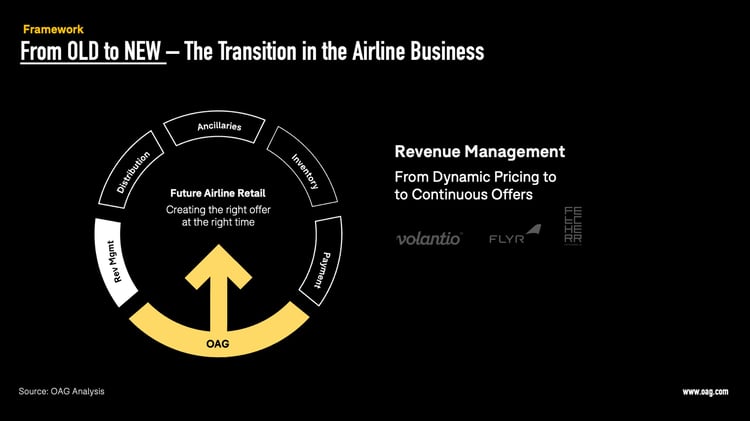

This is the second article in our series decoding the fundamental technology transition underway in the airline industry. Today’s post explores the future of revenue management as one integral pillar of the airline retail transition and the emerging opportunities coming with this exciting shift.

The airline industry is experiencing a massive overhaul, transforming its value chain to embrace new technologies and shifting customer expectations. This shift is critical in order to scrap outdated and clunky legacy systems that create headaches for staff and passengers alike.

Now, airlines are moving towards more flexible, real-time, and future-ready cloud-native solutions.

Why start with revenue management?

Revenue management is a critical component of how airlines make money. From pricing to inventory control, revenue management plays a critical role in ensuring that airlines maximize their profits. As the industry shifts, it's only natural that this crucial function will get a refresh.

Discover how cutting-edge technological solutions that enhance capacity optimization, customer segmentation, pricing strategies, and forecasting accuracy are becoming increasingly important for airlines to gain a competitive edge.

In this article, we will explore how this transition affects the revenue management of airlines. Here’s what we will do:

- Briefly explain what revenue management is and lay out how the airline industry has played a role in shaping this topic over the past few decades.

- Explore the future of airline revenue management and its transition toward continuous pricing that leverages the power of real-time data.

- Present some of the most exciting emerging tech companies that are driving the evolution of next-gen revenue management.

What Is Revenue Management?

Airlines' revenue management role is to analyze and forecast the demand for each flight and set prices accordingly.

This job involves using complex statistical models and historical data to forecast the demand for each flight and then setting optimal prices for each seating class. Modern revenue management systems consider not only historical data but also future data. Future data can include a variety of different sources, such as social media activity, search and weather data. By analyzing this data in real-time, airlines and their pricing algorithms can gain a more comprehensive understanding of customer demand and market conditions, and adjust pricing and inventory levels even better.

The result of this process is a finely tuned pricing strategy that fills as many seats as possible without risking over- or underbooking. This helps airlines optimize their revenues by selling more seats at higher prices during peak periods and selling fewer seats at lower prices during off-peak periods.

In a nutshell, revenue management plays a critical role in the financial success of airlines, helping them increase revenue, reduce costs, and maximize profitability. With robust data feeds that allow real-time pricing adjustments on the fly, airlines can better manage their resources and stay competitive.

The Role of Dynamic Pricing

Dynamic pricing has long been a key component of revenue management for airlines. It allows them to adjust prices based on changes in demand and other market factors.

For airlines, dynamic pricing means that ticket prices can change frequently based on various factors, such as adjustments in capacity and flight frequencies, competitors' routing, time of day, day of the week, seasonality, and even the weather. For example, if demand for a particular flight is high, the airline may increase the price of the remaining seats to maximize revenue. Conversely, if demand is low, the airline may lower the price of the remaining seats to attract more customers.

Dynamic pricing helps airlines achieve a more optimal balance between supply and demand. By constantly adjusting prices based on market conditions, airlines can maximize their revenues and fill as many seats as possible. This is especially important in the highly competitive airline industry, where profit margins are often slim and demand can fluctuate rapidly.

