Long-haul low-cost, one of the most talked about subjects in the aviation industry over the last five years. New carriers, advanced aircraft technology, emergent markets, low oil prices, Airbnb and increasing disposable incomes in some markets have sparked interest in the subject but is it really that significant a development? We’ve taken a look at the hard data to see what in fact is happening.

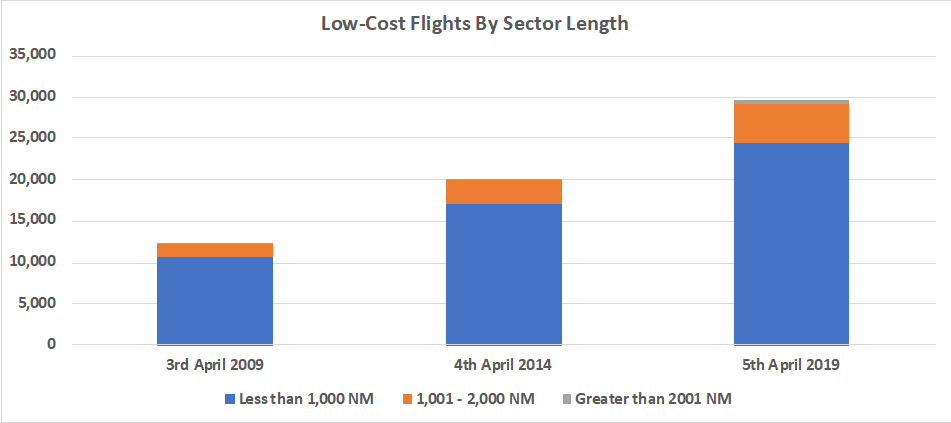

Taking a typical April day, we have looked back over the last ten years at the development of low-cost airline sectors by a range of sector lengths, and in truth most of the low-cost development is at the short-range end of the market. We’ve defined short-haul as anything less than 1,000 nautical miles, medium range as between 1,001 and 2,000 Nm and long-haul anything beyond that point.

Source: OAG Schedules Analyser

In 2009, over 10,700 flights (87%) of all low-cost airline flights were less than 1,000 Nautical Miles in stage length. A typical sector falling into this category would be a London – Munich service or in Asia from Singapore to Jakarta. This year, nearly 24,400 flights are scheduled; a doubling of movements accounting for 82.4% of all flights.

In absolute terms the fastest growing part of the low cost airline market over the last ten years has been in those sectors of between 1,001 to 2,000 Nautical Miles which includes such sectors as Paris – Casablanca (1,041Nm) and Manila – Kuala Lumpur (1,344Nm) where sector lengths typically range from between three and four hours. Sectors flown in this stage length category have more than tripled in ten years suggesting that low-cost airlines are having to fly longer sectors to continue developing their market; but intuitively we probably all realised that anyway!

In fact, less than 2% of all low-cost long-haul flights are operated over sector lengths in excess of 2,000 Nautical Miles and whilst this represents a near fourfold increase compared to ten years ago there is still a very heavy focus on the short to medium range sectors for low-cost airlines. And when comparison is made to the legacy airline sector where more than 7% of scheduled flights operate sector lengths in excess of 2,000Nm there is still a long way to go before low-cost matches the legacy airline dominance. All of which suggests that despite the marketing and press coverage the probability is that the further you fly the more legacy your choice

The longest sector in our data snap-shot of one day is operated by Norwegian Air between Buenos Aires and London Gatwick at just over 6,000 Nautical Miles with the carrier also in second place with a scheduled Rome – Los Angeles sector. Interestingly, whilst the B787 will be used to operate 51 scheduled services, accounting for 24% of all flights in this sector length category. Interestingly there are currently no A350 operations although this will change in 2020 when Air AsiaX start to receive their new aircraft, and proving that longer-haul low cost single aisle services are at least popular with the airlines over half of services will be operated by such aircraft with carriers such as FlyDubai, WestJet, Scoot and JetBlue.

So, whilst low-cost long-haul may have received a lot of coverage in the last few years the reality is that it still only accounts for a very small percentage of all low-cost airline capacity and that perhaps the focus remains in the low-cost mid-range market rather than long-range opportunities.

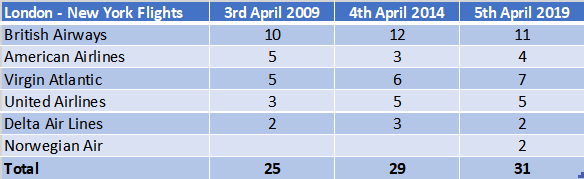

All of which suggest that a very small bit of disruption whilst creating a lot of noise has actually had little impact on the legacy carriers. Taking London to New York, one of the most lucrative legacy airline markets as an example; as the table below highlights the frequency growth of service from legacy carriers has actually been greater than that from the low-cost carrier.

Scheduled Flights London to New York

Source: OAG Schedules Analyser

It may perhaps be argued that the introduction of low-cost services in the market prompted a competitive response from the legacy airlines whilst of course the legacy carriers would perhaps say that building capacity has always been a part of their strategy. Either way, perhaps the ultimate winner is the consumer, faced with increased choice from both legacy and low-cost airlines.

.jpg)

.png)