The World Cup is now a distant memory, and the success of Morocco was a great result for African soccer, showcasing both the skill and resilience of a well-drilled team where everyone accepted their roles and responsibilities. Increasingly, the global pandemic is also a distant memory and something we have all learned to live with. The pandemic was certainly a shared learning experience and for all of us picking up the pieces after lockdowns, restrictions on travel, and our social networking, times have never been harder. The parallels with Africa’s aviation industry run deep but there are reasons for optimism from the learnings and recovery.

A Devastating Event

For many airlines, the pandemic was a moment of survival of the fittest and even the fittest struggled! Those carriers lucky enough to have deep cash reserves managed to survive, scarred but not materially damaged; Ryanair entered 2020 with enough cash reserves for a few years and some African carriers had enough for a few weeks!

In 2020, Africa’s airlines lost some US$7.7 billion, millions of employees within the wider travel eco-system lost their jobs and some eight airlines went into bankruptcy - although some of those were teetering on the edge beforehand. In 2022, African airlines are expected to have lost US$638 million, with those losses hopefully reducing to US$213 million in 2023. Even allowing for those 2023 estimates to be upgraded as the recovery gathers pace, Chinese travel restrictions to ease faster than expected and a stronger demand profile, Africa’s aviation industry will continue to be marginal. It is a tough existence but there are signs of hope in all regional markets and a sense that maybe 2023 could be a turning point for the industry, or is that just sheer optimism? Let’s examine the facts.

More Airlines Than Ever - But Not the Right Type and Size?

There have never been more scheduled airlines in Africa than there are now, some 264 airlines from around the world operated to the continent at some stage last year; that is the highest number for many years. Equally positively, 120 of those airlines (45%) are African-domiciled airlines, again, the highest number over the last twelve years although that is the lowest proportional share since 2010. Alarmingly there were only eight low-cost domiciled African airlines operating and that number has never reached double digits in the history of scheduled aviation in Africa, as the chart below highlights. Only two airlines, Air Arabia Maroc and Egypt, have been consistently operating through that time. Many others have been and gone.

By means of contrast, there were twenty-five non-domiciled low-cost carriers operating flights to Africa with those airlines ranging from Ryanair with over 2.4 million seats to the new Wizz Air Abu Dhabi entry with some 33,000 seats and plans to grow further.

Low-Cost Carriers Struggle to Survive

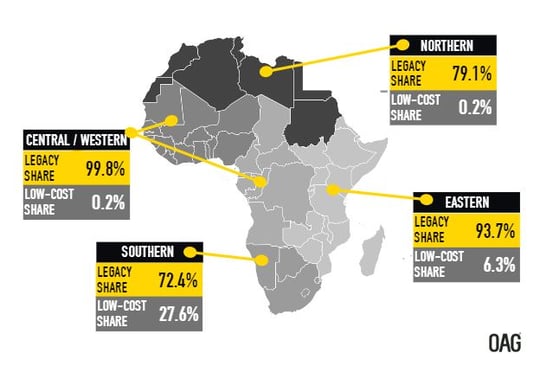

Analyzed by market segment, it is very clear that both penetration and growth in share of the low-cost airline segment is very low, particularly in West, Central, and Eastern Africa where more than nine out of ten seats are operated by legacy airlines. The global average for January 2023 is for 35% of all capacity offered to be operated by low-cost airlines, highlighting just how far behind the rest of the world African aviation is in embracing what is now a proven industry segment, that stimulates new market demand, enhances connectivity, and ultimately drives economic growth.

Any discussion around the low-cost market quickly gravitates towards the difficulties of operating in very regulated markets; stimulating demand with very high levels of taxation; shortages of skilled resources; and the need to challenge established distribution channels and build direct booking activity. All of these are valid points and are proving very difficult to change but is there a more fundamental issue that needs to be addressed: the thorny area of consolidation and scale?

Operational Challenges

For any airline to be successful it needs to operate a diverse network that allows it to weather the inevitable changes in markets as they react to external factors. For some carriers, it’s a wide geographic network that provides that resilience, for some it’s a balance between clear business and leisure markets, and for others, it’s the creation of bases across a country or continent that allow resources to be reallocated at short notice.

For most airlines in Africa, applying any of those principles is challenging as the capacity 'hockey stick' below shows. In total, African-domiciled airlines scheduled nearly 40% of capacity in 2022 and this is supplied by the five largest airlines, with Africa’s single largest airline - Ethiopian Airways - operating 14% of all capacity alone. For comparative purposes the top five airlines in 2022 had a 38% share of capacity and the largest carrier, Ryanair had a 15% share of capacity. So, whilst at a macro level African airlines have a very similar profile to their counterparts in Europe, it is at a more granular level that the challenges of operating become clear.

The average capacity operated per day by an African-domiciled airline in 2022 was 2,284 seats, whilst the average number of daily flights operated was 24, again for comparative purposes in Europe the average was 51, suggesting that each carrier has at least twice as much operational scale as those in Africa. With scale comes efficiency and another part of efficiency is reflected in the type of aircraft operated - looking at last year’s data it highlights one of the greatest challenges facing aviation in Africa: the need for small aircraft types.

