Coronavirus Capacity Update: For the last forty weeks we have analysed the data and every week it has been a grim story of capacity cuts. Short moments of optimism and then another period of reporting on reductions in capacity. However there are signs of recovery in some regions so for the sake of our mental health we've taken a look at some of those this week.

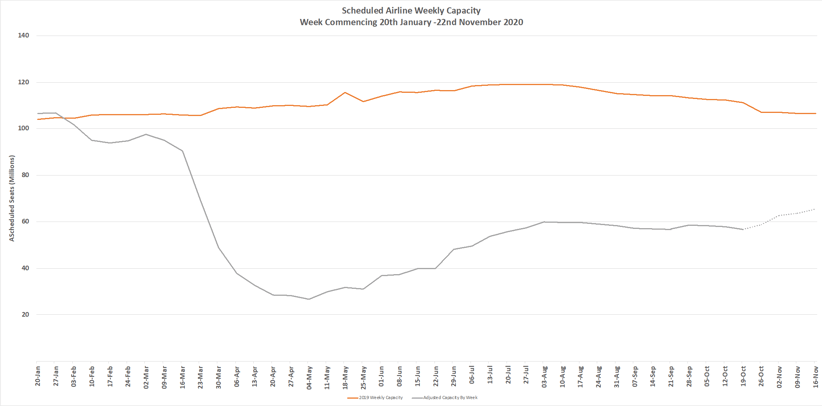

That said, for the headline hunters; global capacity is 56.6 million down from the 57.9 million last week (-2.1%) which compares to the 111.2 million reported this week last year.

Chart 1 – Scheduled Airline Capacity by Week Compared to Schedules Filed on 20th January 2020 & Previous Year

Source: OAG

That’s the grim news; for some more positive news.

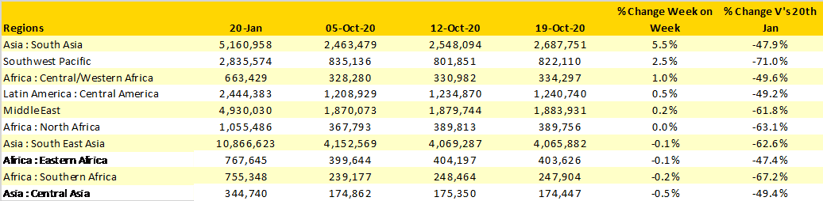

The fastest growing region this week is South Asia where an additional 140,000 seats a week have been added; India might dominate the region and did add nearly 200,000 seats but another driver was the 5% growth in capacity from Afghanistan even if it was only another 1,800 seats with Kam Air proving that sometimes small changes make a difference.

In the Southwest bubbles of a recovery are beginning to happen with some 2.5% growth week on week as Australia and New Zealand introduce the novel concept of one-way bubbles and corridors. Every little step towards a recovery helps and an additional 13,000 seats from Australia and close to 6,000 from New Zealand could be the start of something, fingers crossed on that one.

An additional 4,000 more seats a week in Central/West Africa makes the region the third fastest for growth this week. Nigeria leads the way with 10% growth and close to 10,000 additional seats which is partly offset by the loss of 6,900 seats from Cape Verde as the summer programmes from Europe finish.

Table 1 – Fastest Growing Regions Week Commencing 19th October 2020

Source: OAG

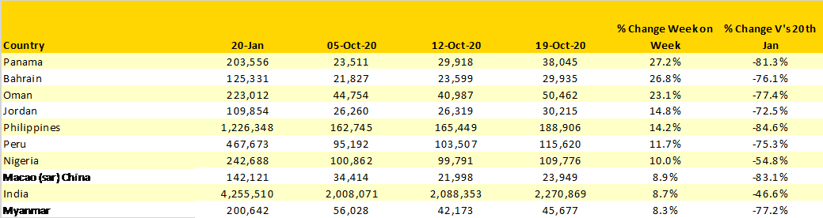

Any capacity growth is positive regardless of the country market size; for smaller countries it can even be argued that signs of a growth in capacity are even more important than in some of the bigger markets. This week we have focussed on the top ten fastest growing week on week; it makes for a slightly different look than normal.

Panama leads the way as the local airline COPA continues to rebuild their network adding some new services with Toronto back in their network providing valuable connectivity to Latin America and parts of the Caribbean. The challenges of operating a hub and almost no domestic market are well documented, and Panama continues to suffer with just 19% of its January capacity being operated. Still, as one former hub airport CEO remarked at a conference that “lockdowns stop people using my facilities and not spending more than a penny”

This week also highlights that there is more to the Middle East than the big three country markets. Both Bahrain and Oman have seen solid percentage growth week on week with Oman surging through the 50,000 seats a week mark and close behind Jordan has a near 4,000 extra seats week on week.

