HOW GREEN IS YOUR AIRLINE?

"ENVIRONMENTAL STEWARDSHIP IS THE EXISTENTIAL THREAT TO OUR FUTURE ABILITY TO GROW"

Ed Bastian, CEO Delta Air Lines Airline speaking at 12th December 2019 Investor Day 2019

(Reported in Atlanta News Now)

Scientists may have been talking about climate change for years but 2019 was the year when the issue went mainstream. Even as the year ended, the news was filled with stories about rampant bushfires in Australia and flooding in Indonesia. As the evidence mounts that the earth is warming, climate related impacts are both being seen more widely and are also being reported more widely by a media thirsty for news which makes headlines.

For aviation, which accounts for 2.4% of global CO2 emissions, according to the International Council on Clean Transport, it is a difficult time. Arguably, the industry has been reluctant to engage on the topic, at least in public, although behind the scenes there have been plenty of measures taken to significantly improve the impact of flying aircraft. The problem, however, is that no matter how fast the industry brings down CO2 emissions, the number of people flying grows faster. As other industries reduce their dependence on fossil fuels, an industry dependent on kerosene, as aviation is, risks accounting for an evergrowing share of global emissions. The industry faces the real possibility that it could become a toxic brand within the next decade.

In this paper, OAG aims to take a dispassionate look at the problem, the action the industry has been taking, the difficulties associated with communicating with the public, and possible consumer responses to flying as a result of climate change.

WE LIKE TO TRAVEL. WE LIKE TO FLY.

Anyone who read the bestselling book The Silk Roads by Peter Frankopan a few years ago will have been struck by the extent to which people have moved vast distances across land to explore new places, trade and settle over the course of two millennia. The same is true today. People love to travel, and air travel has become a core part of the process. Since mass air travel became a possibility, little stopped our appetite for it. When OAG analysts tracked the impact of major global events such as 9/11, SARS outbreak, the eruption of volcanoes, global recession, etc., which temporarily reduced growth in air travel, the effect has been just

that - temporary. Within months, or at most 2 years, growth returned to a level similar to before the event.

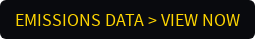

Since 2000, the number of aircraft seats capacity) has grown at an average annual rate of 3.6% while Available Seat Kilometres (ASKs) have grown by 4.6%. The faster growth of ASKs than seats indicates that the average flight is longer than it used to be.

In the dying months of 2019, teenage activist Greta Thunberg captured the attention of millions with her long-distance travel across the Atlantic, hitching a ride on a yacht and choosing to travel by train when making a six-country tour across Europe. Her lack of compromise is hugely challenging for the many people genuinely concerned about the impact of their flying habits; and the impact it is having; those who have until now been able to compartmentalise air travel on the one hand, and concern for the environment on the other. Many in the aviation industry probably fall into that category too.

The question going forward will be whether consumer habits will change, and whether any change will be permanent. Will flygskam, or flying shame, lead to a significant and sustained reduction in air travel, or is it just a localised and temporary phenomenon occurring in Northern Europe which has captured the attention of the media?. There is no doubt that there has been a discernible impact on air travel, with the first warnings coming out of Sweden.

Swedavia, the Swedish airport operator, published year-end statistics for 2019 that showed a 4% decrease in passengers at their Top 10 airports, while domestic passengers fell by 9% in the year[2]. It would be easy to rush to the conclusion that this is attributable to concern for the environment, given the media coverage, but the reasons may be more complex.

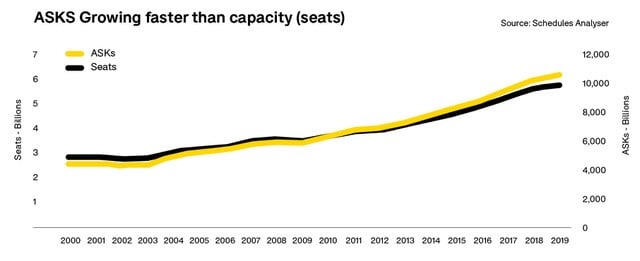

OAG data for traffic from European markets, split out by airlines based, or domiciled, in each country and the all others, shows that in the first nine months of 2019 across Scandinavia and Switzerland passengers seemed to be flying less, at least on their national airlines. Swedish airlines saw the biggest impact with numbers down by 4.1% but foreign airlines flying to Sweden saw passenger volumes rise by 5.9% year-over-year. Across most of Europe, passenger numbers increased.

