HUMANS VS. MACHINES

TECH MARKET INSIGHTS: AN OVERVIEW

The travel experience remains far from perfect – especially at the airport, where congestion, delays, operational inefficiencies, and a general feeling of stress and chaos can arise at any time.

OAG recently surveyed more than 2,000 travelers through its flight tracking app, FlightView, to identify the biggest opportunities for airports, airlines and technology providers to delight passengers, streamline operations and grow revenue. The most surprising finding: while the travel ecosystem continues to test high-tech investments – including robotics, biometrics, advanced security measures and more – it may be overlooking significantly easier and more affordable opportunities to delight travelers, boost efficiency and grow sales.

These OAG findings provide fresh insight and recommendations for airport, technology and travel leaders on:

THE MACHINES ARE COMING: AUTOMATE OR DISRUPT

Travelers want to get to their destination as fast as possible – and airports, airlines and tech providers are investing heavily in automation to make that happen. But despite the investments, there’s still a lot of waiting around: 50% of travelers report spending at least 45 minutes waiting in line while at the airport, with 21% saying they spend at least an hour in line, on average. While a completely queue-less airport experience may be a pipedream, shorter lines and less congestion benefits everyone.

So, what’s the answer? Many airports and airlines are turning to automation. But according to the travelers surveyed by OAG, automation is not a cure-all, at least not yet.

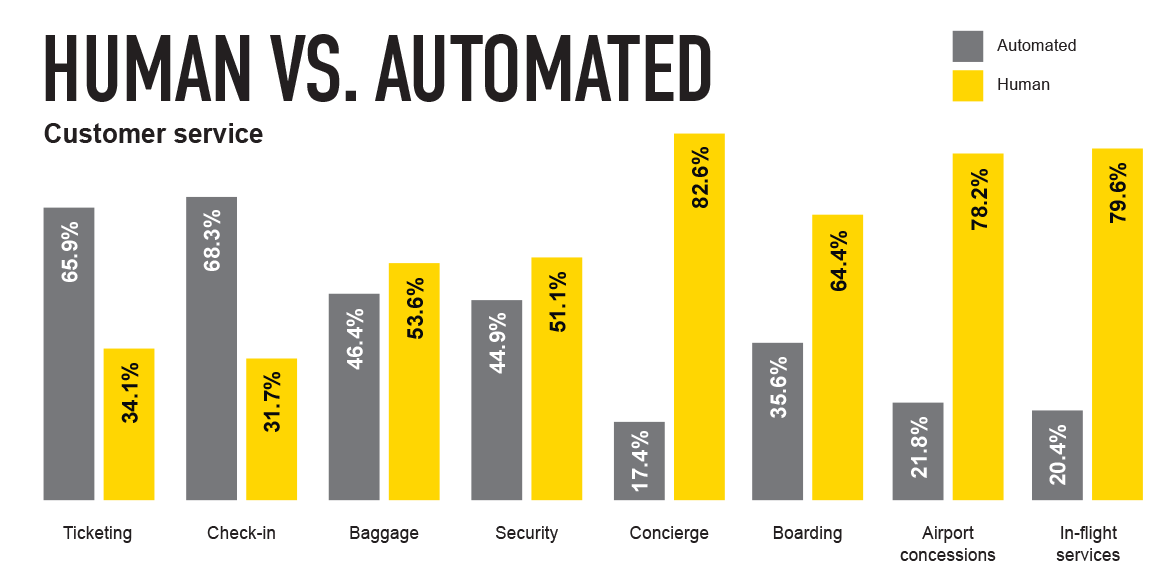

Today, travelers still prefer human customer service to technology automation for almost every travel function, including baggage (54% human customer service preference to 46% automation preference), security (55% to 45%), boarding (64% to 36%), concierge (83% to 17%) and in-flight services (80% to 20%). The only area where most travelers prefer automation to human customer service is ticketing and check-in – both of which are already commonplace today.

While these numbers are somewhat surprising, the shift to automation continues across airports. Digging deeper into the numbers, millennials prefer automation more than the general population in every area except for security. Specifically, millennials are 30% more likely to prefer automated airport concessions and retail and in-flight services compared to travelers 50 years and older. Given that preference levels for automation in several key areas, including security and baggage, were within 10 percentage points of human customer service, OAG expects positive sentiment toward automation to climb over the next few years – and ultimately become the clear preference for most travelers.

