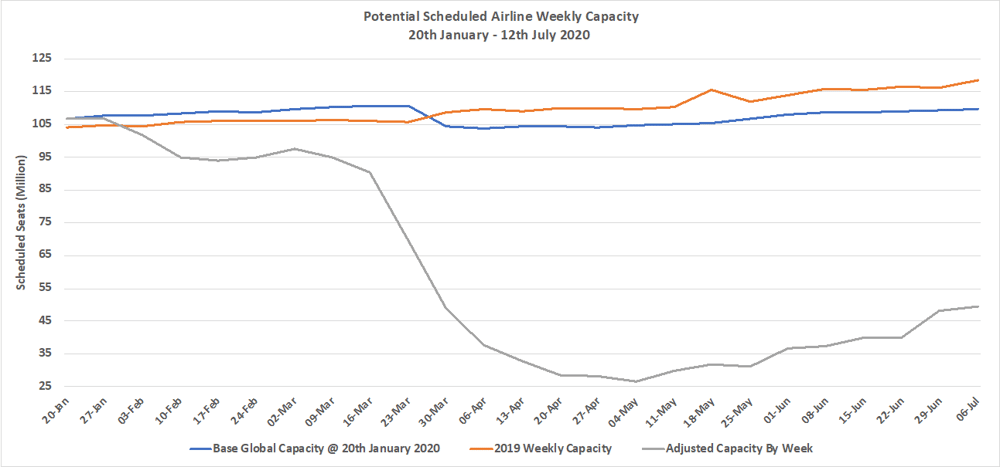

One thing COVID-19 has taught us is not to be greedy, an industry virtually brought to its knees in the first half of the year will take any growth possible even if it is only 3% more than last week.

At just below 50 million seats a week we have in the last six weeks seen capacity bounce back some 60% and are making steady progress back towards the 118 million seats operated in the same week last year.

Chart 1 – Scheduled Airline Capacity by Week Compared to Schedules Filed on 20th January 2020 & Previous Year

Source: OAG

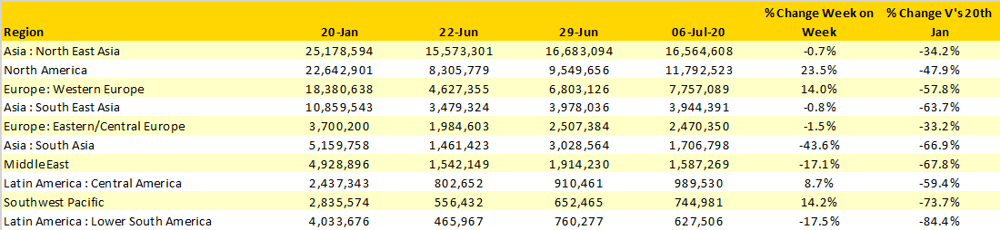

Regional analysis reveals a mixed bag of changes week on week. Exceptional growth of some 2.2 million additional seats this week in North America has resulted in total capacity in the region increasing by 41% in the last fortnight. Western Europe also continued its recent strong growth with just under one million additional seats added this week which in turn resulted in a 67% increase in capacity since the week of the 22nd June. July has certainly started with a bang in some major markets!

However, the same cannot be said for other regional markets. The ebb and flow of capacity that we have seen from Indian carriers in general over the last few months continued this week with total capacity falling back by over one million seats week on week. Such significant fluctuations have been seen before and will be seen again; it reflects the scale of challenges and the vulnerability of demand for airlines seeking their way out of the Covid-19 event.

Similarly, whilst in Asia, Europe and North America we appear to be at the peak or through the worst of the impact other markets such as Lower South America, the Middle East and the whole of the African continent continue to see week on week capacity declines. As we have frequently said, no two markets will see the same patterns of decline and recovery through the worst event to ever hit the airline industry.

Table 1 – Scheduled Airline Capacity by Region

Source: OAG

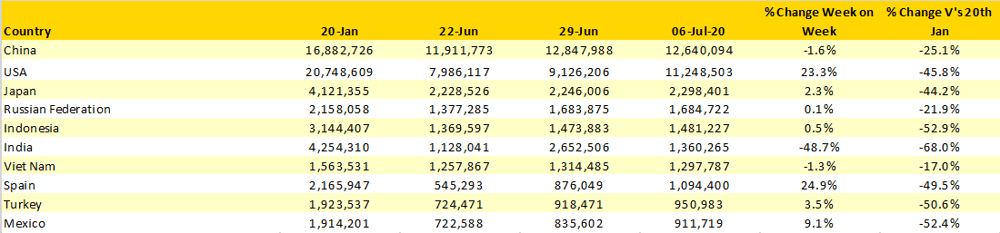

China’s recent run as the largest country market continues to come under pressure as US capacity grows; a third week of the growth levels seen would place the US back on top of the ranking unless China reopens international capacity soon, but even then… For many Europeans the opportunity to escape lockdown and quarantines has benefited capacity to Spain where capacity has doubled in just two weeks; siesta time is certainly over for AENA and their airports!

Table 2- Scheduled Capacity, Top 10 Country Markets

Source: OAG

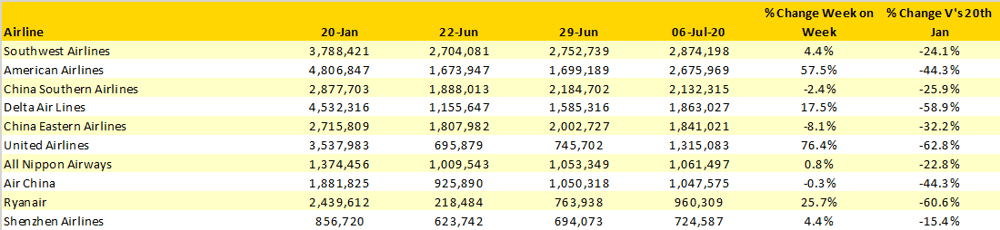

A bold and brave one million additional seats a week have been added back by American Airlines who have now moved into second position in the top ten global airlines and are obviously closing the gap on Southwest Airlines. In absolute terms, American’s additional million seats are impressive but in percentage terms United take the weekly award with a 76% increase in capacity. Both capacity increases should of course address the issue of the middle seat being used for a few more weeks at least as demand inevitably lags behind such capacity growth.

In the battle of European low-cost airlines Ryanair have crept into ninth place with a 25% increase week on week whilst Wizzair one of the pioneers of capacity reintroduction have cut capacity by some 23% and now rank as the 13th largest global airline with some 652,000 seats a week. Easyjet have also increased capacity by some 40% in the last week bringing forward many services back into operation earlier than originally planned in response but are continuing languish in 28th place compared to 15th in mid-January.

Table 3- Scheduled Capacity, Top 10 Airlines

Source: OAG

Looking briefly forward the current planned capacity for next week is showing some 55.5 million seats although we expect to see that reduce slightly; capacity cuts are certainly likely in Australia with travel restricted between Melbourne and Sydney although that could be offset by some more capacity returning to the Beijing market as infection rates fall again.

Ultimately breaking through the 50 million mark will however feel like the long road to recovery has at last begun to gather some pace and with reports of some airlines having to ask for volunteers to travel on later flights perhaps there is light at the end of a very dark tunnel.

.jpg)

.png)