For ten of the past thirteen weeks, scheduled airline capacity from Russian airports has exceeded capacity in the same weeks in 2019. While there has been plenty of focus on the recovery of the domestic Chinese market and domestic US market, much less has been said about Russia but the country has witnessed a remarkable increase in flying this past summer.

While international capacity from Russia has been steadily growing all year it still remains at 39% below 2019 levels, but domestic capacity has been positive since March, and seen a major surge between April and June. If this is a response to demand, it would appear that Russians are keen to be moving again, and though the destinations may have changed, the fact that overall capacity is at pre-pandemic levels implies that they are not being put off by the virus.

Summer Domestic Boom

While there are some airlines driving growth more than others, all the major Russian airlines are benefitting. Overall, domestic capacity is 27% up on where it was two years ago. Pobeda, the low-cost carrier of the Aeroflot Group, is the airline which has experienced the largest growth in absolute terms. Domestic capacity for Pobeda this week is around half that of Aeroflot, but is 81% up on two years ago, compared to a 13% increase at Aeroflot.

Nord Wind, a much smaller airline, has grown capacity by 67% while Ural Airlines has grown by 48%.

Not surprisingly, the Russian domestic destination which were thriving this summer included resorts along the Black Sea coast and this has continued into September. Capacity for the week of 13th September at Sochi (AER), close to the border with Georgia, is up by 77%, while at Gelendzhik (GDZ), a further 250km north, arriving scheduled airline seats are up by 183%. At Anapa (AAQ) another 85km north, capacity is up by 171% compared to the same week in 2019. These three airports currently have 124 routes operating to and from them, almost double the number from this time in 2019, and the total number of airlines seats available has also doubled. Less than 200km from Anapa, further inland, is Krasnodar (KRR), which has also benefitted from the boom in travel to the region, with capacity up by 34%.

International Hotspots

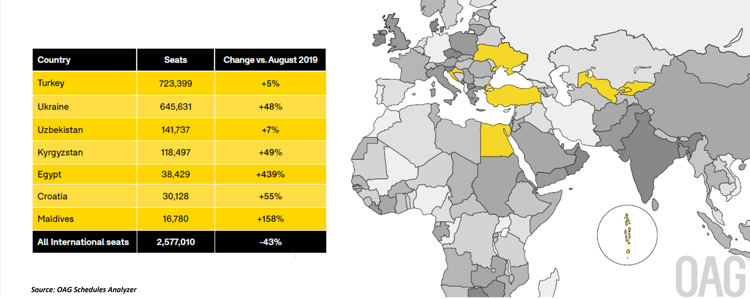

This week sees international capacity at 39% below 2019 levels, an improvement on the average of -43% experienced through August 2021. What is interesting, though, is how some destinations have still managed to grow, some by a large amount. For instance, the Maldives saw an increase in airline seats of 158% in August compared to August 2019, while for Egypt it was a massive 439%. These may not be the largest of the Russian outbound markets by a long way but it goes to show that even in difficult times there are some destinations which manage to make the most of the opportunities available, repositioning themselves and proactively winning engagement in target markets.

Related content:

Future Travel Bookings: What is in Store for Caribbean Destinations this Winter?

Is there a Link Between Vaccination Rates and Opening Up International Air Travel?

Ripples and surges in China as the latest wave hits: how will Asia respond?

.jpg)

.png)