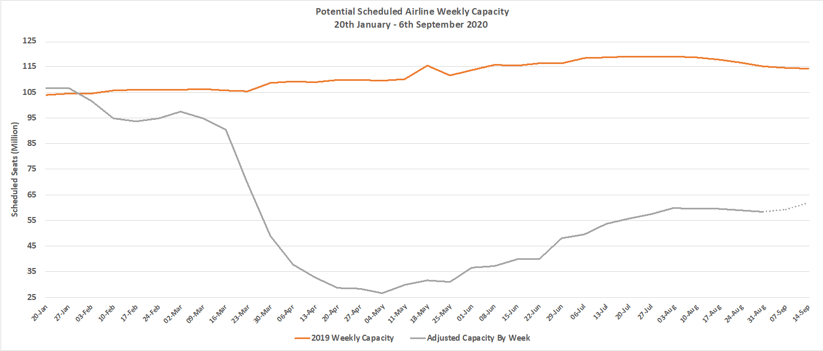

There is an autumnal feel to the weather in Northern Europe at the moment and the leaves are already falling, although perhaps not quite as quickly as global capacity has over the last week. At some 58.4 million scheduled seats planned this week a further half a million seats have been dropped week on week as the industry sets itself for perhaps the most telling six-week period in the Covid-19 recovery phase.

With the possibility of increasing travel lockdowns, airlines seeking rights issues, airline CEO’s returning to investors for “fireside chats”, Government support programmes expiring, winter 2021/21 slot usage issues and of course nervous consumer demand the next six-weeks will probably shape the next twelve months capacity plans for many airlines. The early indications are not looking good, are they?

One week ago, the planned capacity for this week was standing at some 59 million seats; some 600,000 have removed by airlines in the last seven days. Next week’s forward-looking capacity stands at 59.2 million and the following week currently has some 62 million seats; airlines are still clearly adjusting schedules at short notice and will continue to make such short notice changes for quite some time. The viscous circle of travellers booking flights that are subsequently cancelled at short notice will I suspect run through the whole winter season.

Chart 1 – Scheduled Airline Capacity by Week Compared to Schedules Filed on 20th January 2020 & Previous Year

Source: OAG

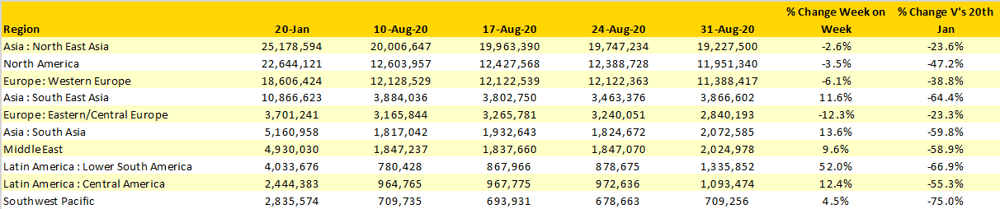

The three largest regional markets in the world account for some 72% of all capacity; all three markets report reductions in week on week capacity for a range of reasons. In North East Asia capacity cuts in China and Japan have dragged back overall capacity; in Europe major low-cost carriers have responded to changing quarantine requirements whilst in North America airlines are locking down to avoid Hurricane CARES less that could hit at the end of September.

On a positive note (perhaps) Lower South America is reporting a 52% increase in weekly capacity although that does come with a very strong cautionary note that whilst many of the major airlines have scheduled to recommence services the probability of all of the planned capacity operating remains very small. More realistically Lower South American capacity will probably shake down close to last weeks capacity of around 900,000 scheduled seats.

