On the face of it, the data looks slightly positive this week with capacity increasing by a strong 3.8% week-on-week, with 81.4 million seats reported. In comparison to two years ago, we remain at -26% but nevertheless, Omicron (the latest Covid variant) appears not to have damaged the short-term capacity of airlines around the globe. Of course, airline capacity remains one part of a complex equation of demand, yield and operating costs. The real test in the coming week will be how well demand holds up, certainly from my own experiences in the last few weeks, it’s strong!

The real test of the impact from Omicron is likely to be around the medium-term demand for travel. And, when that medium-term demand covers one of the hardest periods of the airline year, the first quarter, it is no surprise that airlines are looking hard at their finances once again. Scheduled airline capacity for the first quarter of 2022 currently stands at 1.149 billion seats. Last week it was 1.157 billion, so a reduction of around 8 million, this is one of the lowest rolling forward adjustments we have seen for a long time in the data. The aviation industry has not yet been spooked as badly as politicians by Omicron, or perhaps it is now more experienced from recent learnings about how to handle such events.

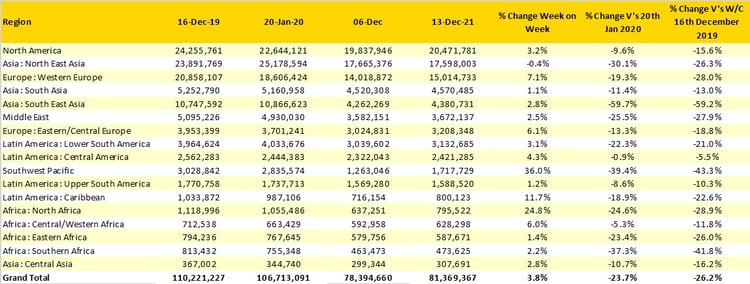

Table 1 - Weekly Capacity Changes by Region

Source: OAG

At regional level North America is once again growing as we forecast a few weeks back, with many major carriers adding back domestic capacity ahead of the holiday season - it is now less than two weeks to Christmas and people are beginning to move. Europe is also reporting big week-on-week levels of capacity growth as the early ski season begins to get underway. Many markets who are dependent on the winter ski season have made it clear that they intend to remain open this year - with travel protocols aside, it could be a strong season for those able to ski... and that's not me!

Away from the bigger regional markets, it is finally time to welcome back New Zealand to the global market with a staggering 72% increase in week-on-week capacity, and whilst almost all those seats are in the domestic market that will be a welcome injection of tourism and trade to local economies. By comparison, the increase in capacity across Australia of over 33% may seem minor, but in volume terms 317,000 extra domestic seats is “slightly” more than the 118,000 seats added back in by New Zealand, and places Australia in 18th position in the global chart.

Hopefully proving the rapid bounce back from initial news of Omicron, North Africa has seen airline capacity recover by 25% week-on-week as airlines and authorities get a better understanding of how to handle such situations. Perhaps this is an indication of how quickly decisions can be turned around and situations improve.

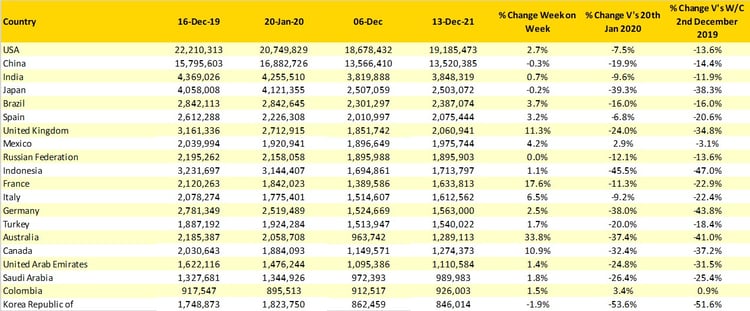

Table 2- Scheduled Capacity, Top 20 Country Markets

Source: OAG

Despite the best attempts of the UK Government to torpedo the aviation industry once again, knee-jerk changes to travel requirements decided around a Xmas party do not seem to have impacted capacity with an 11% week-on-week increase. Airlines in the UK continue to announce new routes and increase frequency whilst overseas carriers continue to rebuild their UK footprint. Last week Virgin Atlantic launched an Edinburgh – Barbados service and Emirates returned with an A380 to London Gatwick, their spiritual home in the UK from where they first launched services. All these developments allowed the UK to jump ahead of Mexico in the global ranking into 7th position, although it remains at only two-thirds of pre-pandemic levels.

Recommended:

Canada is also slowly recovering with another 11% capacity week-on-week increase and like many markets, new routes are once again being announced including a new Kingston – Montreal Dorval service that connects an 80,000 market back to the world once again. Sometimes it’s not always the big routes that are important, regional communities’ connectivity to the world via a major hub is crucial.

Finally, when looking at the top twenty country markets it is worth noting that only three report any week-on-week capacity reductions, and all of those are less than 2% off last week's levels. The whole aviation industry has in recent months restarted and rather than shutting down it seems that the focus is on working through the current bump in the road rather than allowing it to become a roadblock, that message needs to be understood by regulators who seem keen to stop any recovery. Demand is of course another matter but at least the airlines remain optimistic.

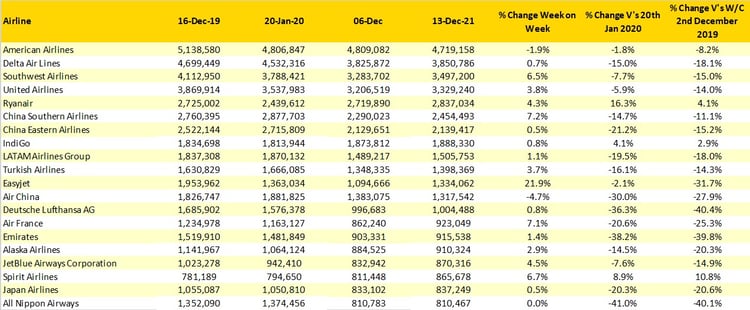

Table 3 – Top 20 Scheduled Airlines

Source: OAG

We noted earlier that the majority of the US major airlines had added capacity back this week, the exception being the world’s largest scheduled airline American Airlines who dropped nearly 80,000 seats week-on-week. At the same time, Southwest added back over 200,000 more seats and although still someway from Delta Air Lines, they are now within “striking” distance of the second spot.

The largest capacity growth week-on-week comes from easyJet, who (for a very long time) have lagged behind their major competitors in the recovery process; the airline are now at two-thirds of their historic capacity, although to put that in some context Ryanair, their largest competitor, are the only airline in the top twenty now operating more seats than in December 2019.

We commented last week on the next seven days being a key period for airlines looking forward and trying to assess the impact of Omicron. It seems at this stage that the industry has maintained the “keep calm, don’t panic” approach to the variant that we suggested a few weeks back; in the face of some of the sensational media coverage and political spin around the variant, that is a positive step. There will inevitably be more twists and turns in the recovery than in an F1 Grand Prix but at least for the moment capacity remains stable, demand, well...

Stay safe everyone.

.jpg)

.png)