Airlines as the “Perceived” Inventors of Dynamic Pricing

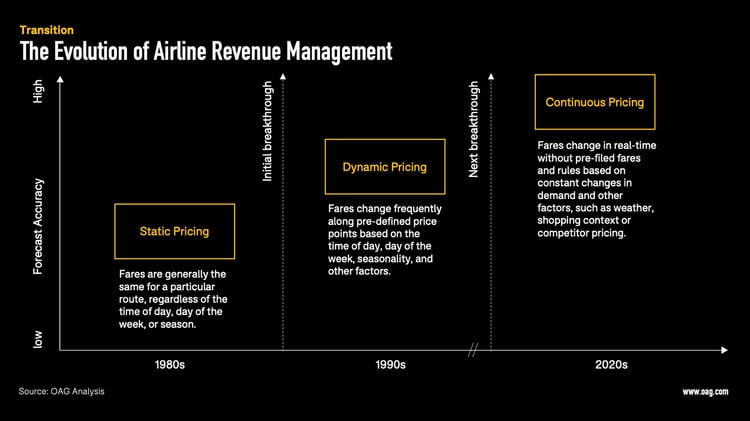

While airlines did not invent the concept of dynamic pricing per se, the airline industry was one of the first to adopt dynamic pricing on a grand scale. Many consider airlines to have been at the forefront of making revenue management what it is today.

Here is how it all went down:

- American Airlines revenue management is often credited with having pioneered the use of these techniques in the airline industry with the development of the "Super Saver" fare in 1978. This was a discounted fare that was available only under certain conditions, such as advance purchase and minimum stay requirements.

- Also, other airlines like SouthWest, Laker Airways, and even People Express were among the early adopters of dynamic pricing and helped to popularize the concept in the airline industry. People Express, for instance, introduced a new pricing strategy called the "People's Express Grab Bag," which offered discounted fares to customers willing to accept a seat assignment at the last minute.

- In these early days of revenue management, airlines would manually adjust prices based on factors such as time of day, day of the week, and seasonality. This sounds basic but was a revolutionary pricing approach back then.

- In the 1980s, airlines began to use more sophisticated computer systems to manage their dynamic pricing, which allowed them to make more accurate and timely adjustments based on changes in demand.

So, while airlines did not invent dynamic pricing, they have been instrumental in popularizing and refining the practice, and it has become an essential component of their revenue management strategies.

How does airline revenue management work today?

While the airline industry pioneered pricing and revenue management, many legacy airlines have struggled to keep up with more recent innovations. Some critics even argue that airline revenue management has stagnated and is still stuck in the late 1990s. However, the truth is that it is less about the complacency of airlines and more about legacy systems, data silos, and other challenges making it increasingly difficult for these airlines to stay ahead of the curve.

As a result, many airlines now face the challenge of updating their systems and processes to keep pace with rapidly changing market conditions and emerging technologies.

In fact, IATA itself admits that the industry is still relying on major breakthroughs from the past in order to price today’s flights and ancillary products. Here’s an example: the amount that a customer pays for a fight is still predominantly calculated through the application of predetermined static price points that limit inventory allocations using 26 booking classes. In other words, the majority of airlines have not yet unlocked the full spectrum of real-time insights into their pricing engines.

“What was innovative and new in the 1980s has long been overtaken by the digital revolution,” Sebastian Touraine, Head of Airline Commercial Systems at IATA and former Head of Dynamic Offers, argues in the Journal of Revenue and Pricing Management.

How is AI changing airline revenue management?

Airlines have been slow to adopt the latest technologies in revenue management. As a result, the airline industry as a whole is facing mounting pressure to upgrade its revenue management systems.

As Fortune describes, currently, most prices are still set by humans. And price analysts can spook easily and lower prices if there is a concern about a low load factor, which is one of the key metrics airlines keep an eye on to determine the percentage of available seats that could have been filled by passengers.

With this being said, today's mostly “static” revenue management systems and processes must be replaced by modern retail-oriented offer management systems. This is a crucial moment for airlines to figure out how to stay competitive in an ever-changing landscape.

How exactly?

The future of revenue management in the airline industry will be shaped by AI-related technologies that allow airlines to capture and analyze big data in real-time and automate pricing decisions—a process often referred to as continuous pricing.

As IATA explains:

“Continuous pricing is a further enabler of offer optimization, as the airline can greatly refine the offered price compared to today’s static and limited options through legacy fare filing.”

What is continuous pricing?

Continuous pricing refers to the practice of adjusting prices dynamically and continuously in real-time based on changes in demand, supply, and a plethora of external market factors. This approach to revenue management is more fluid than traditional revenue management techniques, which rely on fixed pricing structures and periodic adjustments.

Continuous pricing represents a fundamental shift in revenue management, enabling airlines to maximize the value of each transaction by making precise pricing decisions based on real-time data and market conditions.

To achieve this, airlines need to overcome the challenge of managing data flows from multiple sources, while ensuring accuracy by removing anomalies and inaccuracies. Building sophisticated revenue management systems is crucial to implementing continuous pricing, enabling airlines to offer more targeted and relevant products and services to their customers. This is particularly important in liberating clients from the constraints of legacy fare filing and traditional inventory controls, clearing the way for true real-time pricing and offer management.

