At this time of year many scheduled airlines are normally smiling. The Summer season is over, pressure on load factors eases whilst the accountants count the cash and the marketing teams are busy attracting those high yield business travellers for the pre-Xmas rush of conferences, conventions and sales missions. But this is no normal year as we know.

The transatlantic for many airlines is a very lucrative source of revenue and with the IATA Winter Season now four weeks away we’ve looked at the typical revenue generated across the season. However, since Covid-19 was already bugging demand in January we’ve used Winter 2018/19 as a reference point.

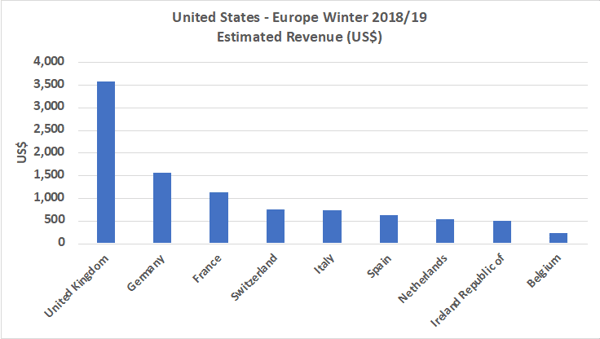

The UK market has always been the most valuable market and in the Winter of 2018/19 generated around US$3.573 billion; put another way that’s the equivalent of US$25.5 million a day so extremely valuable. Collectively the top ten European country markets generated US$ 9.952 billion and in the course of any winter that revenue is crucial to the survival of many carriers.

Chart 1- Estimated Revenues US – Europe, Winter 2018/19

Source: OAG Traffic Analyser

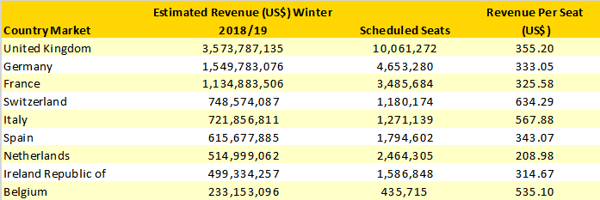

Of course, the revenue generated is a function of the amount of capacity offered and we have therefore used the scheduled capacity data for the same Winter 2018/19 to determine the revenue per seat. Aside from providing a consistent measurement it confirms that Switzerland by any measure always has a higher than average yield and secondly that lots of politicians travel back and forth to Belgium and probably “turn left” when boarding.

More typically half of the country markets have very similar yields ranging in the US$310 – 350 area which appear to be similar to the types of rates we were seeing in the market before the arrival of Covid-19 in January; so Winter 2018/19 would appear to have been very similar to how Winter 2019/20 was shaping up.

Table 1 – Estimated Revenue Per Seat US – Europe, Winter 2018/19 Season

Source: OAG Traffic Analyser

Potential Seven Billion Revenue Shortfall Looming

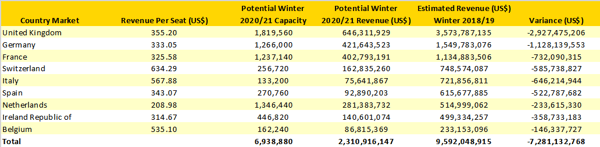

Having calculated an average revenue per seat for the top 10 European markets we then couldn’t resist projecting that forward onto the Winter 2020/21 winter season. Using any of the currently loaded winter transatlantic data would be worthless since we have frequently reported on how much capacity has still to be removed; we’d have a great headline number, but it wouldn’t be credible.

So, we’ve applied the current weekly capacity on offer in each country markets and assumed that this level of capacity would carry through the winter season. Some may think that even this number is overstating what will operate but we like to be optimistic on occasion. The table below works through that calculation: -

Table 2 – Potential Revenue Loss US – Europe, Winter 2021/21 Season

Source: OAG Traffic Analyser

In summary, across the top ten US – European markets if the current situation continues into the Winter season then based on current revenues airlines will lose over US$7.2 billion in revenue compared to their Winter 2018/19 performance. And of course, this optimistic assessment has assumed that demand was broadly as strong as in Winter 2018/19 and realistically we should expect that to be lower; overlay falling yields on that and the revenue shortfall could comfortably reach US$10 billion!

Ultimately this analysis is just that, a piece of analysis but it does highlight the scale of risk that every airline is handling today and the urgent need to re-open key international markets as soon as possible and also the need to rapidly rebuild traveller confidence to fill those empty seats. Unless we can start to make progress in those areas then airlines could be entering the Summer 2021 season in even weaker positions than are already expected.

.jpg)

.png)