Table 1 – Scheduled Airline Capacity by Region, 20th Jan – 6th September 2020 by Region

Source: OAG

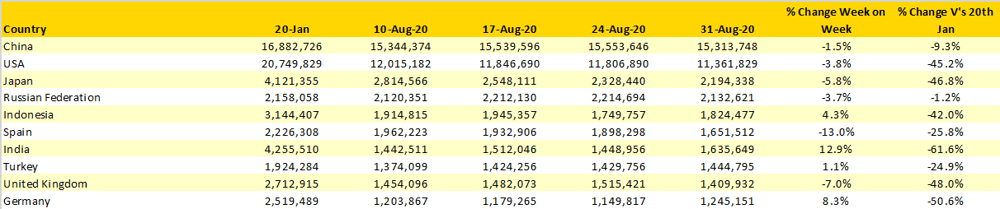

Six of the top ten country markets saw capacity reductions week on week. Just under 450,000 seats were dropped by airlines in the United State and 240,000 in China; of course, China was expected to be the single largest aviation market by 2023/24 so I guess they are ahead of where they expected to be; but for all the wrong reasons. Given how dramatic this winter’s potential capacity cuts could be in the US domestic market without an extension of the CARES Act then China could stretch even further ahead by March of next year.

There is some positive news reported out of India this week as further capacity has been approved by the authorities which should do wonders for yields that are already under pressure in the domestic market. Over the years India has experienced many boom and bust moments in its aviation industry and this week saw another when Vistara Airlines launched their new Delhi – London Heathrow service (3,632 NM) let’s hope the slots are worth some value in the future given current demand for a new carrier on the route. Vistara’s next longest international sector is just 1,455 NM (BLR – DXB) making this new route look like it might be a long-haul for the carrier in every sense of the word.

Despite a 7% reduction in weekly capacity the United Kingdom manages to remain in the top ten listing. However, that is before the impact of the latest round of new quarantine requirements for arrivals from Switzerland and the Czech Republic become baked into next week’s capacity report.

Table 2 - Top 10 Counties Markets

Source: OAG

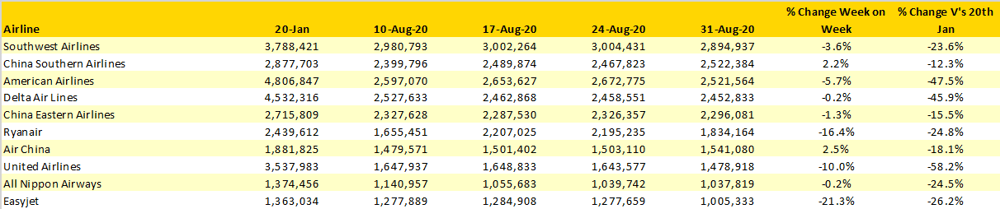

Three of the four US airlines in the top ten listing made week on week capacity cuts; in the case of United Airlines removing 165,000 seats or 10% of their planned capacity. Every indication from the US majors is of further capacity cuts to be made sadly accompanied by staff cuts and furloughs.

American Airlines announcement of cutting fifteen domestic markets from their network may have been the tip of a very unwelcome iceberg. Our analysis which we will discuss in this Wednesday’s OAG Webinar’s suggest that both Delta Air Lines and United Airlines have a number of potential city-pairs that could be dropped without Government funding. Worrying times for those cities involved.

Collectively Ryanair and easyJet have dropped some 630,000 seats week on week as a combination of the end of the European school holidays and quarantine restrictions impact demand. Over the same two weeks last year the two airlines dropped less than 25,000 seats which gives you some idea of how quickly and dramatically airlines have begun to cut back capacity once again. Just where are those much-needed business travellers?

Table 3 - Scheduled Capacity Top 10 Airlines

Source: OAG

Despite the best endeavours of airlines around the globe, it feels like the hoped-for recovery in capacity and subsequent demand has stalled.

Major legacy airlines dependent on both international connecting traffic and premium business demand are seeing secondary Covid-19 spikes and corporate working from home travellers avoid flying. While point to point carriers that are normally capable of stimulating demand with some incredibly low fares are unable to stimulate any real interest as no traveller seems willing to book more than six weeks in advance. These are indeed worrying times and the next six weeks determine how 2021 will shape up for many airlines, airports, travel companies and indeed Government revenues if travel does not pick up quickly.

We may have reached the point where some airlines begin to pay for some people to travel, offering free seats and then seeking to generate ancillary revenues that support the service whilst at the same time rebuilding traveller confidence. It’s a crazy thought but then again, these are crazy times!

.jpg)

.png)