LOYALTY AND DISRUPTION: THE NEW AGE OF TRAVEL

GENERATIONAL LOYALTIES USHER IN A NEW ERA FOR THE TRAVEL INDUSTRY

REPORT SUMMARY

The desire to take to the skies remains strong, but shifting generational loyalties and habits are sparking a new era for the travel industry, according to OAG.

OAG surveyed 2,000 North American travelers in April 2023 to analyze what factors affect traveler loyalty and booking decisions. The main takeaway: It depends on the generation.

This OAG report offers a timely pulse check on the sentiment of travelers in North America and key insights on:

- Generational loyalty trends.

- The impact of on-time performance on loyalty preferences.

- Generational adoption of automated flight rebooking and travel apps.

- Quick insights on sustainability, leisure and business travel.

And a lot more. Read on to get the full details.

Generational Loyalty Trends: Gen Z and Millennials Willing to Switch for Deals, While Baby Boomers Remain Loyal. All Travelers Demand Better Customer Care.

American Airlines (28%), Delta Air Lines (24%), United Airlines (17%), and Southwest Airlines (13%) are the most preferred brands of the travelers surveyed by OAG, which is representative of their combined market share in the U.S. In May 2023, Southwest had the highest market share at 22%, followed closely by American at 20%, Delta at 19% and United at 15%.

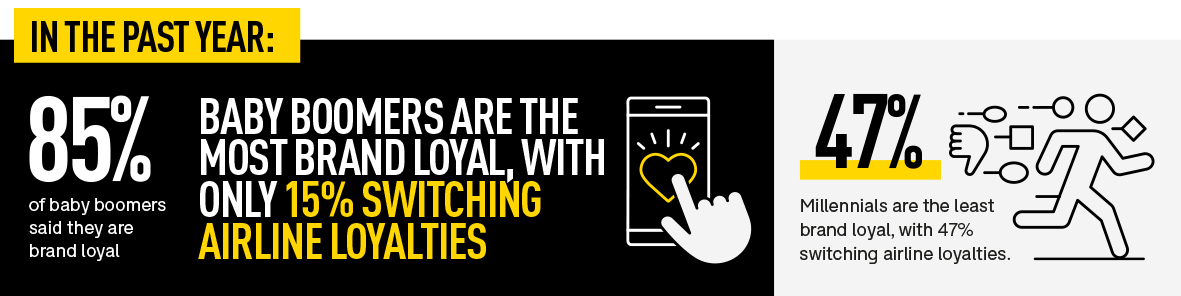

Millennials, the industry’s second youngest (and one of the largest) consumer groups, are more willing to change their airline loyalty than any other generation, which could be due to an increase of low-cost carriers (LCCs) entering the market. Forty-seven percent of Millennials have changed their airline loyalty in the past year, compared to 37% of Gen Z and 23% of Gen X. Baby Boomers are the most brand-loyal travelers, with only 15% having changed their airline loyalty in the last year.

The Cost Factor

Cost is the primary driver of airline preference and loyalty changes among all travelers (60%). Gen Z (77%) is the most likely to change airline preferences to find flights that suit their budget, followed by Gen X (69%) and Millennials (59%), while Baby Boomers (47%) are least likely to change airline loyalty due to cost.

Boomers Value Programs. Gen Z Seeks Variety. Disruptions Impact All

Status and frequent flier programs are tied with on-time performance as the number one reason Baby Boomers (25%) have remained brand loyal.

Additionally, 34% of Baby Boomers and 46% of Gen Z report changing their preferred airline to access more schedules and destination options.

Thirty-seven percent of all travelers changed their airline loyalty due to having experienced significant delays or cancellations in the past year. Millennials are most impacted by disruptions with 42% switching their airline loyalty because of a significant delay or cancellation, followed by 38% of Gen Z, 32% of Baby Boomers and 31% of Gen X.

