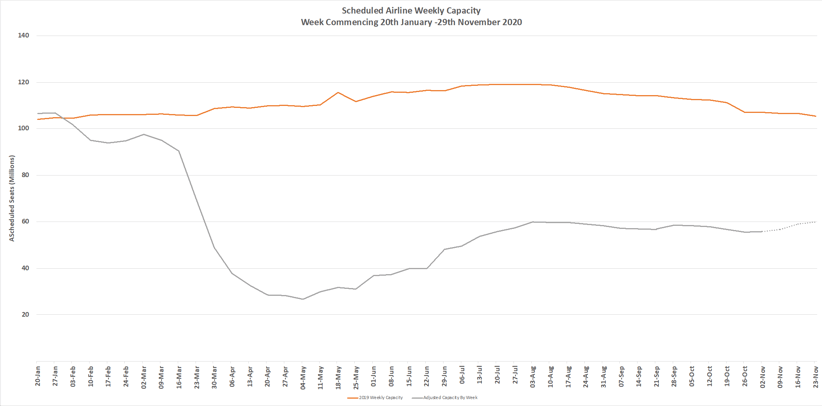

Coronavirus Capacity Update Week Forty-Two: Early Saturday evening and there wasn’t all that much to comment on in terms of global capacity and current trends. Total volumes were looking pretty flat at 55.6 million, very similar to the number reported last week, although optimistically slightly up by all of three tenths of a percentage point.

And then snuck into the UK’s latest lockdown rules was hidden that all but essential international travel is banned from the 5th November. Current weekly international capacity from the United Kingdom is at 700,000 so that means a likely weekly reduction of some 1.4 million seats at least next week. All this in the week that United Airlines announced a four-week trial of pre-covid test on their New York – London services. If this was a TV comedy no one would believe it! There will of course be some flights as the UK seeks to sort Brexit out and essential travel is still permitted.

Chart 1 – Scheduled Airline Capacity by Week Compared to Schedules Filed on 20th January 2020 & Previous Year

Source: OAG

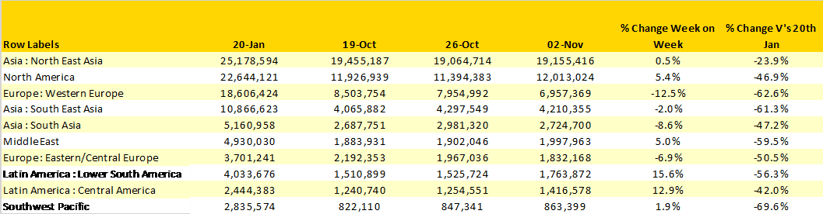

The second spike of Covid-19 in Europe has had a dramatic impact on capacity in Europe; Western European markets are reporting a 12% fall in weekly capacity with one million seats wiped out in one week and Eastern Europe seeing a 130,000 fall in capacity. At the same time North America, where we can’t be sure if this is Covid-19mk1 or Covid-19mk2, has seen a quite remarkable 5% increase in capacity with some 600,000 new seats added – presumably based on voters rushing home before Tuesday evenings deadline. Major airport benefactors have been Miami, Dallas/Ft Worth, Charlotte and Orlando.

More positively the Latin American market continues to rebuild from its lockdown with 16% growth in the lower region and 13% in the central American region. In lower South America capacity has seen a 40% recovery since the end of September although the market remains some 40% below the January levels. Every week of growth is of course a week nearer to recovery and that that has to be positive.

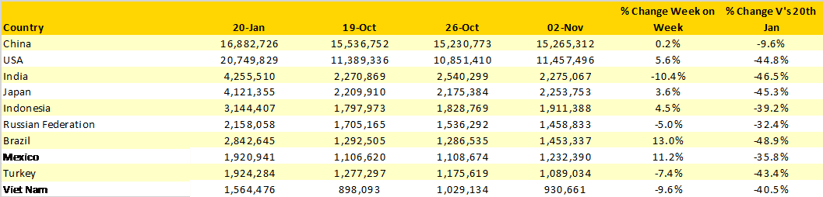

North East Asia continues to be the largest market in the world adding nearly another 100,000 seats this week. Staggeringly less than 1% of all Chinese capacity is operated on international services at some 150,000 seats a week; in the corresponding week last year that figure was some 1.9 million the importance of which will not be lost on airlines such as Cathay Pacific, Thai International and Singapore Airlines

..Table 1 – Schedule Airline Capacity by Region

Source: OAG

The collapse of capacity in Western Europe just leaves Russia and Turkey in the list of top ten countries although their positions are assured for next week given that every major European market appear to be heading south at a faster rate and they both have large domestic markets. China remains one-third larger than second placed United States although the gap has closed slightly over the last few weeks.

Although not on the table below or indeed in the top 30 largest country markets at the moment, congratulations to both Belgium and Romania who both “broke” through the 100,000 seats a week mark. Further down the chart a big welcome back to the Falklands Islands who are welcoming back their first scheduled service and 215 seats since the 6th July and enjoy that LATAM service.

Table 2- Scheduled Capacity, Top 10 Countries Markets

Source: OAG

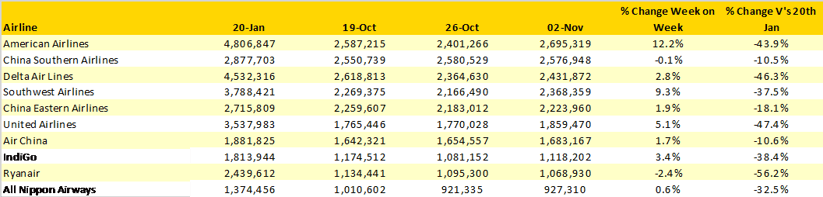

It seems that no airline wants to be the largest in the world for more than a week. This time American Airlines with a staggering 12% increase in capacity week on week have jumped into pole position adding some 290,000 plus seats in a week.

Looking at the data by airline you would think there is some cause for optimism in the United States this week (amongst the airlines I mean) with all of the major carriers have added back capacity. Quite who will trump who next week remains to be seen but it should be a fascinating watch.

Table 3- Scheduled Capacity Top Ten Airlines

Source: OAG

Finally, a huge congratulations to Berlin and the opening of the new airport this week, some ten years behind the initial planned opening and now with enough space to probably host major concerts most evenings given how the market has changed. If the airport had opened on time, then the scheduled capacity this week in 2010 would have 300,000; last year it would have been 368,000 and this week it’s just 85,000. I guess with that trend they are lucky not to be opening next year!

Forecasting, or rather guessing how next week will look is becoming increasingly difficult. Europe’s lockdown is pulling down capacity with easyJet likely to operate no flights from their UK network until the 2nd December and other airlines already offering free changes to reservations or the dreaded voucher. At the same time, the US market appears to be growing strongly and Latin America is recovering although recent increases are unlikely to be greater than Europe’s losses.

The hope of airbridges, corridors and travel bubbles has been replaced by airport testing trials and vaccines although they still look some way from being ready and scalable. Meanwhile the airline, airport, travel & tourism industries struggle to second guess changes in Government policies around the globe; it’s hard enough trying to manage an airline without having to try and think ahead of people who change their minds and strategies when the going gets a little harder.

Chin Up Aviation, it will get better!

.jpg)

.png)