Beyond automation, another opportunity to improve airport efficiency and reduce queuing is real-time deployment (and redeployment) of operational resources. Nearly 60% of travelers surveyed by OAG would let airports, airlines and other travel providers track their location through a mobile or wearable device if they used that data to redeploy staff to busy areas of the airport to cut down on wait times and queues.

EXPEDITING AIRPORT SECURITY: SIMPLICITY IS KING

Along with the impact on customer experience, every minute a passenger spends waiting in line directly impacts airport revenue by limiting the amount of time available to visit gate-side shops and restaurants. Not surprisingly, when asked which line travelers spend the most time waiting in, 59% of travelers said security, followed by boarding lines (20%) and check-in and baggage (16%).

While the travelers surveyed by OAG remain eager for new technologies that improve the security process, few are ready for a fully-automated experience. Business travelers were the only group that preferred automation to human customer service for airport security – with preference rates 23% higher than leisure travelers.

Beyond pure automation, many airports are testing new security innovations to streamline lines and improve security. Recent examples include Adelaide Airport, which is testing new 3D X-ray scanners that screen carry-on bags without making travelers remove electronic devices. Similarly, Chicago O’Hare is deploying new 3D scanning technology that allows TSA to more accurately and quickly identify products in carry-on bags. Other prototypes in development – from shoe scanning technology to AI-driven identification tools – promise to speed security procedures by allowing travelers to keep everything – shoes, wallets, jackets, electronics, liquids and more – right where they are.

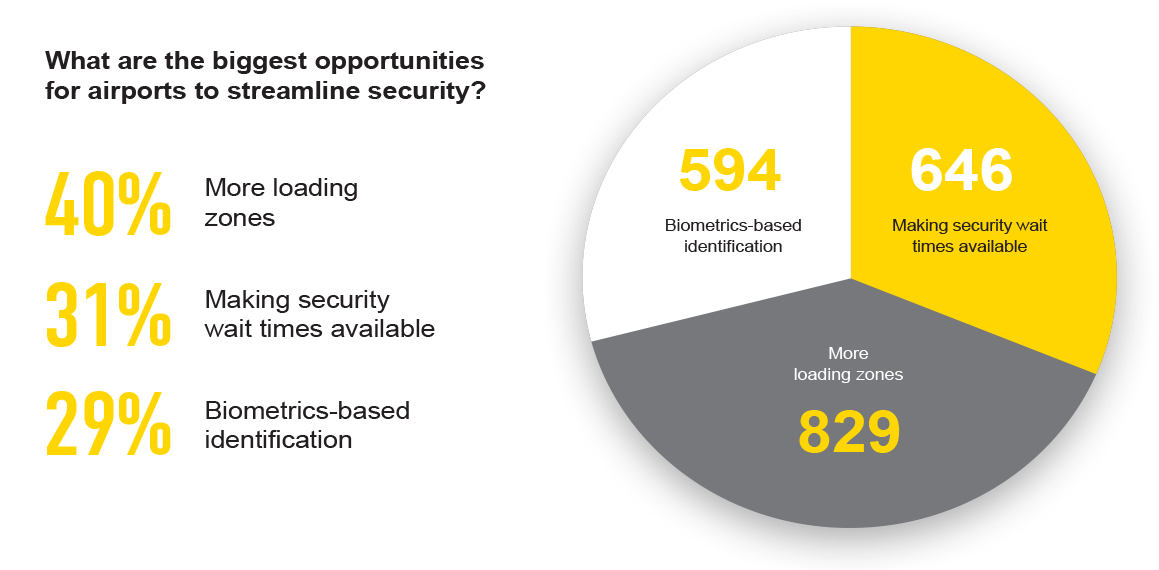

When OAG asked travelers which security development they were most excited for:

But the biggest opportunity for airports to streamline security lines may be a lot simpler. When asked which process change would speed and streamline the security experience the most, the number one response was something much more basic and affordable: the availability of more loading zones for passengers to prepare their bags for scanning (40%). Only 29% of travelers ranked biometrics-based identification processes as the number one choice.

