Africa's Aviation Market

Monthly Airline Data Updates for the African Market

Discover the Busiest Airports and Airlines in Africa This Month | March 2026

How much airline capacity is there in Africa? Find out with new data each month.

Here are some of the key stats from this month's African aviation market update:

- Busiest airport: Cairo International

- Biggest airline in Africa: Ethiopian Airlines

- African country with most global airline capacity: Egypt

- Country with most domestic airline capacity: South Africa

Top Ten Airlines in Africa (Departing seats, one-way) | March 2026

Which is the biggest airline in Africa?

- Ethiopian Airlines remains Africa’s largest carrier, with 2 million seats scheduled for March 2026 - an increase of 4%, or 75,300 additional seats year-on-year.

- Within the Top 10, Royal Air Maroc recorded the strongest growth in the region, increasing capacity by 26.6% year-on-year, followed by South African Airways at 25.5%.

- Kenya Airways has reduced its capacity by 1.3%, equivalent to 4,900 fewer seats.

Top Ten Busiest Airports by Departing Seats in Africa | March 2026

Which is the Busiest Airport in Africa?

- Cairo remains the largest airport in Africa with 1.7m seats in March 2026, an increase of 10.2%.

- Fastest growth within the Top 10 largest airports in Africa came from Casablanca and Hurghada, with increases of 19.5% and 16.8% respectively.

- READY TO VIEW: The World's Busiest Airports of 2025

Airline Capacity in Africa | March 2026

How much airline capacity is there in Africa This Month?

- Total airline capacity across Africa this month is 24.8 million seats, up 10.4% compared with March 2025.

- International capacity represents 77% of total capacity and is up by 10.2% vs March 2025. Domestic capacity increased by 10.8%.

- Mainline carriers represent 79% of the market and capacity increased by 10.4% vs March 2025. Low-cost carriers have grown at a similar rate, increasing capacity by 10.1% year-on-year to 5.2 million seats.

WE'LL LET YOU KNOW WHEN NEW DATA IS ADDED

Add your name to the list and we'll email you once a week with a round-up of the new aviation data added to our dashboards, the latest in-depth analysis from our air travel experts, travel technology news, easy to digest infographics and more.

African Countries' Airline Capacity | March 2026

Which African Country Has The Most Airline Capacity (Domestic + International)?

- Egypt remains the largest country market in Africa with 3.1m seats in March 2026, an increase of 12.5% vs last year.

- Capacity in South Africa grew by 12.7% vs last year to 2.6m seats in March 2026, an additional 290,800 seats.

- Of those in the Top 10 countries, Algeria recorded the fastest capacity growth, up 16.6% compared with March 2025.

Which African Country Has THE Most DOMESTIC Airline Capacity?

- South Africa remains Africa’s largest domestic market, with 1.8 million seats this month - up 13.9% year on year.

- Domestic capacity in Cameroon has nearly doubled, reaching 92,300 seats.

- Domestic capacity in Congo continues to decline, down 26.8% with 33,600 fewer seats.

Airline Capacity By African Region | March 2026

Where do flights from Africa go?

- Capacity to Europe remains the largest international destination region, with 9.3m seats (1m additional seats vs March 2025).

- Capacity to the Middle East has increased by 387,000 seats year-on-year, making it the second-largest international market with 4.7 million seats.

Which Region of Africa Has Most AIRLINE Capacity?

- Capacity to/from North Africa is the largest market with 6.7m seats, an increase of 724,700 seats year-on-year.

- Capacity to/from Western Europe is now the second-largest market, with 4.3 million seats - an increase of 426,100 seats, or 11%, year-on-year.

- Although one of the smaller markets, capacity to/from Eastern/Central Europe grew at the fastest rate of 32.7% vs March 2025, largely as a result of strong growth in capacity between the Russian Federation and Egypt. North East Asia also saw strong growth, up by 19.7% vs last year.

