Coronavirus Capacity Update Week Forty-Four: But capacity falls below June levels.

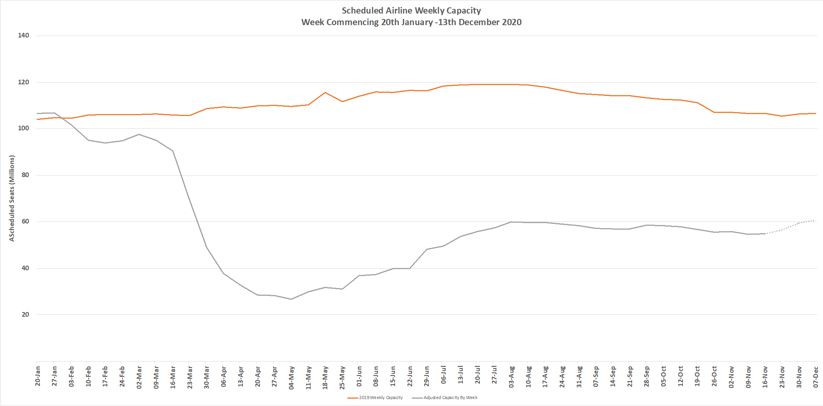

Whilst news of a vaccine led to airline stocks bouncing up by over 35% in the week and announcements of air corridors starting from the 22nd November between Singapore and Hong Kong; global capacity remains pretty flat week on week. A very modest 63,000 additional seats this week equates to a one-tenth of a percentage point increase in capacity; but remains below the total reported for the week beginning the 20th July 2020.

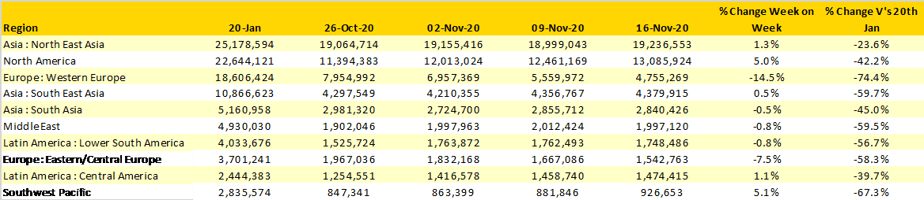

Even in a flat week the data shows a number of changes in various markets and some perhaps strange changes. It remains hard to understand how the North American market saw a further 5% increase in capacity when Covid-19 infection rates appear to be escalating at a rapid rate, the absence of any lockdowns and thanksgiving only a week away probably accounts for some of that growth.

In Western Europe meanwhile increasing infection rates combined with lockdowns in many markets are having a staggering impact. Weekly capacity is now at 4.7 million seats; just 25% of what was on offer at the beginning of the year and less than those available in the middle of June. Since the Summer, Western European capacity has grown from 4.6 million to 12.1 million in the middle of August and now back to 4.7 million; not great news for any airline or travel related business.

Chart 1 – Scheduled Airline Capacity by Week Compared to Schedules Filed on 20th January 2020 & Previous Year

Source: OAG

Six of the top ten regional markets remain at less than half of their January capacity levels; alongside Western Europe extremely large markets such as South-East Asia and the Middle East are struggling to maintain around 40% of their base capacity levels whilst the Southwest Pacific at -67% has at least this week seen the re-opening of some more Australian domestic capacity.

Table 1 – Schedule Airline Capacity by Region

Source: OAG

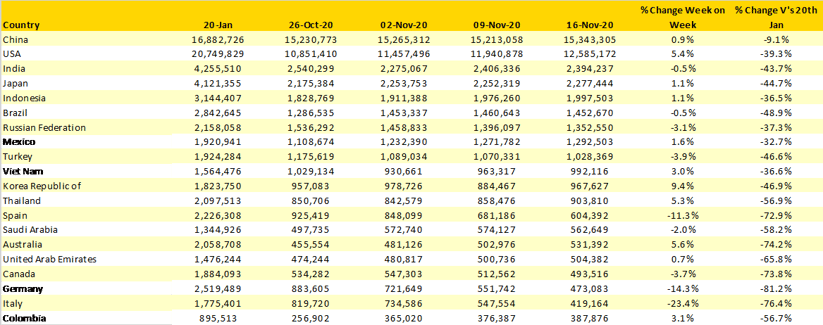

The top ten country markets look a bit like the English Premier League this week with no changes taking place; there were of course no games played, and as with the Premier League the bottom half of the table always has more interest!

Major European markets such as Italy (-23%), Germany (-14%) and Spain (-11%) have manged to hang on to places within the top 20 but some other major markets have been relegated to Championship positions. The United Kingdom saw capacity fall by a further 157,000 seats and is now down at an unlucky 13% of the January base point. Meanwhile France remains just behind the United Kingdom in 23rd position but does at least have a slightly higher share of its original capacity at 20%.

Table 2- Scheduled Capacity, Top 20 Countries Markets

Source: OAG

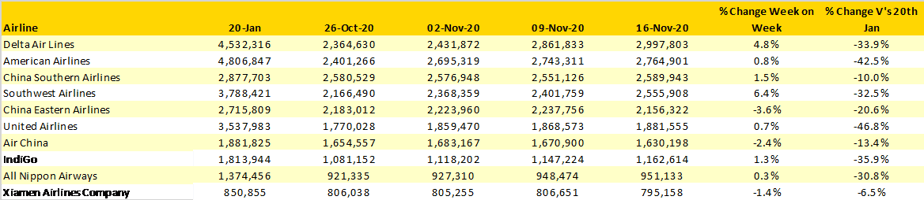

Determined to stay at number one for at least two weeks, Delta Air Lines added a further 136,000 (5%) more capacity week on week whilst Southwest also added over 150,000 seats and JetBlue 80,000 more as many US carriers continued to rebuild capacity. Leisure destinations remain those markets with the strongest growth, Florida seeing a 15% week on week increase in capacity with Delta Air Lines adding just under 100 extra flights a week and Southwest some doubling up on that with 194 new flights destined for the State.

In China less than one percent of all scheduled flights planned for the week will be to an international destination highlighting one of the real challenges in the market recovery; until Chinese airlines are flying international sectors the impact on the surrounding regional markets is devastating. In Hong Kong, Cathay Pacific continue to edge upwards and are now operating 27% of their January capacity whilst further south in Singapore the national carrier remains at just 13% of January capacity levels.

Table 3- Scheduled Capacity Top Ten Airlines

Source: OAG

Analysis of capacity since early September highlights just how differently Covid-19 has impacted regional markets at differing speeds. Whilst much of Asia, the Middle East and Europe continues to see significant cuts as carriers drop capacity. And yet in an almost counter intuitive development, capacity in the United States continues to race ahead week on week whilst there is little week on week supporting evidence from the TSA processed numbers.

On the 12th November there were some 866,679 (36%) travellers compared to 2.3 million the previous year. Scheduled capacity for the 12th November 2020 was 1.8 million; suggesting a load factor of around 46%; and yet more capacity is being added. Forward bookings must be painting a very optimistic picture of future demand or load factors will be dipping below the 40% mark pretty quickly.

The next few weeks capacity data continues to show week on week capacity cuts at a global level leaving us hoping for a recovery in capacity from early December as Western European lockdowns are lifted, or will they be? Only time will tell!

.jpg)

.png)