Table 2- Scheduled Capacity, Top 10 Fastest Growing Countries Markets

Source: OAG

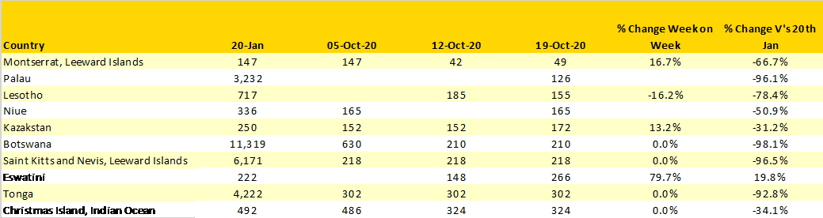

The ten country markets with the lowest weekly capacity are highlighted or should that be low-lighted in the table below. Two of these country markets have their first services for quite a few weeks; Palau with a United Airlines B737 service and Niue with an Air New Zealand A320 with a twice weekly service. Turning up ten minutes late for the United Airlines service could be a problem; it is only once weekly at the moment!

Part of the fun of small market aviation is the intimacy of getting to know every passenger and Montserrat, Leeward Islands offers that this week. The total forty-nine seats are operated on a once daily service with seven seats each day making for a careful weight and balance calculation before each departure.

Table 3- Smallest Country Markets by Capacity Week Commencing 19th October

Source: OAG

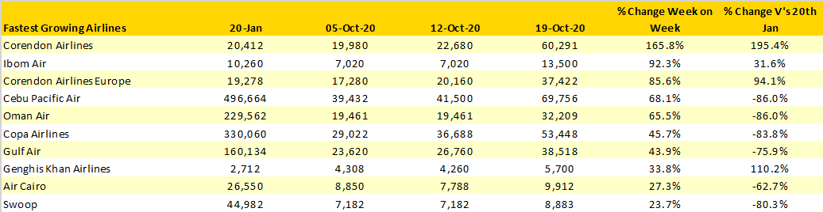

The list of the top ten fastest growing airlines week on week offers a couple of great opportunities for valuable insights as Genkhis Khan Airlines make history by appearing in any such list and Swoop well swoop into the top ten!

Correndon Airlines (so good, they named it twice!) also makes the list in both first and third position as their different operating divisions are both building capacity back up this week; collectively the two airlines are adding back over 55,000 seats week on week. And hopefully Ibom Air (pronounced “Ebom”) a Nigerian based carrier is now exploding back into operation with a near doubling of capacity with the return of services to major markets such as Enugu.

Table 4 - Scheduled Capacity, Top 10 Fastest Growing Airlines Week Commencing 19th October

Source: OAG

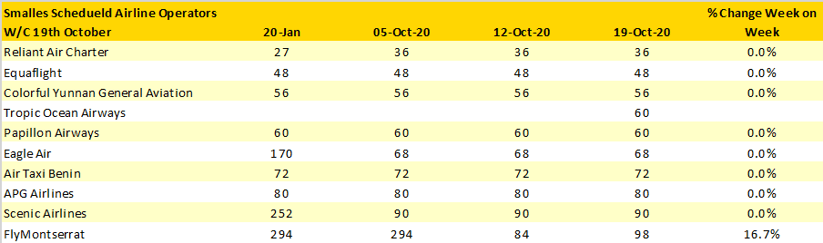

In a blog covering the more niche scheduled operations we had to include those airlines with the smallest capacity. With eighteen seats a week from both Danbury and Nantucket the local communities can rely on Reliant Air Charter and there Beechcraft service whilst Papillon Airways continue to flutter around the Grand Canyon National Park whilst Eagle Air are perhaps not soaring quite as high as they were a few weeks back. Nevertheless, all of these airlines both continue to operate and provide valuable services to local communities and the few tourists that still remain, so kudos to them and others in this position.

Table 5 – Scheduled Capacity, Smallest 10 Airlines Operating Week Commencing 19th October

Source: OAG

Look hard enough in any data and there will always be pockets of good news and positives; even in the hardest of times for the airline industry. If you need your weekly fix of top airline and airport data then the OAG weekly tracker will have more insights that should satisfy your needs.

Equally, just once in a while it’s good to recognise the wider range of airlines and airports that continue to operate and the services that they provide. Operating a small carrier is challenging, vulnerable to wild swings in the market but immensely rewarding on occasions and for many people it is where their carriers started and ironically finish!

Next week the clocks go back, the weekly blog will therefore appear one hour later than normal and will return to its normally darker themes. Will 56.8 million reduce fall to 55 million or below; how will some major airlines and country markets be responding to the second round of Covid-19?

Only time will tell.

.jpg)

.png)