TRAVEL DEMAND REMAINS STRONG, DESPITE RISING INFLATION AND CONGESTION

BUSINESS TRAVEL CHARTS ITS OWN RECOVERY

REPORT SUMMARY

Consumers are eager to take to the skies right now, but increasing talk of a U.S. recession could impact travel’s continued recovery in the second half of 2022, according to OAG.

OAG surveyed more than 1,400 North American travelers in April and May to analyze how consumer behaviors are influencing the travel industry’s future. The main takeaway: despite rising inflation, consumer demand remains incredibly strong, with most consumers planning to travel this summer following two years of COVID lockdowns, protocols and restrictions.

This OAG report offers a timely pulse check on the state of travelers in North America. It offers key insights on:- Consumer demand and traveler confidence

- The impact of higher ticket prices and inflation on travel

- How industry staffing shortages are impacting the recovery

- The return of business travel

And a lot more. Read on to get the full details.

Travel Demand Remains Strong: COVID No Longer Grounding Travelers

OAG’s survey indicates that 27% more people are traveling this summer compared to summer 2021.

Sixty-two percent are booking at least two months in advance (51% are booking between 2-6 months in advance with 11% booking six months or more in advance). This is a stark contrast from 2021 when nearly half of travelers were booking on short notice (between two weeks to a month) due to concerns over flight changes, cancellations and possible COVID outbreaks.

While the Delta variant grounded domestic and international demand last fall, Omicron variants are not deterring travelers this year. First-quarter results from airlines are mostly positive, with many carriers reporting record revenues as the summer kicks off. This correlates with the attitudes of those surveyed:

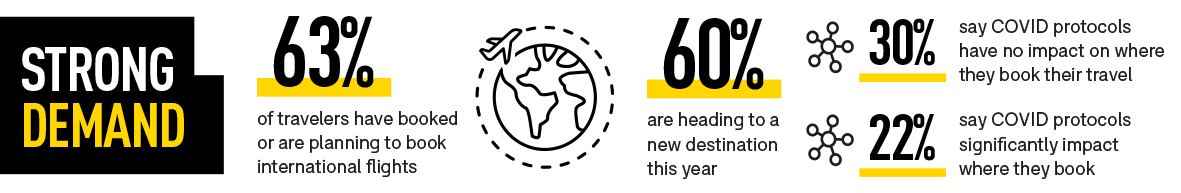

- 63% of travelers have booked or are planning to book international flights (compared to 49% in 2021).

- Nearly 60% are heading to a new destination this year.

- 30% say COVID protocols have no impact on where they book their travel, while only 22% say COVID protocols significantly impact where they book.

The three-month forward-looking airline capacity data backs up this trend, with more than 300M planned for North America (1.6B globally) through the end of September.

North American travelers are eager to jet set again. In 2022, 63% have booked or are planning to book international trips, and nearly 60% are flying to a brand-new destination. |

When it comes to lifting the mask mandate on U.S. airlines and at airports, the sentiment is split – 51% think the mandate should stay with 49% happy to see it go. Masks or no masks, travelers are flying again for the peak summer season, which spells good news for airlines.

RISING TICKET PRICES, INFLATION AND TRAVEL DEMAND: WHAT’S THE BREAKING POINT?

As noted above, travelers are booking trips and are eager to fly right now, despite higher costs and rising inflation.

The big question on everyone’s mind: What’s the breaking point?

According to OAG’s survey:

Fifty dollar and $100 ticket price increases aren’t likely to influence travelers’ purchasing decisions right now. Only 4% said they were extremely unlikely to purchase with a $50 increase; 15% are extremely unlikely to purchase with a $100 increase.

Ticket price increases of $200+ are more likely to influence travelers’ purchasing decisions. Forty-five percent said they are extremely less likely to book with a $200 increase; 68% are extremely less likely to book with a $300+ increase.

While ticket prices jumped 18.6% in April alone, many travelers are kicking themselves for not booking earlier. Sixty percent admitted to not taking advantage of low-ticket fares earlier this year or in late 2021.

Most travelers are eager to get to their destinations as quickly as possible. Few are willing to wait 3-4 hours during a layover, even if it means they can save $100-$200 on ticket prices. More are willing to wait 3-4 hours to save $300-$400 on ticket prices. The willingness to wait 5+ hours during layovers drops no matter the ticket price. |

Industry Staffing Shortages: The Acceptable Headache

According to OAG’s survey, 54% of respondents said staffing shortages have little to no effect on their travel experience, while only 34% said staffing shortages are negatively affecting their travel experience.

Those who were impacted listed flight schedules - including delays and cancellations - as the number one impact (52%), with customer service as the second most negative impact (19%).

