It’s been a good week for scheduled airline capacity with nearly sixty airlines relaunching services; as we predicted last week everyone was just waiting for June! Those airlines range from the global; welcome back Turkish Airlines, the regional such as Transavia.com and the essential such as Pacific Coastal Airlines. Fingers crossed for each and every one of those reopening this week.

.

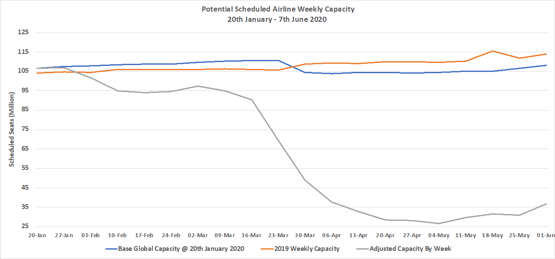

Global capacity has bounced into June with 5.7 million seats added week on week, some 267,000 additional flights are scheduled to operate this week representing a near 16% increase on last week through a combination of the returning carriers and some capacity growth. Capacity however does remains 66% below the levels filed last year as the chart below highlights but 36.7 million seats and breaking through the 35 million mark feels positive.

Demand now becomes the crucial issue for all airlines in the recovery phase and again there are indications of some growth in search and booking activity in both the Chinese domestic market and indeed Europe and particularly Italy. Despite that demand interest we should not be surprised to see short notice cancellations and capacity adjustments in the coming weeks; flying empty is in many cases worse than flying at all!

Chart 1 – Scheduled Airline Capacity by Week Compared to Schedules Filed on 20th January 2020 & Previous Year

Source: OAG

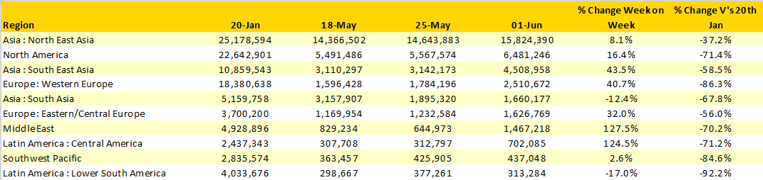

Capacity increased across the majority of the major regional markets with only South East Asia and Lower South America reporting week on week reductions. Both the Middle East and Central America regions saw capacity double week on week. In the case of the Middle East the reopening of Saudi Arabia where twenty-eight airlines will supply some 290,000 from a zero-based position last week. Whilst in Central America, both Vivaaerobus and Volaris have more than doubled capacity week on week.

North East Asian capacity is now “only” 37% below January’s level with domestic capacity at 80% of the previous norm whilst international capacity remains at just 13% of the historic levels as continued travel bans, particularly in China delay any recovery in that segment.

Table 1 – Scheduled Airline Capacity by Region

Source: OAG

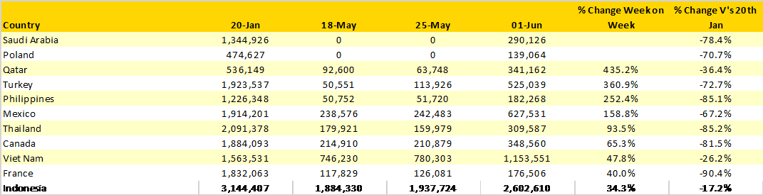

With the top ten country market sizes largely unchanged compared to last week we have taken a look at the fastest growing major markets. Not surprisingly Saudi Arabia and Poland top the list from their zero-based position while Qatar, Turkey, Mexico and the Philippines have all more than doubled the levels of weekly capacity available

Table 2- Scheduled Capacity, Top 10 Country Markets

Source: OAG

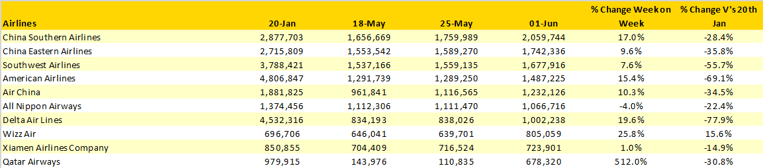

The top ten airlines remain very similar to previous weeks but on a positive note nine of the ten increased capacity week on week as confidence continues to come back to the market. China Southern Airlines addition of some 300,000 additional seats week on week is purely across their domestic network which now accounts for over 99% of all their flying.

Table 3- Scheduled Capacity, Top 10 Airlines

Source: OAG

The first week of June may be a turning point for the industry in terms of capacity but we need to remain very cautious about the outlook for the summer. With uncertainty remaining and traveller confidence yet to be restored there is a lot of factors outside the airlines control that will continue to affect demand and ultimately capacity. Taking just one market example, in the United Kingdom some 7.8 million seats have been removed by airlines in the last two weeks through to the end of July and as each week passes, we expect to see further adjustments in all markets.

Air bridges, corridors and bubbles may be interesting discussions and capture the interest of the regulators and public; sadly, they only offer partial solutions for airlines and airports. Only as and when we are able to connect domestic and international markets will we begin to see a return to the levels that we once enjoyed; but that may still be a long way away.