It is too simplistic, though, to attribute what we are seeing in Scandinavia to concern for the environmental impact of flying. Between July and October 2019, according to OAG data, traffic from Sweden was down by 22% at Norwegian and traffic at sister airline Norwegian Air Shuttle was down by 7%. While Braathens also saw a drop-in traffic of 11%, at SAS the number of passengers was the same as the previous year and Ryanair grew traffic by 9%.

Even in Sweden the drop in traffic is not being experienced across all airlines. In fact, much of the traffic reduction can be attributed to Norwegian which has been very public about its efforts to reduce capacity and cut loss-making operations to support profitability. The primary reason for its drop-in traffic is that it was flying less.

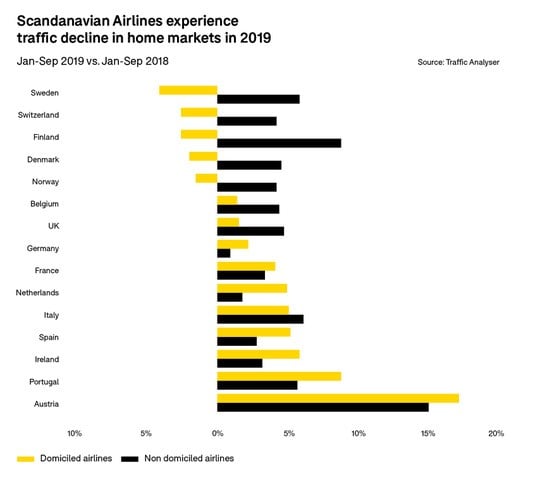

So, is there a flying shame effect? According to OAG Traffic Analyser, there has certainly been a reduction in flying within Western Europe. While headline traffic numbers broadly tracked passenger volumes month-by-month in 2018, as 2019 past overall growth reduced and August saw a fall of 1% in traffic, October’s was down by 1% and November’s was down by 1.5%.

However, what people say they want and what they actually do can often be two very different things. Austrian Airlines have been offering carbon offsetting for some time but fewer than 1% of passengers pay to offset their carbon emissions[3]. Similarly, KLM offers a CO2ZERO scheme for carbon offsetting but in 2018 only 88,000 passengers travelled carbon neutral. That’s fewer than 0.5% of all passengers carried by KLM.

[3] https://simpleflying.com/austrian-airlines-carbon-neutral-growth/

TECHNOLOGY AND MAKING REAL REDUCTIONS

Against this lethargy by the travelling public, the aviation industry – airlines, airports, manufacturers, air traffic control – has been working hard to reduce emissions. Of course, this is not simply an altruistic exercise; airlines experiencing the high oil prices of 2008 or the period between 2011 and 2014 know the risk to their businesses when fuel makes up such a high proportion of operating costs. Improving the efficiency of aircraft and operations, in general, has been a major strategic goal.