Over two-fifths of scheduled flights were operated with Turboprop aircraft while another 20% were operated by regional jets, resulting in more than 61% of all flights being operated by aircraft that typically have fewer than 50 seats per flight. For any airline creating a long-term sustainable turbo-prop/regional jet network is challenging, typically requiring high selling fares and high aircraft utilization and whilst the fares are high, the continual punitive taxes applied effectively discourage demand stimulation in all but the most wealthy or tourist markets.

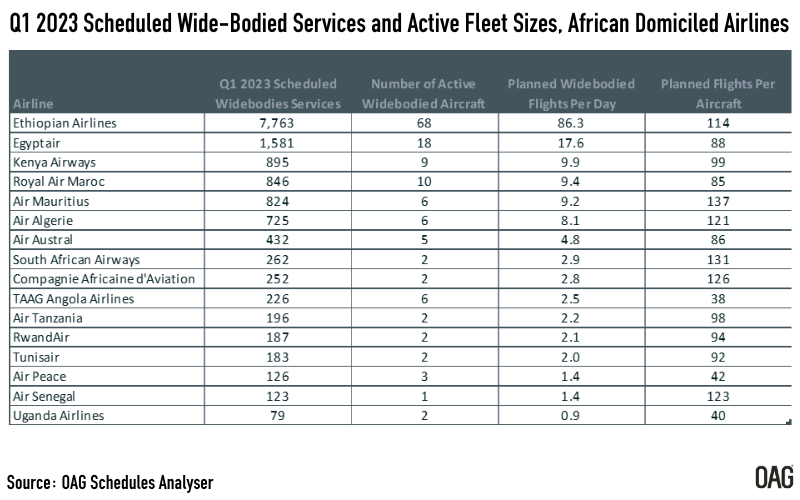

Productivity at the other end of the spectrum, across the wide-bodied fleets of African airlines, highlights another series of challenges and inefficiencies. Looking at the current planned first quarter 2023 schedules reveals several carriers operating with a low number of daily wide-bodied services. While airlines such as Ethiopian (114), Air Mauritius (137) and South African (131) are striving for a high degree of operational use, carriers such as RwandaAir, Air Peace and Uganda Airlines appear to be using their aircraft for less than two flights a day, hardly efficient operations by any measurement criteria.

At Another Set Of Crossroads?

Post-pandemic with the recovery now in full swing, African aviation appears to be at another set of crossroads, and it would be fair to say it has plenty of experience of such moments, but has frequently failed to take the right direction. The key question is what the right direction should be, and is it possible to make progress that is both sustainable, grows access to travel and creates a profitable industry for all? There is no “golden bullet” to establish that position but perhaps there are some ideas or thoughts to consider.

Industry consolidation has often been discussed as a way forward, but it has yet to deliver results for either majority or minority partners in Africa. Disputes over ownership and control, allocation of resources, scheduling, management teams and even pricing have frustrated attempts at any form of consolidation. The loss of strategic control, protection of national interest and frequent changes of government control have proved difficult barriers to overcome, and many attempts have floundered on “majority investment, minority influence” type arguments. Given the history, politics, and failure of previous attempts then it would be a brave airline CEO to suggest a consolidation play in the near future. But are there other alternatives?

An African Airline Alliance?

Is a partnership approach a more realistic and less emotive means of creating the necessary critical mass and network that a pan-African airline could operate? Could this provide the necessary supporting foundations for the wider airline community to build around? Is it possible to make something happen? Well, there are four very distinct geographic regions within Africa and in each of those there is a dominant airline operator that has successfully secured enough scale and mass to survive and move forward, could some form of partnership between those carriers be a catalyst for change?

Each of these airlines enjoys strong market positions in their respective regions, in most cases offering at least twice as much capacity as the second largest airline in that region and all having a range of existing partnerships in place with smaller carriers. Post-pandemic many airlines have realized that they were lucky to survive the event. In many cases, without Government support, sympathetic lessors and some savage cuts in resources they would have collapsed. No airline CEO wants to be in that situation again so developing new strategies that de-risk such exposure will be vital in the next few years and creating strategic but non-equity-based partnerships represent a way forward. Previous partnerships in Africa have always been built around investment rather than recognizing the commercial benefits that could be created by working together. But most of those have failed, were those attempts to run before walking realistic? Could softer options have been considered and was too much effort wasted at the negotiating table with too many “interested parties”? Absolutely YES!

Africa's New Opportunity

In the early stages of the pandemic many people uttered the phrase “in adversity is opportunity”. There is some truth in this sentiment and African aviation now has that opportunity to make a quantum leap forward in terms of its development, value to economic growth and most importantly connecting a continent that is best connected via Paris or Rome at the moment. To make that happen requires trust, but not cash. It requires partnerships rather than ownership. And most importantly it requires inspirational leadership to step forward. Nothing is impossible with the right mindset.

African aviation is once again at a crossroads, the journey to date has been long, impacted by too many detours and stumbled across too many roadblocks as it has attempted to make progress. The latest crossroad is probably the last opportunity in a reset world. Can the continent make the right turn?

.jpg)

.png)