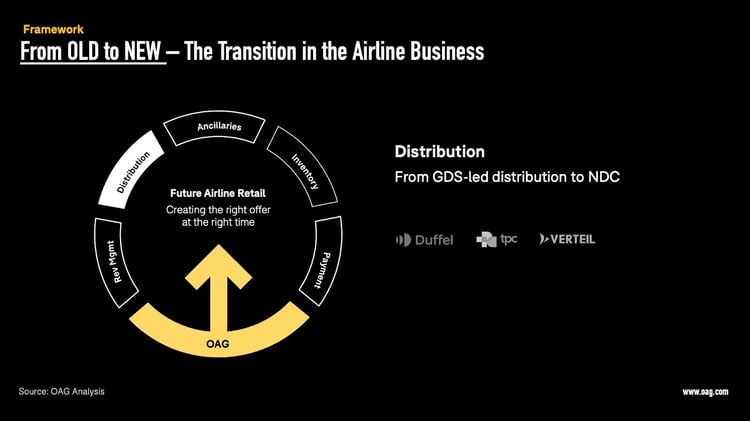

This is the third article in our series decoding the fundamental technology transition underway in the airline industry. Today’s post explores the role of New Distribution Capability (NDC) as a major step forward for revenue management and the airline transition towards a better future for customers and airlines alike.

As we outlined before, the airline industry is in the midst of a profound technological transformation, with new innovations and disruptions reshaping how airlines do business. At the forefront of this transition is New Distribution Capability (NDC), a new data exchange protocol that promises to revolutionize how airlines distribute and sell their products.

NDC represents a major step forward, particularly for next-gen revenue management, enabling airlines to offer more personalized and dynamic offers to customers and optimize pricing and inventory in real time. The ultimate goal is to provide the right products at the right time—a promising and transformative vision that the industry is eagerly working towards.

In this article, we'll delve into the exciting world of NDC and explore how it is transforming the airline industry as we know it.

Specifically, we will explore the following key aspects of NDC and its impact on the airline industry:

- Review the progress made in implementing NDC across the industry.

- Examine the challenges that have hindered NDC adoption so far.

- Highlight real-world airline use cases demonstrating how NDC revolutionizes airline retail.

- And finally, provide an overview of the top NDC-focused travel tech startups that airlines, travel agencies, Global Distribution Systems (GDSs), Online Travel Agencies (OTAs), and corporate travel managers (TMCs), should consider for potential collaborations or integrations.

Quick Recap: The History of NDC

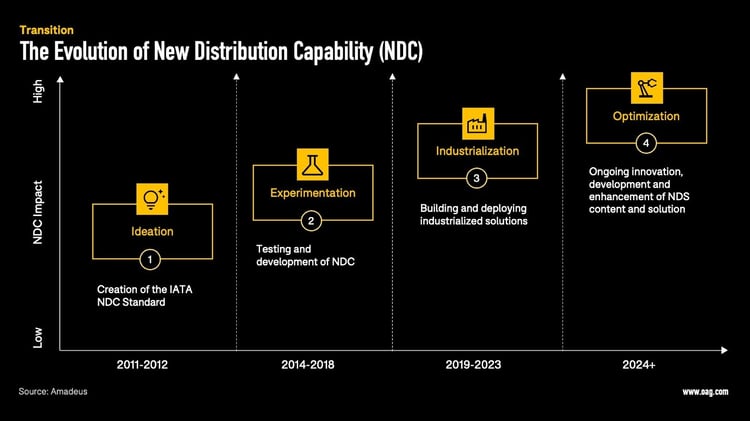

NDC traces its roots back to 2012 when the International Air Transport Association (IATA) first introduced the concept as a response to the evolving needs of both airlines and passengers. The underlying motivation for NDC was to address the limitations of the “indirect” booking flow, in which GDSs were responsible for building offers from various pieces of flight content, including availability from an airline's Computer Reservation System (CRS), rates from air price repository ATPCO, and schedules from third-party databases like ours at OAG.

As illustrated by Altexsoft, the NDC approach was meant to empower airlines to regain control over their products, creating dynamic packages of ancillaries, and enabling them to adjust offers based on current market demand and customer preferences, rather than relying solely on the capabilities and limitations of GDSs.

The airlines to first adopt NDC were Lufthansa, British Airways, American Airlines, and Iberia. The initiative aimed to address the limitations of legacy distribution systems and enable more effective communication between airlines, travel agencies, and consumers.

