21 year old JetBlue starts its much heralded service between New York and London on Thursday 11th August, but will it be the start of the disruption to transatlantic flying that some are expecting?

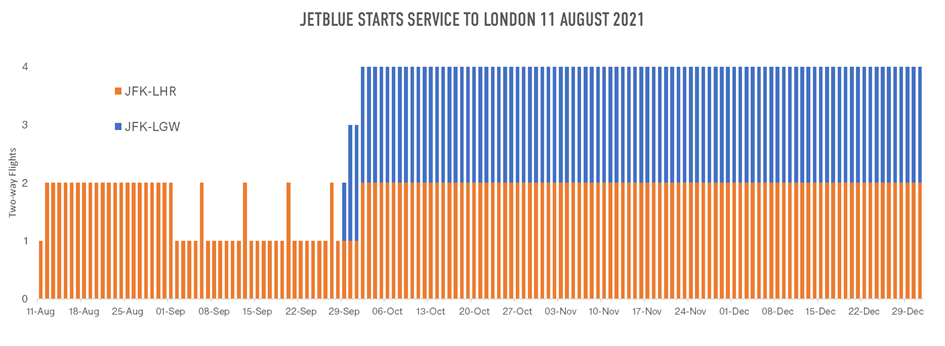

A look at the flight schedule might say no. A few weeks of daily JFK-LHR operations quickly turns to 4-per-week through September, hardly enough to make an impact on capacity. By October the schedule returns to daily operations between JFK and LHR and another daily service between JFK and LGW is added. But this only amounts to 17,000 seats out of the 5.5 million available between North America and Western Europe through October. That’s 0.3% of the north Atlantic market capacity, and hardly makes a dent in the 12% of seats to be operated by British Airways, 11% by United Airlines or 10% by Delta Air Lines. Even looked at from a UK perspective, JetBlue will only operate 1.1% of all seats, and 1.2% of all Business Class seats between the UK and North America in October, compared to British Airways’ 45%. So why the noise?

JetBlue has form as a disruptor and specifically in disrupting business travel markets, and there is possibly no more lucrative business travel market than the North Atlantic. Before the pandemic Heathrow-JFK was the only billion dollar route in the world, thanks to the large numbers of corporate travellers flying back and forth in seats towards the front of the plane. From the early days JetBlue aimed to disrupt markets it entered through the fares on sale and the amenities offered. Eight years ago, JetBlue announced the launch of its new Mint service, providing a new business class for transcontinental air services in the US. Until then, disruption had been the preserve of the low-cost carriers, going for volume while keeping prices low, and stimulating a new era of cheap air travel.

With the launch of new air services on the Atlantic, JetBlue has also created the Mint Suite. Like any other 21 year old GenZ-er, the service is characterised by that combination of personalisation and technology, making for a seamless environment where leisure and work can be combined. Each A321LR has 24 of these redesigned business class seats along with 114 economy seats.

Another adaptation being made for the launch of transatlantic air services is return air fares. Until now, the airline has generally stuck to one-way fares; it’s not been cheaper to fly on a return ticker than to purchase two one-way tickets.

A sign that JetBlue has the potential to be a formidable force is the way other airlines are responding. A look at some typical business class fares between JFK and LHR in November shows that British Airways is offering the same fares at JetBlue both out and back. Virgin Atlantic has a round trip fare which matches the combined one-way fares from both JetBlue and British Airways, while American has a lower fare offering.

|

JFK-LHR RETURN TRIP OUT 6 NOVEMBER 2021, RETURN 13 NOVEMBER 2021 Fares extracted from airline websites on 10 August 2021 (USD) |

|

|||||

|

|

|

Blue Basic |

Blue |

Blue Extra |

Mint

|

|

|

JetBlue |

Out |

276 |

351 |

532 |

1,180 |

|

|

Return |

443 |

518 |

723 |

1,507 |

|

|

|

|

|

|||||

|

|

|

Economy |

Premium Economy |

|

Business |

|

|

British Airways |

Out |

252-302 |

456-480 |

|

1,180-1,430 |

|

|

Return |

518-547 |

783-1082 |

|

1,507 |

|

|

|

|

|

|||||

|

|

|

Economy Light |

Economy Classic |

Economy Delight |

Premium |

|

|

Virgin Atlantic |

Return |

690-719 |

840-869 |

940-969 |

1,328-1,357 |

|

|

|

|

|||||

|

|

|

Basic |

Main |

Premium |

Business |

|

|

American Airlines |

Return |

500-536 |

608-644 |

892-910 |

1,926 |

|

|

Source – Airline websites |

||||||

Having similar fares isn’t necessarily a sign of disruption, just competitor activity. However, when compared to average fares from 2 years ago, before the market had been affected by covid-19, business class return fares were closer to US$3,000 or more. So, fares for October 2021 are on offer at a 25% discount on fares for October 2021. This might be simply that fares reflect post pandemic demand – while demand is lower, low fares are needed to stimulate the market – but it could be early signs of the impact that JetBlue is having.

|

AVERAGE FARES JFK-LHR ROUNDTRIP AUGUST 2019 |

|||

|

|

Average Fare - All |

Average Fare - Business |

Average Fare – Discount Economy |

|

British Airways |

621 |

2,887 |

206 |

|

Virgin Atlantic |

950 |

3,707 |

280 |

|

American Airlines |

387 |

3,140 |

186 |

|

Source – OAG Traffic Analyser |

|||

Now may seem to be an odd time to launch a bold new initiative, on the back of a global pandemic, and when travel between the US and UK is still not as free of restrictions as many would wish. This is especially so when viewed from the European side of the Atlantic, but Southwest, along with other US carriers has seen recovery come quicker than European airlines have. The large domestic market and more limited use of travel restrictions has meant that JetBlue scheduled capacity in August is ‘only’ 12.4% below where it was in August 2019. In the US and around the world there are a number of new entrants setting about some degree of disruption and making the most of low-cost aircraft leases, available employees and airport slots. JetBlue’s endeavour is also timely, taking advantage of the weak transatlantic market and corporate travel sector which is weakening potential competitors, as well as the availability of new aircraft with lower operating costs and better environmental credentials. What’s not to like?

.jpg)

.png)