CHINA AVIATION MARKET

Flight Data for China

Explore Chinese Flight Statistics | January 2026

Flight data insights and aviation analysis focused on China's airline market , with data powered by OAG's Schedules Analyser.

Here's an overview of the top statistics from China's aviation market this month:

- The busiest airport: Baiyun International (CAN)

- Top Chinese airline (domestic): China Southern Airlines

- The busiest domestic air route in China: Shanghai Hongqiao to Shenzhen (SHA - SZN)

- China's biggest city for air capacity: Beijing

- The top country Chinese travellers fly to: The Republic of Korea

- Scroll down for more data from each category.

The data is updated monthly. Seats are calculated as departing seats (one-way). The data displayed in the charts below is available to download here.

TOP 10 BUSIEST AIRPORTS IN CHINA | JANUARY 2026

Which are China's biggest airports?

- Baiyun International (CAN) remains China's busiest domestic airport in January 2026 with 3.4m seats. Capacity has remained constant year-on-year.

- Shenzhen (SZN) and Beijing Capital (PEK) airports follow closely as the second and third busiest airports, with 3.1m and 2.9m seats respectively and similar growth rates.

- Kunming Airport recorded the steepest decline, with capacity down 7% year-on-year. Xi’an Xianyang Airport also experienced a significant reduction, with capacity 5% lower than in January 2025.

- READY TO VIEW: The World's Busiest Airports of 2025

WE'LL LET YOU KNOW WHEN NEW DATA IS ADDED

Add your name to the list and we'll email you once a week with a round-up of the new aviation data added to our dashboards, the latest in-depth analysis from our air travel experts, travel technology news, easy to digest infographics and more.

TOP 10 DOMESTIC AIRLINES IN CHINA | JANUARY 2026

What are China's Top Airlines?

- China Southern Airlines remains the busiest airline in China in January 2026 with 10.7m seats, representing 15% of the domestic market.

- China Eastern Airlines is the second busiest airline in China with 10m seats in January 2026 and a 14% share of the market. However, capacity is down 6% year-on-year.

- Percentage-wise, Spring Airlines has recorded the biggest increase in capacity again vs last year, with 15% more domestic seats than January 2025. They now represent 4% of the Chinese domestic market.

- The majority of the other airlines in the Top 10 reduced airline capacity between 2% and 7% compared to January 2025.

TOP 10 BUSIEST AIRLINE ROUTES IN CHINA | JANUARY 2026

Which are the Most Flown Airline Routes in China?

- Shanghai Hongqiao to Shenzhen (SHA - SZN) remains China's busiest route in January 2026 with 647k seats, a capacity increase of 27% year-on-year. Beijing Capital Airport to Shanghai Hongqiao (PEK-SHA) is the second busiest route again this month with 633k seats.

- Capacity grew fastest on several Shenzhen routes, including Shanghai Hongqiao-Shenzhen and Hangzhou-Shenzhen (CAN-SHA), which both grew by 27% vs last year. Shenzhen - Beijing Capital (SZN-PEK) also recorded strong year-on-year growth, up 10% this month.

CHINA'S BUSIEST CITIES BY AIRLINE CAPACITY | JANUARY 2026

Which Chinese Cities are Key For Air Travel?

- Beijing remains the busiest city in China in January 2026 with 5.3m seats through the 2 main airports, representing 8% of the market.

- Shanghai is the second busiest city with 4.7m seats in January 2026, representing 7% of the market.

- Capacity to and from the cities of Haikou and Kunming decreased at the fastest rate of 10% and 7% respectively vs January 2025.

DOMESTIC VS INTERNATIONAL AIRLINE CAPACITY | JANUARY 2026

How Much of Chinese Airline Capacity is Domestic?

- Domestic capacity accounts for 83% of all seats to, from, and within China in January 2026, with 70.3m seats.

- Overall capacity contracted by 2% vs last year, with domestic capacity decreasing by 3% and international capacity remaining constant.

DISTRIBUTION OF CHINA'S INTERNATIONAL AIRLINE CAPACITY BY COUNTRY | JANUARY 2026

Which Countries do Chinese Travellers Visit?

- The Republic of Korea overtook Japan as China's busiest international market in January 2026 with 837k seats, a 9% increase year-on-year.

- Capacity to Japan reduced by 44% to 623k seats, taking it from the 1st to 4th biggest international market. Chinese government travel warnings and political pressure has led to reduced business and leisure demand, and airlines have reallocated capacity to other markets.

- International capacity grew fastest to Vietnam and Laos, both up 26% vs January 2025, followed by the UAE and Indonesia, each up 23%.

- International capacity to Thailand decreased by 21% compared to January 2025.

TOP 10 PROVINCES BY SEAT CAPACITY | JANUARY 2026

The table shows domestic capacity by Chinese Province for this month and the same month last year.

China's Largest Provinces for Air Capacity

- Guangdong remains China’s largest province for scheduled domestic airline capacity, with 8.1 million departing seats in January 2026 – 11% of all scheduled departing capacity and 2.8 million more seats than Beijing Province.

- Capacity contracted at the fastest rate in Hainan Province this month, by 11% vs last year. Shandong province also saw a significant reduction, with capacity down by 10%.

