While legacy airline competitors are keeping an eye on how Norwegian Airlines fares with its long-haul low-cost flights on the Atlantic, long-haul low-cost options have been a regular feature of Australian international air services for some years. Are there lessons to be learned, and can we use the experience with Australia to predict the likely low-cost market share in long-haul markets?

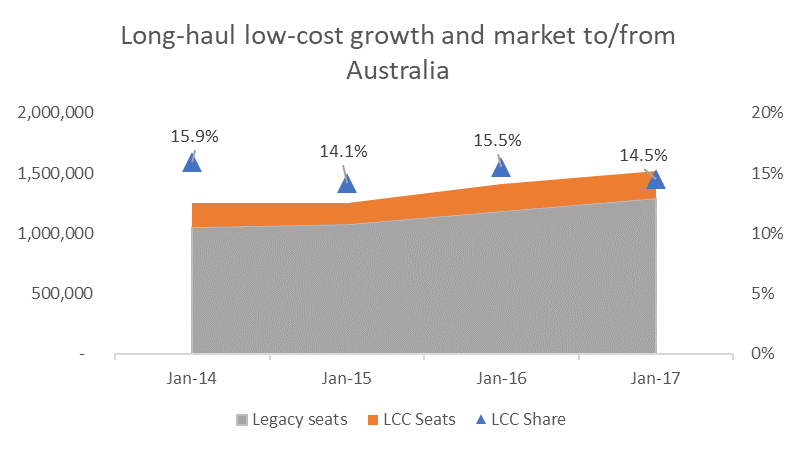

In September 2017, there were 1.5 million international airline seats available to and from Australia on routes over 4,000km. Of these, 14.5% were with low-cost airlines. While the long-haul market from Australia has grown by 21% between September 2014 and September 2017, the low-cost share has remained fairly static – 15.9% in September 2014, 14.1% in September 2015 and 15.5% a year ago. This is much lower than the typical low-cost share in short-haul and regional markets.

Through this period, two low-cost carriers have dominated the market, Australia-based Jetstar Airways with 47% of long-haul low-cost capacity, and Kuala Lumpur-based AirAsia X with 39%. Scoot operates a further 11% of capacity and Cebu Pacific the final 4%. While Jetstar has gradually added to its capacity, the other carriers have seen capacity grow and shrink in different years.

How does this compare to the evolution of low-cost airline capacity share more generally?

Low-cost airline capacity has been growing for decades, not just in absolute terms but also as a share of the total market. Back in 2000, low-cost carriers operated just 6% of airline seats. This had doubled to 12% by 2005 and was 20% by 2010. Today low-cost carriers make up 29% of scheduled airline capacity globally and the share appears to still be rising.

On transatlantic routes, where long-haul low-cost airlines are a more recent phenomena, low-cost capacity only makes up 5% of capacity.

Is the lesson from the established long-haul low-cost Australian market that expectations should be set at a maximum share of around 15% of the market for low-cost capacity? Maybe. Maybe not. Norwegian’s competitors on the North Atlantic will be watching and waiting.

.jpg)

.png)