With the expectation that a decision on where London’s next runway capacity will be delayed again, this time until later this year, we take a look at the effect of the continued delays on new capacity at the capital’s airports.

Up until the mid-2000s, the value of a daily slot pair at London Heathrow was believed to be in the region of £4m. Some slots were sold in 2007/08 for around £20m, then the price fell back to £15m in 2013. In 2016, Oman Air reportedly purchased a pair of slots for £50m.

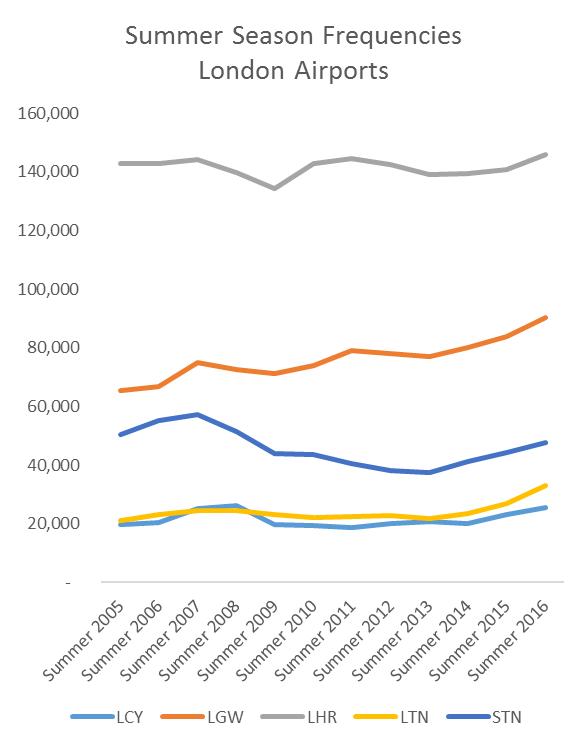

Whilst it seems that slot prices at Heathrow have appreciated even faster than the London property market, it reflects the position at Heathrow which is effectively full. Summer 2016 will see flights from London’s 5 biggest airports hit their highest ever level, 5.3% up on Summer 2007 which was the previous highest. At Heathrow, Summer 2016 will see flights reach 145,794. This is all relative though, with the change in the peak since Summer 2007 translating to just seven additional flights per day at Heathrow. It's not hard to see why these slots might attract such a premium.

Overvalued? Or just market rates?

Rumour has it there are 30 airlines waiting for slots at Heathrow and so Oman Air should be reassured that their investment is unlikely to devalue, at least not in the medium term.

What effect does this queue at Heathrow’s perimeter gates have on the rest of the London airport system? Frequency at London’s other airports is exhibiting strong growth this summer, with Luton leading the way with 23% more flights this summer than last year. Low-cost carriers – easyJet, Wizz Air and Ryanair – are driving this growth. Luton is part way through a major redevelopment which will increase passenger capacity by 50% to 18 million passengers a year by 2020. Gatwick and Stansted are also experiencing strong growth with 8% more flights but Gatwick is increasingly filling up as carriers realise new runway capacity in London’s airport system is still at least a decade away.

Might we start to see premium prices for slots at Gatwick in the coming years? In 2013, easyJet secured its position at Gatwick with the purchase of 25 daily slot pairs from Flybe, with at a reported cost of £20m. Summer 2016 sees 20 new routes starting from Gatwick and easyJet, British Airways and Norwegian are behind this growth. Gatwick will operate an average of 54 movements at peak hours this summer and whilst it is taking positive steps to squeeze every last bit of capacity out of its single runway, ultimately it is constrained, so it will be challenging for Gatwick’s biggest carriers to grow, unless there is consolidation or acquisition of marginal carriers.

What is clear is that while Heathrow remains full, London’s other airports will continue to benefit. Whilst this means growth is secured, this brings challenges about facilitating it and accommodating a pace of growth that is in excess of these airports’ long-term planning assumptions.

If you liked this post, you may also like:

.jpg)

.png)