Middle East Aviation Market

Monthly Middle East Airline Data Updates

DISCOVER THE BUSIEST AIRPORTS, AIRLINES AND COUNTRIES IN THE MIDDLE EAST THIS MONTH | FEBRUARY 2026

Which is the biggest airline in the Middle East? Where is the busiest airport in the region? Which countries have the most airline capacity and how is this split between low-cost and mainline carriers? All of these questions and more are answered in our monthly Middle East aviation data analysis and commentary. Data is sourced from OAG's Schedules Analyser; a cutting-edge platform for airline schedule analysis.

Airline Capacity in the Middle East

In The middle East this month there are 35.1M scheduled airline seats, +6.3% year-on-year

- Capacity across the Middle East is expected to increase by 6.3% in Feb 26 vs last year, to 35.1m seats.

- International capacity, which represents 88.2% of the market, grew by 6.3% vs Feb 25, 1.8m additional seats to 31m seats.

- Domestic capacity represents 11.8% of the market and grew by 6.5% vs Feb 25.

*As of July 2025, international capacity is reported on a two-way basis (previously one-way departing).

How is Capacity Split between Low-Cost and Mainline in the Middle East?

- LCCs account for 29% of capacity in the Middle East this month, growing by 11.6% vs Feb 25.

- Mainline carriers account for the remaining 71% of market capacity, growing by 4.3% vs last year to 25m seats.

*As of July 2025, international capacity is reported on a two-way basis (previously one-way departing).

Top 10 Middle East Country Markets

Which Middle Eastern Country Has Most Airline Capacity?

- The United Arab Emirates and Saudi Arabia are the largest markets, with 7.4m and 7.1m seats respectively.

- Capacity in the UAE grew by 4.9% (340,900 additional seats), while in Saudi Arabia the growth rate was more than double, up by 10.2% (654,700 additional seats).

- Within the Top 10 countries, capacity grew at the fastest rate in Israel again this month, by 35.4%, followed by Iraq and Jordan, where capacity grew by 15.5% and 13.6% respectively.

- Capacity contracted by 37.7% in Iran (465,200 fewer seats) vs Feb 25.

WE'LL LET YOU KNOW WHEN NEW DATA IS ADDED

Add your name to the list and we'll email you once a week with a round-up of the new aviation data added to our dashboards, the latest in-depth analysis from our air travel experts, travel technology news, easy to digest infographics and more.

Top Ten Middle East Airports

Which is the Busiest Airport in the Middle East?

- Dubai (DXB) remains the region's largest airport this month, with the hub handling 4.9m seats.

- Jeddah has overtaken Doha to become the second busiest airport with 2.8m seats, an increase of 8.7% vs last year.

- Tel Aviv continues to be the airport with the fastest growth in capacity, up 32.3%, which is 218,500 more seats than last February.

- Riyadh and Sharjah also experienced double-digit increases of 15.6% and 14.7% respectively. 273,400 seats were added in Riyadh vs last year.

- READY TO VIEW: The World's Busiest Airports of 2025

Top Ten Middle East Airlines (One way, departing seats)

Which is the biggest Middle Eastern airline?

- Emirates remains the largest airline in the region, with the network carrier handling 3m seats, an increase of 3% vs Feb 25.

- Within the Top 10 carriers in the Middle East, flyadeal, FLYNAS and Etihad grew at the fastest rates of 30%, 30% and 22% respectively vs last year.

Watch Aviation Expert Q&As

MORE RESOURCES FROM OAG

China Aviation market Data

The busiest airports, largest airlines, biggest cities for airline capacity and more

View Data

US Aviation Market Data

This month's leading airlines, airports, states and more from the US market.

View Data

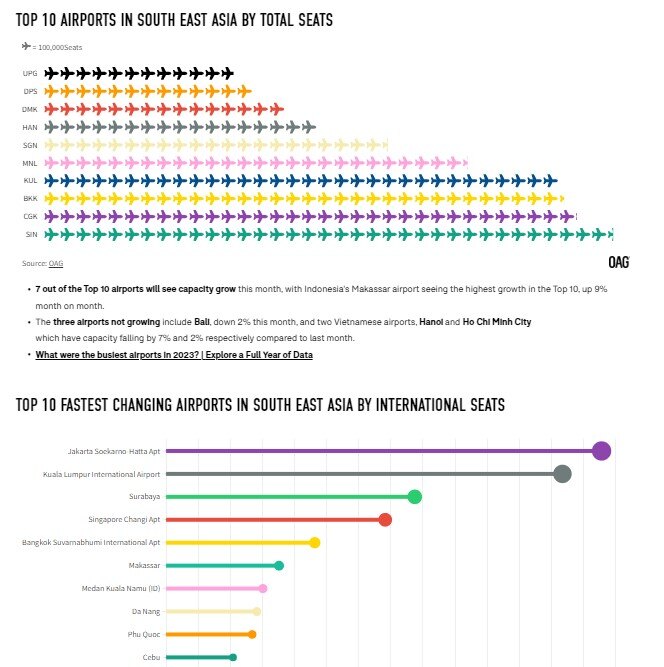

South East Asian Aviation Market Data

SE Asia's biggest country markets, airports, airlines and more are updated each month.

View Data

Aviation Market Analysis

Analysis of the latest data and developments in the aviation world.

Read Now

.jpg)

.png)