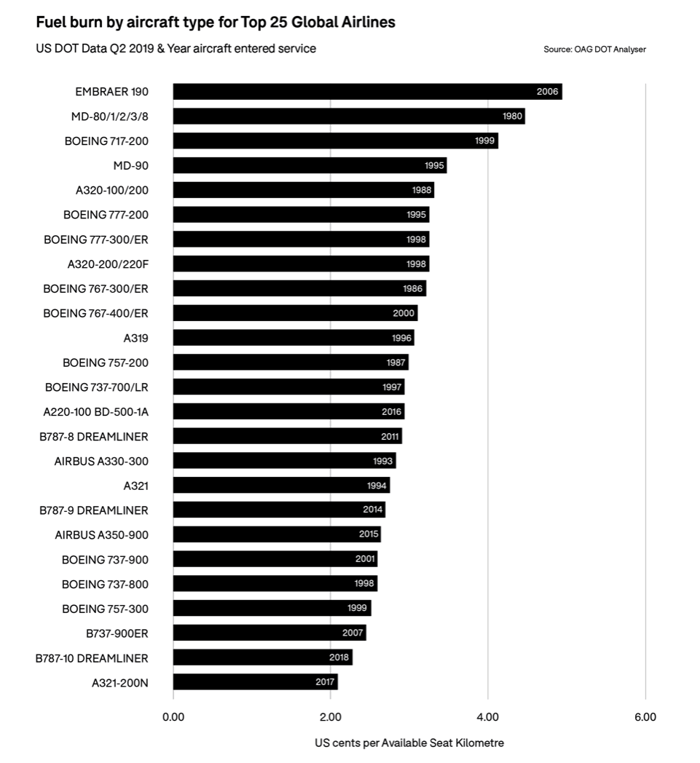

The result has been new aircraft types and airlines replacing older ones with newer, more efficient versions. Data sourced from OAG DOT Analyser on the 25 largest airlines in the world by aircraft type for flights to and from the United States shows how average fuel burn has improved with newer aircrafts although short-haul aircrafts cannot be easily compared with planes flying longer routes and the effect of fuel hedging by some airlines can mask real underlying trends.

According to Airbus, CO2 emissions for today’s aircraft are 80% lower than they were back in 1970. Boeing claim that the B787 Dreamliner uses 20-25% less fuel on a per passenger basis than the planes it replaces.

This is one of the facts which Europe’s largest low-cost airline, Ryanair, uses to make claims about being Europe’s greenest airline, never mind that it has flown on average 7% more airline seats each year for 10 years, far exceeding the improvements in aircraft emissions.

Newer and more efficient aircrafts may be the most obvious technological advance but there are numerous other smaller measures which airlines and manufacturers have been taking.

- Aer Lingus worked with the Irish Aviation Authority (IAA) in 2018 to reduce the amount of time landing lights were extended in both climb and descent. Following a successful to IAA regulations, Aer Lingus’ A320 fleet now saves an additional 620 tonnes of fuel per year.[4]

- Aer Lingus’s new A321 neos with a new generation engine type and sharklets reduce fuel consumption by 15% compared to existing planes.[5]

- At JetBlue new efficient A220 aircraft consume 40% less fuel than outgoing Embraer 190 aircraft in the fleet.[6]

- In 2018 KLM realised a reduction of 11,000 tons of CO2 emissions through route optimisation and 4,400 tons of CO2 through weight reduction.

- KLM has also been a pioneer in the area of sustainable biofuel which may emit 80% less CO2 compared to fossil kerosene.

- Jetstar’s A321neo (long range) aircraft which begin arriving in 2020 15% less fuel than the aircraft they are replacing.[9]

- Qantas is replacing its B747 fleet with newer B787 Dreamliners which burn 20% less fuel.[10]

- On landing Austrian Airlines pilots taxi to the gate using just one engine, a measure which has, according to the airline, saved 11,000 tons in CO2 each year. Austrian Airlines has also reduced onboard weight by removing some newspapers, replacing carpets and life-jackets with lighter models and by removing coffee machines on board. [11]

[4] “How Aer Lingus Worked with Regulators to Cut Emissions”, Simple Flying, 3rd December 2019

[5] “How Aer Lingus Worked with Regulators to Cut Emissions”, Simple Flying, 3rd December 2019.

[6] “JetBlue: New Airbus A220s to offer more seats, bigger bins on Embraer routes, 11 July 2018, USA Today

TARGETS, OFFSETTING AND BENCHMARKING

Against this backdrop of real improvements in performance, the industry has come together to set collective targets. Most notable are those published by IATA, the scheduled airline industry association, back in 2009. They are:

- An average improvement in fuel efficiency of 1.5% per year from 2009 to 2020

- A cap on net aviation CO2 emissions from 2020 (carbon neutral growth)

- A reduction in net aviation CO2 emissions of 50% by 2050, relative to 2005 levels.

