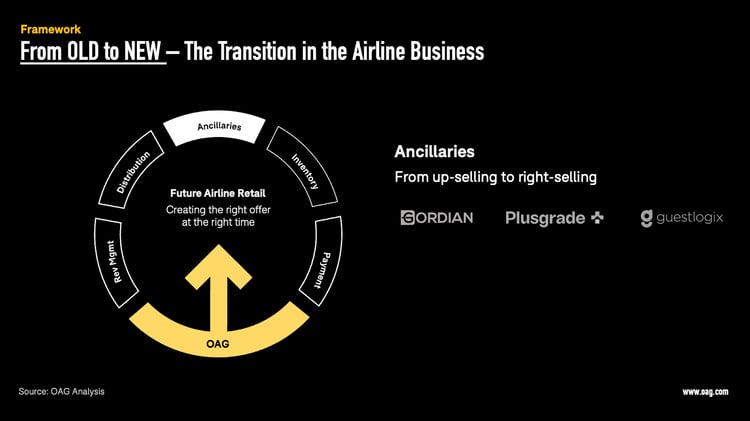

This is the fourth article in our series decoding the fundamental technology transition underway in the airline industry. Today's post investigates the burgeoning realm of ancillaries, an ever-expanding area with enormous revenue potential that signifies a key evolution within the airline industry's journey towards a brighter future for both passengers and airlines.

Key Points About The Rise and Future of Airline Ancillaries:

- Ancillary services—such as seat selection, baggage, and personalised add-ons—are now core revenue drivers for airlines, accounting for over 15% of total revenues.

- This strategic shift is fuelled by evolving technology, smarter distribution, and growing traveller demand for flexibility and customisation.

- Ancillaries benefit both airlines and passengers: they reinforce financial stability, support innovation, and enhance the customer experience.

- The landscape continues to evolve rapidly, with digital retail, AI-driven offers, and new product ideas redefining how airlines engage with and serve today’s travellers.

Ancillaries are the additional services and products airlines offer beyond the base airfare, such as premium seat selection, priority boarding, additional baggage, and even hotel bookings and car rentals. Over the past decade, ancillaries have transformed from mere add-ons to becoming a cornerstone of airlines' financial health. They represent an invaluable revenue stream in an industry characterized by tight margins and intense competition.

In light of more airlines selling their flights through their direct (airline.com) channels and NDC's potential to present personalized offerings, the landscape of ancillaries stands at the precipice of exponential growth, instigating a profound paradigm shift in customer service and experience within the airline industry. To navigate this terrain, airlines are increasingly inclined towards holistic decision-making, considering total passenger revenue for each flight as a comprehensive metric.

A primary strategy for achieving this augmentation in total revenue - beyond merely raising fares - is the pursuit of enhanced ancillary revenue. This approach provides an exciting avenue for diversification and personalized service, further contributing to the evolution of the industry.

What is the Significance of Ancillary Revenues?

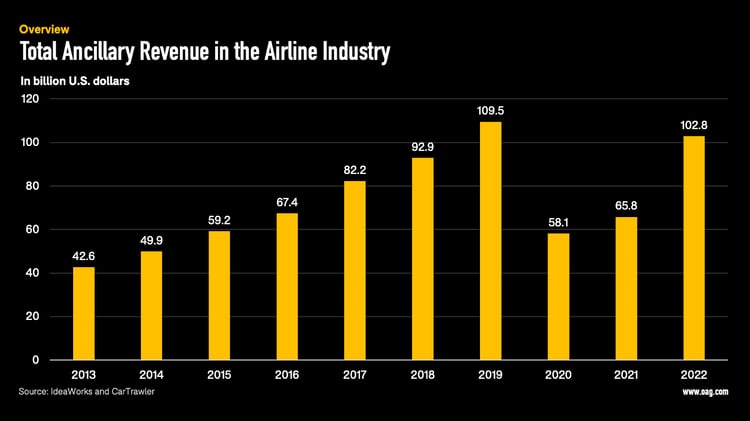

In order to truly understand the transformational impact of ancillaries in the airline industry, it is important to evaluate their quantitative significance.

Ancillary revenues are not just a supplemental income source for airlines but have evolved into a critical driver of financial robustness.

Comprehensive research conducted by IdeaWorks and CarTrawler illustrates this shift.

