Overall airline capacity between the Middle East and Europe, traditionally a market dominated by mainline carriers, has seen a reduction. This summer there is 4% less capacity operating between the markets compared to summer 2023. In part, this reflects the wider industry challenges of: supply chain issues, aircraft shortages and market access. However, the story is very different for the Middle East based Low-Cost Carriers (LCCs) who represent a 22% share of capacity in summer 2024 - unchanged from summer 2023.

Mainline Carriers' Dominance in the Middle East

The traditional Middle East to European markets of the UK, Germany and France are served purely by mainline carriers, partly due to range. For example, the distance between the UK and UAE is around 3,400 nautical miles and whilst within the theoretical range of flydubai’s B737 Max 8, or Wizz Air Abu Dhabi’s A321 neos, these prime markets are already well served by mainline carriers - in flydubai’s case by its larger sibling, Emirates. However, in terms of their respective networks there is some co-operation between flydubai and Emirates, with the former acting as a feed for the latter on some flight routes. In terms of overall capacity between the Middle East and Europe, Emirates is the largest operator, with 20% of seats this summer. flydubai operates just 5%, making their combined capacity account for a quarter of all seats.

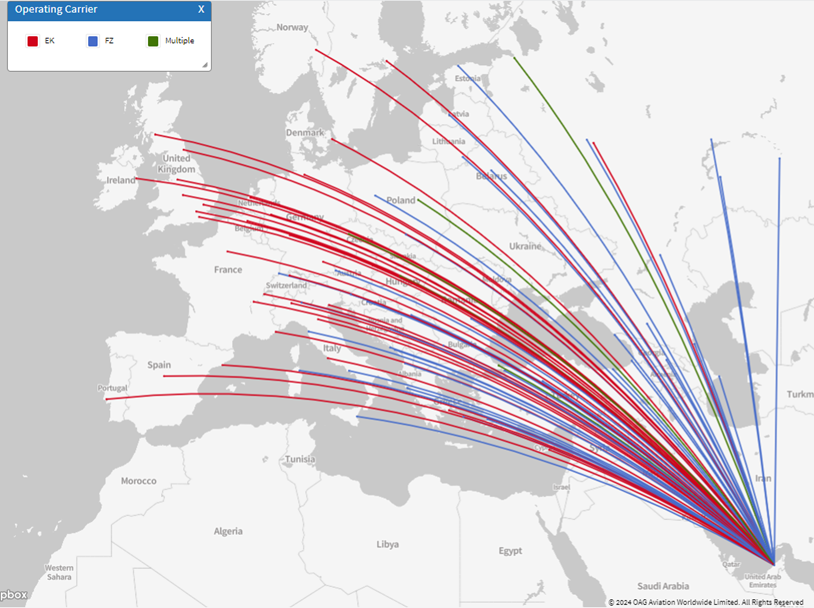

The below combined network map - showing Emirates (EK - red) and flydubai (FZ - blue) - highlights the preferred operating range of flydubai’s network and the extent to which Emirates primarily serves larger markets that can sustain a higher frequency – most of Emirates’ European routes operate at least daily, if not more frequently, whilst flydubai typically operates on a lower weekly frequency to smaller markets. This summer, Emirates' average daily frequency will be 1.9 on routes between the Middle East and Europe whilst flydubai’s is a little lower at 0.9.

Emirates and flydubai networks – Summer 2024

There are overlaps (highlighted in green) on just four routes – Istanbul, Prague, Warsaw and St Petersburg.

FOCUS OF LCC CAPACITY IS EAST FOR NOW

Geography undoubtedly plays a role here, with those European country markets which are closer to the Middle East benefiting from a higher share of LCC capacity. Almost 50% of capacity between UAE and the Russian Federation is operated by LCCs. LCCs also have a strong presence on routes between the UAE, Saudi Arabia and Israel to Turkiye, again a function of their geographic proximity. Whilst it may seem unusual to include a route between Turkiye and Saudi Arabia in an analysis of the capacity between the Middle East and Europe, Turkiye is actually categorised as being part of Europe in air capacity terms, as it technically straddles Europe and Asia. Slightly counter to the trend is Italy, where 22% of capacity operating to and from the UAE is provided by LCCs.

BALANCE OF LCC CAPACITY IS SHIFTING EAST

The top 10 LCCs operating between the Middle East and Europe dominate the LCC market, illustrated below. They operate 86% of LCC capacity between the Middle East and Europe this summer. However, this is just 19% of total capacity between these two regions, although LCCs do serve 99 of the 236 country pairs operated. Turkish Pegasus Airlines is the largest LCC, operating 1.53m seats this summer, followed by flydubai with 1.28m seats. However, whilst Pegasus has reduced the number of routes it is serving, taking out 7 routes net, flydubai is serving 5 more routes. Air Arabia added 75,000 more seats this Summer, adding 2 new routes.

In contrast, Ryanair has reduced capacity by 174,000, taking out 7 routes and adding 6 new routes. Capacity also appears to have switched between carriers within the Wizz Air Group. Wizz Air Hungary has reduced capacity by 0.9m seats and the number of routes by 49, whilst Wizz Air Malta has increased capacity by 0.4m seats, adding 14 routes and Wizz Air Abu Dhabi has increased capacity by just under 0.1m, with 3 fewer routes.