How Does NDC Work Specifically?

NDC is a communication protocol based on XML (eXtensible Markup Language), which standardizes the way airlines and travel industry partners exchange data. XML is a markup language that allows for structured, organized, and easily readable data. This standardized format ensures that all parties in the distribution chain can understand and process the information being exchanged, regardless of the specific systems they use.

Additionally, NDC leverages Application Programming Interfaces (APIs) to facilitate data exchange between airlines, travel agencies, and other industry partners. APIs are sets of rules and protocols that allow different software applications to communicate with each other. Through APIs, airlines can directly connect their inventory and reservation systems with travel agency platforms or other distribution channels, bypassing the need for intermediaries like Global Distribution Systems (GDSs). As well, airlines using APIs can share their product offerings directly from the airline Passenger Service Systems (PSS) to a B2B platform or Airline Agent Portal/OTA, which many consider to be a significant advancement over the legacy EDIFACT protocol that has been in use for the past 40 years.

In summary, the combination of XML and API-based communication, enhanced by third-party data providers like ourselves at OAG, allows for richer content, personalization, and dynamic pricing in the airline distribution process.

The Adoption of NDC

Over the past few years, NDC has evolved significantly.

In 2015, IATA launched the NDC Certification Program, which established a set of standardized guidelines and protocols for NDC implementation. This program has been instrumental in fostering widespread adoption, as it ensures consistency and compatibility across different systems and stakeholders.

Since then, NDC has garnered the support of numerous airlines, technology providers, data providers, travel agencies, and even GDSs, with all of these key industry players actively participating in its adoption and promotion, especially since the onset of the pandemic.

Interestingly, the involvement of GDSs (and also data providers like OAG) in the adoption of NDC has turned out to be much more inclusive than initially anticipated. Early on, many experts predicted that NDC would cause GDSs and data providers to vanish as intermediaries between airlines and travelers. However, this has not been the case. Instead of being sidelined, technology intermediaries have taken on crucial roles in the NDC adoption process. Ultimately, NDC has fostered a far more collaborative approach among industry stakeholders than initially envisioned.

As a result of this collaborative approach, NDC adoption has gained significant momentum. IATA reported that, as of April 2021, the number of NDC certifications across airlines, IT providers, and sellers had grown by 18% year-over-year, achieving the organization's self-set target of 20% NDC bookings by mid-2021.

As the initiative gained momentum, the range of NDC-enabled solutions expanded, with a growing number of companies offering innovative tools and services that leverage the capabilities of this new data exchange protocol.

We will look at some of them, especially from the startup arena, at the end of this article.

Many Industry Stakeholders Are Committed to NDC

To drive forward the development of NDC, most industry stakeholders have actively participated and collaborated to establish NDC as the go-to IT standard across the industry.

These parties include:

Most major airlines have embraced NDC and are working on integrating it into their distribution strategies. They have recognized the potential of NDC to enhance their offerings and improve revenue management. As of today, more than 60 airlines worldwide are NDC certified. While there are hundreds of airlines globally, it's noteworthy that these 60+ NDC-certified carriers include a diverse range of both large and smaller international airlines. This underscores the growing potential of NDC across the industry, acknowledging the importance of all airlines in shaping the future of travel distribution.

Key Global Distribution Systems (GDSs) like Amadeus, Sabre, and Travelport have, after some initial hesitation, progressively embraced NDC and started developing solutions that support the new protocol. These companies have been investing in the necessary infrastructure and technology to facilitate the adoption of NDC by their travel agency partners and airline customers. However, GDSs continue to have a special relationship with NDC, which we will explain in more detail below.

Technology providers such as Farelogix, Datalex, and IBS Software have played a significant role in the development of NDC by creating the technology platforms and tools that enable airlines and travel agencies to leverage the new protocol. These technology providers have designed solutions that support NDC's advanced data exchange capabilities, allowing for improved personalization and dynamic pricing.

Data providers play a crucial role in the NDC ecosystem by offering trusted, and accurate global datasets. We at OAG, for example, supply and streamline flight schedules. Fare data aggregators enable the process of integrating with airlines by ensuring that data is presented in a unified format, validated, and up-to-date. All these data companies remove time constraints that airlines may face in their development pipelines, allowing for a more efficient NDC rollout. By working with data providers like us, industry stakeholders can more effectively navigate the complexities of NDC implementation and benefit from a reliable and accessible data source. We enable stakeholders to access airline data at scale, providing a comprehensive and streamlined solution, rather than relying on a time-consuming and resource-intensive one-to-one approach with individual airlines.