By embracing continuous pricing and optimizing their revenue management systems, airlines can increase their competitiveness and conversion rates, ultimately driving profitability and success in a fast-changing market.

The COVID-19 pandemic has proven how important the transition towards real-time-based continuous pricing is. Travel restrictions and reduced demand have made it more difficult for airlines to rely on historical data to forecast future demand and set prices accordingly. Unfortunately, many airlines could not deal with the rapid and unforeseen changes in consumer demand patterns. This has resulted in widespread industry frustration with legacy revenue management systems. The exasperation has shifted from a steady drip into an open faucet of discontent, as Cole Wrightson, Chief Product Officer at Flyr, concludes.

“The need for adaptive, more modern systems has become so great that some airlines have completely turned off their legacy systems and opted to manage everything manually, just to survive. The inconsistency between year-over-year demand patterns and the increased frequency of schedule and capacity changes invalidate many of the outdated assumptions upon which legacy revenue management systems are built.”

In order to ward off further frustration, continuous pricing must become the new base level of revenue management systems. However, the question arises as to which technologies will help this dream come true.

Let’s take a look.

The Technologies Needed for Continuous Pricing

New Distribution Capability (NDC) plays, arguably, the most critical role in enabling continuous pricing for airlines. This technology provides a standardized framework for distributing dynamic pricing and personalized content to customers through third-party channels—more on that in our next article.

Following the publication of the IATA Dynamic Offer Creation white paper in October 2018, IATA has been leading the transition towards the next era of pricing as part of the larger movement towards fully dynamic offers. As the name spells out, the latter not only refers to dynamic price determination but a fully flexible bundling of airline products, aka content, whose offers present real-time construction characteristics in response to shopping requests and their respective contexts. For more information, check out IATA’s Dynamic Offers Maturity Model, which provides great insights.

From a broader technology perspective, three emerging tech advancements will take revenue management to the next level of continuous offers. These advancements enable airlines and their given revenue management systems to change parameters on the spot. In doing so, airlines can overcome the irrelevance of historical sales data for demand forecasting. This can be further enhanced using more sophisticated statistical tools.

- Artificial Intelligence (AI): AI can revolutionize revenue management by allowing airlines to analyze vast amounts of data in real-time and make more accurate predictions about demand and pricing. AI can also help airlines automate pricing decisions and optimize revenue in real-time. AI enables airlines to cross-sell, upsell and serve in the moment of need. This technology will empower customer interaction and lead to a digital-first future in which the right offer is created at the right time.

- Machine learning: Machine learning (as part of the broader AI terminology) can help airlines analyze data patterns and make predictions about future demand and pricing through the correlation of data inputs, pricing decisions, and revenue performance. Deep learning technology is needed to contextually analyze data for more optimal pricing and revenue strategies, and more accurate forecasting. This technology can also personalize pricing and promotions based on a customer's past behavior and preferences. Algorithmic forecasting continuously infuses data and interprets it through machine learning without requiring the intervention of revenue managers.

- Internet of Things (IoT): The IoT can provide airlines with even more real-time data on everything from flight delays to customer preferences, which can be used to improve revenue management decisions. For example, by using IoT sensors to monitor weather conditions in real-time, airlines can adjust pricing and inventory levels in response to weather-related changes on demand. Also, sensors in airports can provide data on delayed apron operations, for example, as offered by Assaia, which helps revenue managers adjust pricing in real-time.

As all of these technologies demonstrate, the future of revenue management is an important strategy that will enable airlines to sell the right seat to the right customer at the right time and price. This is only possible with an ever-increasing amount of data spanning beyond booking data, competitor flight schedules, and pricing, for instance, via incorporating information from capital markets, oil futures, and other economic indicators that influence the market. All this data must then be analyzed and processed in real-time for accurate decision-making.

Are Airlines Prepared To Invest in the Future of Revenue Management?

As time progresses, more and more airlines are realizing it’s time to switch things up. In fact, many airlines have already invested heavily in the development of sophisticated AI-driven systems that better forecast demand and manage inventory and pricing.

Here are a few concrete examples:

- One example is SAS, whose advanced revenue management system, in partnership with Amadeus, is based on a new revenue forecast model that applies live sales data. This technology improved the airline’s demand forecasting ability by 30%, as the carrier explained in a case study.

- Another example is Lufthansa, which, in 2019, partnered with travel booking app Hopper, to leverage their AI and machine learning capabilities for more accurate predictions about flight prices.

- AirAsia also reconfigured its tech stack to operate more efficiently by heralding more forward-looking data analysis via its collaboration with Kambr.

- JetBlue’s partnership with FLYR Labs has brought a host of revenue optimization opportunities for the airline.

