Coronavirus Capacity Update Week Forty One: The last week has probably been one of the most depressing ever in the aviation industry as a series of airlines reported billion-dollar quarterly losses, major carriers announced large redundancy programmes and more and more scheduled airlines revealed plans to cut capacity by up to 30% over the IATA winter season. The loss of another one million seats takes total global capacity down to 55.6 million, 52% of both the January base point and last year’s weekly total.

On the good news front travel bubbles are being tested and already bursting as travellers arriving within a bubble then catch a domestic flight to a destination outside of the bubble. Surely whoever thought about such bubbles had worked through some of the more obvious tactics travellers would use to get from A to B. Similar bubbles from Singapore to Hong Kong are in development and UK nationals are now singing their hearts out with travel to the Canary Islands now permitted. And more than one million people were processed through TSA security points on Sunday the 18th October which is a positive trend over recent weeks.

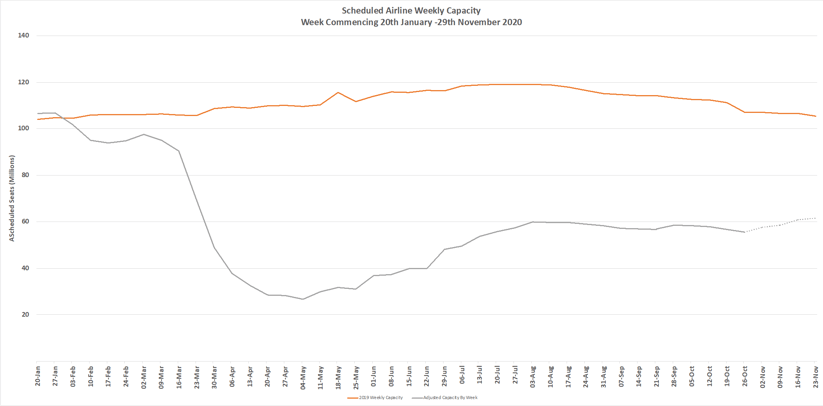

Forward looking capacity remains optimistic given that we have seen a steady trend over the last month of capacity falling by around a million seats a week but at some point the tide has to turn, doesn’t it?

Chart 1 – Scheduled Airline Capacity by Week Compared to Schedules Filed on 20th January 2020 & Previous Year

Source: OAG

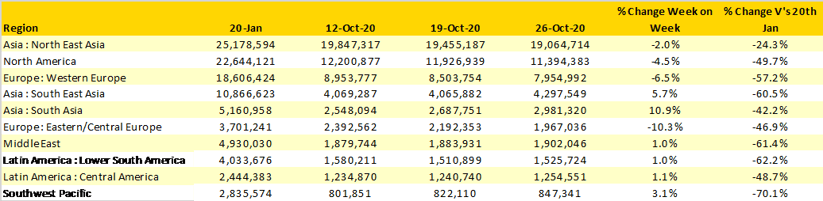

The three largest capacity regions all reported week on week reductions all seeing around half a million fewer seats on sale this week. Western Europe is now creeping backwards to just over 40% of capacity on sale in January and with IAG’s recently announced capacity cuts yet to be reflected in the data the chances are that it will fall below that point by the end of November. The regional bright spot continues to be South Asia where more capacity has been introduced in both India and Bangladesh and if that capacity can stick in the market it will obviously be a welcome development.

Eastern Europe has seen the largest week on week decline of over 10% or some 225,000 seats as the Russian Federation saw just under 150,000 seats removed and the Ukraine some 27,000. Secondary spikes of Covid-19 are seeing airlines cut capacity perhaps quicker than during the first infection period and we should not be surprised to see more capacity cuts in those markets reporting increased infection rates in the coming weeks.

.Table 1 – Schedule Airline Capacity by Region

Source: OAG

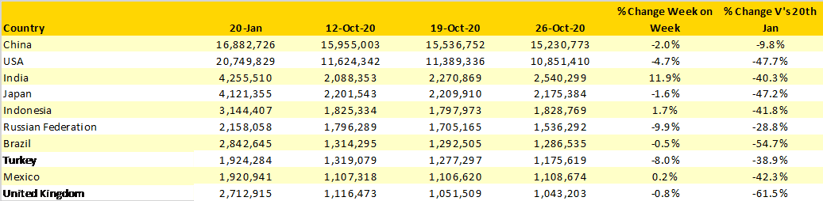

India continues to move up the country chart into third place as a consequence of another 270,000 seats being added with some 12% growth placing the country amongst the fastest growing major markets in the world. Only three of the top ten country markets saw an increase in capacity week on week.

Impressively, the United Kingdom re-entered the top ten by not seeing as heavy capacity cuts as both Spain and Germany which are now in 13th and 14th places respectively; Spain reporting 7% fewer seats and Germany 11%. With Vietnam in eleventh position and within 14,000 seats of the UK this week’s appearance may be no more than a brief visit to the top ten.

Table 2- Scheduled Capacity, Top 10 Countries Markets

Source: OAG

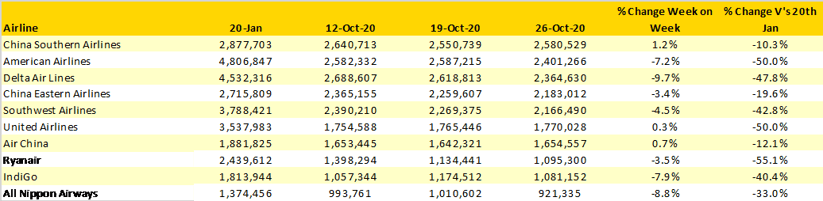

Let’s hope Delta Air Lines hadn’t planned a campaign about last week’s news that they were the largest airline in the world; they’ve lost that position already to China Southern and have slipped back to third place with American Airlines in second. The top ten airlines look pretty settled now with some “distance’ to eleventh placed Shenzhen Airlines. Ryanair may well fall out of the grouping once their latest round of capacity cuts have been reflected in the database.

Amongst the largest twenty airlines in the world the fastest growing carrier this week was LATAM who added back a further 5% capacity but continue to only operate one-third of their January schedules as they emerge out of Chapter 11 and the Latin American market begins to recover.

The last week has seen plenty of coverage of the tough conditions facing both Cathay Pacific and Singapore Airlines. Cathay Pacific are currently operating just 18% of their pre Covid-19 levels and for Cathay Dragon the situation is even worse at just 8% as their historic reliance on the China market impacts and current restrictions frustrate any hope of a recovery. For Singapore Airlines the current recovery rate of 10% and continuing costs and commitments to adverse fuel hedges has led to the carrier using a large chunk of the funding they received from shareholders earlier in the year. Worrying times indeed for both airlines; will the proposed airbridge solve the problem?

Table 3- Scheduled Capacity Top Ten Airlines

Source: OAG

On the 31st August the planned scheduled capacity for October amounted to some 356.7 million scheduled seats to be operated; the total at the end of the month is closer to 255.0 million; a reduction of 104 million seats over a relatively short planning horizon. For airlines to be axing nearly one-third of planned capacity at between one-and two-months’ notice is a worrying statistic as we head into the winter season.

And of course, we are now in the first week of the IATA winter season for those of you in the dark about such things. Last winter there were some 2.242 billion scheduled seats operated, this winter we currently have some 1.762 billion loaded for sale; a 22% reduction in capacity. If we managed to keep the current capacity level that would be quite some achievement from where we are today, more realistically we could yet see nearly half a billion seats removed in the next five months.

.jpg)

.png)