Whilst collectively across their entire network the Wizz Air group of carriers will operate more capacity this summer – an increase of 0.6% to seats on last summer – this is not the case for the Europe to Middle East market where capacity is down overall. Wizz Air is also facing constraints on its ability to grow this summer because of the ongoing Pratt and Whitney engine issues, meaning as much as 20% of the fleet is grounded whilst maintenance and repairs are underway.

TURKIYE AND EASTERN EUROPE ARE MOST POPULAR

Undoubtedly again due to geography, and a preference for operating routes of up to 4 hours in flying time (to maximise aircraft utilisation), the Top 10 routes operated by LCCs from the Middle East to Europe include:

- Dubai to Moscow

- Middle Eastern capitals to Istanbul

- Dubai and Abu Dhabi to Baku

- Tel Aviv to Bucharest

Routes seeing most growth are also to Turkiye, Istanbul and Trabazon, and East/Central Europe, with capacity increasing by 44,000 seats on the Abu Dhabi – Baku route. Tehran – Istanbul records a similar increase this summer.

NEW ROUTES INTRODUCED BY THE MIDDLE EASTERN LCCs ARE LARGELY UNCOMPETED

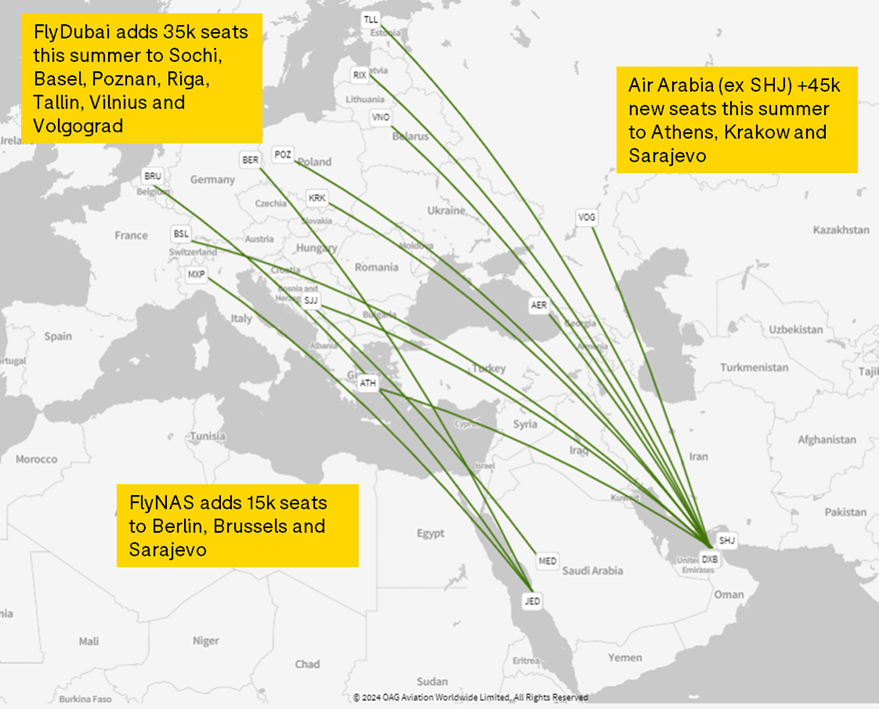

New routes are being introduced into the growth markets of Italy, Greece and East/Central European countries, primarily Poland, Bosnia & Herzegovina and the Baltic countries. In addition, flydubai is the first UAE based carrier to introduce direct flights to Basel, enabling passengers to travel to Dubai or connect via the Dubai hub conveniently to their network or further afield with their codeshare partner Emirates. FLYNAS is introducing weekly flights this summer to Berlin Brandenburg Airport and 2 flights per week to Brussels from Jeddah.

Many of the new routes, particularly those introduced by Air Arabia, FLYNAS and flydubai do not face any competition which is a sweet spot for an LCC as there is less pressure on pricing.

By contrast, Wizz Air Malta faces competition from mainline carriers on its routes Vienna and Italy; with Austrian Airlines operating on TLV-VIE, Saudi Arabian on JED-MXP and Etihad on AUH-VIE and AUH-FCO. Ryanair competes with Wizz Air Malta on flights from Tel Aviv to Bucharest, where it introduced a weekly flight and Tel Aviv to Vienna where Ryanair has reduced capacity and now operates 6 flights per week. flydubai and Wizz Air Malta compete on the Dubai – Bucharest route.

New Routes Operated by Middle Eastern Low Cost Carriers

Of these new routes, only flydubai’s Dubai-Riga route faces competition (from Air Baltic, and most of these routes operate on the basis of a twice or three times weekly frequency. flydubai’s Baltic routes don’t start operating until almost the end of the summer season, in mid October.

MIDDLE EASTERN LCCs WELL PLACED TO MEET GROWING DEMAND OF NEW MARKETS

Johan Eidhagen, managing director of Wizz Air Abu Dhabi told Air Gulf Business Insight that 18% of their travellers are Emiratis, the largest demographic segment. There is growing demand in both the Middle East and East/Central Europe and Middle Eastern carriers are well placed to meet this demand, introducing new routes with young fleets. That, combined with a healthy aircraft order book – flydubai orders total 129 more B737 Max8’s, and flyNas 71 A320-200s (source: Centre for Aviation), and the ongoing Vision 2030 plans to develop connectivity to Saudi Arabia in the next 5 years means there will likely be much more growth to come in this market.