MORE RESOURCES FROM OAG

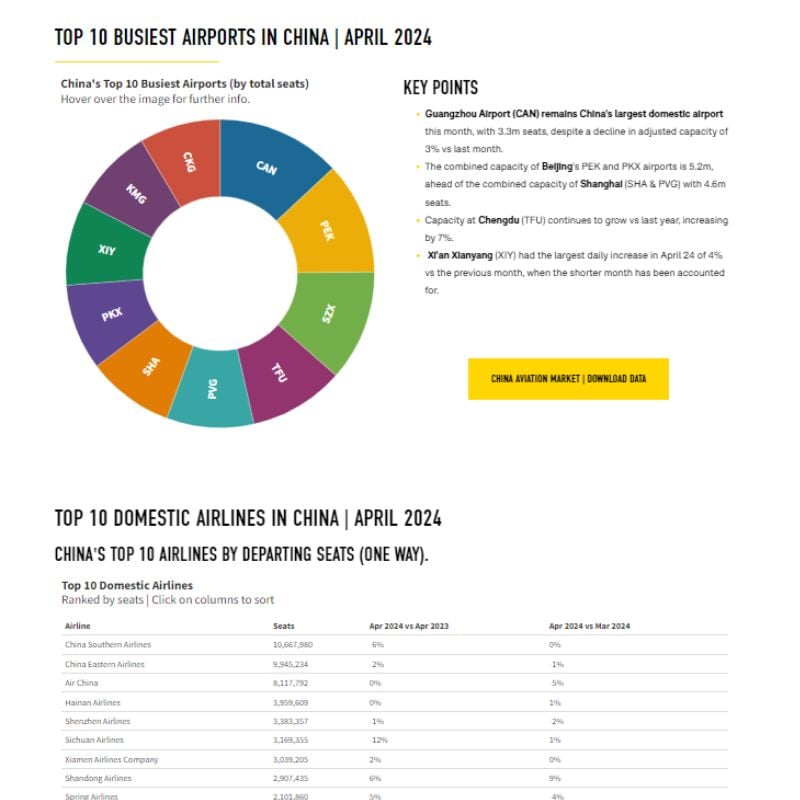

China Aviation market Data

The busiest airports, largest airlines, biggest cities for airline capacity and more

View Data

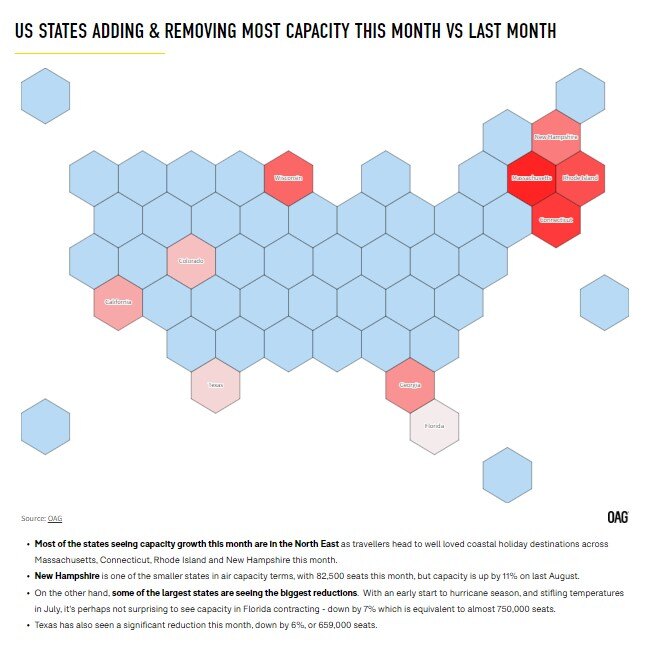

US Aviation Market Data

This month's leading airlines, airports, states and more from the US market.

View Data

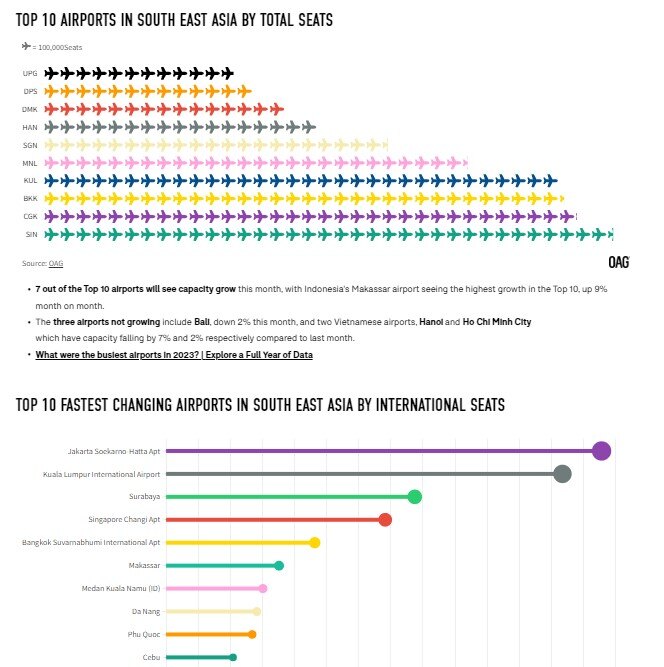

South East Asian Aviation Market Data

SE Asia's biggest country markets, airports, airlines and more are updated each month.

View Data

Aviation Market Analysis

Analysis of the latest data and developments in the aviation world.

Read Now

.jpg)

.png)