SOUTHEAST ASIA AVIATION MARKET DATA

LATEST SE ASIA FLIGHT DATA INSIGHTS AND ANALYSIS

DISCOVER THE BUSIEST AIRPORTS, AIRLINES AND FLIGHT ROUTES IN SOUTHEAST ASIA THIS MONTH | FEBRUARY 2026

How much airline capacity is there in Southeast Asia? Find out with new data each month.

In February 2026, the top stats from the Southeast Asian aviation market are:

- Busiest Airport: Singapore Changi (SIN)

- Biggest Airline: AirAsia

- Country with Most Airline Capacity: Indonesia

- Top Destination Region: Asia Pacific

- And discover more...

Find below flight data and analysis focused on the Southeast Asia aviation market, with data powered by OAG's Schedules Analyser. The data is updated monthly. Seats are calculated as departing seats (one-way).

AIRLINE CAPACITY IN SOUTHEAST ASIA | FEBRUARY 2026

How Much Airline Capacity is There in SouthEast Asia This Month?

- Overall capacity in Southeast Asia grew by 8.3% compared to February 2025 to 50.9 million seats.

- International capacity increased by 9%, whilst domestic capacity increased by 7.3%.

- International capacity represents 57% share of the market, and domestic capacity accounts for the remaining 43% market share.

WE'LL LET YOU KNOW WHEN NEW DATA IS ADDED

Add your name to the list and we'll email you once a week with a round-up of the new aviation data added to our dashboards, the latest in-depth analysis from our air travel experts, travel technology news, easy to digest infographics and more.

SOUTHEAST ASIAN COUNTRIES' AIRLINE CAPACITY | FEBRUARY 2026

Which sOUTHeAST aSIAN Country Has The Most Airline Capacity (Domestic + International)?

- Indonesia remains the largest country market in Southeast Asia, with 9.5m seats and a 2.3% increase in capacity this month compared with February 2025. Thailand is the second-largest, with 8m seats, a 7.8% increase in capacity vs last year.

- The country markets growing at the fastest rate are Viet Nam and the Philippines, with a 15.5% and 11.6% increase in capacity (910,700 and 546,700 additional seats respectively) compared with last year.

- Capacity in Myanmar continued to decline by 24.2% vs February 2025, a reduction of 75k seats.

- For more insight into airline capacity, get in touch regarding our flight seat data here.

Which sOUTHeAST aSIAN Country Has The Most Domestic Airline Capacity?

- Indonesia is the largest domestic market in Southeast Asia with 7.5m seats - an increase of 1.8% in capacity.

- Viet Nam recorded the largest increase in domestic capacity by volume, adding 534k seats compared with February 2025.

- Myanmar, by contrast, has seen domestic capacity fall sharply, down 46.1% with 83,000 fewer seats.

Top Ten Largest Southeast Asian Airports by Departing Seats | February 2026

Which is the Busiest Airport in SouthEast Asia?

- Singapore Changi remains the largest airport in Southeast Asia, with 3.4m seats. This represents a 4.4% reduction in capacity compared to last year.

- Kuala Lumpur and Bangkok follow close behind as the second and third busiest airports, both with capacity of 3.35m seats.

- Among the region’s Top 10 airports, Ho Chi Minh City and Hanoi recorded the fastest growth, with capacity up 17.8% and 16.6% respectively year-on-year.

- READY TO VIEW: The World's Busiest Airports of 2025

Airline Capacity By Region | February 2026

Where do International Flights From SOUTHEAST Asia Go?

- Capacity to the rest of Asia Pacific remains the largest international market with 17.9m seats and an increase of 11.7% (1.9m more seats) vs last year.

- International capacity within SE Asia, the next largest market with 6.5m seats, grew by 4% (249k more seats) vs February 2025.

- Capacity to North America continues to grow at the fastest rate this month, increasing by 14%.

TOP 10 LARGEST SOUTHEAST ASIAN AIRLINES BY SEATS | FEBRUARY 2026

- AirAsia continues to be the region's largest carrier with 2.8m seats this month, an increase of 11.4% vs February 2025.

- Vietnam Airlines increased capacity at the fastest rate compared to last year, with growth in capacity of 19.5% - 428,500 additional seats.

- Within the top 10 carriers, Lion Air is reducing capacity the fastest, down 12.8% vs February 2025, with 289,000 fewer seats.