MORE RESOURCES FROM OAG

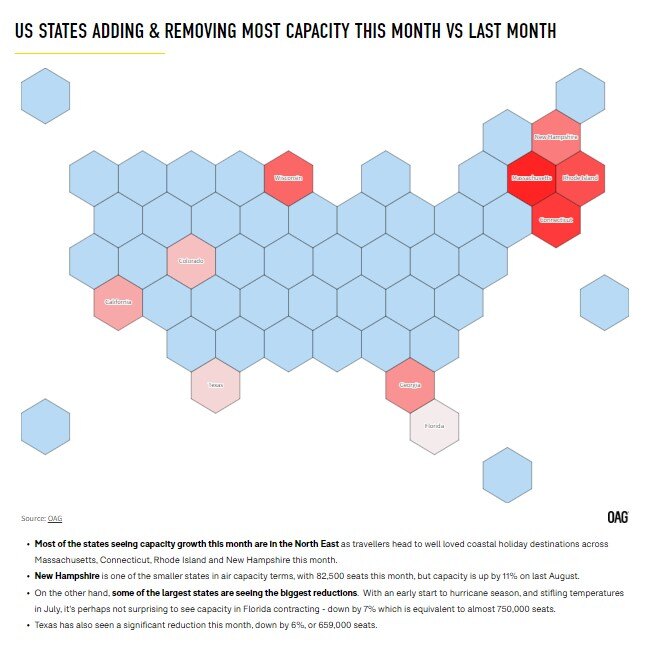

US Aviation Market Data

This month's leading airlines, airports, states and more from the US market.

View Data

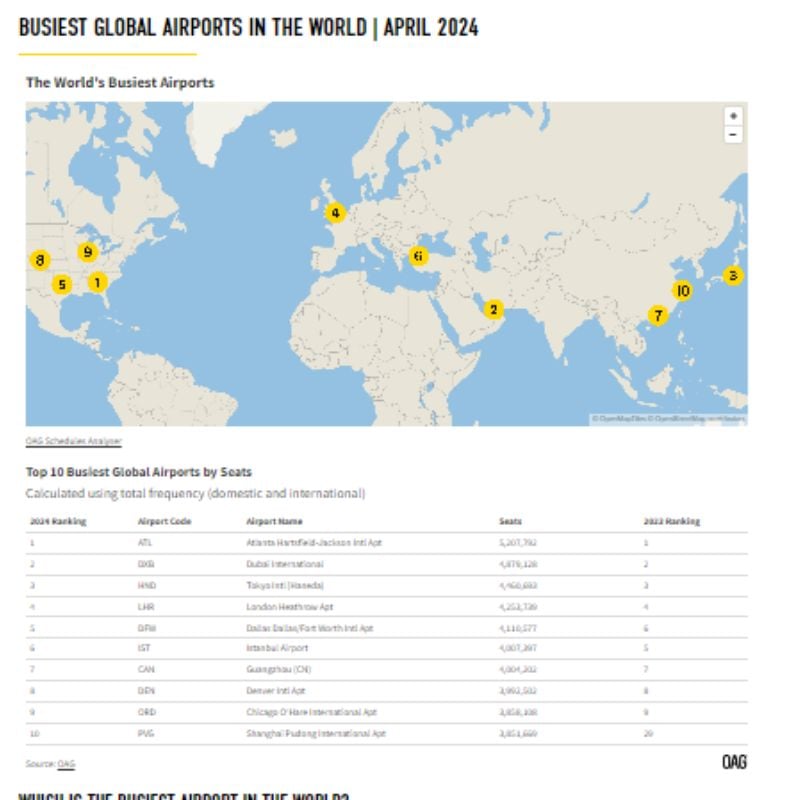

Busiest Airports

Data and analysis on the busiest global, international and regional airports, updated monthly.

View Data

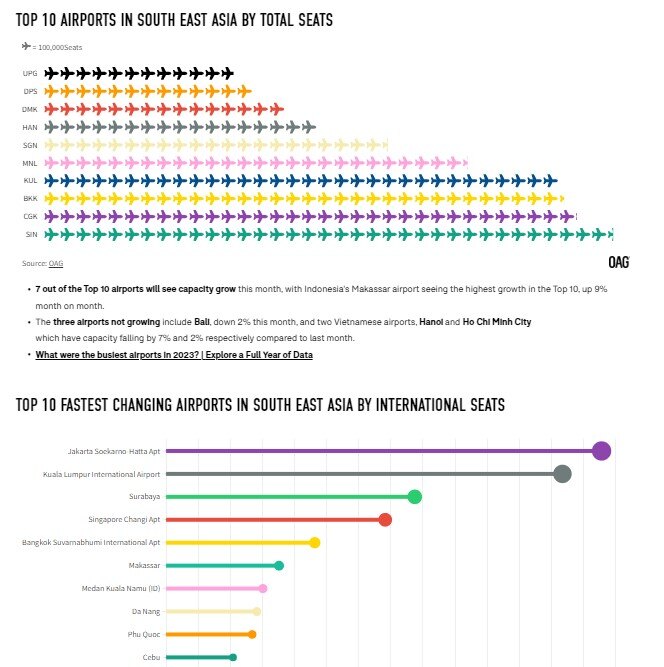

South East Asian Aviation Market Data

SE Asia's biggest country markets, airports, airlines and more are updated each month.

View Data

Aviation Market Analysis

Analysis of the latest data and developments in the aviation world.

Read Now