The problem with these, of course, is that because of the continued growth in air travel, there is a gap between the actual emissions and the targets with offsetting being the only realistic near-term solution. For many climate change campaigners, off-setting isn't a solution at all. It is simply paying someone else to fix the problem or buying your way out of the problem. Herein lies the issue for the industry. How should it be communicating what it is doing without simply being accused of greenwashing? While Delta Air Lines can claim that it has not increased its carbon footprint since 2012, capping emissions at what they were in that year, it could not have achieved this without offsetting.

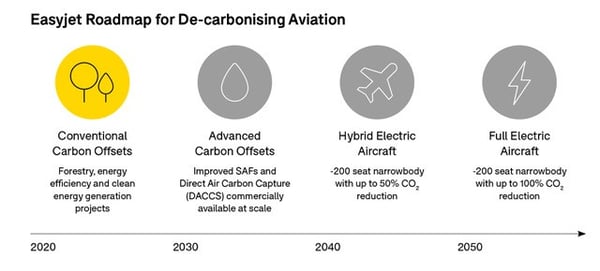

The second half of 2019 saw a number of airlines push out statements about offsetting, or being carbon neutral from 2020, as the scale of the threat to their long-term business appeared to increase. Easyjet is among those airlines, saying it will become the first carrier to offset carbon emissions from all flights soon. CEO John Lundgren admitted in an interview that this is not a perfect solution, calling it an interim step before new technologies come into play, and saying this is what customers want. [12] In a sign of intent, the airline also signed a Memorandum of Understanding with Airbus for a joint research project on hybrid and electric aircraft.

To its credit, Easyjet went further than most airlines in presenting to investors a technology roadmap for short haul airlines. It may be very short on details but highlights that it is this lack of a roadmap from where we are to where the industry needs to be.

Qantas has been offsetting for 10 years and claims to operate the largest offsetting programme of any airline. It phrases the use of offsetting as part of the transition to a low carbon economy. In July 2019 the airline launched a scheme where frequent fliers earned rewards for what they spent on offsetting.

In the meantime, there are various industry initiatives which try to combine a mix of evidence of actions being taken, targets, benchmarking and public communication messages. Pre-eminent among them may be the Carbon Offset and Reduction Scheme for International Aviation (CORSIA) being set up and implemented by the UN’s International Civil Aviation Organisation (ICAO). CORSIA provides a standard mechanism to calculate off-setting requirements for airplane operators but participation is voluntary in the pilot which extends through 2023.

While CORSIA is still to get up and running, in Europe the more ambitious European Emissions Trading Scheme (ETS) has been in place since 2005 and accounts for over three quarters of international carbon trading.[13] While ICAO would like CORSIA to be the only offsetting mechanism available, there is a reluctance by the EU to encourage States to move away from the ETS. The two schemes differ in that ETS is a market-based mechanism with a carbon price that can rise and fall, while CORSIA requires airlines to make payments to offsetting schemes.

Aside from these schemes which are focussed on reducing net carbon emissions, there are a number of schemes aimed at proving the sustainability credentials to the investor community such as CDP, the Dow Jones Sustainability Index, MSCI ESG, FTSE4Good and others. These provide scores and ratings and an evidence base for proving the environmental, social and governance (ESG) credentials of companies and can often be seen listed in the annual reports of airlines.

CDP[14], for instance, is a global not-for-profit body that runs a disclosure system for investors, companies, cities, states and regions regarding their environmental footprint. It gathers data, and scores companies on their performance, and makes this data available to investors. Over 8,000 companies participate, many of them global household names, and in 2018, 139 made it to the CDP climate change ‘A List’. Perhaps not surprisingly, there were no airlines among them, although many of the world’s largest airlines participate.

Arguably, these initiatives have been too slow. They have also been aimed at the industry and at investors but as the scale of the PR challenge has picked up pace through the latter half of 2019, airlines have been increasingly taking their message about how green they are directly to the travelling public.

THE PR BATTLE

There are a range of strategies available for airlines wanting to take their sustainability message direct to consumers. Many have been producing Sustainability Reports for some years, laying out their approach but these are only ever a rehearsal of the arguments needed in battle for public opinion. Similarly, some airlines have dedicated areas of their website, such as Air Canada’s ‘LeaveLess’.

