Five weeks ago, China was the third largest international aviation market in the world; today it ranks 25th, just behind Portugal and slightly ahead of Vietnam some change in just a few weeks!

International Capacity Continues Downward Trend

The latest data for the week commencing the 17th February shows a further reduction in international capacity from China of 270,000 seats a week bringing the overall capacity reduction since the 20th January to some 1.7 million seats; a near 80% reduction. Japan, Thailand and Chinese Taipei are the largest losers of capacity week over week; in the case of Japan some 47,700 fewer seats are scheduled some 36% fewer than one week earlier.

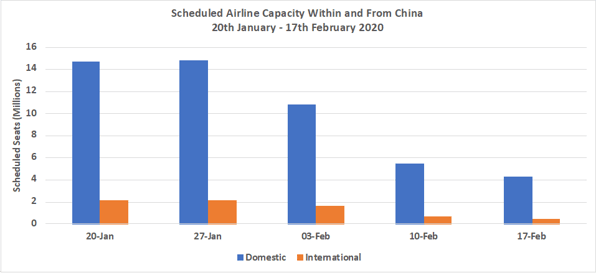

Chart 1 – Scheduled Airline Capacity Within To/From China

Source: OAG Schedules Analyser

Whilst the adjustments in international capacity are of interest and probably receive a greater share of attention the domestic Chinese market will see some 10.4 million fewer seats operated than the week of the 20th January. Placing that in context for every one international seat lost some six domestic seats have been removed from the market. And taking just one example, China Eastern Airlines will operate over 1.9 million fewer seats than five weeks ago; somewhere close to 271,000 fewer seats a day.

Japan and Thailand Impacted Further

We’ve noted before the “ripple” effect of the virus on markets closest to China and the table below illustrates precisely how much capacity has been lost in what are the top ten international markets from China.

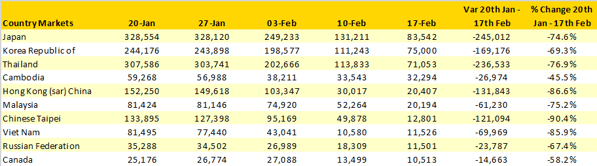

Table 1 – International Scheduled Airline Capacity from China Top 10 Markets

Source: OAG Schedules Analyser

Japan with some 245,000 fewer weekly seats and Thailand with some 236,000 “lead” the list in terms of lost capacity whilst in percentage terms Chinese Taipei (-90%) and Hong Kong (sar) China with over an 85% loss of capacity will between them see a quarter of a million fewer seats from China than five weeks ago.

Chinese Airlines Falling in Global Rankings

The ultimate revenue damage to the airlines affected is clearly significant, especially at a time of year when revenue generation is for many at one of its lowest points. Capacity also fails to recognise the impact on load-factors and anecdotal evidence suggest that those flights that are operating have much reduced load factors compared to five weeks earlier; it’s not very often when travelling that you are asked what row you would like rather than a window or aisle!

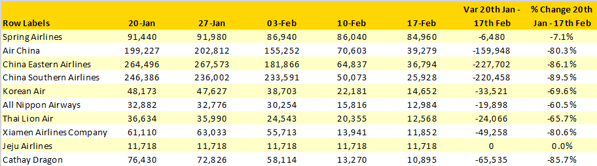

China Eastern and China Southern are the most heavily impacted carriers from an international perspective, both airlines having reduced capacity by over 200,000 seats a week as a result of Coronavirus. Placing that in context, China Southern now operate some 800 more international seats a week than Air Astana and China Eastern are just ahead of Tunis Air in a global ranking in 113th place.

Table 2 – Top 10 Airlines from China, International Capacity

Source: OAG Schedules Analyser

Expecting Further Chinese Domestic Capacity Cuts

In the darkest moments looking for light at the end of the tunnel provides some insight into how airlines are handling the crisis. From a domestic perspective there would seem to be an expectation that capacity will bounce back next week; our view is that this more accurately reflects the daily management of the situation by locally based airlines and we expect further capacity to be cut this week.

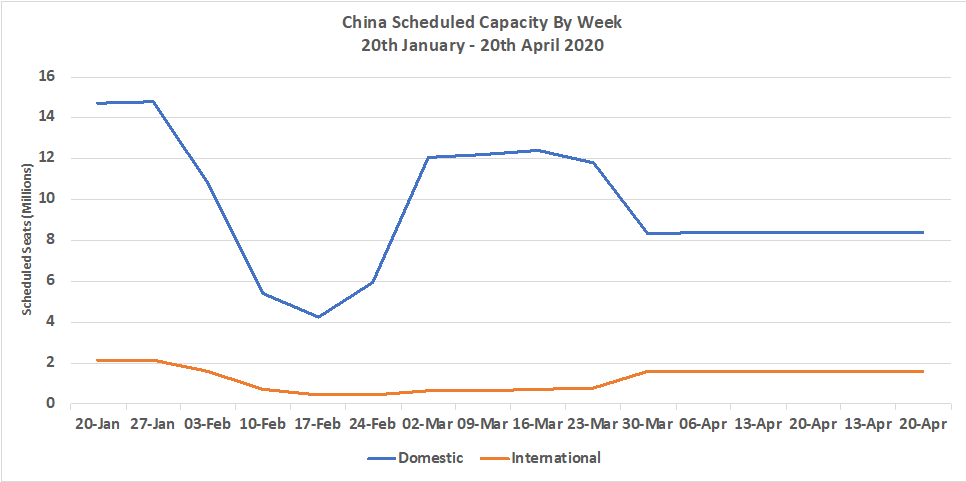

Chart 2 - Scheduled Airline Capacity Within To/From China To The 20th April 2020

Source: OAG Schedules Analyser

Across the international markets there appears to be a much more pragmatic approach with most overseas airlines taking their services out of the systems until the end of March; coinciding nicely with the Summer IATA season launch. We therefore do not anticipate any significant change from that end of March reinstatement at this time but by the end of February early March some further movement out could be possible if the situation remains unchanged.

No event that we remember has had such a devasting effect on capacity as Coronavirus. In many ways it highlights the importance of the Chinese market to aviation and the rapid globalisation of air services as new markets and travellers emerge everyday. Ultimately the market will recover we know that, but in the short term the damage to some airlines and the long term impact on their growth may linger beyond the virus.

.jpg)

.png)