BUSIER SKIES AND A DEMAND FOR VACCINE PASSPORTS

The Next Phase of U.S. Travel - Latest Survey Results

REPORT SUMMARY

OAG surveyed more than 1,800 U.S. travelers in July and August to analyze how travel behaviors are changing.

The main takeaway: Travelers are finally flying again – but the skies look very different and the air travel market recovery remains turbulent.

This report offers a timely pulse check on the state of U.S. travelers during this latest phase of pandemic travel. It offers key insight on:

- Traveler confidence

- Vaccination rates and attitudes while traveling

- Booking behaviors

- Holiday travel outlook

- Business travel landscape

And a lot more. Read on to get the full details.

TRAVEL CONFIDENCE GROWS BUT SOME CONSUMERS REMAIN GROUNDED

Travelers are taking to the skies once again. Domestic capacity in the U.S. was up 81% from June – August 2021, compared to the same period last year. OAG’s survey indicates that the growth will continue: 70% of all consumers surveyed have already booked flights for the future.

While the revival of air travel has been strong, nearly a third of travelers (30%) remain grounded. Boosting confidence with this segment will be key for maintaining and accelerating the air travel market’s continued recovery.

What will it take to get people that haven’t booked flights yet to fly again? There are several factors at play. According to OAG’s survey:

- 40% are waiting for regional COVID-19 vaccination rates and regulations to improve

- 30% are waiting for vaccine passports to be required

- 14% are waiting until they are fully vaccinated

- 14% said they would fly if the trip required minimal flying time (under two hours)

VACCINATION RATES PLAY AN IMPORTANT ROLE

Vaccination rates, especially given the fast-spreading Delta variant, are a crucial piece of the puzzle. While health experts agree that vaccinated individuals have a significantly reduced chance of getting COVID, vaccines remain a polarizing issue for people everywhere, including travelers.

OAG’s survey found that only 15% of non-vaccinated individuals plan to get vaccinated before their next trip. Fifty percent said they won’t get vaccinated and 35% prefer not to say.

Mandates may not change the situation. Of those that said they were not yet vaccinated, 56% said they still wouldn’t get vaccinated even if the airline, airport, or destination required it to travel. Only 9% said they would get vaccinated if it were required to travel. This stance will likely be put to the test sooner than later. Many airlines and countries are actively considering – and in the case of Qantas, several Canadian airlines, and vacation destinations like Turks and Caicos – requiring vaccinations to travel. OAG expects more airlines and destinations to follow suit in the months ahead, especially if the Delta variant continues to spread at current levels.

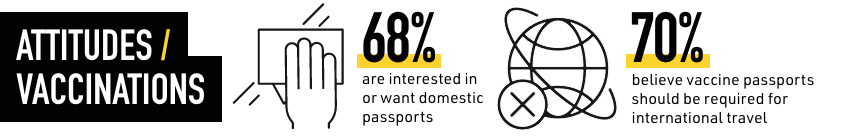

While the unvaccinated appear set in their ways, vaccination remains very important for the majority of U.S. travelers. Eighty five percent of all travelers surveyed by OAG said they were fully vaccinated at the time of the survey. Sixty eight percent of all survey respondents said they are interested in or want domestic vaccine passports, with 42% feeling strongly that domestic vaccine passports should be required; 70% believe vaccine passports should be required for international travel.

The idea of vaccine passports is popular among U.S. travelers.

Booking Behavior Remains Erratic

Nearly half of travelers surveyed are still booking on short notice (between two weeks to a month in advance), and half are booking between two-six-plus months out. This puts airlines in a difficult cash flow position, as the market traditionally books flights up to 11 months before the date of travel.

There are many reasons why travelers are booking with shorter booking lead times. According to OAG’s survey:

- 27% are holding out for cheaper fares

- 18% are concerned flight schedules will change or be canceled

- 12% are hoping to see regional COVID cases decline

- 8% are concerned about a possible COVID outbreak

The Delta variant plays a role as well. OAG is seeing both domestic and international demand soften heading into the fall.