Over the span of less than a decade, global ancillary revenues dramatically rose from $42.6 billion USD in 2013 to over $102 billion USD in 2022. Even more impressive, 2022's figures almost matched 2019’s record of $109.5 billion USD, despite the disruptions caused by the global pandemic.

Following this chart, it becomes evident that the impressive growth trajectory has elevated ancillaries to a crucial pillar supporting airlines' financial stability.

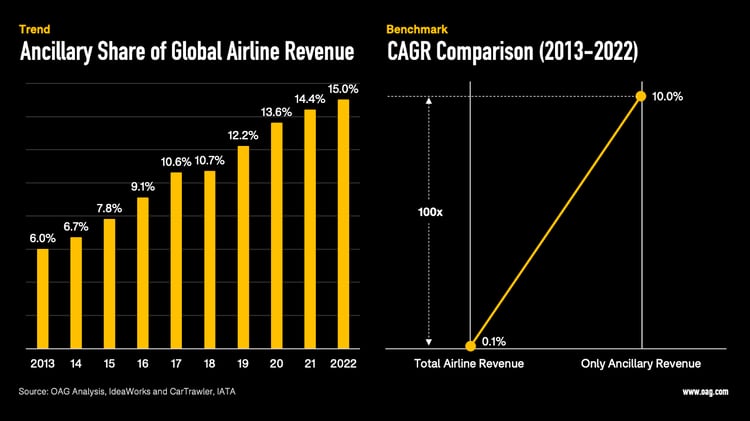

This dependency on a strong ancillary segment becomes clear when we delve into the proportion of total airline revenue that is derived from ancillaries. In 2022, a historic high was reached, with ancillary revenues accounting for a staggering 15% of total airline revenue.

Such a significant share underscores the strategic importance of ancillary revenues and highlights the need for airlines to effectively manage this ever-expanding category.

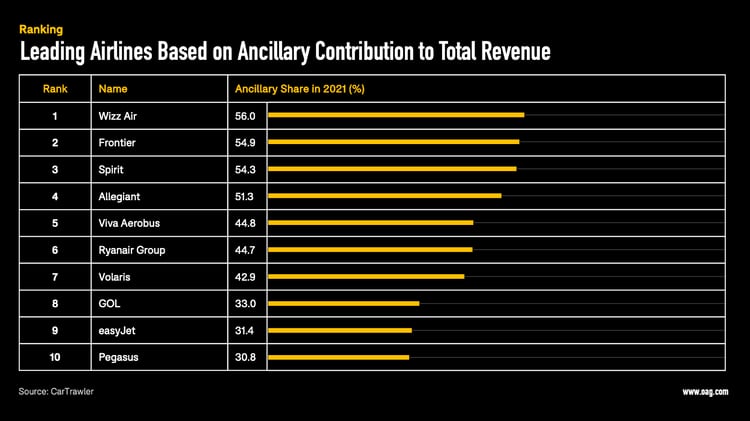

Some top airlines' ancillary revenue contributions, as calculated by CarTrawler, follow:

- Qatar Airways: 5.2%

- Lufthansa Group: 8.5%

- Air France-KLM: 8.7%

These figures further underline the role of technological advancements and new distribution models, like NDC, in unlocking the full potential of ancillary revenue streams.

Why Are Airline Ancillaries Surging?

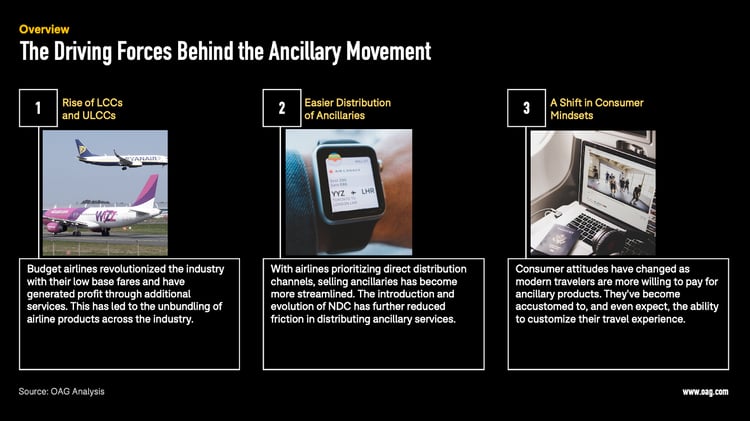

The significant growth of the ancillary segment didn't happen in a vacuum. It was driven by a convergence of airline industry trends and consumer behavior shifts.