FORGET ROBOTS. TRAVELERS WANT TERMINAL GPS AND ON-DEMAND DELIVERY

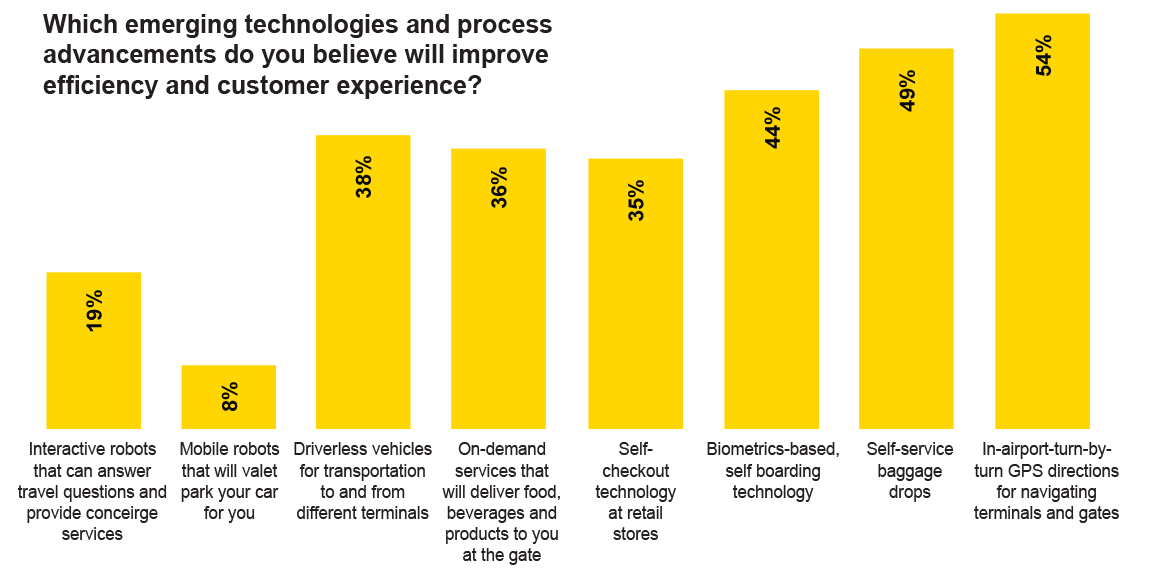

When it comes to the technology travelers believe will improve and streamline their experience the most, the number one answer wasn’t biometrics, robots or any other emerging technologies. It was something much simpler: in-airport turn-by-turn GPS directions for navigating terminals and gates (54%).

Overall, the travelers surveyed by OAG were more skeptical about emerging technologies than expected:

Self-service amenities were in high demand for younger generations. Compared to the total survey population, millennials were:

54% of millennials, 37% of business travelers and 35% of all travelers showed interest in self-checkout options at the airport. While this has become commonplace in grocery and retail stores, in-airport adoption has been slow. But momentum is building: Amazon Go recently announced plans to expand into U.S. airports including Los Angeles International and San Jose.

Overall, consumer readiness for robotics was surprisingly low. Only 19% of travelers said they see value in interactive robots that can answer travel related questions and provide concierge services. Less than 10% said they would value mobile robots that could autonomously park their cars – an approach currently being tested by London's Gatwick Airport and Lyon-Saint-Exupéry Airport in France.

With a healthy skepticism for emerging technology, where should airports, airline and tech providers invest? The answer is intelligence.

Resurfacing the initial finding – that travelers crave simplicity, speed and efficiency – the travel market would be well-served to go back to the basics by investing more in real-time information-sharing and transparency.

Information and intelligence remain critical for improving the travel experience. Of the travelers surveyed by OAG:

Another way of putting it: travelers value accessible and trustworthy information substantially more than emerging technologies like robotics and biometrics.

Airlines and airports will continue to test and deploy emerging technologies – and rightfully so. Many of these innovations have the potential to completely transform the travel experience by making the day-of-travel faster, less chaotic, more enjoyable and secure. In the process, it’s imperative to not overlook the basics of delighting travelers: an informed traveler is a happy and relaxed traveler, and relaxed travelers spend more.

UNTAPPED OPPORTUNITIES: DRIVING GATE-SIDE REVENUE

Where do travelers spend most of their time while waiting for their flight?

