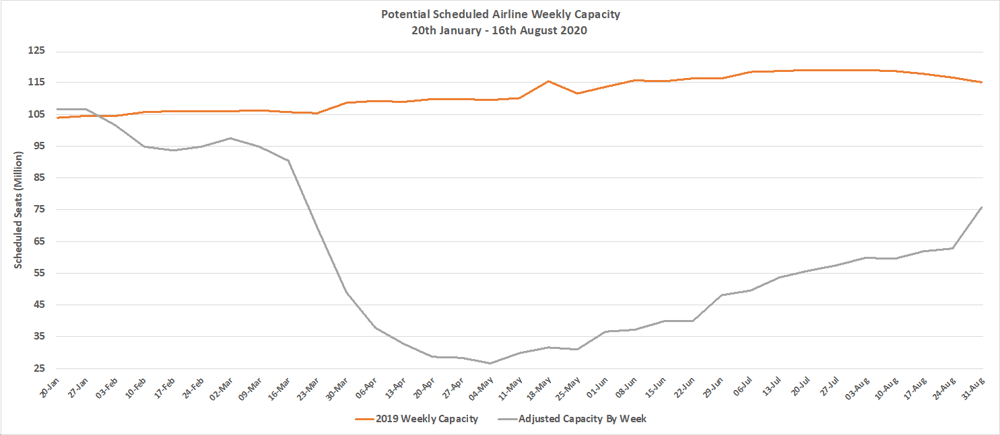

We may not have realised it at the time and it certainly didn’t feel that great, but last week’s global capacity may have represented the peak week for 2020 in the new world of Covid-19.

Last week we broke through the 60 million mark; this week we are just below that point and although there are pockets of capacity growth around the globe there are also a number of new travel and rumoured travel restrictions dragging capacity down. Strangely, week 32 last year saw a very small decline in global capacity on the previous week, but when the base was close to 119 million a drop of 200,000 seats was neither here nor there. Roll on a year and we remain at some 50% of the previous year’s capacity.

In the chart below we have for the first time included a sneak preview at the current scheduled capacity for the next few weeks. Scheduled capacity is expected to increase by just over 5% in the next two weeks and by the end of August reached 75million; a 26% increase. It will not happen, and airlines continue to make last minute schedule adjustments as the combination of travel restrictions and demand in response continue to damage the whole travel and tourism sector.

.

Chart 1 – Scheduled Airline Capacity by Week Compared to Schedules Filed on 20th January 2020 & Previous Year

Source: OAG

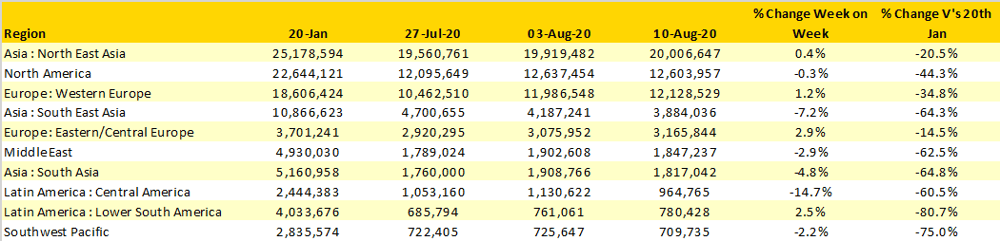

Six of the largest ten regional markets remain at 60% or more below their pre Covid-19 levels with Lower South America (-81%) and the Southwest Pacific (-75%) stubbornly refusing to move forward and in the case of the Southwest Pacific unlikely to change before the second quarter of next year given current travel restrictions.

Frustratingly, six regional markets reported reductions in weekly capacity with Central America reporting a near 15% reduction with the loss of some 160,000 seats week on week. Mexico dominates the Central American region and all of that capacity loss is in that market with major city pairs such as Cancun – Mexico City and Guadalajara – Mexico particularly impacted with Vivaaerobus reporting a significant capacity cut this week.

Eastern and Central Europe is now the closest regional market to its January capacity levels with some 3.1 million scheduled seats a week. Capacity from the Russian Federation is at 99% of the January base and the Ukraine is now reporting capacity growth against January although this may in part be the conversion of previous charter capacity into scheduled services.