The Rise of Low-Cost Carriers (LCCs) and Ultra-Low-Cost Carriers (ULCCs):

These airlines revolutionized the industry with their business models, offering incredibly low base fares and generating profit through additional services. By placing the spotlight on ancillary revenue, these carriers have made it a key lever for profitability and sparked a wider industry trend. This has led to the unbundling of airline products among premium carriers (although not to the same extent). Since then, the unbundling revolution, which began onboard budget airlines, has slowly but steadily spread across every aspect of the travel industry.

Easier Distribution of Ancillaries:

Airlines have been exploring a diverse mix of channels to sell ancillaries, including direct channels and third-party Online Travel Agencies (OTAs). The emergence of NDC and its subsequent evolution has supplemented the existing distribution system, smoothening the sale of ancillaries across all channels. This trend is underpinned by advancements in revenue management systems, which not only facilitate dynamic pricing of ancillary products but also support continuous pricing outside a rigid set of rules.

A Shift in Consumer Mindset:

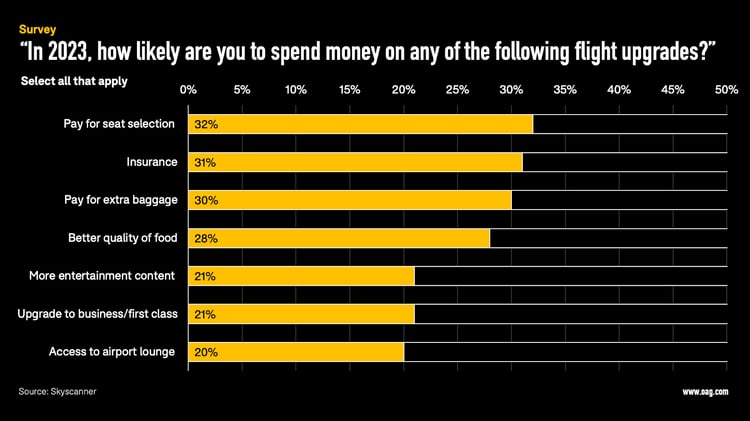

The market trends we've seen in the airline industry have also had a knock-on effect on consumer attitudes. Modern travelers seem more willing than ever to pay for (certain) ancillary products. They've become accustomed to, and even expect, the ability to customize their travel experience according to their preferences. These findings are supported by McKinsey research, which found that customers no longer shop for flights solely based on price and schedule. Attributes like Wi-Fi availability, in-flight entertainment, seat details and maps, on-time performance, and even environmental impact increasingly affect a customer’s decision to purchase a ticket (although it’s unclear if travelers would be willing to pay for them).

Taken together, these driving forces have set the stage for the ascendancy of the ancillary movement, signaling an exciting shift in the way airlines approach revenue generation.

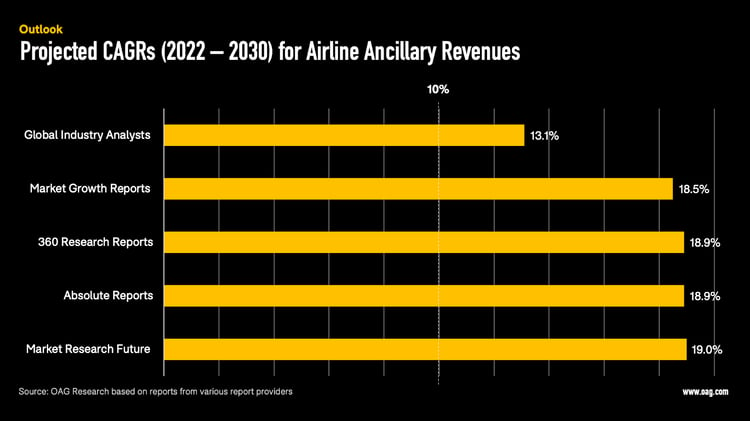

Given the momentum of these trends, most analysts foresee a bright future for ancillary revenues.

As illustrated in the chart below, expert predictions suggest that growth in this sector is far from slowing down. Rather, we can anticipate a double-digit expansion over the next few years, solidifying the critical role of ancillaries in airlines' revenue streams.

This continued growth underscores the importance for airlines to strategically invest in, and optimize, their ancillary offerings.

