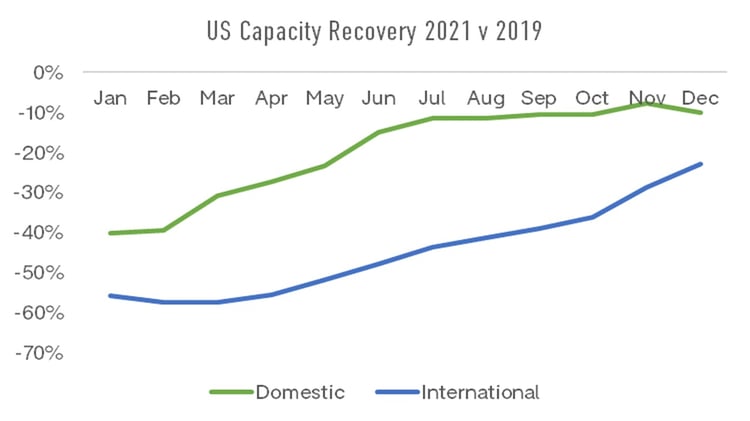

OAG has been tracking airline capacity in the United States closely for a number of months, reporting each month on scheduled capacity recovery by State, airline, airport, and even down to route level. As of December 2021, US domestic capacity had reached 90% of December 2019 levels, which was a slight drop back after reaching its closest point in November at 92% below 2019.

Source: OAG

Florida Capacity Back to 2019 Level

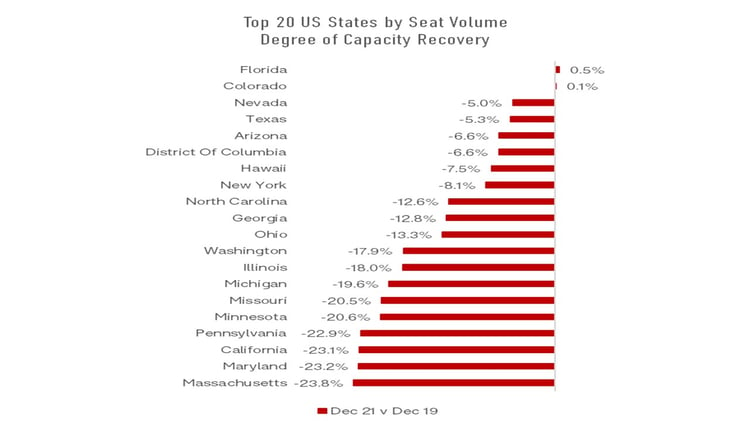

In 2019, Florida was second in size after California in terms of seat capacity, but has recovered more rapidly, becoming the largest state by seat volume in 2021. It is also only one of two States to have reached recovery, with capacity sitting at 0.5% above December 2019 levels this month.

The other State to have reached December 2019 capacity volumes this month is Colorado where capacity is now 0.1% above where it was two years ago.

There are a handful of other States which are approaching recovery, where capacity is within 10% of December 2019 levels. These include Nevada, Texas, Arizona and New York. In some part leisure traffic has been instrumental in driving recovery as travellers visit friends and family across the country, and take vacations within the US rather than travel overseas. Las Vegas has remained popular throughout 2021, with a number of the busiest US domestic routes operating to and from the city.

Some of the other big States for airline capacity lag further behind – Massachusetts, Maryland and California, for example – all have capacity at less than 80% of the December 2019 level.

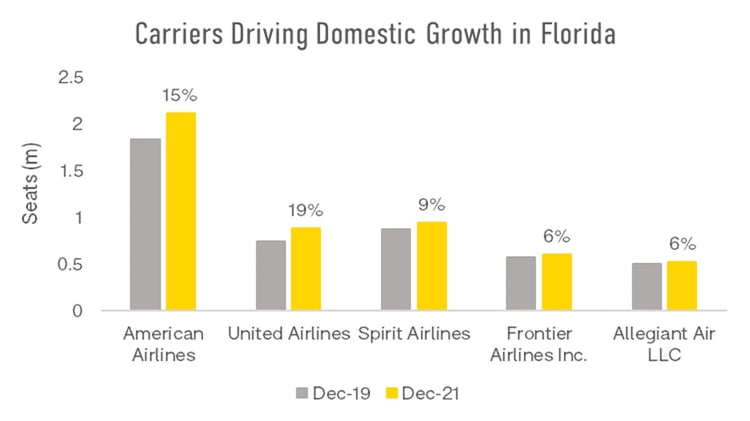

Florida’s capacity recovery is in part due to strong domestic growth. Domestic capacity was 4.4% higher in December 2021 than December 2019, while international capacity was 13.3% smaller in volume. There were close to 370,000 more domestic seats operated in December 2021 than two years earlier with the 5 largest airlines in the market adding 557,000 additional seats but smaller airlines scaling back by 190,000 seats. The capacity share of these five airlines increased from 54% to 58%.

Source: OAG

Florida’s capacity recovery is in part due to strong domestic growth. Domestic capacity was 4.4% higher in December 2021 than December 2019, while international capacity was 13.3% smaller in volume. There were close to 370,000 more domestic seats operated in December 2021 than two years earlier with the 5 largest airlines in the market adding 557,000 additional seats but smaller airlines scaling back by 190,000 seats. The capacity share of these five airlines increased from 54% to 58%.

Source: OAG

Challenger Airlines

So, which are the airlines driving recovery across the USA? The Top 10 airlines account for 94% of all scheduled airline capacity but it is the smaller ones in this list which seem to be driving growth. American Airlines, by far the largest airline – operating 23% of all capacity this month – is flying 6.4% fewer seats this month than two years ago. Delta Airlines, ranked second, is flying 15.2% fewer.

Contrast this with Spirit operating 6.7% more capacity, Frontier 11.7% more and Allegiant 10.5% more. For Spirit, a large portion (80%) of this additional capacity has gone into Florida, helping produce the results shown above. For Frontier, Florida is also the major beneficiary of extra capacity and making up 30% of Frontiers extra seats, but Nevada, New York, California and Texas have also benefitted from the airlines’ growth. Allegiant has focussed much less on Florida although it has grown its presence there. Texas, California and Tennessee all gain from Allegiant growth as do Illinois and Iowa but to a lesser extent.

.jpg)

.png)