Last week Virgin Atlantic confirmed that it will be closing its Little Red operation in 2015, just 18 months after launching it and following weeks of speculation. When Virgin launched Little Red in 2013 the idea was to replace the domestic feeder traffic to transatlantic routes from London Heathrow that was previously provided by bmi. Apparently as much as 25% of Virgin’s routes to North America came from bmi.

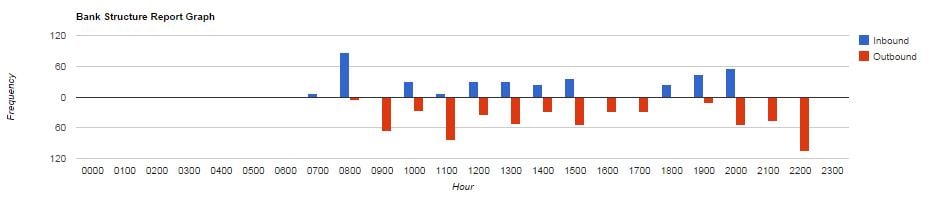

On paper, Little Red and Virgin ensured that inbound arrivals from Aberdeen, Edinburgh and Manchester into London Heathrow met outbound departing flights to the rest of the world, even if transferring between flights meant the use of an airside bus between Terminals 2 and 3.

Little Red/Virgin Scheduled Arrivals and Departures at LHR from Aberdeen, Edinburgh and Manchester to the rest of the world, October 2014

Source: OAG Schedules Analyser – Bank Structure Report

So what went wrong? Many in the industry will say that this was a venture never likely to succeed. London to Manchester in particular was always going to be difficult when the competing rail journey time is now only just over 2 hours. An increase in direct international services from Edinburgh means fewer Scottish passengers need to connect over London, when they can go via destinations such as Istanbul, Doha, Dubai and Chicago.

Furthermore, the Little Red/Virgin Atlantic combination simply wasn’t strong enough to compete with the hub activity of airline alliance networks either at Heathrow or elsewhere. Not only has loyalty to the British Airways brand and frequent flyer scheme remained strong, powering traffic through Heathrow, but services from regional airports to other European hubs have grown.

So, for instance, capacity from Manchester to Amsterdam, a SkyTeam hub, has grown by 19% between 2012 and 2014, and capacity from Aberdeen to Paris Charles de Gaulle, also a SkyTeam hub, has grown by 23%. Over the same period, airline seats offered between Edinburgh and Frankfurt, a Star Alliance hub, have grown by 38%. So passengers travelling from the UK regions to the rest of the world have more choice than ever about where they choose to connect.

While the provision of international transfer traffic was always a key part of the strategy for Little Red, the airline has faced steep competition for domestic traffic to fill those seats. easyJet has helped build London Gatwick as a domestic access point to the London market and offers 34% more seats this October than last. Moreover, BA has been moving domestic capacity to London City Airport, with 15% more domestic seats at LCY this October than in October 2013. And with that, has moved some of the higher yielding business traffic destined to and from the City.

So now the speculation begins over whether there could be another airline prepared to bid for these slots. If no carrier steps up then the slots will be returned to BA – a move that doesn’t seem to be in the passenger’s best interests. Aer Lingus may step into the breach, or might we finally see a low cost carrier operating domestic routes from London Heathrow?

.jpg)

.png)