Technological progress, particularly in the realm of deep learning and artificial intelligence (AI), is primed to give ancillary revenues a further boost. AI enables airlines to optimize revenue by predicting customer behavior and personalizing ancillary offerings. As these technologies continue to evolve, they will play an increasingly pivotal role in driving airline profitability through ancillary sales.

The Double Benefit of Ancillaries for airlines and passengers

Ancillaries, far beyond being mere add-ons to the ticket price, have become an integral part of the travel experience and airline economics. They have reshaped the interaction between airlines and their customers over the years, providing (mostly) tangible benefits to both parties.

Benefits for Airlines:

The ancillary revenue model presents a robust retail system for airlines. With fares fluctuating due to supply and demand, the ancillary components add a layer of financial stability, somewhat insulating airlines from the ups and downs of the global business environment. In 2023, it's increasingly common to see airlines, particularly in key markets like North America and Europe, adopting this "à la carte" retail approach in some form. It's become a strategic tool, helping to build resilience and boost profitability amidst market uncertainties.

Benefits for Travelers:

The advent of ancillaries has also enhanced the passenger experience, offering a more personalized and flexible travel journey. By unbundling services and providing add-ons like preferred seating, upgraded Wi-Fi, or lounge access, airlines can cater to a diverse range of customer preferences. Not only does this mean a more tailored journey for passengers, but it also allows them to take control of their expenses, paying for only what they value. As a result, more and more travelers see unbundled fares as a viable way to save money according to Morning Consult. In fact, this à la carte approach has helped to democratize air travel.

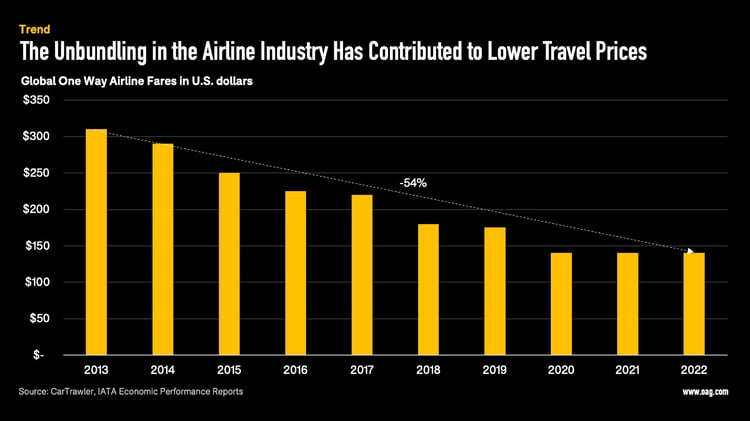

The latter can be seen when taking a look at numbers by CarTrawler again.

- In 2013, the global average one-way fare was $306.20 USD (adjusted to 2022 dollars for inflation).

- Fast forward to 2022, the one-way fare projected by IATA is a significantly reduced $140.69 USD.

This translates to an astonishing 54% inflation-adjusted reduction over the past ten years.

Yet, this trend invites a caveat. As we sail into 2023, airfare prices are projected to inflate by approximately 35-50% compared to the pre-pandemic era, spurred by a confluence of factors such as inflation and macroeconomic shifts. It's also worth noting that the data from 2022 as a reference point may offer a somewhat distorted perspective, given that numerous markets were inaccessible to more profitable long-haul travel for the majority of the year, potentially suppressing the average fare.

Decoding Ancillaries: Revenue Drivers and Missteps

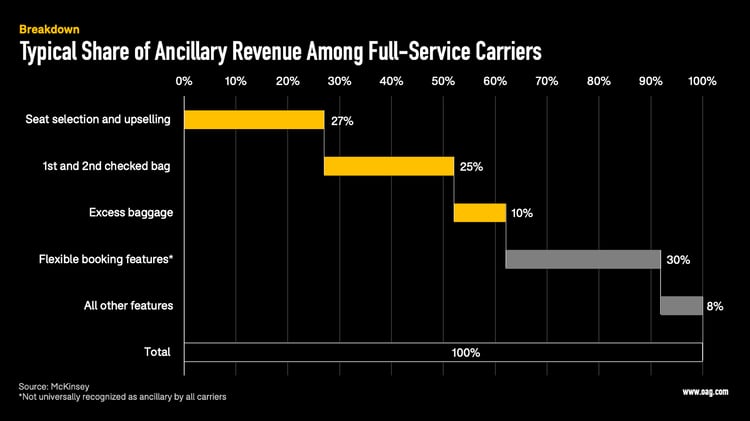

In the dynamic world of airline ancillaries, it's crucial to appreciate the nuances shaping this sector. While ancillaries are a rising trend, a closer look at their makeup reveals a skewed dependency on certain types.