Travelers spend most of their time at the gate over fear of missing an important update. Naturally, gate clustering limits consumer spending, and anecdotally, tends to increase the general feeling of stress, anxiety and congestion at the airport.

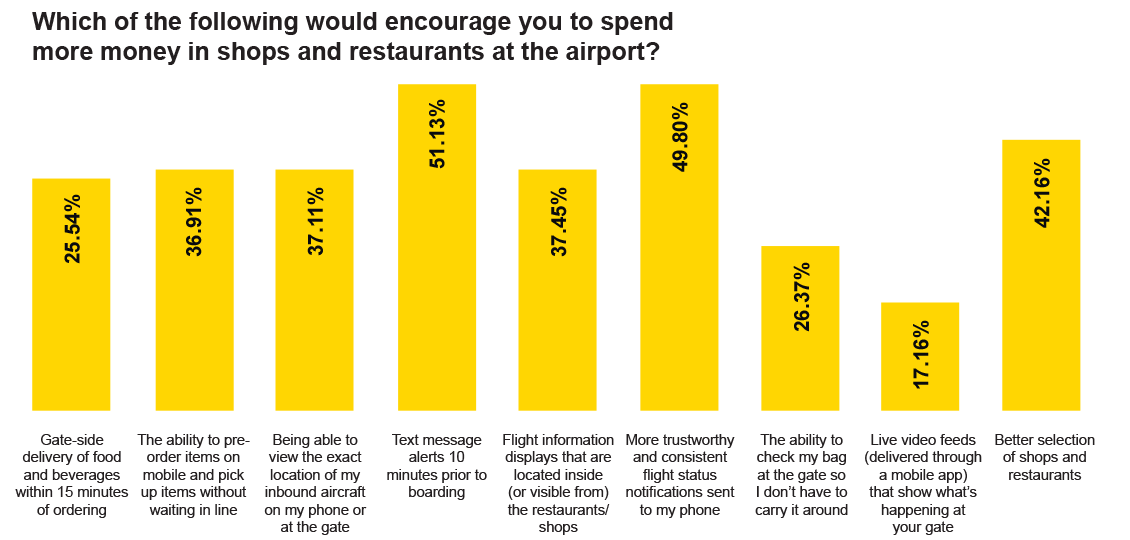

Shifting these numbers – even slightly – will have significant positive ramifications for airports, airlines and retailers. OAG asked travelers which technologies and process improvements would encourage them to leave the gate and spend more money at shops and restaurants. The answer was clear: more consistent, proactive and trustworthy flight information:

The top two responses: text message alerts 10 minutes prior to boarding and more trustworthy and consistent flight status notifications sent directly to phones.

Another revenue opportunity that’s ripe for airports and providers to capitalize on: on-demand, gate-side delivery and pre-ordering through mobile. In fact, OAG found that only 6% of travelers have pre-ordered food or drink for pickup at a gate-side restaurant, but 66% would consider doing this in the future. Similarly, only 9% of travelers have ordered gate-side delivery of food and drink, but 62% are willing to try it in the future.

Several startups are looking to capitalize on gate-side food delivery. This year, San Diego International Airport became the second airport in the U.S. to capitalize on app-based food delivery within the airport through its deployment of “At Your Gate”, a mobile app and delivery service that bills itself as an “in-airport personal shopper.” In addition to passengers, these services benefit airport, airline and service employees, who often have even less time to grab food and drink than travelers. A similar service, Airport Sherpa, has been operating at Baltimore/Washington International Airport since July 2018.

OAG’S TAKE: FOUR STEPS TO IMPROVE THE AIRPORT EXPERIENCE, GROW REVENUE AND STREAMLINE OPERATIONS

Interested in finding out more about OAG's data solutions and analytical platforms?

We can give you trial access to a range of our tools, send you a sample file of our data or consult on the right data feed for you.

Request a free trial today and speak to an OAG representative to discuss your exact needs and requirements.

Americas - +1 800 342 5624

Asia Pacific - +65 6395 5888

China - +8610 5095 5965

Japan - +81 3 4578 7293

Europe, Middle East, Africa - +44 (0)1582 695050

Copyright 2023 OAG Aviation Worldwide Limited | Registered in England and Wales. Company No. 08434134