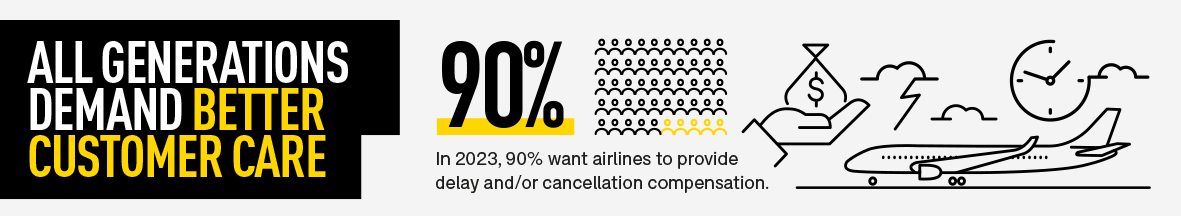

Ninety percent of all travelers agree that airlines should be required to provide delay and/or cancellation compensation.

In 2023, 90% of those surveyed would support the US DOT initiative of delay compensation. |

Loyalty Affirmed: On-Time Performance Key to Winning Travelers

On-time performance (OTP) remains a crucial lever in determining and affirming passenger loyalty.

Thirty-six percent of all travelers say the number one reason for their continued loyalty is an airline's proven track record for being on time. Gen Z’s loyalty is the most driven by on-time performance, with 63% remaining loyal to their preferred airline, followed by 52% of Millennials, 35% of Gen X and 25% of Baby Boomers.

According to OAG’s Monthly On-Time Performance Data, the top five most on-time airlines in the U.S. in April 2023 were Delta Air Lines, Alaska Airlines, Sun Country Airlines, American Airlines and United Airlines.

The criticality of on-time performance creates opportunities for Online Travel Agents (OTAs) to differentiate their brand. According to OAG’s 2022 North American traveler sentiment survey, 53% of respondents said OTA’s and travel apps can improve their booking experience by giving real-time travel updates, including probability for making connections.

Booking & Monitoring Habits

On-time performance also shapes booking habits. Eighty-two percent of all travelers said on-time performance affects the flight and/or airline they book with, assuming price and schedule options are relatively equal. Ninety-one percent of Gen Z are more inclined to pick the airline for on-time performance, compared to 87% of Millennials, 81% of Gen X and 77% of Baby Boomers.

Travelers also expect airlines to proactively communicate schedule changes in real-time, with 43% checking their flight’s punctuality at least once or twice between booking and their day of travel.

Gen X monitors OTP the most with 34% “always” checking their flights’ on-time performance between their time of booking and day of travel, compared to 30% of Baby Boomers, 28% of Millennials and 25% of Gen Z.

Gen Z and Millennials Are Embracing Automated Flight Rebooking and Changing the Game for Airlines, OTAs and Tech Providers

Younger generations are embracing automation and tech, and gravitating toward airline apps and third-party tech providers, while older travelers still stick to "old school" methods for travel information.

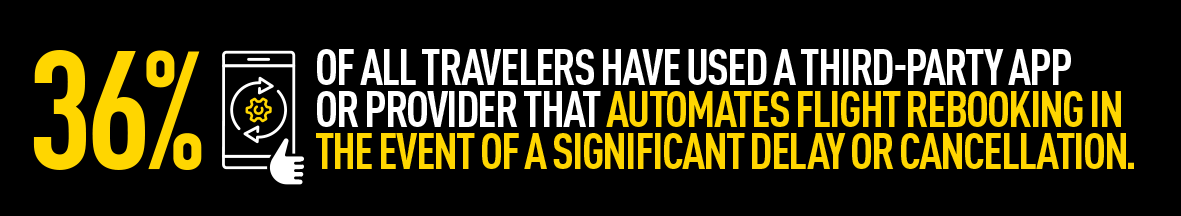

On average, 36% of all travelers have used a third-party app or provider that automates flight rebooking, with Millennials (59%) and Gen Z (54%) leading the charge. Gen X (26%) and Baby Boomers (25%) prefer to call an airline for rebooking when their flight is canceled.

