Every day we seem to hear of shortages: tomatoes, electricity, micro-chips, and aircraft spare parts. Quietly lurking in the background is probably one of the most worrying shortages for the aviation industry, pilots. Whilst the glamour of apparently great salaries, stopovers in exotic locations, and significant fringe benefits - including a uniform and seemingly endless upgrades when traveling - may appear attractive, the aviation industry faces a crisis in the next decade and there appear to be few solutions.

Fail to Prepare, Prepare to Fail

I can’t remember how many times I was told this when younger, and I can confirm it’s true, but the aviation industry failed to prepare for this shortage despite the warning signs. For many years, both Boeing and Airbus in their yearly market forecast have predicted how many additional aircraft will be required for the next twenty-five years and airlines may have failed to plan for the impending shortage, but can they be blamed?

Pilot salaries are amongst the highest in the aviation industry and while the work can be extremely stressful, the number of hours worked is amongst the lowest of any working group; indeed, many pilots have secondary jobs or small businesses that they run when resting. Salaries in the UK range from circa £25k for a new first officer to more than £150k for an experienced long-haul pilot, and that’s before the pier diem allowances are counted for some. The current average salary works out at £54,000 and in an industry with wafer-thin margins, no airline has ever been able to carry more resources than are actually required. Airlines have always been cautious about pilot recruitment, especially those at a regional level which see themselves as the “practice area” before pilots move on to larger airlines, longer routes, wider aircraft, and, in many cases expatriate, nomadic lifestyles.

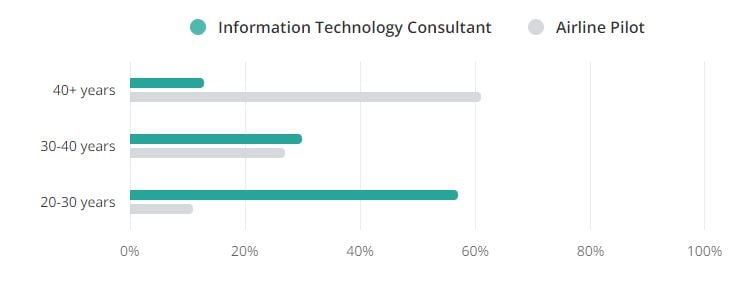

With recruitment seemingly carefully managed by the whole industry, a ticking time bomb was always looming, since the one thing no one could control was age and there is a requirement in many markets for pilots to retire at 65 or in some cases 60. The chart below shows that over 60% of pilots are aged over 40 which is a heavy concentration of resources heading for an armchair, especially when compared to other industries and professions.

Average Age of Commercial Pilots v Information Technology Consultants

Source: Zippia

Source: Zippia

Piloting Through the Gap

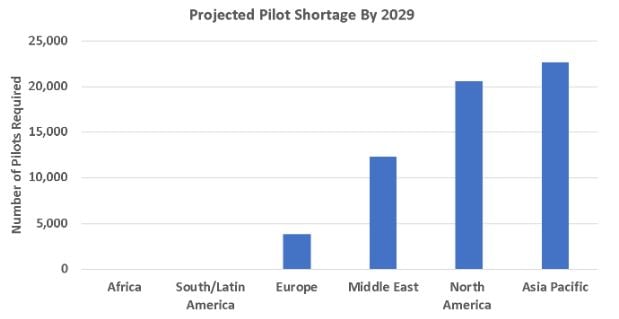

Estimates vary as to how big the pilot shortage will be and how soon it will cause problems, but in broad terms analysis seems to settle on a shortage of around 55,000 pilots by the end of the decade with both mature markets such as North America and emergent regions such as Asia Pacific equally badly affected. With such a shortage looming it is not surprising that airlines are concerned about both keeping existing trained crews and how to increase the workforce over the next decade in an increasingly mobile workforce where employee loyalty appears limited.

Source: Statista

Source: Statista

Filling the Pilot Gap

Identifying the potential problem is fine, but finding solutions is of course more important, and it seems that airlines are adopting several tactics to fill those gaps. Even so, there are no easy solutions, although sudden and dramatic changes in entry requirements can provide a short-term fix.

Southwest Airlines recently announced that they will reduce their pilot entry requirements to 500 hours of experience from the current 1,000-hour requirement which will provide a short-term injection of new resources into the airline. This also comes with the additional cost of onboarding those pilots into the business. Reducing the minimum experience will not in any way compromise the required training program of the airline, and Southwest believes that this step will assist in improving operational resilience against such incidents as those experienced at the end of 2022.

Meanwhile in Atlanta, Delta Air Lines has struck a “once in a lifetime” agreement with their pilots for up to a 30% salary increase over the next four years with an immediate 18% increase and a series of “one-off” bonus payments, part of which is a 14% payment of their 2022 salary. This agreement has already caused ripples in other US majors: Hawaiian Airlines has agreed to a four-year deal for their pilots with a 33% increase over the period, and others will surely have to follow. Indeed, American Airlines’ pilots’ union in February suggested their members should apply to Delta Air Lines to secure their futures as negotiations appear to have stalled with American on terms and conditions.

Clearly, in the United States the demand for and therefore value of an experienced pilot has never been stronger and the implications for all commercial airlines will inevitably be a shortage of newly qualified pilots gaining experience with regional airlines before moving forward to the mainline carriers. If pilot supply is compromised at the high end of the “resource chain” then it’s the smaller carriers that suffer and must reduce frequencies, which impacts revenues and eventually the sustainability of the business.

Recommended:

Building for the Future

Always ahead of the game, Emirates is taking a slightly longer-term perspective on the pilot shortage and working to build its own supply of pilots rather than relying on attracting expatriates to the company. For many pilots the attractions of working for Emirates have been hard to avoid; tax-free salaries, expatriate lifestyles, long-haul operations, and a great work/life balance with access to anywhere in the world virtually non-stop. But even Emirates has realized it needs to invest in building its own pool of pilot talent and recently announced a further investment of US$135 million in an extension to its flight training center in Dubai, ready for operation from 2024. By the end of 2024, Emirates will have some seventeen flight simulators and will have increased training capacity by over 50% in less than two years, partly to accommodate further fleet expansion and conversion, but also to facilitate local recruitment.

In Denver Colorado, United Airlines is halfway to completing a US$100 million investment in a new pilot training center with twelve advanced simulators, through which they intend to hire some 10,000 new pilots by the end of 2030. Since the airline only has 12,000 active pilots at the moment that highlights the sheer scale of the challenge that many carriers are facing.

Paying for an Education

As we know, airline operating margins are wafer-thin; a small turn on operating costs and the potential profit of any airline can be compromised. In part, the need to carefully manage the costs you can control has resulted in the current pilot shortages, although other factors such as age distribution and attitude to retirement have accelerated the pilot shortage.

Ultimately airlines will have to employ more pilots and carry more operational costs than was previously the case; initially, as salaries increase and then as more pilots join airlines around the world. Those costs are not likely to be absorbed by the airline but passed onto the traveler in the way of increased airfares. It may only equate to a few more dollars per flight, and for most people that cost will be an acceptable price to pay. What it also confirms is that even in the most technical and advanced of industries the price of skilled workers cannot be undervalued!

.jpg)

.png)