Major travel agencies and aggregators, including Expedia, Booking.com, and CWT, have also embraced NDC, recognizing the opportunities it presents to enhance their services and provide a more seamless customer experience. By adopting NDC, these companies are better positioned to offer personalized and dynamic offers to their customers, leading to increased satisfaction and loyalty. Skyscanner, for example, has applied NDC to its metasearch concept and, as a third party, connects airlines to agencies, OTAs, and customers via its NDC solution to enable direct bookings. Skyscanner was the first major search engine that jumped on the NDC standard plane. In turn, the company has offered end-customers an improved booking experience where the user has the most information while broadening airlines’ customer reach. Since then, other OTAs, such as Kayak and Hotwire, have also started offering their own NDC solutions.

However, despite all of this great commitment, participation is far from complete, with an estimated 80% of all bookings still not NDC-enabled today.

In particular, travel agencies struggle with adopting NDC more quickly. According to a 2022 Phocuswright survey among travel agency employees, only 7% were familiar with NDC and using it, while the remaining 93% either had no access to NDC content or they were not familiar yet with the technology.

These stats illustrate the untapped potential for NDC in the future, especially since industry-wide participation in NDC is mission-critical to enable consistency and interoperability.

This brings us to some of the key challenges NDC has been facing over the past few years.

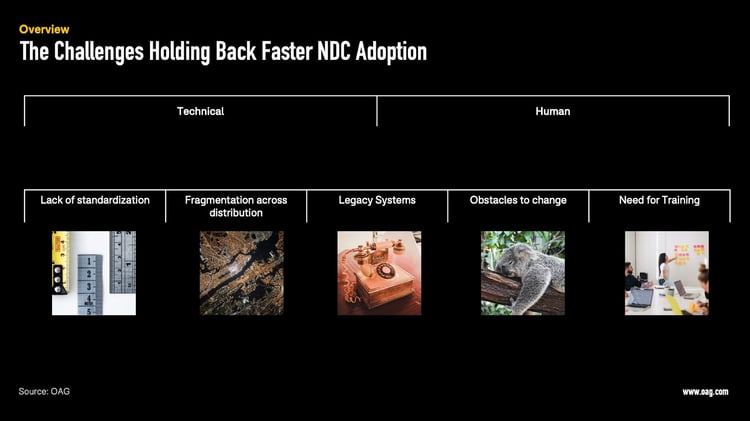

What’s Holding NDC Back?

While NDC has made considerable progress, its overall adoption over the past ten years has been slower than initially anticipated. IATA reported in June 2022 that 10% of all indirect sales were made through an NDC API. While this adoption is a significant uptake compared to the previous year when only 5-6% of indirect sales were NDC-enabled, the stats show that NDC adoption is still in its infancy.

Why is this the case despite the industry-wide commitment that has been going on for over a decade?

There are several factors and challenges that have contributed to this.

Let’s go through each category in a bit more detail.

Legacy Systems

The airline industry relies heavily on complex, deeply entrenched legacy systems, making it difficult for companies to switch to a new protocol like NDC. These complex and long-established systems often form the backbone of airlines' operations, making it challenging for companies to transition to an innovative protocol like NDC. The shift necessitates not only a significant investment of time and resources (the industry will likely need to spend between $3 billion and $15 billion over the next ten years) but also demands technical expertise to navigate the complexities of integrating NDC with existing systems.

Additionally, certain unresolved challenges with NDC may cause some organizations to view their legacy systems as more favorable going forward. One of the most significant challenges with NDC is handling the massive volume of searches and directing them to the appropriate airline. If every search leads to calls being made to every airline API, it would result in a process that is expensive, computationally heavy, time-consuming, and inefficient. In such cases, collaborating with experienced data providers like OAG can offer streamlined solutions to efficiently manage search volume, ensuring a more effective and cost-saving approach.

Consequently, the daunting task of overhauling or updating these legacy infrastructures, combined with some unresolved challenges of NDC, has posed a substantial barrier for many organizations. This hinders their ability to embrace the full potential of NDC and its transformative impact on the airline industry.

