GLOBAL TRAVELER SENTIMENT SURVEY

REPORT SUMMARY

Since the start of the year, coronavirus has devastated the aviation and travel market, causing consistent and severe capacity cuts week after week. Globally, overall capacity is down nearly 50 million seats or 47%.

When will the air travel market start to recover and how do we get there?

Throughout the summer, OAG surveyed more than 4,000 global travelers to discover how the pandemic was influencing their decisions to fly, and to identify what airlines, airports, online travel agents (OTA) and other providers can do to rebuild confidence.

MOST CONSUMERS ARE PREPARED TO FLY (IF THE CIRCUMSTANCES ARE RIGHT)

While many consumers remain wary of catching COVID-19 while traveling, the overall fear factor (as it relates to catching the virus while at the airport or flying) is not as prominent as most think. On a scale of 1-10, with 1 being not concerned with catching the virus while traveling and 10 being very concerned, 52% of respondents rated their fear level at 5 or below – and only 32% said it was an 8 or higher.

On a scale of 1-10, more than half of travelers rated their fear level of catching COVID-19 while traveling at a 5 or below.

Nearly a third of travelers have not adjusted their travel habits (and don’t plan to) as a result of the virus. When it comes to those that are adjusting their habits, there’s a segment of the population that’s still willing to fly, but taking a more conservative approach:

- 37% will fly if it’s critical

- 25% will fly directly and avoid using connecting flights and airports

- 10% will fly during off-peak times

Overall, more than three-quarters of consumers said they were planning to fly domestically in the next six months, compared to 69% who are planning to fly internationally. Airlines and tourism companies can potentially capitalize on these trends and boost passenger levels by prioritizing their efforts around domestic travel, particularly focusing on cities with low transmission rates.

.png?width=850&name=Traveler%20Sentiment%20LP%20Graphic%2001%20(1).png)

As the industry recovers, direct flights and domestic travel will become even more popular. Airlines and tourism companies can potentially boost passenger levels by focusing their efforts around these trends.

Airlines have already implemented various safety measures and changes to increase capacity numbers. One that has gained traction in the news: pledges to leave the middle seat open. However, in addition to the lack of long-term viability and overall effectiveness, OAG’s survey found that this isn’t the solution passengers are looking for – with both APAC and European travelers ranking “leave the middle seat open” as the 5th most effective safety measure airlines could take in light of the virus. North American travelers ranked it as the 2nd. When looked at globally, “leave the middle seat open” placed third. What ranked above it and below it?

COMMUNICATION IS KEY

Consumers are most afraid of catching coronavirus while on the plane (40%), followed by airport terminals (17%). Seventy-six percent think that requiring all passengers and staff to wear masks is the most effective safety measure for both airlines and airports, followed by improved cleaning procedures. With proper safety and sanitation measures top of mind for consumers (and the industry already implementing various improvements), ample opportunity exists for airlines and airports to alleviate concerns by proactively communicating the steps and procedures they are taking to prevent transmission.

The major path to rebuilding confidence lies with the industry more aggressively communicating to travelers what it is doing to ensure flying is safe.

.png?width=850&name=Traveler%20Sentiment%20LP%20Graphic%2003%20(2).png)

KNOWLEDGE IS POWER

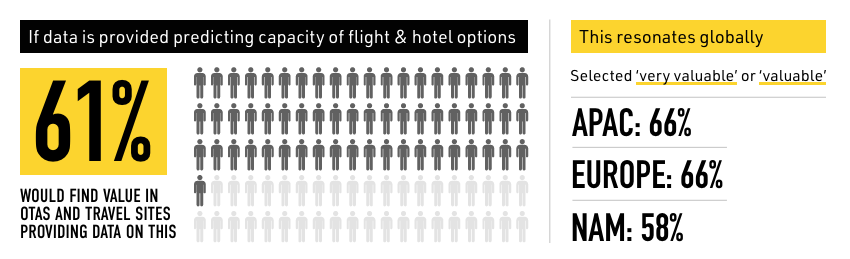

The more data the industry can arm travelers with the better. The majority of consumers (61%) said they would find value in OTAs and travel sites providing data on the predicted capacity of potential flight and hotel options.

