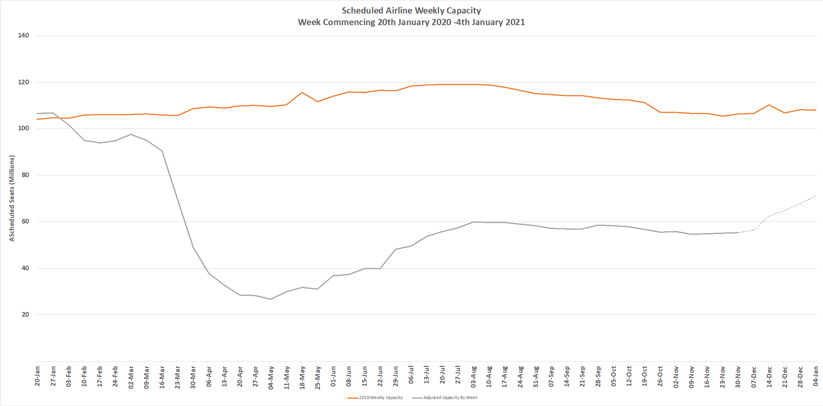

Coronavirus Capacity Update Week Forty-Six: It’s been a very quiet week on the global capacity front although optimism continues to grow with more vaccine news and some airlines reporting up to 200% increases in booking activity week on week; they just didn’t mention what the base point was! An additional 100,000 seats week on week represents a positive move but at 55.2 million we are treading treacle at some 52% of the same capacity last year.

Many airlines are now trialling their own Covid-19 protocols and progress is being made on many fronts, but the reality remains of little change in capacity being likely before the first quarter of next year. Scheduled capacity for the first quarter stands at just over one billion seats compared to 1.2 billion for this year; a shortfall of just 18% which either suggests lots of confidence in a first quarter recovery or a lot of airlines still working out their plans. I suspect the latter for nearly every market in the world aside from China.

Chart 1 – Scheduled Airline Capacity by Week Compared to Schedules Filed on 20th January 2020 & Previous Year

Source: OAG

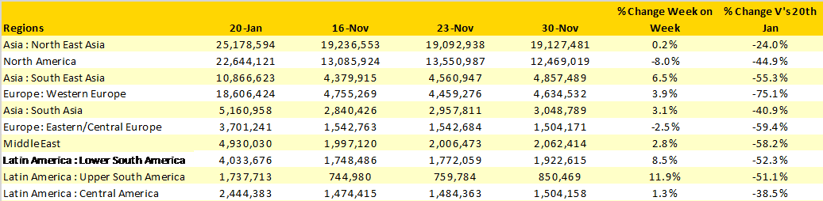

The North American market is now taking a rest after the Thanksgiving “rush” with one million fewer seats on offer this week representing an 8% reduction on capacity. TSA Checkpoint data, a reasonable proxy for passenger numbers reports some 6.2 million for the week commencing the 22nd November; that compares with 15.8 million for the same week last year; only two days broke the one million mark. The data suggests that the Thanksgiving week was not a great one for the airlines; their November reports will make for an interesting read.

Europe reported a mixed bag, Western Europe up by some 3.9% (+175,000) whilst Eastern Europe is down although only by some 38,000 seats. Perhaps surprisingly the recovery in Western Europe is led by Spain and the United Kingdom. In Spain Vueling have an increase in capacity of some 26,000 seats or 37% whilst their legacy parent Iberia have similar capacity to last week; with a notable increase in capacity from the 3rd December. In the United Kingdom, BA, easyjet and Jet2 all have large increase as the UK comes out of its latest lockdown and into tears of despair.

Table 1 – Schedule Airline Capacity by Region

Source: OAG

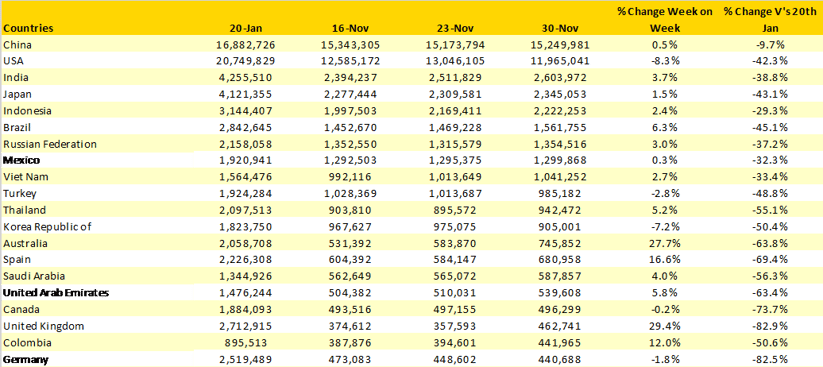

The top country markets remain unchanged. Australia leaps ahead of Spain with more than a 27% increase in capacity as the country continues to reopen for more domestic services and the Sydney – Melbourne sector continues to grow week on week with a further 14,000 seats added back in the last seven days.

A number of European countries return to the top twenty; Spain, Germany and the United Kingdom join Turkey in the listing with France sitting in 21st position.

Table 2- Scheduled Capacity, Top 20 Countries Markets

Source: OAG

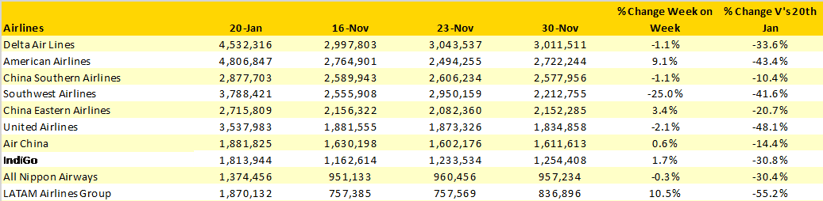

The flexibility of capacity can be very important in the rebuild and if that is the case then Southwest may be well placed; this week’s capacity is some 25% below last weeks as the airline takes a breather before adding back capacity in two weeks’ time. A 25% reduction in seats from the airline equates to over 700,000 seats being dropped, a quite remarkable amount. We have in the past remarked on how American Airlines and Southwest appear to be following different strategies and American have given more food to that thought by adding back some 9% capacity; these two carriers certainly are not following each other!

The welcome return of LATAM to the top ten with weekly capacity growth of 10.5% and an additional 80,000 plus seats reflects the reopening of the wider Latin American market and the role that this airline plays. In January, LATAM also held tenth position in the ranking, it’s just a shame that with a million fewer seats a week they can still hold on to that place.

.Table 3- Scheduled Capacity Top Ten Airlines

Source: OAG

Traditionally the next three weeks are amongst the slowest of the year with corporate demand slowing and leisure travel stalling ahead of the seasonal holidays at the end of the year. With no significant corporate demand and leisure travel being frustrated by lockdowns I suspect we will be cruising at some 55 million seats through to perhaps the end of January given the pace of recovery and market confidence. With IATA finally accepting last week that industry losses would exceed US$118 million rather than the US$84 million that they had been quoting for weeks. For airlines, airports and suppliers within the tourism industry, 2020 cannot end quick enough, fortunately only one month to go now!

.jpg)

.png)