Coronavirus Capacity Update Week Forty-Five: Global aviation capacity continues to hover around the 55 million mark with an additional 400,000 seats (+0.7%) and with the North American market reporting a 460,000 increase in capacity it tells you how much is happening in the rest of the world. I guess we should be giving thanks for those increases in capacity although whether those seats will be filled is a moot point at the moment.

The weekend’s news from Singapore of the proposed corridor to Hong Kong being postponed at less than 24 hours’ notice, highlights the difficulties for everyone in the planned recovery, building any type of consumer confidence will be hard for airlines in the coming months. Fortunately, the UK Governments additions of Bonaire, the Northern Mariarna Islands and US Virgin Islands will I’m sure bring lots of booking activity this week……not!

More hopefully, trials across the Atlantic of Covid-19 free flights from United, American and British Airways could lead to a breakthrough in travel and of course vaccines are arriving like London Buses; all at once. The chances of these making any difference in demand before the new year fades as every day passes but we are at least on the cusp of some more positive news. Can it just come quickly please!

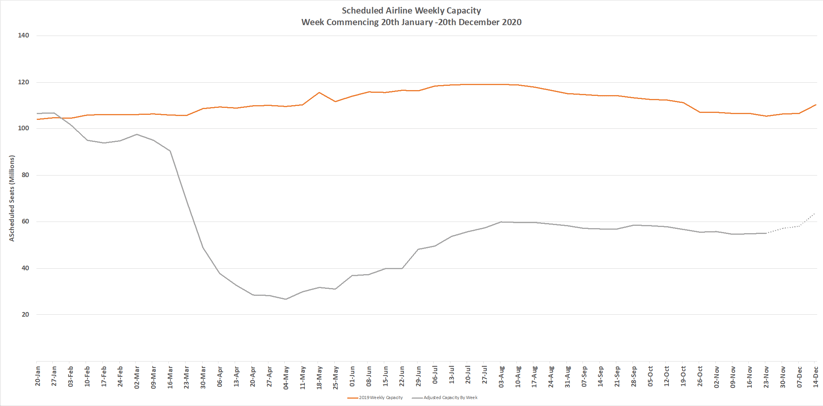

Chart 1 – Scheduled Airline Capacity by Week Compared to Schedules Filed on 20th January 2020 & Previous Year

Source: OAG

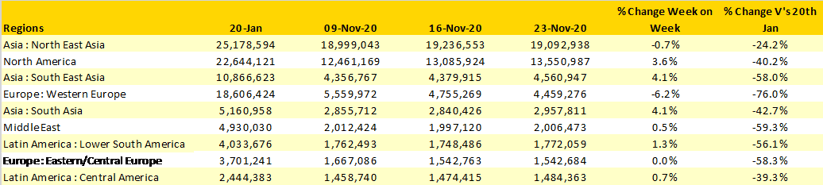

Eight of the top ten regional markets reported increases in capacity week on week. As mentioned, North America reflects the largest weekly increase in capacity but North East Asia despite a 143,000 (-0.7%) reduction in capacity remains the largest regional market. In percentage terms, South Asia had a good week with some 4.1% more capacity being added back in India from all the major carriers with Indigo leading the way with a further 67,000 seats, the airline now holding a 48% share of Indian domiciled airline capacity.

Western Europe continues to see less capacity week on week, nearly 300,000 seats drifting out of the market with the region now at just 24% of its pre Covid-19 levels. Recent announcements around capacity from major European carriers for the first quarter of 2021 reflect little confidence in a significant recovery before the Summer 2021 season. The difficulties in the market also being highlighted by further funding provided to Tui, Air France and KLM also seeking early Xmas presents and Norwegian sadly filing for protection. Meanwhile UK airlines continue to wait for Government support; good luck on that Xmas wish.

Table 1 – Schedule Airline Capacity by Region

Source: OAG

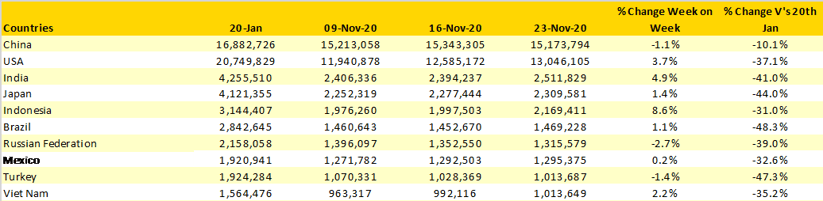

The consistent week on week capacity increases in the US market and an equally steady but smaller series of declines in Chinese capacity is bringing the two major aviation superpowers slightly closer to each other and will probably retain its number one position until international capacity to the United States returns to normal.

The absence of any Western European country in the top ten highlights just how badly damaged the market remains; Spain in 13th place remains the largest single market in Western Europe but has seen a drop of some 20,000 scheduled seats week on week. Germany and France are the only other two Western European markets to feature in the global top 20.

Table 2- Scheduled Capacity, Top 20 Countries Markets

Source: OAG

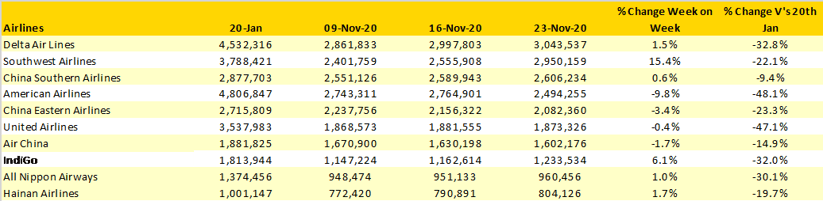

Week on week Southwest Airlines have added an additional 400,00 seats; almost the equivalent to the complete increase in global capacity in the anticipation of a strong Thanksgiving period for the airlines; they may be regretting that given recent calls for travellers to stay at home over the holiday and the airline noting “softening demand” last week. Taking a slightly different perspective on this week’s holiday demand, American Airlines have cut capacity by nearly 10% week on week reporting “a weakening of bookings”. Only one of those airlines will have called this right at the end of the week.

And in this Thanksgiving Week, it’s worth thinking about those airlines that at least from a capacity perspective continue to be badly impacted. EasyJet and Air Asia are operating just 5% of their January capacity, Thai International only 4% and in total some 49 airlines are operating less than 10% of their January capacity; times remain tough for many.

Table 3- Scheduled Capacity Top Ten Airlines

Source: OAG

Levelling out with global capacity at just above half of pre covid-19 levels is distressing although I guess we could say that more than half of the capacity has recovered if we want to put a politician’s spin on the numbers. Demand we know lags behind that capacity reduction and that number is certainly well below the 50% of last year’s activity. Worryingly, there is little evidence or support for seeing a significant change before the end of March in many markets and demand may need to be jabbed back into life.

But ending on a good news story, the B737-max has finally received FAA approval and airlines will be rushing to cash in those car park tickets to make sure they get the aircraft back out of the pound. Unfortunately, for many airlines this news is probably one of the last presents they wanted for Xmas, but as always, only time will tell.

.jpg)

.png)