offsetting and cancellation insurances, to be consistently available at the click of a mouse. Today’s travelers are used to buying everything they need on Amazon with ease. The airline retail experience, in comparison, feels outdated, and this needs to change. Customers expect to buy airline tickets and related services with the same convenience they find on other e-commerce platforms. This puts pressure on airlines to enable better customer experiences. On a similar note, travelers are no longer willing to accept being stuck in airlines’ customer service hotlines for hours in cases of flight disruptions like cancellations to re-book their flights or request reimbursements. The digital traveler of today demands immediate digital self-service.

A New Breed of Travel Tech Companies

Together, these trends have led to a rapidly growing ecosystem of Travel Tech companies, many of which are startups, aiming to own the end consumer via customer-facing mobile apps.

We will explore many of these big and small tech players in more detail in this article series that will stretch over the next six months. Here is a sneak peek.

Most of these Travel Tech players are leveraging digital technologies, such as Machine Learning and AI, to serve customers in ways the legacy system simply won’t allow. These companies have set out to try and untangle airlines from old, clunky tech systems. Instead, they want to provide innovative software solutions that can revolutionize how things are currently done.

More importantly, these tech companies can leapfrog the entire airline industry towards a modern, dynamic, and customer-friendly system in near-exponential ways.

Overall, this accelerating transition is transforming all major steps of the airline value chain.

In fact, as we indicated earlier, it refers to more than just the IT stack of the airline industry.

The system transition also affects how physical aircraft are powered through the air, as in the case of Sustainable Aviation Fuel (SAF). This “technology” is increasingly replacing conventional jet fuel amid rising sustainability concerns among travelers (and the public). Also, in this space, a rapidly growing ecosystem of startups and innovative corporations is pushing for progress.

However, the system transition predominantly focuses on the customer-facing (retail-) side of the airline business. How flights are offered, packaged, sold, and also re-booked in cases of flight disruptions is changing dramatically, which will benefit airlines and travelers alike. The way data is shared among major industry stakeholders like airlines and airports is also transforming rapidly, enabling a more seamless travel journey.

Airlines Are Hesitant To Drive Change

As a whole, the aviation industry has a natural risk aversion. Given this, airlines remain hesitant to fully move away from the legacy system. This is mainly due to the misconception that said system provides greater stability since it has existed for a long time.

“Developments in technology have enabled the industry to transform their traditional processes and embrace change. However, legacy systems have remained resilient in the face of innovation,” argued Nasly Yoosuf, co-founder and CTO of Avtra, one of the many innovative software solution providers trying to disrupt the industry.

The airline industry has long been a notoriously low-margin business which is unlikely to change anytime soon, despite U.S. airlines expecting to generate a record profit of USD1 per passenger in 2023. Therefore, airlines tend to stay away from more radical transformation efforts. For such significant change to occur, initial investments are required, ones that do not pay off immediately.

As 2023 progresses, it becomes more apparent that the airline industry can no longer wait to shake things up. Many of the most recent IT outrages support the notion that the perceived better stability of the legacy system is a significant misconception.

Cynics have started labeling the dependency of airlines on legacy systems the “Southwest Syndrome.” As time marches on, this syndrome is affecting more and more airlines around the world. The legacy systems currently running will continue to be stress-tested in unprecedented ways, especially with rising numbers of air travelers in the future. On top of this, external shocks, such as extreme weather events and labor strikes, will likely lead to more unexpected disruptions of airline operations on a more frequent basis. In turn, these disruptions will demand more agile systems. Given this, it's high time airlines embraced a new system with a more robust technology stack.

The benefits that come with these systems will lead to not only better-performing operations but also happier customers.

Recommended:

The Right Offer at the Right Time

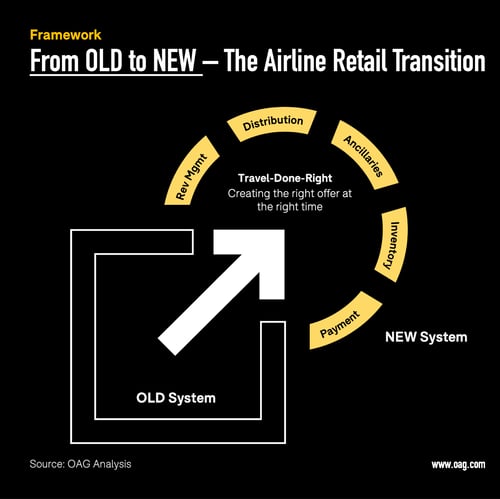

This paradigm shift towards “Airline Retail of the Future” will ultimately enable a new system, which can be best described as

Travel Done Right: Creating the right offer at the right time

What do we mean by this? Here’s one concrete example related to this transition, which is specifically tied to airline ticket sales:

Old System: For the longest time, airline tickets and respective ancillary add-ons, such as extra legroom and additional baggage allowance, were historically offered by airlines at one or two pre-defined touchpoints during the travel journey. This happened when people booked their flights (online or in-person) or when speaking to an airline agent at the check-in counter. The available buying options were limited, defined by existing rules in the industry, such as existing network agreements between airlines. This meant travelers could only choose from a limited combination of flight legs.

New System: However, since the onset of the Travel Tech Transition, air travel tickets and ancillary services can now be purchased more flexibly during the entire travel journey. This can happen when travelers are at the gate, as in the case of seat upgrades via Plusgrade. As well, it can take place in fully flexible combinations, such as across airlines without a network agreement, which is the case when it comes to Virtual Interlining. The same is true for more flexible payment schemes, such as buy-now-pay-later models, which were unavailable to customers just a few years ago.

There are many more examples like this that we want to explore in more detail.

And they will become much more obvious and important given that the transition towards “Travel Done Right” is just getting started.

The Outlook for What’s To Come

At present, many in the industry still struggle to see the benefits of this new system, while others simply don’t have the financial means to kick off the transition. Given this, we want to explore the “Travel Done Right” transition in a structured way with concrete examples and use cases.

For this, we will analyze the system transition along six major airlines' (primary) business activities.

In each category, a growing number of startups and tech players are disrupting the legacy system, leading to newer, more flexible, and customer-friendly ways of doing business.

Data is what ties all of these emerging software providers together.

So, in the OAG spirit - as we build the bridge for many of these emerging companies to effectively work together with our own data services - we will focus on presenting the startup prodigies with the most advanced data capabilities in each segment.

Over the next few months, we will go through each category and speculate on how the new system will precisely shape the airline retail model of the future.

Stay tuned for more updates in the weeks to come. Below is the order in which we will analyze the airline value chain:

- Airline Revenue Management - and its transformation to order management.

- Airline Distribution - which is changing from indirect to direct booking as well as from traditional GDS-led distribution to NDC.

- Airlines Ancillaries - where we witness a trend from up-selling to right-selling.

- Airline Inventory - network agreements are increasingly undermined by virtual interlining as well as intermodality.

- Airline Payments - the industry is transitioning from fixed to flexible purchasing schemes.

.jpg)

.png)