Obstacles to Change

As with any significant transformation, there can be resistance to change from various stakeholders. Some stakeholders, like travel agencies, may be hesitant to adopt NDC due to concerns about the costs involved, the potential disruption to existing processes, data challenges, or a lack of familiarity with the new protocol.

GDSs have been cautious in their approach to NDC adoption, mainly due to the significant changes the new protocol brings to the existing distribution landscape. NDC enables direct connections between airlines and travel agencies or other distribution partners, shifting the dynamics of the traditional distribution process where GDSs played a central role as intermediaries. This evolution in the distribution landscape could lead to adjustments in the GDSs' revenue models and require them to adapt their business strategies accordingly.

Fortunately, the introduction of NDC has unlocked massive innovation among GDSs. They have rethought their roles in the distribution process and explored new opportunities for collaboration and innovation. As the industry navigates this transformative journey, it is essential for all stakeholders to work together to overcome the obstacles that come with change and to fully realize the potential benefits of NDC for the entire travel ecosystem.

As Sabre rightfully concludes: “No one company can bring NDC to life on its own. Re-tooling processes that have been in place across the industry for decades is a group effort, so activating NDC will take time.”

Need for Training

Another key challenge hindering the rapid adoption of NDC is the need for extensive training and education of all parties involved in the airline distribution ecosystem. As Qantas' experience demonstrates, transitioning to NDC demands significant educational efforts across the industry, ensuring that stakeholders at every level grasp the concepts, benefits, and implementation aspects of NDC. Qantas has focused on educating its sales teams and employees, but it also acknowledges that understanding among travel agencies can vary greatly.

As a result, it is crucial for airlines and other industry players to continuously share information and knowledge, fostering a better understanding of NDC across the entire travel ecosystem. This ongoing education will play a vital role in accelerating NDC adoption and maximizing its potential benefits for the airline industry.

Data and Standardization Challenges

While IATA has made efforts to standardize NDC through its certification program, variations in implementation and interpretation of the standards can still cause challenges. While the XML schema is a standard, each airline implements this schema in their customized APIs differently. This means, aggregators might need to integrate with each NDC channel separately, requiring changes and investment. As a result, data standardization has been a major issue, with inconsistencies in data formats and quality across different sources. Companies like OAG play a critical role in addressing this challenge by leveraging advanced technology and agile delivery models to ensure compatibility with various data formats. By providing API ready-to-query data sets, we streamline the integration process and enable a more efficient and seamless transition to NDC for industry stakeholders.

In summary, this lack of standardization might present itself as the biggest challenge in hindering the global adoption of NDC. Ensuring that all industry players adhere to the same set of rules and guidelines is crucial for the smooth functioning of NDC, but achieving this level of standardization has been an ongoing challenge.

As Tom Kershaw, chief product and technology officer at the travel technology and distribution company Travelport, recently concluded: “That lack of standardization has hampered what the industry is trying to do, and also the fact that our industry is by its very nature global also creates challenges as there are all these regional variations that have to be taken into account. We’re getting better, but I do think the technology in the industry is slower than many other industries.”

Fragmentation Across Distribution

The airline distribution landscape is highly fragmented, with numerous intermediaries and touchpoints. This complexity can make it more challenging to implement a new protocol like NDC across the entire industry, as each player may have different requirements, preferences, and technological capabilities.

As Amadeus explains, adding to this are the logistics of reaching alignment across the industry. For NDC to be viable, there needs to be commercial agreements between airlines and technology partners; airlines and travel sellers/corporations; technology partners and travel sellers/corporations. Given that there are thousands of stakeholders across this industry, a huge number of commercial agreements need to be concluded to set the terms for NDC bookings. As NDC initiatives do not prescribe standardized commercial models, it means that alignment often boils down to a case-by-case, bilateral negotiation.

In addition to the challenges mentioned above, another factor contributing to the slower adoption of NDC is the response of GDSs to the new technology. Recognizing the potential threat posed by NDC, GDSs have proactively improved their own systems and offerings. As a result, many airlines now find that the enhanced capabilities provided by GDSs have reduced the urgency to switch over to NDC. In other words, the competitive pressure exerted by NDC has led GDSs to up their game, inadvertently slowing down the overall shift towards NDC adoption in the airline industry.