- Seat selection fees and baggage fees emerged as the frontrunners in the ancillary revenue race, accounting for over half of the total ancillary revenue, according to McKinsey.

- Baggage fees alone (including checked baggage, heavy and extra-large bags, and additional carry-on bags) comprised more than one-third of all ancillary revenue.

Interestingly, these findings align with a Skyscanner survey indicating that seat selection and extra baggage are among the top three ancillary products travelers are willing to pay for this year.

From these figures, two critical insights emerge:

Low-Cost Carriers and Ancillaries:

The significance of ancillaries is mission-critical for low-cost carriers. Some budget airlines may allocate seats randomly to passengers who don't pay to pre-select their spots. For families or large groups wanting to sit together, this can generate substantial revenue. The same applies to extra baggage. For example, airlines like easyJet, Ryanair, and Wizz Air only permit one under-seat bag for free as exposed by Simple Flying, turning additional baggage into a lucrative extra. As a result, it’s no wonder that all of the top ten airlines in the world with the highest dependency on ancillary revenue are low-cost carriers.

Underutilized Ancillary Services:

Despite the dominance of baggage and seat selection, few other services have successfully entered the ancillary top tier. Why is this the case? History suggests that simply attaching a separate price tag to each product or service doesn't guarantee customers' willingness to pay, as Skift rightfully concludes. Driving ancillary revenue depends on creating the right opportunities and messages that resonate with customers in the right moments of their booking journeys. In fact, several experiments with unique (but excessive) ancillary services have not proven fruitful:

- In 2012, Spirit Airlines attempted to charge customers for basic services beyond carry-on bags and checked bags, like printing boarding passes. This strategy triggered a customer backlash and negative publicity, forcing Spirit to reconsider its approach.

- In 2010, Ryanair's plan to introduce pay-to-use toilets on its planes was met with a similar reception, and the airline had to abandon the plan.

While these findings offer some thought-provoking insights, it's clear that the development of ancillary revenue streams has predominantly focused on seat selection and baggage fees.

Beyond these areas, the progress in generating substantial revenue through other ancillary services appears somewhat limited, suggesting that there is a wealth of untapped potential waiting to be harnessed.

In the final chapter of this series, we'll shed light on some innovative travel-tech startups that are pushing the boundaries of conventional ancillary services. These pioneering firms are revolutionizing the way ancillaries are conceptualized and sold, underlining that there are still vast and unexplored territories in this segment brimming with potential.

“How” and “When” Can We Redefine Airline Ancillaries?

In a world where unbundled services are the new norm, simply offering more doesn't always equate to improved bottom-line results. The equation for a successful ancillary strategy involves a judicious blend of human creativity and machine-based learning, as Allianz Partners explains.

It's about delivering the right message about the right product at the right time. This holds particularly true in the airline industry, an area that witnesses startlingly high online shopping cart abandonment rates - reaching as high as 90%.

The issue here is that simply providing a wider range of choices can backfire. When presented with an overwhelming number of options, customers may opt to make no choice at all. This underlines the importance of not just WHAT we offer as ancillaries, but also HOW and WHEN these products are presented to the customer.

A crucial component of this approach involves visual presentation. Customers, quite understandably, wish to visualize what they're buying before they make a purchase decision. Being able to show (rather than tell) a flight shopper about their potential flight experience is a transformative concept that is rapidly gaining traction in the airline industry. One such example is former startup Routehappy (now part of ATPCO), which allows shoppers to visually understand the differences between airline offers.

In light of this, the spotlight turns to a new breed of startups that are making significant strides in the ancillary landscape. These firms are focused on perfecting the “how“ and “when” of presenting ancillary products to customers. They are leveraging technology and innovative approaches to redefine the way these additional services are conceptualized, presented, and sold.

- Take, for instance, Renacen, which has developed an innovative 3D Seat Map. This unique tool provides a 360-degree immersive view from the specific position of the chosen seat during the booking process. It offers travelers an enhanced visual understanding of the different cabin classes, thus fundamentally improving the 'how' of presenting this ancillary option.

