This month Eurostar, the iconic high-speed rail service between London and Paris, turns 25. Happy Birthday Eurostar!

When it was launched there was much speculation about the impact on air services between London and Paris.

Before the ‘chunnel’ was an option for travellers, flying was the fast alternative to taking a ferry and then a train or car to reach one city from the other. Would the arrival of direct rail services do away with the need for flying all together? Would the benefits of departing and leaving from a city centre outweigh any time disadvantage that the new means of travel had compared to taking a flight?

Then and Now

While there is no doubt that the Eurostar has had a considerable impact on demand for air travel between the two capitals, there continues to be a market for those who want to fly.

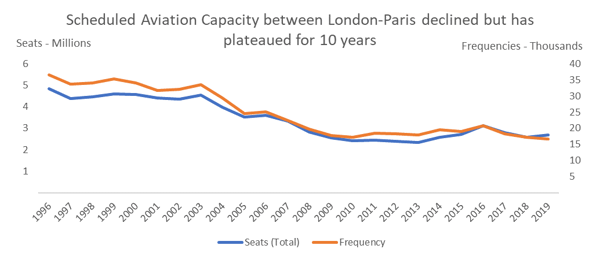

Looking back 23 years, when OAG data is available from, airlines offered capacity of 4.8 million seats annually between London and Paris. Today there are 2.7 million seats, which at 55% of the 1996 position is a significant reduction but far from catastrophic. It is a number dwarfed by the numbers travelling on Eurostar which rise to 11m in 2018, across all its routes. The number of scheduled flights has changed from 36,600 to 16,755. This is a larger decline than that of seats but is accounted for by the use of larger aircraft.

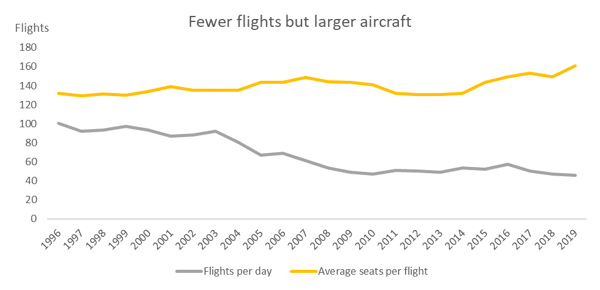

The average number of flights per day between the two capital cities was 100 when the Eurostar opened for business, but today is down to 46. While that seems like a major change, and indeed it is, the route still offers high frequency.

|

|

1996 |

2019 |

|

Seats |

4,837,753 |

2,698,173 |

|

Flights |

36,608 |

16,755 |

|

Flights per day |

100 |

46 |

|

Average seats per aircraft |

132 |

161 |

Back in 1996 40% of aircraft were variants of the B737, while a further 13% were A320’s and 20% were Regional Jets or turboprops. Today 85% are A318’s, A319’s or A320’s, resulting in a shift in average seats per plane from 132 in 1996 to 161 today.

Impact on Air Travel

While there was an immediate reduction in air services when Eurostar started operating it was, in fact, relatively small. The real impact of Eurostar on flying has been gradual. After an initial reduction in capacity, the number of airline operations stabilised and it was nearly 10 years before there seems to have been a more significant shift away from air. The reduction in scheduled aviation capacity which occurred in the mid 2000’s appears to have coincided with the start of the new Eurostar service from St Pancras International Station in London, and away from London Waterloo.

Source: OAG Schedules Analyser

Source: OAG Schedules Analyser

Rail vs Air – Evolution of Travel Times

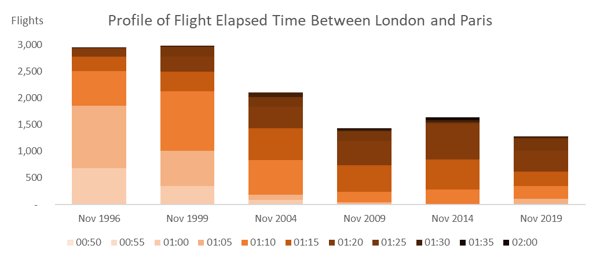

With high speed rail in place between St Pancras and the Channel Tunnel, the Eurostar services were able to reduce their scheduled travel times from 3 hours to 2 hours and 16 minutes, bringing them much closer to the elapsed journey times for flights.

While it appears that the shortening of the journey time by rail in 2007 had an impact on air volumes, it’s not clear that the gradual increase of the elapsed times for flights between London and Paris is having a similar effect. While 94% of all flights were scheduled to arrive within 75 minutes in 2010, this has dropped to just 48% today. Back in 1996 it was most likely that a flight would be scheduled to take 1 hour and 5 minutes but now the most likely elapsed time is 1 hour and 25 minutes. Against this backdrop the train increasingly appears more reliable and competitive for door-to-door travel time.