With this being said, even with the introduction of NDC, it is important to note that multiple distribution models are expected to coexist in the foreseeable future. These include distribution via GDSs, NDC aggregators, and “direct connect” methods. Traditional distribution models will not only remain relevant but also continue to evolve and improve, thanks to the competitive pressure exerted by NDC. Simultaneously, new models like NDC will further emerge and expand within the industry. This diverse landscape underscores the complex nature of airline distribution and highlights the need for ongoing innovation and adaptation as industry stakeholders navigate these various channels.

In summary, It would be a mistake to attribute the slower-than-expected adoption of NDC to any single party or stakeholder. The reality is that the challenges are multifaceted, with various industry players confronting their own unique sets of obstacles in embracing this new standard.

Moreover, alternative distribution systems have continued to exist and evolve for good reason, providing valuable solutions and options for different stakeholders in the airline distribution ecosystem.

Concrete Examples of NDC’s Impact

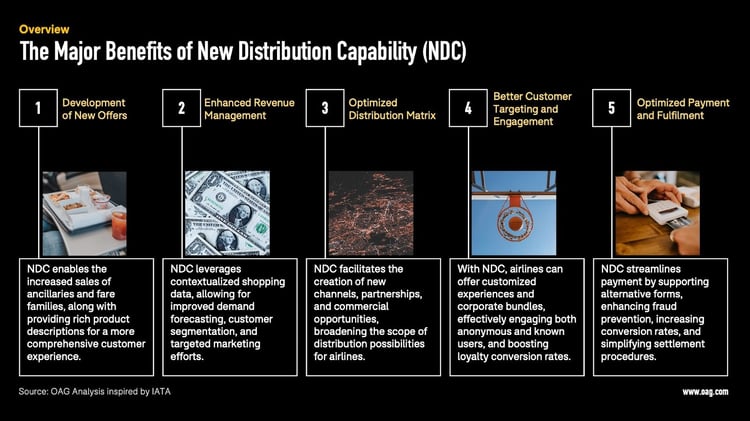

Despite some of the adoption hiccups described above, the potential of NDC to transform the way airlines distribute and sell their products is enormous, particularly in terms of ancillary services. McKinsey estimates that the airline industry can capture up to $40bn in additional revenue annually by 2030 (equivalent to about 4% of current industry revenues).

How exactly can airlines do this?

By adopting NDC, airlines can offer a more personalized and dynamic experience to their customers, which in turn can lead to increased revenue and customer satisfaction.

Here are a handful of concrete examples to make this more tangible:

- In 2017, American Airlines launched its NDC-enabled platform, which allowed the airline to offer customized bundled fares to travel agencies. This innovation enabled travel agents to access and sell a range of fare families with different inclusions, such as priority boarding, preferred seating, and checked baggage, depending on the traveler's preferences and needs. Most recently, American Airlines has also taken a controversial step to make some of its content available to travel agencies only through NDC in its continuous push to offer customers higher customization of its products.

- British Airways has been an early adopter of NDC. For instance, British Airways was one of the first airlines to offer the "Choose Your Seat" option to customers through NDC-connected travel agencies, allowing passengers to select their preferred seats based on real-time availability. British Airways has also introduced additional price classes using NDC, which enabled it to increase price points from a standard of 26 to more than 73 on selected short-haul routes.

- Lufthansa Group has been a strong advocate for NDC from the get-go. It has used the protocol to enhance the distribution of its ancillary products, such as the "Economy Light" fare, which offers a lower-cost option for passengers with carry-on luggage only. Through NDC, Lufthansa can provide this fare to travel agents, enabling them to cater to the needs of price-sensitive customers more effectively. Lufthansa Group was also the first airline group to levy a cost surcharge for bookings made via GDS in 2015, thereby, establishing a precedent for many other airlines to follow a similar strategy, including Air France-KLM, and American Airlines.

- Qantas has embraced NDC as a way to improve the customer experience and offer more personalized products. Through its NDC platform, Qantas provides real-time pricing and availability for ancillary services like extra legroom, special meals, and lounge access. This empowers travel agents to provide a more comprehensive and tailored service to their customers.

- Finnair is implementing NDC, amongst the usual use cases, for continuous pricing for travel agents. This is part of its plan to transition fully to NDC by 2025, for which the airline has also just announced it would be removing all of its domestic itineraries from EDIFACT distribution.

