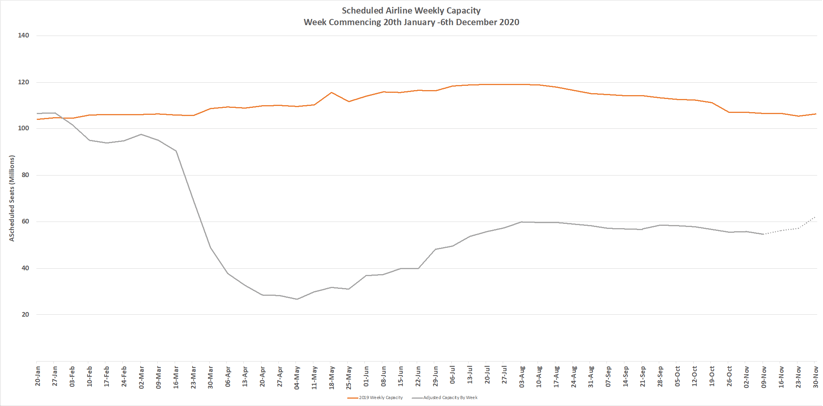

Coronavirus Capacity Update Week Forty-Three: The worrying and steady weekly decline in global capacity continued into a fourteenth consecutive week of capacity cuts with another one million seats wiped out across the worlds scheduled airlines. Current trends will take us below 50 million seats a week by year end which in turn would be somewhere around 54% below the 106 million reported in the last week of 2019. Can 2020 end quick enough?

Since the 20th January we have seen just over 2.275 billion fewer seats operated by scheduled airlines compared to the same time last year. Assume an industry average load factor of 75% and then a cautious yield per passenger of US$250 per sector and the passenger revenue loss to the industry is running close to US$426 Billion; slightly more than the IATA current estimate; an 80% load factor would give you US$455 Billion. That’s a lot of cash.

Chart 1 – Scheduled Airline Capacity by Week Compared to Schedules Filed on 20th January 2020 & Previous Year

Source: OAG

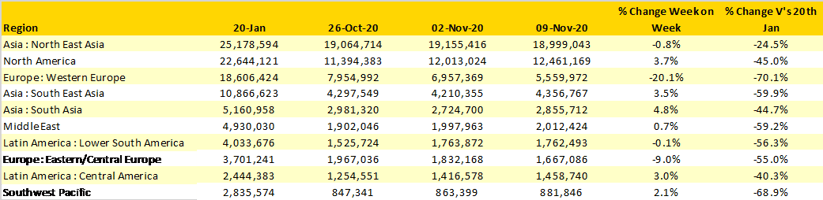

The expected reductions in Western European capacity as a result of new lockdowns is perhaps deeper than we expected; a 20% fall in capacity and the loss of another one million seats a week hardly helps a number of airlines beginning to look nervously at forward bookings and cash flow. Western Europe is now at only 30% of its January levels making it the poorest performing regional market in the world. I’m not sure that is what we are trying to achieve.

North America and specifically the United states appear to have something to celebrate with another 400,000 plus seats added to the weekly capacity which is a near 4% increase although we have no intention of recounting any of our numbers! Many of the other major regional markets remain at broadly similar capacity levels to the previous weeks although the Southwest Pacific (Australia & New Zealand) reports a 2% increase as the impact of corridors, airbridges and bubbles is realised with a stunning 18,000 extra seats a week.

Table 1 – Schedule Airline Capacity by Region

Source: OAG

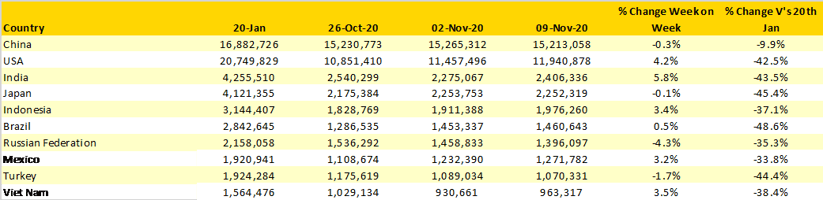

No significant changes within the top ten country markets this week; all of the action is within the ten to twenty country listing although some of those countries may soon have fallen out of that list.

The United Kingdom now reports over a one third (-37.5%) reduction in weekly capacity as the lockdown bites. British Airways who until very recently had been adding capacity back when others were scaling back this week dropped over 100,000 seats a week from their network and effectively confirmed that they will not be operating much from London Gatwick this Winter. EasyJet easily cut another 78,000 seats from their UK network and now have just 18,000 seats scheduled, in January that was some 440,000. The UK is now at just 20% of its pre Covid-19 capacity levels; some 121 airlines operated scheduled flights to the UK in January, that is now down at 75.

Both Germany (-23.5%) and Spain (-19.7%) have also seen large reductions in capacity this week as both markets feel some of the knock-on effect from the UK lockdown. Both countries have saw weekly capacity fall by nearly 170,000 seats.

Table 2- Scheduled Capacity, Top 10 Countries Markets

Source: OAG

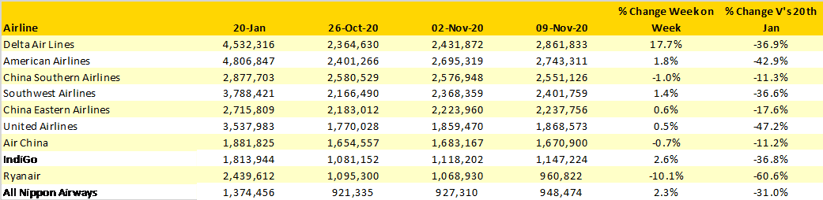

Delta Air Lines are again the worlds largest scheduled airline adding back a bold 430,000 seats this week, a near 18% increase suggesting some more confidence in the market. Some 97% of that new capacity has been allocated to domestic services and then the second largest growth market for DL has been to Mexico where generally demand from the US has remained strong through the pandemic.

Ryanair are hanging onto ninth position in the chart although that will not bother Michael O’Leary as much as profitability. The smallest of capacity reductions from the carrier could see them fall outside of the chart leaving no Western European airline amongst the world’s top ten carriers, a situation that many of us would probably have never expected.

Table 3- Scheduled Capacity Top Ten Airlines

Source: OAG

With just six weeks left in 2020 it seems that any hope for some light at the end of the tunnel for global capacity has now been fully extinguished by current lockdowns. The implications of the current situation are now extending beyond the IATA Winter Season into the Summer 2021 season and although its blindingly obvious the industry is in crisis. We all know that vaccines are urgently required and that infection rates need to be brought under control but more importantly we need authorities and regulators to support rather than suppress aviation.

In January 715 airlines filed capacity with OAG, this week that was some 647 supplied data; a reduction of 68. Over 10% of the worlds scheduled airlines have failed to survive the pandemic; heading into the darkest parts of the Winter season we can expect more fatalities, how many more before the industry really gets the help it needs?

.jpg)

.png)