Additionally, more than half of travelers (53%) said it would be valuable to see rates of COVID-19 transmissions at their intended destination when booking. Results are similar across regions:

- APAC: 65% see it as very valuable or valuable

- Europe: 68% see it as very valuable or valuable

- NAM: 47% see it as very valuable or valuable

With the majority of travelers (75%) saying they would consider the rate of COVID-19 infections at their end destination, OTAs and travel sites can gain a leg up by proactively providing this information to passengers booking.

There are more airline and flight capacity changes happening now than ever before. OAG ensures businesses have real-time access to updates through the world’s largest and most accurate flight information database. Find out more here.

MILLENIALS AND GEN Z TO LEAD THE RECOVERY

Most of the industry has set its sights on the resurgence of corporate travel demands and wanderlust wishes from those with disposable incomes. While these traditional, high-value travelers are crucial to overall recovery, immediate attention and marketing should be turned to millennial and generation Z consumers.

These passengers were already eager to travel before COVID-19, believing that tourism benefits local communities as well as their personal growth. As we wade through the pandemic, Millennials and Generation Z are more likely than others to travel domestically in the next six months (84% vs. 79%). They are also less likely to adjust their travel plans and behavior in light of the virus (66% vs. 70%), and are also slightly less concerned that they will catch coronavirus while traveling (with 56% rating their fear level at 5 or below and only 28% saying it’s an 8 or higher).

CLEARER SKIES AHEAD

With a sizable segment of consumers ready to get back in the air, traveler sentiment indicators point to a looming recovery (if the right environment can be created).

Everyone has a role to play:

Regulators must provide more clarity around new procedures and processes. Airlines and airports can more effectively communicate with travelers.

OTAs can offer more actionable information during the booking process. And travelers can do their part as well, by wearing masks, maintaining distance where possible, and staying home if they are sick or have symptoms.

Of course, the full recovery will be driven by how well we fight the pandemic globally and how fast we develop vaccines, and when restrictions around large events are safely lifted.

To learn more about the developing impact of COVID-19 as well as how and when the market will recover, visit OAG’s dedicated resource hub here.

ABOUT THE GLOBAL TRAVELER SENTIMENT SURVEY

The OAG Global Traveler Sentiment Survey took place between July and August 2020 and surveyed the users of its flight tracking website and app Flightview. The results show data from 4004 respondents, here is a breakdown of their ages and geographies:

Ages: 18-34: 12% | 35-50: 30% | 51-69: 47% | 70+: 9%

Geographies:

- APAC:- Australia, India, Singapore, Philippines, Japan, China, Thailand, Malaysia, Indonesia, United Arab Emirates, New Zealand, Pakistan, Republic of Korea, Bangladesh, Israel, Saudi Arabia, Sri Lanka, Vietnam, Kuwait, Afghanistan, Iraq, Lebanon, Myanmar, Qatar, Brunei Darussalam, Cambodia, Iran, Maldives, Nepal, Bahrain, Bhutan, Cyprus, Jordan, Kyrgyzstan, Oman

- Europe:

- United Kingdom of Great Britain and Northern Ireland, Germany, Spain, France, Ireland, Switzerland, Italy, Belgium, Netherlands, Poland, Portugal, Austria, Greece, Russian Federation, Turkey, Sweden, Lithuania, Finland, Czech Republic, Hungary, Luxembourg, Malta, Romania, Serbia, Ukraine, Croatia, Iceland, Slovakia, Slovenia

- NAM:

- United States, Canada, Mexico

LATEST UPDATES

03 November 2023

Covid 19 RecoveryLeaders throughout Southeast Asia have made it a priority to attract more Indian and Chinese travellers as a quick...

05 September 2023

Covid 19 RecoveryBefore the pandemic disrupted the global tourism market, France was the most popular destination for global touris...

31 August 2023

Covid 19 RecoveryEvery month we track the travel recovery in China, in this analysis we explore how China’s international airline c...

PUNCTUALITY LEAGUE 2023

Explore extensive on-time performance data for airlines and airports.

BUSIEST ROUTES RIGHT NOW

View the world's busiest international and domestic flight routes.

FUTURE OF TRAVEL

Discover the new technology shaping the future of travel for airlines, travel companies and tourists.

.jpg)

.png)