Globally, airline capacity is back to pre-pandemic levels. Despite January 2024 being slightly below 2019 capacity levels (-0.8%), total airline capacity in Q1 this year is expected to increase by 10.2% versus last year, representing an increase of 2.1% versus 2019. Nevertheless, this rebound belies variation across and within regions.

All regions across Asia have reached and exceeded 2019 capacity, except South East Asia. North-East Asian and European markets traveling to/from South-East Asia have not yet fully recovered. International airline capacity in China has taken longer than many other markets to recover, including its own domestic travel market which has grown by 17% versus January 2019.

China Airline Capacity: Has The Surge Begun?

China surprised the world when it announced it was re-opening its borders on 8th January 2023. However a year on, Chinese international capacity is still 30% below 2019 in Q1 2024, and even once that level is reached then there will be four years of lost capacity and demand growth to recover. During this period market dynamics have changed with Chinese outbound travel affected by different demand and supply factors.

The Largest And Most Valuable Outbound Travel Market

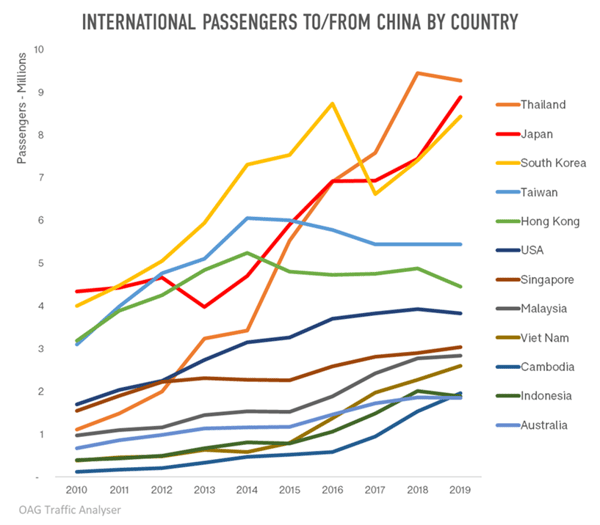

56 million air passengers traveled to/from China in 2010, this increased to 147 million in 2019. From 2010 to 2019 this represented approximately:

- 60 million more passengers between China and North-East Asia,

- 19 million more to/from South-East Asia,

- 4 million to/from Europe,

- 3 million to/from North America and SW Pacific.

China's outbound tourists are the biggest spenders of any nationality, with an expenditure of USD 254 bn in 2019 (USD 152 bn just for the US-China visitor market). As a result, there is fierce competition in the Chinese outbound market.

Since 2010 international passengers had been growing at an average rate of 11.2%, and even faster to some South-East Asian destinations: by 27% to Thailand, 37% to Viet Nam and 19% to Indonesia. Currently, less than 10% of Chinese citizens hold a passport, but back in 2019 10m new passports were being issued annually - suggesting considerable untapped potential demand.

Ambitious targets For Chinese Visitors Are Being Set Around The World

- Thailand’s tourism authority recorded 3.5m Chinese tourists in 2023, with 8.2m targeted for 2024 - in 2019, the figure was 11m.

- Cambodia is expected to reach 700,000 Chinese tourists in 2023, after targeting 1m.

- Australia had 1.4m Chinese visitors in 2019, and statistics for Jan-Sept 2023 report just under 0.5m.

- Indonesia recorded 570,000 Chinese tourists from Jan – Sept 2023, a long way off the 2.07m achieved in 2019. Projections for 2024 are to return to 2019 levels.

Steady growth and recovery is expected in Asia’s China tourism markets; however, the South-East Asian tourist destinations will need to work hard to differentiate their offer in the face of strong competition. As part of its Vision 2030, Saudi Arabia also has a target of 5m Chinese tourists by 2030, from 100,000 in 2023. The flight time from Shanghai to Riyadh is 12 hours 30 minutes compared with Shanghai to Sydney which is 10 hours 30 minutes, making it a potential competitor market.

Chinese Carriers Lead The Return

The share of international capacity to and from China operated by Chinese carriers is increasing, now 63% up from 47% in Jan 2023 and 53% in Jan 2019. For China’s Top 10 outbound markets, every country has seen an increase in the share of capacity operated by Chinese-domiciled carriers. The major three airlines - China Southern, China Eastern and Air China - have increased their international share from 60% in 2019 to 64% today. They face the challenge of meeting both increasing domestic and international capacity demands.

The geopolitical situation in Ukraine is also influencing European and North American carriers’ return to the Chinese market. Their preference is to enable their alliance partners to operate flights to China, rather than incur the extra flight time and cost of flying around, rather than over, Russian airspace.