All of these examples demonstrate the exciting potential of NDC in transforming airline distribution and enhancing customer experience. However, it is important to note that, so far, much of the focus has been on establishing new “pipes” for distribution, while comparatively little progress has been made on more revenue-generating aspects, such as dynamic offers, unbundling, and other innovative service offerings. As the industry continues to adopt and refine NDC implementation, it will be essential for airlines, GDSs, and other stakeholders to shift their focus towards fully leveraging the revenue opportunities that this new protocol has to offer.

Leading NDC-Enabling Technology Startups

As the airline industry continues to evolve and embrace the potential of NDC, fostering continuous innovation is crucial for driving further adoption and unlocking its transformative benefits.

In this dynamic landscape, numerous technology startups have emerged, playing a mission-critical role in advancing the NDC agenda and offering unique solutions that empower airlines and other industry stakeholders. These trailblazing companies are at the forefront of NDC enablement, shaping the future of airline distribution and helping the industry navigate the complexities of NDC adoption.

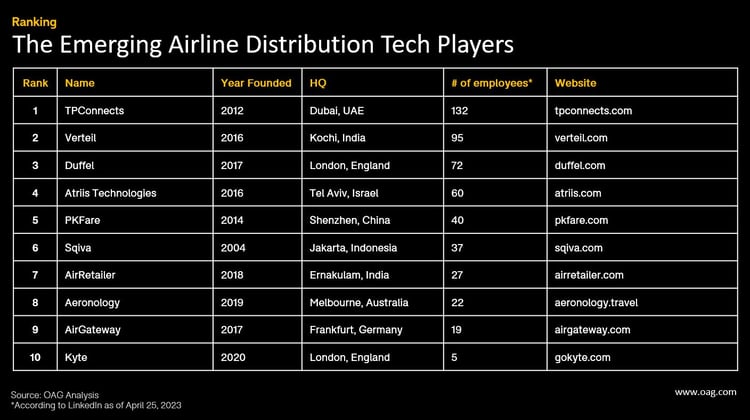

In this final chapter, we present a carefully curated list of the top ten most promising airline distribution startups, showcasing their unique contributions and the impact they're making in revolutionizing the airline industry.

For years, many airlines have been innovating the way they sell fares online through their respective websites and mobile apps. However, they have faced challenges in building the digital infrastructure that enables agencies and e-commerce companies to sell tickets in similar ways. To overcome these obstacles, they have turned to young companies for assistance, some of which we will highlight in the ranking below.

In particular, flight aggregators such as AirGateway, Duffel, and Verteil have emerged as significant NDC enablers due to their ability to offer multiple integrations simultaneously. As Altexsoft explains, these aggregators are relatively new players in the airline distribution landscape, establishing direct connections with both full-service and low-cost carriers (LCCs) as well as GDSs to source NDC, GDS, and LCC offers. Travel vendors can access this content through a unified API or a prebuilt booking tool.

Disclaimer: We excluded long-established technology companies like Accelya (which took over Farelogix), Travelport, ATPCO, JR Technologies, and similar companies that have been around for several decades. Instead, we focused on the most recent wave of technology disruptors that are working to transform the tradition-bound business of distributing airfares.

As you explore the innovative solutions provided by these top-10 startups, you will notice two things.

First, their focus varies—some companies are helping airlines to develop NDC capabilities, while others are assisting OTAs, TMCs, and other travel partners in consolidating supply. Interestingly, some startups are working on both aspects simultaneously.

Second, a common thread among many of these startups is their emphasis on enabling airlines to offer enhanced methods for selling ancillaries. The future of ancillary retail is undoubtedly a pivotal aspect of the ongoing technology transition in the airline industry and merits a dedicated examination.

With this in mind, our next article will zero in on the fascinating world of airline ancillaries.

We'll explore the latest developments, trends, and innovations shaping this segment, further decoding the future of airline technology and its impact on the industry as a whole.

Catch up with our series on the technology transformation in the airline industry:

Part One: From Old To New: The System Transition In The Airline Industry

Part Two: The Evolution Of Airline Revenue Management: The Impact Of Emerging Technologies

Part Four: Shaping Airline Retail: The Unstoppable Rise of Ancillaries

Part Five: Reshaping Airline Journeys: The Unfolding Saga of Virtual Interlining

Part Six: Maximizing Flexibility: The Innovative Transformation of Airline Payments

.jpg)

.png)