MORE RESOURCES FROM OAG

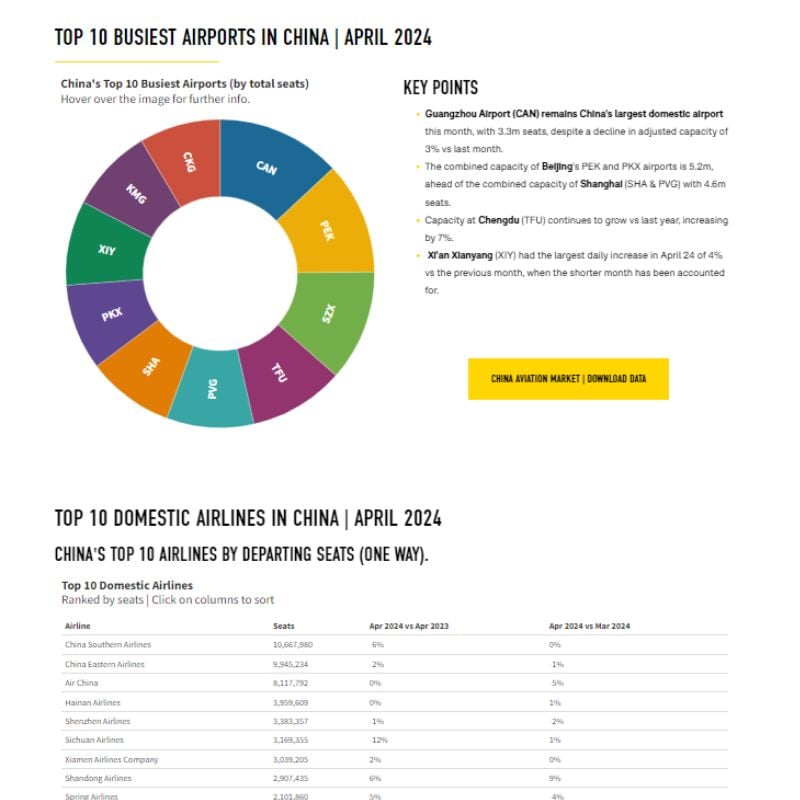

China Aviation market Data

The busiest airports, largest airlines, biggest cities for airline capacity and more

View Data

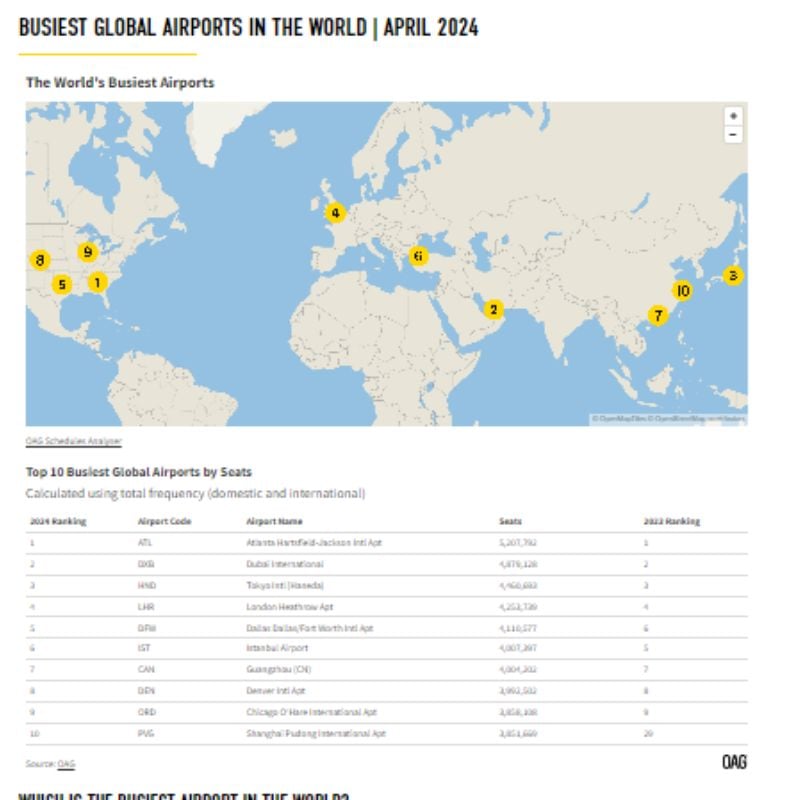

Busiest Airports

Data and analysis on the busiest global, international and regional airports, updated monthly.

View Data

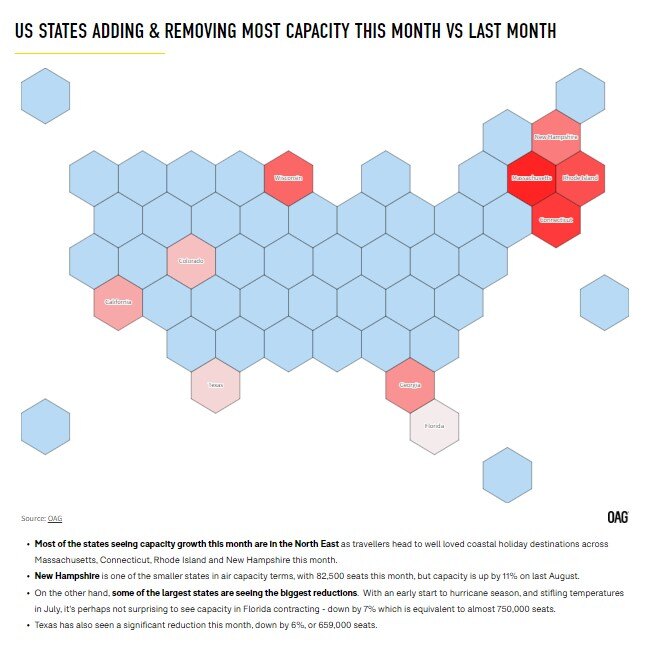

US Aviation Market Data

This month's leading airlines, airports, states and more from the US market.

View Data

Aviation Market Analysis

Analysis of the latest data and developments in the aviation world.

Read Now

.jpg)

.png)