We all want to get back to normal, business travellers flying around the globe securing new contracts, holiday makers whizzing off to sunspots and families visiting friends and relatives. Quite when that happens remains anyone’s guess but before any progress can be made airlines need to get their aircraft back in the skies, not an easy task and one that has seen airlines adopt very different strategies.

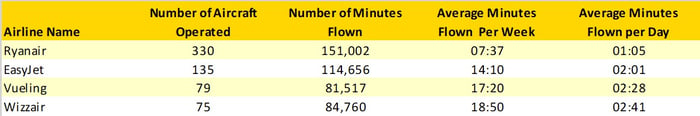

Following The Data – as recommended by scientists and politicians around the world we have tracked the data, well at least the flight status data for some of the major low-cost airlines in Europe. Over a one-week period we have tracked all scheduled flights operated by Ryanair, easyJet, Wizz Air and Vueling to identify the number of aircraft that they operated (identified by aircraft registration number) and the number of minutes they were airborne.

From tracking the data, we had noticed that different airlines appeared to have different approaches to how they were using their fleet. It seemed that one airline had returned a large proportion of their fleet to the skies of Europe but were using those aircraft for only a few hours a day whilst other carriers had returned fewer aircraft to the skies but were using them for longer hours each day. An interesting difference in approaches but what did the data reveal?

The first thing to note is that Ryanair appear to have taken a very different approach to the other three carriers operating some 330 aircraft for at least one flight during the seven-day period analysed. Some of those aircraft were registered to subsidiary companies such as Malta Air but the airline appears to have operated twice as many aircraft as their closest rival and yet only flown for 31% more!

Wizz Air are the carrier working their aircraft the hardest with a daily average of 02:41, typically daily aircraft utilisation is in excess of twelve hours a day for low-cost carriers which just highlights how little capacity is being operated.

Table 1 – Average Minutes Flown, Major European LCC’s 3rd May – 9th May 2021

Source: OAG Flight Status Data

The different strategies being applied is perhaps best highlighted by the proportion of the carrier’s fleet that operated in the seven-day period analysed. Accepting that 100% of the fleet being used is unlikely given maintenance requirements typically somewhere near 95% plus utilisation would be expected the current levels are well below the normal operating levels for low-cost carriers.

The data also reveals the challenges that these and indeed all airlines face in their recovery with a lack of clarity around country markets reopening. For easyJet, the recall of nearly 60% of their fleet back into full service will take time, not just from the aircraft’s operational perspective but the crewing of those aircraft. It may also explain the latest news from easyJet that they will not be operating more than 15% of their full capacity until at least the end of June; ramping back up operations takes time.

Table 2 – Proportion of Aircraft Fleet in Service, 3rd May – 9th May 2021

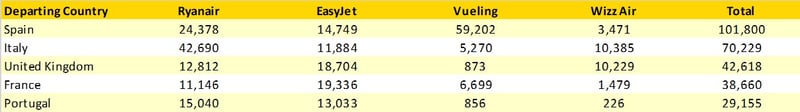

Finally, a quick cut of the data by departing country reveals that Spain is the busiest country market for minutes flown, essentially because of Vueling who operated over half of the activity across the major low-cost airlines. For the remainder of the carriers analysed their spread across multiple European markets is reflected by easyJet with their pretty even distribution of minutes flown across the top five European markets for low-cost services and by Ryanair in Italy; their largest market but accounting for only 28% of their minutes flown.

Table 3 – Minutes Flown By Major LCC’s In Top 5 European Markets, 3rd May – 9th May 2021

Source: OAG Flight Status Data

In summary, it is clear that every airline behaves differently, and many factors affect their planning. The concentration of activity in one market can have an influence and so can geography; central European markets are always likely to have shorter sector lengths than those countries on the fringes of Europe. These insights may also be an indicator of the real operational state of preparation of the four airlines; after all, if most of your aircraft are already operational working them harder should in theory be easier than bringing aircraft back into service. If that is the case, then Ryanair look like they may be ahead of everyone; but isn’t that normally the case!

.jpg)

.png)