- Azul Airlines has partnered with Fetcherr, another emerging Travel Tech provider, to pilot demand prediction via Fetcherr’s Algo pricing platform.

- And many other airlines launched similar initiatives as this Georgia Tech study explains; Etihad, for instance, partnered with Sabre to better incorporate live shopping data into their pricing engines; Alaska Airlines incorporated real-time insights of travelers looking for vaccine information into their forecasting models; and Air Canada, United, and Qatar have all placed a much greater focus on AI-driven continuous pricing over the past few years.

However, the implementation of new technologies can be complex, and it requires a significant long-term investment in development, infrastructure, and personnel. The integration of new technologies into an airline's revenue management system requires changes to existing business processes and staff training, alongside potential software integrations. Another challenge airlines face in implementing new revenue management technologies is the upfront cost. Many technology suppliers do not offer risk-sharing options, making it difficult for airlines with limited resources to invest in unproven technologies with uncertain ROI.

Airlines also continue to face challenges related to data management, as capturing and analyzing large amounts of data from multiple sources accurately to feed its algorithms can be a complex and time-consuming process. Additionally, some airlines have faced resistance from within or from other stakeholders who are concerned about privacy and data security issues. As well, the introduction of AI-based revenue management demands new skills, especially from revenue managers.

In the ever-evolving world of airline revenue management, partnerships with tech companies are becoming increasingly vital. Data-savvy tech firms have proven exceptionally beneficial in helping airlines transform their outdated systems.

So, which emerging tech companies fit the bill? Let’s find out.

Leading Revenue Management Startups

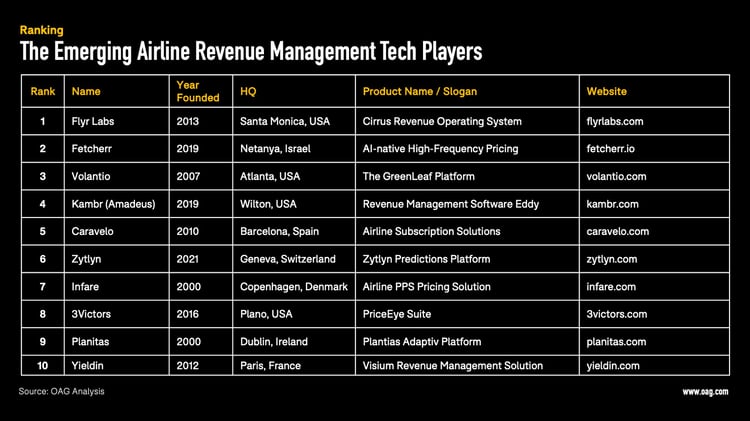

Through collaborations with emerging tech players, airlines can leverage the latest technologies and expertise on the market without having to build and maintain these capabilities in-house.

Additionally, collaboration with such companies can provide airlines with access to innovative solutions and fresh perspectives on revenue management. Startups, especially, are often more agile and able to adapt more quickly to changes in the market, which can be an advantage for the fast-moving airline industry.

As a starting point for airlines to get a high-level understanding of the growing revenue management tech landscape, here is a ranking of ten of the most promising revenue management travel tech companies.

Disclaimer: The ranking system was created by taking into account the total amount of Venture Capital raised and the latest media attention each company has received. Unfortunately, we were unable to consider financial metrics such as revenue or client count for this ranking. Therefore, please take this ranking with a grain of salt and keep in mind that it may not be a comprehensive representation of each company's success.

Overall, there is a growing number of startups offering innovative solutions for revenue management in the airline industry. By partnering with these companies, airlines can leverage cutting-edge technologies to improve their revenue management strategies and stay competitive in the market.

Data is what ties all of these emerging software providers together.

The AI and machine learning capabilities of these companies can help airlines improve their revenue management systems and optimize pricing strategies in real-time. However, there is still more that needs to be done in order to create a truly continuous pricing environment.

As previously mentioned, one of the most promising technologies for achieving this goal is NDC, a standardized data exchange protocol that enables airlines to provide more personalized and dynamic offers to customers. By leveraging NDC, airlines can offer tailored products and services to individual customers based on their preferences and behavior. In turn, airlines can adjust prices in real-time to maximize revenues.

Catch up with our series on the technology transformation in the airline industry:

- Part One: From Old to New: The System Transition in the Airline Industry

- Part Three: The New Distribution Capability Journey: Redefining Airline Commerce

- Part Four: Shaping Airline Retail: The Unstoppable Rise of Ancillaries

- Part Five: Reshaping Airline Journeys: The Unfolding Saga of Virtual Interlining

- Part Six: Maximizing Flexibility: The Innovative Transformation of Airline Payments

.jpg)

.png)