Variations in Trusted Travel Sources

Across all age groups, airline apps edge out third-party apps as the most trusted source of information about travel delays. While 33% of all travelers look at airline apps during the day of travel, 28% rely on third-party apps.

But different generations trust different sources. Airport and terminal displays rank highest among Gen Z (36%). Third-party travel and flight tracking apps rank highest among Baby Boomers (39%), while only 17% look at airport and terminal displays. Airline apps rank highest among Millennials and Gen X, at 32% and 29% respectively.

Prioritizing Deals & Non-Traditional Options

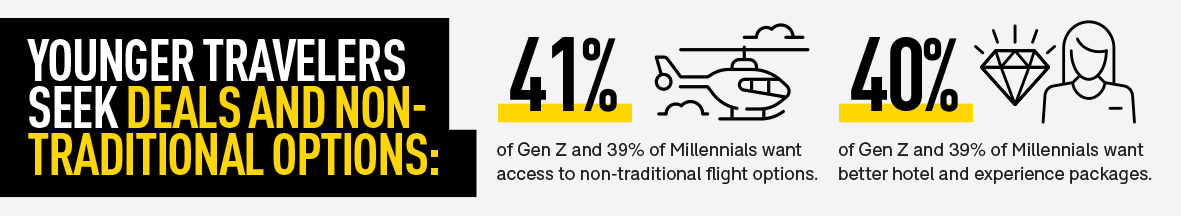

Younger travelers' booking habits are driven by deals. Forty-one percent of Gen Z and 39% of Millennials will change how they book to gain access to non-traditional flight options at a better price. Similarly, 40% of Gen Z and 39% of Millennials will change how they book to access better hotel and experience packages.

Price is a significant driver of booking habits for Gen Z, with 30% likely to change their booking habits if a different travel app or site offered better price predictability.

Quick Hits: Sustainability, Leisure, and Business Travel

Here are three additional quick-hitting takeaways from OAG’s survey:

- Baby Boomers are prioritizing leisure, while Millennials are prioritizing sustainability. The generation that’s least driven by sustainability? Baby Boomers, with only 1% taking sustainability into account when selecting their choice of airline. The generation that’s most driven by sustainability? Millennials, with 20% choosing more sustainable flights when selecting their choice of airline.

- Baby Boomers are traveling for leisure more than any other generation. Seventy-six percent of Baby Boomers and 66% of Gen X listed vacation and leisure as the main reason for their travels this year, followed by 61% of Millennials and 57% of Gen Z.

- Gen Z and Millennials are traveling more for business. Thirty percent of Millennials and 26% of Gen Z have planned business travel this year, compared to 25% of Gen X and 19% of Baby Boomers.

Travel Outlook: 2023 and Beyond

As the market begins to soften in the latter half of 2023, airlines will need to prioritize on-time performance as a critical service differentiator, especially for the younger generations of travelers. Ensuring lifetime consumer value becomes essential for sustaining their business in this evolving landscape.

About the North American Traveler Sentiment Survey

OAG surveyed travelers who have flown in the past year and users of OAG’s flight tracking app, Flightview by OAG.

Methodology:

Timing: April 2023

Respondents: 1,718

Geographies:

NAM: United States, Canada, Mexico

LATEST UPDATES

12 February 2026

InfographicsWhich are the busiest airports in Asia Pacific? Capacity data for the entire year of 2025 reveals that the region’...

16 February 2026

Future of TravelWelcome to the first regular edition of the OAG Airline-Tech Innovation Radar in 2026, where each month we spotlig...

10 February 2026

Aviation Market AnalysisGlobal sporting events rarely result in an immediate increase in demand during the event itself. In many cases, ai...

PUNCTUALITY LEAGUE 2023

Explore extensive on-time performance data for airlines and airports.

BUSIEST ROUTES RIGHT NOW

View the world's busiest international and domestic flight routes.

FUTURE OF TRAVEL

Discover the new technology shaping the future of travel for airlines, travel companies and tourists.

.jpg)

.png)