- Another firm at the forefront of ancillary innovation is Omnevo. Omnevo is paving the way for next-level digital ancillary revenue and operations empowerment. Their product suite enables airlines (and airports) to regain full control of their omnichannel retail customer engagement, leveraging the strength of e-commerce marketplaces. This is a prime illustration of rethinking the 'when' and 'where' of offering ancillary options, tailoring the delivery to the customer's journey for maximum convenience and revenue generation.

Who are the Emerging Airline Ancillary Tech Players?

- Plusgrade: Year Founded: 2009, HQ: Montreal, Canada, Number of Employees*: 608

- Gordian Software: Year Founded: 2017, HQ: Seattle, USA, Number of Employees: 58

- Omnevo: Year Founded: 2021, HQ: Wiesbaden, Germany, Number of Employees: 53

- Guestlogix: Year Founded: 2002, HQ: Toronto, Canada, Number of Employees: 39

- AtYourGate: Year Founded: 2015, HQ: San Diego, USA, Number of Employees: 37

- Aeronology: Year Founded: 2019, HQ: Melbourne, Australia, Number of Employees: 23

- Renacen (3D SeatMap): Year Founded: 2011, HQ: Badajoz, Spain, Number of Employees: 22

- SeatBoost: Year Founded: 2012, HQ: Los Angeles, USA, Number of Employees: 18

- Airfree: Year Founded: 2016, HQ: Paris, France, Number of Employees: 15

- ModiFly: Year Founded: 2021, HQ: Berlin, Germany, Number of Employees: 4

*According to LinkedIn as of May 31, 2023

Building upon these exciting examples of innovation, we have compiled the above ranking of further pioneering travel-tech startups.

In the ranking above, we present a list of ten emerging ancillary travel-tech startups that are making waves in the industry.

Disclaimer: As in our previous company rankings, we excluded long-established technology companies like ATPCO, Switchfly, and similar firms that have been around for several decades. Instead, we focused on the most recent wave of technology disruptors that are working to transform the tradition-bound business of ancillary sales. Also note that the ranking is primarily based on a qualitative assessment, incorporating key factors such as innovativeness, product maturity, scalability, market traction, and potential long-term impact.

While this top-ten ranking showcases the most promising startups poised to redefine the ancillary landscape, it's essential to acknowledge that they are not the only players influencing this space.

Many established companies, with years of experience in the airline industry, are also making significant strides in ancillary innovation.

- For instance, United Airlines and American Airlines have introduced a luggage delivery service that delivers your luggage directly to your final destination or home, starting at $39.95 per bag, eliminating the need to wait at baggage claim.

- Lufthansa offers a sleeper's row option for long-haul flights, which reserves an entire row of three seats for passengers, accompanied by a mattress cover, blanket, and pillow of business-class quality.

- AirAsia launched Xpress Baggage which is available via the carrier’s Super App at selected destinations for those who want their bags to be delivered among the first at baggage claim.

These examples demonstrate the innovation within established airline players. Notably, global distribution systems like Amadeus, Sabre, and Travelport are also playing an instrumental role in this process. They have modernized their platforms to manage the more complex selling of ancillaries, thereby helping airlines and travel agencies better merchandise their products. Simultaneously, tech-aggregator firms and larger airline groups have made significant strides, launching direct distribution channels in partnership with technology vendors such as Accelya and Travelfusion. These collaborations represent a concerted effort across the industry to enhance and personalize the traveler experience with a wider range of ancillaries.

However, the past has often demonstrated that industry outsiders, like technology startups, can introduce novel perspectives and disruptive solutions that have the potential to reshape traditional systems. By bringing a fresh viewpoint and leveraging modern technologies, these startups often push the boundaries of what's possible, driving the industry forward.

So, while we continue to watch and admire the progress made by all players in the ancillary space, it's worth giving these innovative startups an extra close look.

Stay tuned for the remaining two categories in our six-part Airline Transition article series, where we will further delve into this fascinating journey of airline evolution and innovation.

Catch up with our series on the technology transformation in the airline industry:

Part One: From Old To New: The System Transition In The Airline Industry

Part Two: The Evolution Of Airline Revenue Management: The Impact Of Emerging Technologies

Part Three: The New Distribution Capability Journey: Redefining Airline Commerce

Part Five: Reshaping Airline Journeys: The Unfolding Saga of Virtual Interlining

Part Six: Maximizing Flexibility: The Innovative Transformation of Airline Payments

.jpg)

.png)