Source: OAG Schedules Analyser

The Last 10 Years

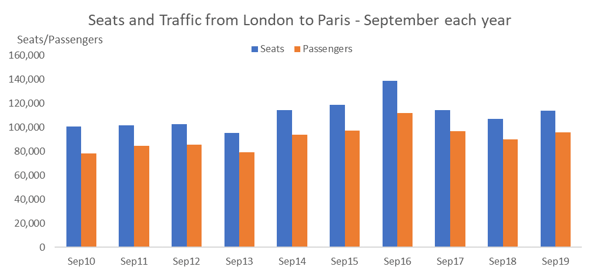

Since around 2009, airline commitment to the London-Paris route has been consistent and even saw moderate growth in the couple of years leading up to 2016. Since then capacity has again been declining slowly.

Looking at passenger volumes for September each year since then, there was a comparable peak in 2016 followed by a decline in traffic. However, load factors have improved slightly meaning that the 96,000 passengers who flew from London to Paris in September 2019 was the 4th highest volume of traffic since 2010. At the start of the decade on average 78% of seats were filled and this has risen to 84%.

Source: OAG Schedules Analyser

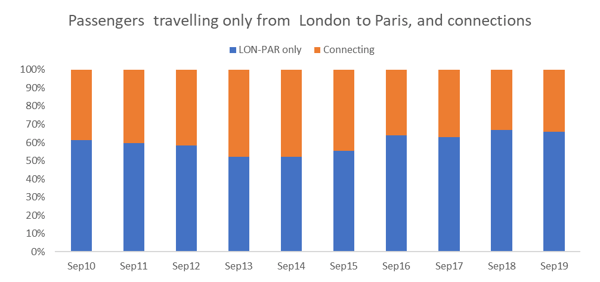

Of course, not every passenger taking a flight between London and Paris starts their journey in one city and ends it in the other. Another factor to be considered in looking at traffic between London and Paris airports is the proportion of traffic using the flight to connect onwards. In September 2019, 34% of passengers connected between flights at either airport or both. Passengers wishing to take the train and planning onward connections will almost certainly have to change train station in either London or Paris to do so.

Source: OAG Schedules Analyser

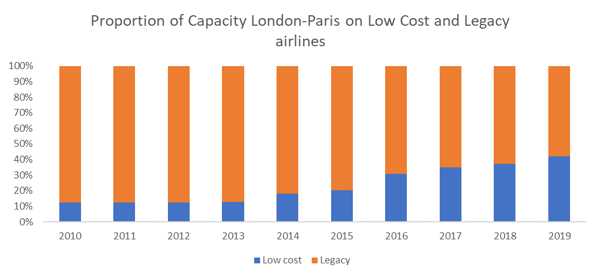

Another factor which may have contributed to the use of slightly larger aircraft and higher passenger loads is the growing share of airline capacity which is operated by low-cost carriers with their standardisation of fleet and competitive fares. While only 12% of scheduled airline seats were operated by low-cost carriers in 2010, that proportion has risen to 41% today. Arguably, without the competitive fares of the low cost carriers the market may have declined more than it has.

Source: OAG Schedules Analyser

It will have been a relief to the airlines operating between London and Paris, and the various airports serving the market, that air traffic did not disappear overnight when the Eurostar service began. The decline in traffic volumes has probably been slower than many anticipated, and the market has been surprising in its resilience. It appears that travellers like to have a choice and the market has responded.

What does the future hold?

Looking forward, though, there are two factors which point to continued decline of the route: congested skies and rising environmental concerns. If the analysis is correct in pointing to comparative journey times as one of the key aspects of passenger choice, and possibly the reliability of the scheduled travel times too, then it’s not good news for the airlines and airports. Congested skies above Southern England and Northern France are likely to stay that way and airlines will be tempted to continue to pad the schedules to maintain reliability making the flight time closer to the 2 hours 16-minute train ride. The downside of this action in the light of consistent Eurostar travel times will be to increase the competitive disadvantage of air travel. Factor in congested airport terminals and lengthy security queues at peak time and the tipping point may be closer than it appears.

And then there’s consumer behaviour changes associated with concerns about climate change. With a well-known high speed rail option available for this relatively short route – just 350km - it would not be a surprise to many in the industry if this route sees some passengers make a deliberate choice to let the train take the strain as they consider the carbon footprint of their travel choices.

.jpg)

.png)