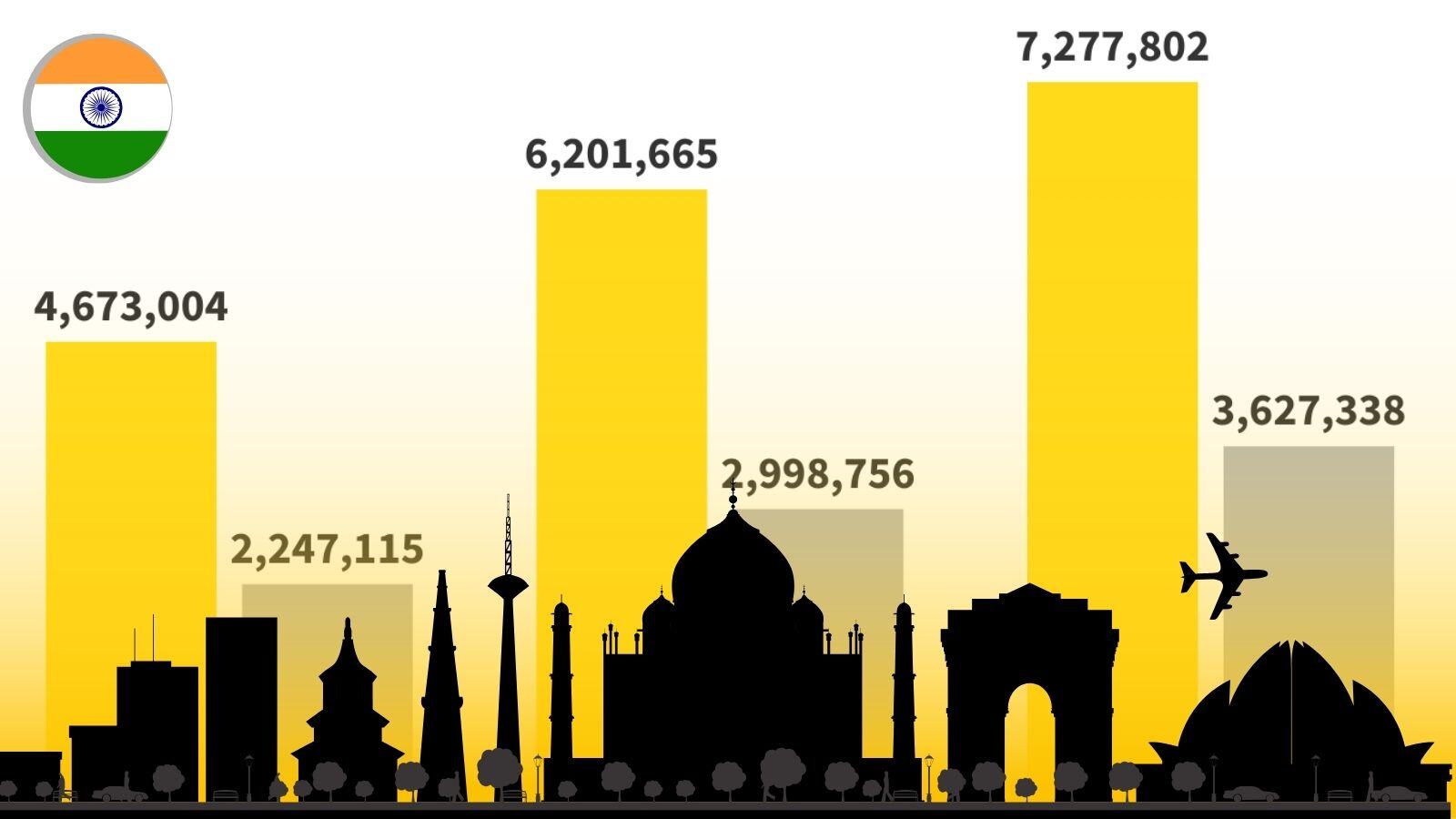

Over the past decade, India's international travel market has grown on average by 4.5% per year, from 4.7 million seats in April 2014, to 7.3 million in April 2024. There has been a 17% increase (from 6.2 million) since April 2019.

Which airlines lead the way in India's international market, and which countries and regions are most important for its growth? This new infographic lays out the key data.

India's Biggest Outbound Carriers

In April 2024, the top three airlines for international capacity share from India were:

- Air India (20%)

- IndiGo (17%)

- Emirates (7%)

Both Air India and Emirates held the same positions - first and third respectively - in April 2014, but Jet Airways was in second position on the list back then. Jet Airways was declared bankrupt and ceased operations in 2019, while IndiGo, which is now 18 years old, has grown rapidly since 2014.

The Importance of the Middle East for Indian Aviation

With 3.6 million Indians based in the United Arab Emirates and 2.6 million in Saudi Arabia, it's perhaps not surprising that the two countries take the first and third spots on the list of the biggest international markets for Indian air travel. While in April 2014 the UK and Malaysia were the third and fourth biggest markets, Thailand and Qatar have replaced them, meaning there are now three Middle Eastern countries in the top five, which plays out as follows:

1. United Arab Emirates

2. Singapore

3. Saudi Arabia

4. Thailand

5. Qatar

The data for this infographic is taken from part two of our series focusing on the current state of the Indian aviation market, which you can read here.

If you'd like to be first to know when we upload new infographics, aviation market analysis and airline news (typically twice a week), subscribe below. 👇

.jpg)

.png)