Having looked like a certainty, and then not, by the end of June the acquisition of Air Transat by Air Canada looked like it was back on again. While the Board of Air Transat agreed to the deal to purchase the airline, worth $520 million, there are still a number of regulatory hurdles to pass.

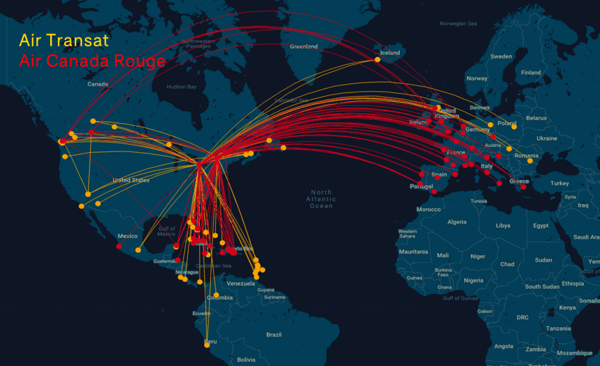

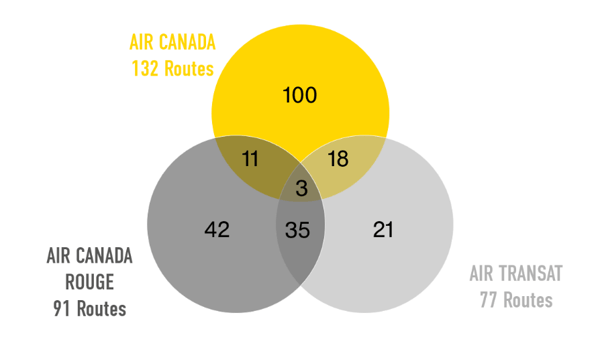

While Air Canada already has a low-cost leisure brand in Air Canada Rouge, it is right to ask what Air Transat brings, especially when Air Canada is saying that it will preserve the Air Transat brand. While there is some overlap – 35 routes in July 2019 – there are plenty of routes where the two brands don’t coincide and creating new opportunities for Air Canada to have a low fare offering aimed at leisure travellers. While Air Canada Rouge has network strength in Europe and the Caribbean, the focus of the Air Transat network is stronger in Canada as well as in the US and Latin America. It too has a significant operation to the Caribbean but many of the destinations differ.

There are only three routes which are operated by Air Canada, Air Canada Rouge and Air Transat; these are Montreal (YUL) to Vancouver (YVR) and Calgary (YYC) and also Calgary to Toronto (YYZ), which is perhaps not surprising.

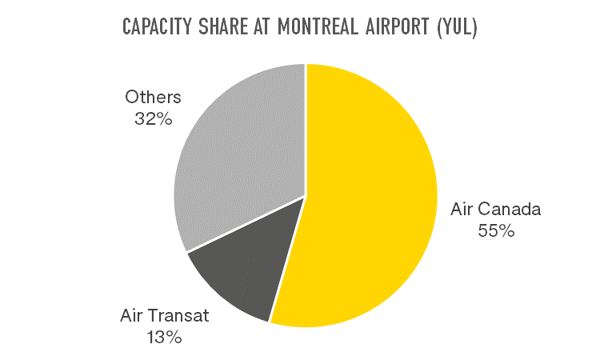

One of the main obstacles for the transaction will be the dominance that a merged Air Canada and Air Transat operation will have on the Transatlantic and also in Montreal. With both airlines based in Quebec, it’s not surprising that they have a strong presence in Quebec’s main city. Air Canada, including Air Canada Rouge which flies with the ‘AC’ code, operates 55% of outbound scheduled capacity from Montreal which means it is already dominant. Add another 13% capacity share with Air Transat and there will be real concern that with more than two-thirds of capacity in the hands of a single airline group passenger choices will be affected.

There are only three routes which are operated by Air Canada, Air Canada Rouge and Air Transat; these are Montreal (YUL) to Vancouver (YVR) and Calgary (YYC) and also Calgary to Toronto (YYZ), which is perhaps not surprising.

One of the main obstacles for the transaction will be the dominance that a merged Air Canada and Air Transat operation will have on the Transatlantic and also in Montreal. With both airlines based in Quebec, it’s not surprising that they have a strong presence in Quebec’s main city. Air Canada, including Air Canada Rouge which flies with the ‘AC’ code, operates 55% of outbound scheduled capacity from Montreal which means it is already dominant. Add another 13% capacity share with Air Transat and there will be real concern that with more than two-thirds of capacity in the hands of a single airline group passenger choices will be affected.

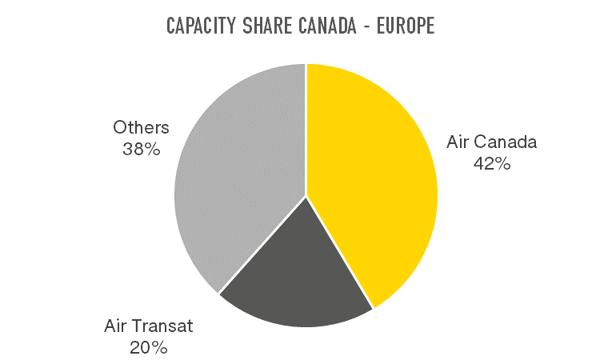

A similar picture emerges for Canadian transatlantic capacity. While Air Canada operates a smaller proportion of seats between Canada and Europe, at 42%, Air Transat operates 20%. Again, the combined entity has around two-thirds of the capacity.

While being responsible for such a large share of capacity in the market may be a concern, it’s not as if this hasn’t been an issue until now. Air Canada already operates 55% of seats at Montreal and an even higher share at Toronto Airport where its share is 57% in July 2019. Elsewhere in Canada competition is stronger; at Calgary Westjet is the major player with over half of seats and Westjet has a healthy 20% of capacity at Vancouver.

Of course, the political desire to see am even stronger Quebec-based company, and the jobs and economic impact that goes with that, may mean that the hurdles are overcome.

.jpg)

.png)