The results of OAG's annual traveler sentiment survey reveal that travel demand is strong (64% taking 3 or more trips in a year), but there are some key differences between generations when it comes to the services, ancillaries, reward programs and technology driving travel purchasing behaviours.

Knowledge of these differing preferences can be leveraged to improve customer experience, maximize revenue and drive airline loyalty scheme adoption.

This infographic highlights just some of the insights into airline loyalty enrollment revealed by our 2024 traveler survey.

Which generation is most likely to be enrolled in a frequent flyer program?

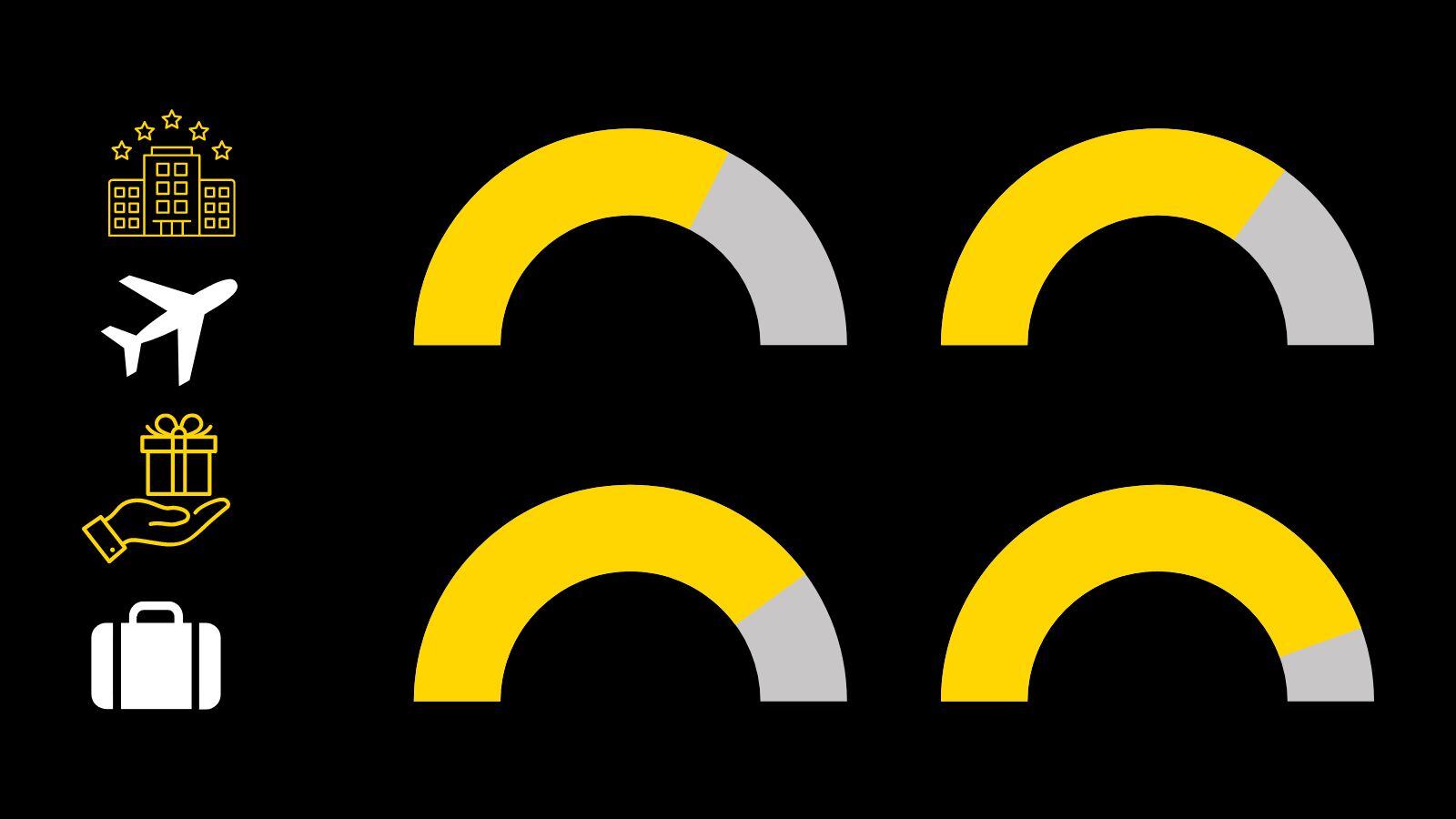

Baby boomers are most likely to be enrolled in an airline loyalty scheme, with 89% being enrolled. The rate of adoption steadily drops as we look at younger generations, with 80% of Gen-X, 70% of Millennials and 65% of Gen-Z being part of a frequent flyer program. Overall, these schemes are still popular, with 82% of travelers enrolled.

How Can Airlines improve frequent flyer scheme adoption?

Having established that the popularity of frequent flyer programs is decreasing with each new generation, OAG's survey data also reveals the barriers that keep travelers from enrolling and the incentives airlines could use to bring them back on board.

When asked how they'd like to be able to spend loyalty points, across all generations respondents said:

- 73% would like to spend points on hotel accommodation.

- 53% want to use airline loyalty points for car rental services.

Overall, then, it seems the best way to improve loyalty program adoption and engagement is to let customers use accrued points for other travel-related services.

When it comes to signing up for airline credit cards, across all generations the top incentives were:

- 63% would like free checked baggage as a card holder.

- 56% would be enticed by a sign-up bonus.

- 43% want access to airport lounges.

What services will airline passengers pay more for?

All things being equal, most travelers say they would pay more for a ticket with a legacy carrier like Delta Air Lines, American Airlines, or United Airlines, as opposed to flying on a low or ultra low-cost carrier.

- 32% would pay up to $50 more to travel with a mainline carrier.

- 21% would pay up to $100 dollars more.

While opinion is divided equally between those that agree with stricter airplane carry-on policies and those that don't, many are willing to pay more to take more than one extra carry-on item into the cabin:

- 67% are willing to pay up to $20 for extra carry-on luggage.

- 19% would pay $21-$50.

OAG surveyed 2,000 North American travelers who have flown in the past year and users of OAG’s flight tracking app, Flightview by OAG, to analyze their preferences. The results highlight generational differences in attitude to loyalty, service, ancillaries and more.

Read full survey results and analysis here

.jpg)

.png)