The welcomed addition of another 2.9 million scheduled seats (18,200 flights) back into the Chinese domestic market provides a positive update on the impact of the Coronavirus event for the aviation industry. It also places China back as the second largest market in the world; that may purely be a coincidence.

Meanwhile the spread of Coronavirus into parts of North East Asia and Europe at the end of last week could have been expected to see large reductions in capacity this week as airlines reacted. The latest data filed with OAG over the weekend would indicate that this is not the case and that many airlines remain cautious about cutting capacity more than is necessary. Both events make for a slightly more positive picture as we enter week seven of the event.

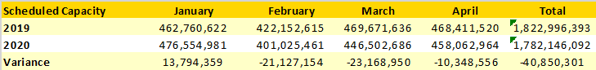

Table 1 – Scheduled Airline Capacity by Month, Jan – April 2019 V’s 2020

Source: OAG Schedules Analyser

The impact of Coronavirus can be seen in the table above, headline capacity for the first four months of 2020 versus 2019; some 40.8 million fewer seats. With market feedback that passenger load factors have been significantly lower in affected markets the impact on revenues may severely damage the profitability of many airlines this year.

North East Asia

Of the 2.9 million scheduled seats returning to the Chinese market some all but 3,000 are on domestic services with China Southern Airlines alone adding back some 684,000 seats and China Eastern a further 566,000. Reports from industry sources suggest that the dramatic capacity recovery has led to very low fares being made available as the Chinese Government seeks to repatriate locals after the Chinese New Year.

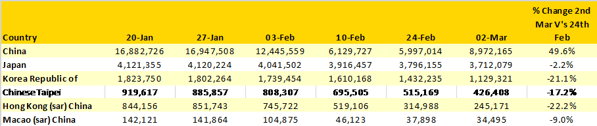

Table 2 – Scheduled Airline Capacity North East Asia Markets, 20th January – 2nd March 2020

Source: OAG Schedules Analyser

The optimism in China is not reflected in neighbouring markets where the impact of Coronavirus appears to be accelerating. South Korea has seen a 21% reduction in capacity and Hong Kong (sar) China a further 22% reduction; since the 20th January, capacity has fallen by some 71% in the Hong Kong market alone.

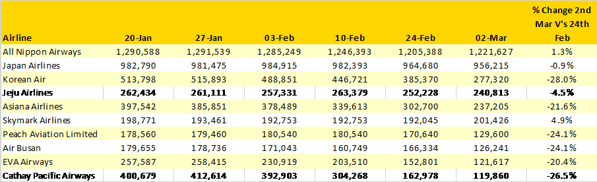

The strength of the Japanese domestic market has provided a degree of protection to the locally based airlines with to date; ANA’s capacity is only down by some 2.7% since the 20th January and JAL by 5.3% with minimal change in the last week. However, for Cathay Pacific, Korean Air, Asiana and Eva Airways further capacity cuts of more than 20% in the last week reflect the severity of the situation being faced on a regional basis. Seven weeks ago, Cathay Pacific would have been in fourth place on this list; this week they have just made the top ten.

Table 3 - Top 10 Scheduled Airline Capacity North East Asia, 20th January – 2nd March 2020

Source: OAG Schedules Analyser

South East Asia

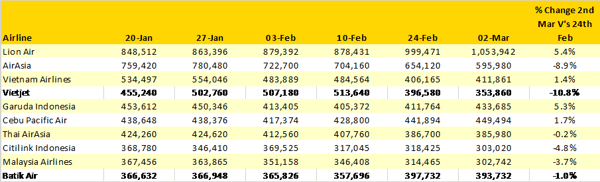

The potential impact of Indonesia reporting its first case of Coronavirus is highlighted by the table of top South East Asian airlines and the current levels of schedule adjustment that we are seeing from those carriers based in Indonesia. Airlines such as Lion Air, Citilink Indonesia and Batik Air have all added capacity in the last seven weeks; if that growth can hold with a wider outbreak of the virus is yet to be seen.

One major carrier that no longer appears in the weekly top ten airlines in South East Asia is Singapore Airlines who now rank 12th who cut capacity by a further 5% this week resulting in a total cut of some 12.5% since the 20th January and their first cuts for the last four weeks.

Table 4 - Top 10 Scheduled Airline Capacity North East Asia, 20th January – 2nd March 2020

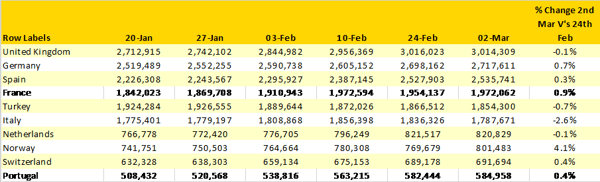

Europe

The recently announced outbreak in Northern Italy does not appear to have impacted total capacity at a country level although airlines are still adjusting schedules and re-accommodating passengers from some cancelled services before removing flights from their systems. Some airlines have sought to add capacity to existing routes across their networks taking advantage of expected increases in demand over the approaching Easter holiday period.

Table 5 - Scheduled Airline Capacity European Markets, 20th January – 2nd March 2020

Looking specifically at capacity from Milan this week shows a reduction of some 25,500 seats across the four major airports which represents a 5% reduction in capacity.

In summary the capacity re-introduced to the Chinese domestic market outweighs the reductions made in capacity in other markets, especially North East Asia where airlines are continuing to reduce operations. Ultimately capacity is but one measurement and if as seems to be the feedback that many of that re-introduced capacity has yet to translate into demand recovering then it would seem that Coronavirus still has some way to go before we see a capacity recovery outside of China.

.jpg)

.png)