Table 1 - Scheduled Airline Capacity by Region, 20th Jan – 16th August 2020 by Region

Source: OAG

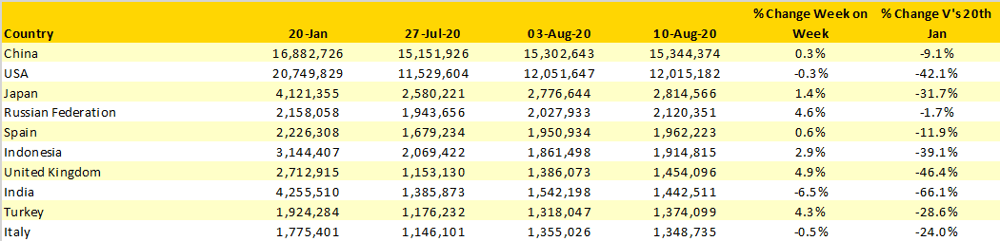

The top ten country markets now have a more familiar feel than in the depths of Covid-19. China continues to be the largest market with some 15.3 million seats a week of which 99% are operated on domestic services. Russia as noted earlier, is the only country market in the top ten to have positive growth against the January base point. Capacity growth in India has stalled as the Government continues to closely monitor and control the levels of service operated and amongst the top ten markets India remains the furthest away from their original capacity levels.

Table 2 - Scheduled Capacity, Top 10 Countries Markets

Source: OAG

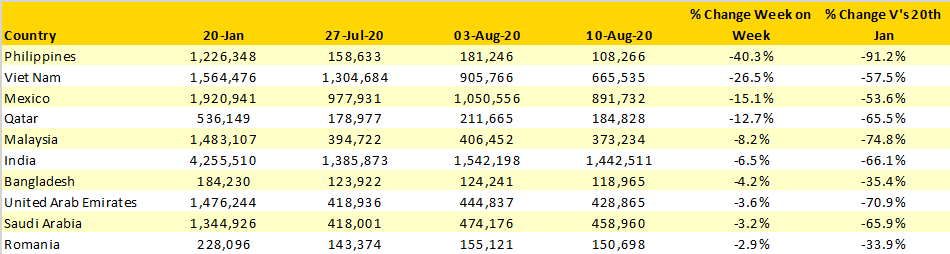

This week we have taken a look at those markets with more than 100,000 seats a week with the largest reductions in weekly capacity which perhaps includes one or two surprises. The closure of domestic air services to Manila from the 4th August explains the 40% capacity reduction in the Philippines whilst a Covid-19 spike in the Da Nang region of Vietnam has resulted in capacity dropping by over a quarter week on week.

Both Qatar and the United Arab Emirates also show capacity reductions and with both markets heavily reliant on connecting traffic flows constant changes in travel restrictions and secondary spikes of Covid-19 frustrate the local airlines ability to really ramp up capacity to the levels required. That said Emirates have this week added back the A380 on scheduled services to both China and Canada as they slowly rebuild their network; interestingly Etihad have yet to return the A380 to scheduled services with no current schedules planned before the end of September if indeed they do bring the aircraft back that early.

Table 3 – Ten Largest Capacity Reduction by Country w/c 10th August 2020

Source: OAG

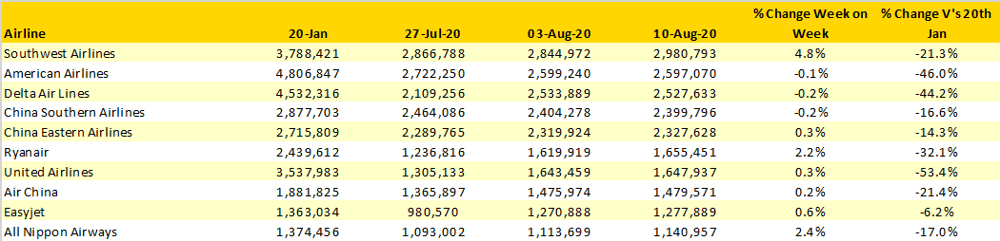

There has been little change in capacity across the top ten airlines in the last week. Aside from Southwest Airlines and Ryanair who have added some 140,000 and 35,000 additional seats respectively this week most airlines seem to have reached what could be their peak capacity week for the rest of the year.

Many globally recognised airlines continue to remain almost grounded. Singapore Airlines will operate only 6% of their January capacity this week whilst Cathay Pacific will operate just over 10% of their normal production levels. Meanwhile COPA are hopeful of relaunching services from early September which would be very encouraging given the capacity damage seen throughout Latin America.

Table 4 - Scheduled Capacity Top 10 Airlines

Source: OAG

If indeed last week does prove to have been the busiest from a capacity perspective in the Covid-19 world, then the outlook for the coming winter season is pretty gloomy. We remain at half of the capacity operated in January 2020; some 5,400 (22%) of all routes operated are currently not served. Some 714 airlines operated scheduled services in January, this week the number is down at 643 and amongst those operating more than 100,000 seats a week the numbers went from 177 to 121; being a mid-size airline has proven to be a very uncomfortable position!

Overlay those statistics with news of airlines seeking an extension to the CARES Act, TSA processed passenger plateauing at around 26% of last year’s levels, Virgin Atlantic filing for Chapter 15 and airport terminals being mothballed with no intention of reopening until Summer 2021 the data looks grim. It may be the traditional peak demand weeks of the year, but the data would suggest that if this is as good as it will get then the Winter will be challenging for everybody.

.jpg)

.png)