Some - but not all - markets in Europe are seeing strong airline capacity growth in China, in particular Italy, Türkiye, the UK and Spain. There has also been strong capacity growth to Qatar, a key market for connections to other destinations, and to Saudi Arabia in the Middle East. Egypt and South Africa have also seen increased China capacity versus January 2019. In contrast, capacity to the Americas remains significantly down.

Fewer International Destinations Are Being Served

Whilst capacity has returned to the major hubs, all regions have seen fewer international destinations served since the reopening of the borders. Services no longer operated tend to be to secondary destinations and may well have been an opportunity for carriers to stop serving unprofitable routes.

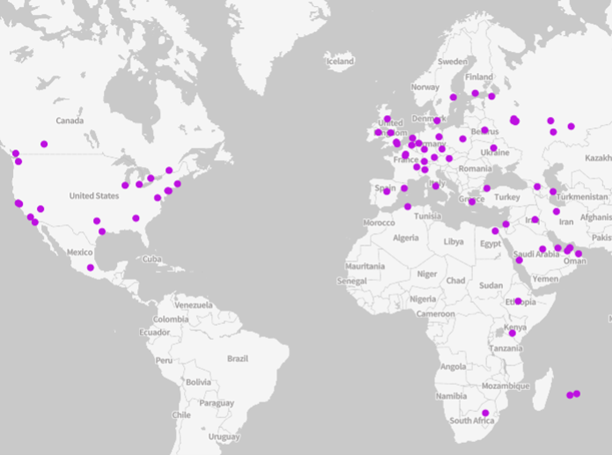

International Destinations Jan 2019

In January 2019 there were 119 Asia Pacific destinations served, and 77 in the rest of the world (mapped out above):

- MENA: 17 destinations

- Americas: 21 destinations

- Europe: 39 destinations

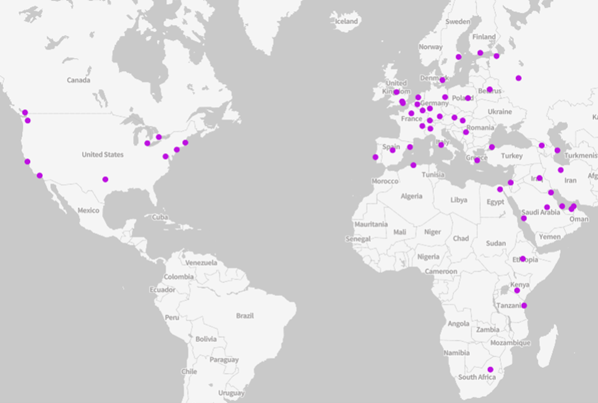

International Destinations Jan 2024

In January 2024, there were 85 Asia Pacific destinations served, and 56 in the rest of the world (mapped out above):

- MENA: 15 destinations

- Americas: 10 destinations

- Europe: 31 destinations

A Different Type of Traveler

China’s economy grew by 5.2% in 2023, a shakier recovery than many analysts expected. China has not been immune from the cost-of-living crisis affecting the rest of the world, particularly affecting the Gen Z and Millennial segments which were driving the market for weekend shopping trips to SE Asia and Japan. In contrast, the pensioner market has more disposable income and seak experiences when they travel - especially nature-based (rather than luxury goods). There is real interest in different destinations such as the Middle East, from Jordan to Iran, and Africa, including cheap safaris. This trend began before the pandemic where Australia saw an increase in independent camper van tourists from China; whilst VFR and international student travel has picked up to Australia, the holiday market has not.

From Closed Doors To Open Borders

Recognizing the need to remove the barriers and make it easier to stimulate the tourism market, China has a much more open mindset to visas. The visa regime is changing rapidly: in late 2023, China announced visa-free travel for five European countries and Malaysia for a year. Steps have also been taken to simplify tourist visas for US residents wishing to travel to China. China and Singapore have begun discussions to implement a visa-free policy likely to take effect in early 2024. These reciprocal visa issues mean that China has never been more accessible.

Competition for the Outbound Chinese Traveler Has Never Been Stronger

Tourism authorities will have to prioritise tourism marketing plans and work with supply partners to offer the right product at a cost-effective price. Saudi Arabia is investing heavily in targeting Chinese travelers through joint marketing campaigns with China-based Trip.com. Integration with tour operators may facilitate the distribution of new destinations, and whilst capacity needs to build to meet these ambitious targets, it is clear that this will be an area of future high growth.

The upcoming Chinese New Year holiday will see travelers get away in larger numbers than ever before, an extended break combined with new visa freedom means there’s never been a better time to travel from China. We watch with interest to see which destinations will be most popular this year and wish our readers in China happy holidays.

.jpg)

.png)