This blog takes a closer look at the those issues and challenges raised in OAG’s recent webinar, 'Discuss: Aircraft Lease Rates and Airfares Have Never Been Higher' on how the aircraft leasing sector is responding to the challenges it currently faces.

Is the Supply Chain broken?

Boeing and Airbus struck deals to sell billions of dollars' worth of aircraft at the Singapore airshow in February, however supply chain disruptions mean they are likely to struggle to deliver them on time. Manufacturers are already behind in their current orders due to parts shortages and lack of skilled labour, as the travel sector recovers from the havoc caused by the Covid-19 pandemic.

Problems across the supply chain were initially caused by the pandemic when restrictions and border closures disrupted shipments of raw materials and led to layoffs of pilots, flight attendants, baggage handlers and aircraft mechanics. The war in Ukraine also disrupted oil supplies and triggered higher costs for goods and services worldwide.

The supply chain remains a major issue, with parts shortages leading to planned aircraft maintenance schedules being disrupted and taking longer – in some cases, months longer. This has been compounded by Pratt & Whitney engine problems forcing over 400 A320 aircraft (per Mark Dunnachie, SVP Commercial ACIA Aero Leasing) to be grounded to have the engines disassembled and inspected and the industry faced further disruption last month when 171 B737-9 MAX aircraft were grounded due to a faulty exit door plug.

Michael Szucs, chief executive of Philippine carrier Cebu Pacific, told AFP at the Singapore Airshow that his airline had been forced to ground 10 aircraft which may increase to 16 this year due to problems in the Pratt & Whitney engines. He reported a shortfall in their capacity through aircraft grounding and delays in delivery from Airbus.

Global AIrline Capacity is Back to Pre-Pandemic Levels

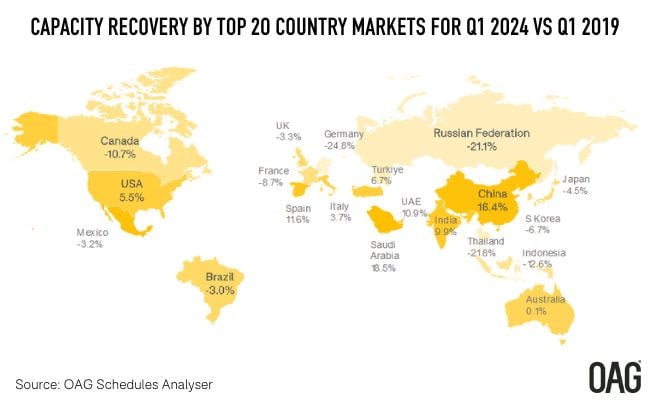

In contrast, global airline capacity this quarter is expected to be 2% ahead of quarter 1 in 2019 and 10.1% ahead of the same quarter in 2023. However, performance varies across and within regions. Eastern Europe is the only region which remains below 2019 levels because of the ongoing disruption caused by Russia’s invasion of Ukraine and capacity is still down by 5.7% across Europe. This has also been impacted by the reduction in domestic air services replaced by high-speed trains, particularly in Germany and France.

Africa however is now 9.1% ahead of 2019, with strong capacity growth across most parts of the continent continuing (with the exception of South Africa). Latin America is almost at the same level, with capacity across the continent up by 8.9% on 2019. Even the Asia Pacific region has now reached recovery overall, up 3.1%. South East Asia lags behind, down 12.9% on 2019, and the South West Pacific region is also behind, by 2.3%.

There is some debate as to whether discretionary travel is softening. Nevertheless, it is evident post pandemic that spend on travel continues to be prioritised across all age groups and air travel is of course an important enabler of a range of things from economic growth, trade and enabling families and friends to remain connected, wherever they are in the world. Globally, the markets seeing growth have large younger populations, growing disposable incomes and consequently growing potential demand.

Demand for Aircraft Has Never Been Higher

Against this backdrop, industry experts at OAG’s webinar explained that airlines are increasingly looking at the leasing market to keep their fleets flying. Previously approximately a third of airline capacity was leased, according to Mark Dunnachie, SVP ACIA Aero Leasing, it is now 50% and growing. Even amongst airlines that have traditionally bought their aircraft, leasing is being used as an important finance channel, enabling them to flex their fleets alongside aircraft purchases. However, as Eddy Pieniazek, Head of Analytics and Advisory at Ishka explains “The pool of lease aircraft available is not quite as big as some may imagine and that in turn pushes prices up”. Lease rates have moved from an all-time low in 2020 to an all-time high in 2023.

Mark elaborated that whilst the regional jet leasing market is very price and time sensitive, there are at least 4 or 5 airlines chasing every aircraft. This has created a shift in power to the lessor regarding which airlines they lease to and the terms. Jon Howey, Head of Aviation Risk, CALC, confirmed that, whilst wide bodied lessors required longer lead time and longer relationships, they were also able to secure better rates and security packages at the moment.

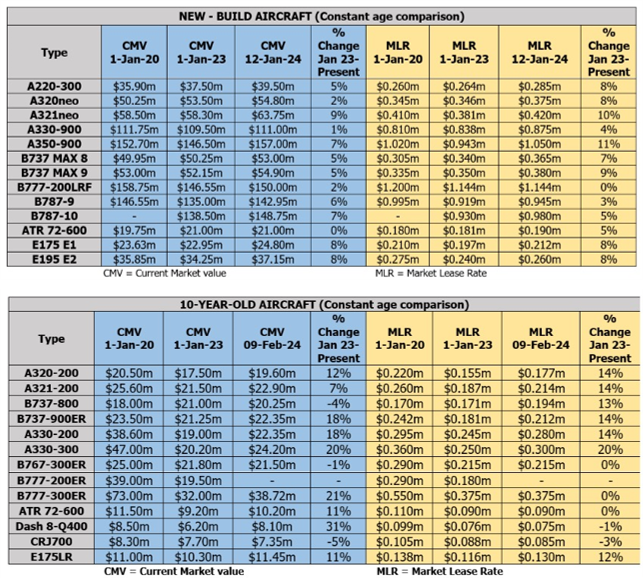

Market lease rates for new build aircraft have increased in the last 12 months for almost every category. The lease rates for 10-year-old aircraft have also seen considerable increases across most aircraft types, with the exception of B767/777s and some regional jets where rates have fallen.

Source: Ishka

Source: Ishka

Both Mark and Jon noted that airlines are overall keener to lease aircraft for a longer period of time. This has led to a significant increase in the number of long-term leases and consequently an increase in the average age of most operating fleets. Not only are airlines not benefiting from the 20% operating cost savings of a new aircraft, this issue is likely to impact airlines’ abilities to meet the sustainability targets of carbon emissions. Jon explained that there was also pressure from lessors to negotiate leases earlier and to build awareness of manufacturers’ inability to meet demand. He cited the short-term planning cycle that the Chinese carriers were used to and the challenges this presented in the current environment.

A Cyclical Industry

Whilst beneficiaries of the current supply storm, the lessor industry experts were only too aware of the cyclical nature of the aviation industry. They were divided in their expectations of when the supply backlogs would be resolved, with Jon Howey expecting the later part of the decade and both Mark Dunnachie and Eddy Pieniazek estimating 2027/2028. Eddy considered that there was potential for the manufacturers to overshoot demand. Cost pressures from labour, maintenance, spare parts to leasing aircraft are up, which is leading to higher airfares than 2019. This may dampen demand.

In the meantime, there was never a more critical time for effective aircraft fleet planning to meet these challenges.

.jpg)

.png)