OAG handles over 160,000 schedules changes and sends out over 4M status messages a day. Any change can impact booking conversions and traveler experiences. Access the freshest data available via OAG's Flight Info API. |

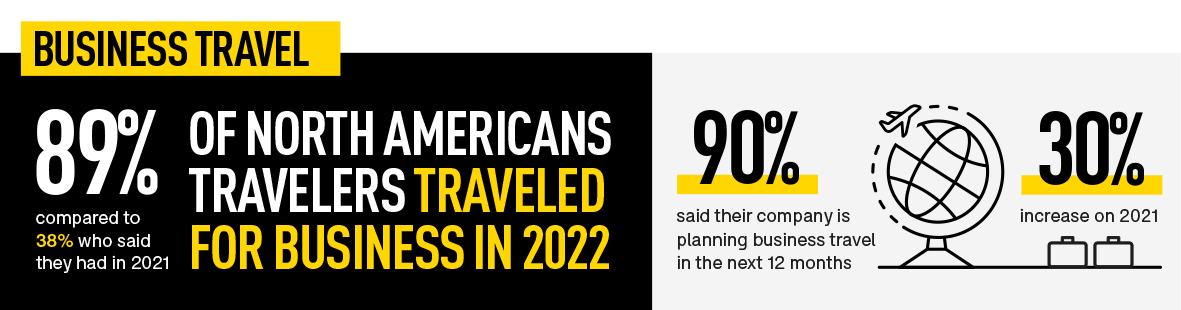

North American Business Travel is Back

As pandemic-era restrictions continue to lift, businesses are sending workers to in-person meetings and events again.

Eighty-nine percent of North American travelers said that they had traveled for business so far in 2022, compared to 38% who said they had in 2021. And 90% said their company is planning business travel in the next 12 months—a nearly 30% increase from last year. We can expect this trend to continue as 50% said their company plans to travel at the same frequency or more often in the next year compared to pre-pandemic levels.

According to the Global Business Travel Association (GBTA), the surge in business travel could be attributed to a revamp of corporate travel policies and employees broadly willing to travel for business despite economic and supply chain challenges.

“We’re seeing significant gains in the return of business travel, especially over the past month or two. GBTA’s global data shows more companies are allowing domestic and now also international employee travel. Booking levels and travel spending continue to return, and there’s high levels of optimism and employee willingness to travel for business. This comes even as the industry faces challenges beyond COVID-19 including rising fuel prices, inflation, supply chain disruption and war in Ukraine”

Suzanne Neufang, CEO, GBTA

Quick Hits: Booking Experience, Sustainability, Biometrics & More

Here are four additional quick-hitting takeaways from OAG’s survey:

1. The pressure – and stress – associated with booking travel increases substantially as prices increase. Given the rising demand and higher costs, third-party travel providers – specifically online travel agents (OTAs), mobile apps and more – need to be on their game. According to OAG’s survey, OTAs and travel apps can improve CX and the overall booking experience by:- Providing better price predictability on when to book 59%

- Giving real-time travel updates, including probability for making connections 53%

- Offering more non-traditional connecting flight options at a better price 50%

- Enhancing personalized travel and activity recommendations 18%

- Improving the ability to book hotel, experiences and accommodations at packaged rates 15%

- Enhancing online and inflight retail options 14%

2. While airlines are becoming increasingly transparent about their carbon emissions, sustainability is not a priority right now for North American travelers. Sixty-two percent of those surveyed said they do not factor a flight’s sustainability into their travel decision-making and 48% said they would not be willing to pay more for a more sustainable flight.

3. Today’s travelers are also more willing to share their biometric data (such as facial recognition, fingerprint or retina scanning, etc.) if it means they can get to their destination faster. According to those surveyed by OAG, 59% are willing to share their data to get through security lines faster and 56% are willing to use biometrics to streamline customs and immigration. Only 28% reported being moderately to extremely concerned about sharing their data for airport processing.

4. People just want to get to their final destinations — quickly and conveniently. Although the majority of those surveyed (69%) said they have not booked a self-connecting flight within the last 6 months (e.g., creating your own itinerary by connecting with different airlines and airports), 50% said they want OTAs and apps to offer more non-traditional connecting flight options at better prices.

Passengers crave connectivity now more than ever. Airlines, technology providers and OTAs have an opportunity to eliminate traveler headaches while also accessing valuable ROI. Learn how some of the industry’s leading creative innovators are tapping into this demand. |

Travel Outlook: This Summer and Beyond

2022 is holding firm through to the end of the peak summer season according to the three-month forward scheduled airline capacity data, which now includes flight data for September.

With demand remaining strong for the next few months despite continuing increases in fares, airlines are confident of a successful summer season. Looking further out, there is some concern around the price of oil, inflation and an economic recession. But for now, the market from both a demand and supply perspective is in its best position since 2019.

About the North American Traveler Sentiment Survey

OAG surveyed users of its flight tracking app Flightview by OAG.

Methodology:

Timing: April - May 2022

Respondents: 1,442

Geographies:

NAM: United States, Canada, Mexico

LATEST UPDATES

10 February 2026

Aviation Market AnalysisGlobal sporting events rarely result in an immediate increase in demand during the event itself. In many cases, ai...

11 February 2026

Aviation Market AnalysisChina's Longest Spring Festival Holiday: Top Domestic and International Travel Destinations for 2026

While Spring Festival in China traditionally centres around families and friends celebrating Chinese New Year toge...

06 February 2026

Aviation Market AnalysisJanuary's on-time performance (OTP) rankings have landed! The OTP data shows the percentage of flights that arrive...

BUSIEST ROUTES

Which are the Busiest Routes in the world right now?

View OAG’s ever popular Busiest Routes whenever you need as they evolve and change over time.

BUSIEST AIRPORTS

What is the Busiest Airport in the World?

View and interrogate the World's Busiest Airports with data and analysis updated each month.

ON-TIME PERFORMANCE

Free monthly On-Time Performance reports for airlines and airports.

Global rankings and reports compiled using the most comprehensive airline schedule database in the world.

.jpg)

.png)