Direct flights and ticket prices are still the biggest considerations for consumers when booking a flight and choosing an airline. Short connection times still matter as well, possibly more than pre-pandemic. Only 7% of respondents said they are willing to book a connecting flight where their connection is 3 hours or more.

Of those surveyed, 88% expect ticket prices to rise in the next 12 months, with 64% saying a price increase of 20% or more will moderately or significantly impact their intent to travel. Interestingly, 37% said price increases will only have small, if any, impact on their travels plans – which likely speaks to increased household savings levels and society’s collective need to travel post-lockdown, and the fares experienced during the pandemic.

When taking COVID protocols into consideration during the booking process, the three most important factors for travelers in order are: cleanliness, mask protocols and space per passengers. This marks an interesting shift from the previous year where mask protocols ranked as the most important COVID protocol for consumers, followed by cleanliness and space per passengers.

Holiday Travel Bounces Back

The increase in travel confidence should result in a strong 2021 holiday travel season.

Of the 38% of travelers surveyed by OAG that said they typically fly for the holidays, only 40% of this group did so in 2020. This year, the percentage of that group who do intend to fly more than doubled (85%). Planned capacity for Thanksgiving week tells a similar story, currently with 47% more domestic seats booked than last year.

Business Travel Outlook Remains Cloudy

While consumers are eager to travel again, companies have been slow to resume business travel. Of the business travelers surveyed, only 62% said their company is planning air travel in the next 12 months, while 38% said their company either has no plans (20%) or has not specified plans (18%).

Only 41% of business travelers surveyed expect their company to return to pre-pandemic travel rates in the next 12 months. Over the next year:

- 15% said they expect to travel about 25% less than pre-pandemic levels

- 16% said they expect to travel about 50% less than pre-pandemic levels

- 11% said they expect to travel about 75% less than pre-pandemic levels

- 9% said they don’t plan to travel unless critical, and another 9% said they don’t plan to travel at all

Of the business travelers who have yet to return to the skies, 11% expect their first trip to take place in Q4 2021, while nearly 5% expect to wait until 2022.

The slow return to business travel could be impacted by global travel constraints. According to the Global Business Travel Association (GBTA), there is an appetite to resume non-essential business travel and in-person meetings, but critical functions for business continue to be impacted by government policies and restrictions.

There is clearly an appetite to resume non-essential business travel and in-person meetings to promote collaboration, networking and business opportunities. And interestingly, it doesn’t appear that cost savings are necessarily a key driver in waiting to get travelers back out on the road. However, government policies and restrictions on international travel continue to hinder progress in pursuing activities so important to conducting business,

Suzanne Neufang, CEO GBTA

Clear but Bumpy Skies Ahead

U.S. travelers are eager to jet set again, but with COVID variants surging and labour issues continuing to impact airlines, the outlook remains turbulent.

With travel restrictions and regulations constantly changing, schedule flexibility remains critical for airlines and real-time information remains essential for travelers.

OAG handles over 150,000 schedules changes a day. Any change can impact booking conversions and traveler experience. Discover the new Flight Information API to gain access to the freshest data available.

ABOUT THE U.S. TRAVELER SENTIMENT SURVEY

OAG surveyed users of its flight tracking app Flightview by OAG 47% of respondents were traveling at the time they took the survey.

Methodology:

Timing: July – August 2021

Respondents: 1,811

Geographies:

NAM: United States, Canada, Mexico

LATEST UPDATES

18 December 2025

Aviation Market AnalysisSouth Korea’s aviation sector continues to exceed its relative scale, and nowhere is this more striking than on th...

12 December 2025

Aviation Market AnalysisWhen you have millions of presents to make and wrap, a fast-approaching deadline, and yearly disputes between the ...

10 December 2025

Aviation Market AnalysisCentral Asia may be the smallest aviation region globally, with 33.7 million scheduled seats in 2025, but it is le...

PUNCTUALITY LEAGUE 2023

Explore extensive on-time performance data for airlines and airports.

BUSIEST ROUTES RIGHT NOW

View the world's busiest international and domestic flight routes.

FUTURE OF TRAVEL

Discover the new technology shaping the future of travel for airlines, travel companies and tourists.