KLM took one of the first bold moves by taking out a large print adverts in June 2019 asking the public to fly responsibly. It was almost a request to fly less.

This direct approach was designed to build trust and convey an honesty about the problem, however KLM’s fleet is ageing, and it would be hard for the airline to boast of its fuel-efficient planes. The very fact that a major airline was hinting at shaming its passengers shows that climate change concerns are increasingly difficult to ignore.

Subsequently, a number of airlines have issued press statements about revised and more ambitious targets. A common theme is the aim to be carbon neutral by 2050, as opposed to have reduced carbon use by 50% by 2050, as in the original IATA target. These include Aer Lingus, British Airways, Qantas and Virgin Atlantic

British Airways went a step further in October 2019, announcing that it would be offsetting emissions on all UK domestic flights from 1st January 2020. This move requires a small increase in fares, and it should be noted that domestic ASK’s accounted for just 3.5% of all British Airways ASKs in 2019.

If passengers are saying they want and expect airlines to take action on their behalf, but when it comes to checking the box where they sign up personally for offsetting and the associated extra cost, will we see a similar response from more airlines?

ARE NEW TAXES AROUND THE CORNER?

While consumers are free to make choices based on their pocket and conscience, governments have a role too. Economists will point to the need to use taxation as a means to drive consumer behaviour, but this is one area the industry has been keen to keep a lid on. Johan Lundgren, CEO of Easyjet, speaking at the Aviation Festival in London in September 2019, said that higher taxes will reduce the pool of funds to invest in modern technology required for cleaner airplanes. He is right, but if we are indeed facing a climate emergency, the industry needs to wake up to the fact that taxation, whether of passenger flights, frequency fliers or aviation fuel, will likely be surfacing as part of a potential solution in the next year. Within the European Union the idea of taxing flights is gaining some momentum. France announced a new tax on airlines operating from its airports in July 2019 ranging from 1.5 euros for domestic and intra-European flights to 18 euros for business class tickets outside the EU. There is now a coalition of nine countries asking the EU to consider ‘aviation pricing’.

Meanwhile, in the UK, the government has been quick to consider the option of removing domestic Air Passenger Duty as a means of giving relief to struggling Flybe, demonstrating the tensions that exist in policy use around taxation.

THE YEAR AHEAD FOR SUSTAINABLE FLYING

Concern about climate change is not going away. What we have seen in the past year is consumer concern ramp up considerably. Flying shame may be having a real impact on airline traffic but so far mainly limited to northern Europe and the effect remains relatively modest to date. Will 2020 see this go mainstream or will the usual response of airlines to soft forward bookings be to lower fares and stimulate demand among a public that readily chooses a bargain?

Offering passengers the option of choosing to pay to offset their flights has barely made a dent on emissions when presented as an extra cost. Increasingly, consumers expect businesses to clear up the mess themselves, so we will likely see more airlines say that they are picking up the cost for offsetting. However, timing will be key timing will be key as airlines don’t want to raise costs before competitors.

In the arena of public policy, pressure will mount on governments to use the stick as well as the carrot, adding taxation to the arsenal of tools available to reduce emissions alongside voluntary measures.

In the meantime, for all the data being gathered, there is a lack of data available to consumers to make choices about whether some airlines are better to fly with from an environmental perspective. Carbon Calculators, although widely available on various websites, don’t reflect the measures being taken by individual airlines, such as the efficiency of the operation and the fuel burn of the type of aircraft being used.

WHAT DO CONSUMERS NEED FROM AIRLINES?

Against this backdrop, what do consumers actually want or need from airlines? There are numerous ‘carbon calculators’ on the internet but mostly they simply take data about the distance being flown to calculate a likely fuel burn, a proxy for carbon emitted. No account is taken of the airline and whether it is an airline that has taken more measures to reduce emissions, or not. Aircraft type is also not being taken into account, yet we know that one aircraft can be massively more efficient than another. But how much visibility does the traveller really have of that? These online tools can help air travellers calculate their offsetting but can’t really do much for helping them choose between a better or worse flight, or a better or worse airline.

And, as we have already seen, there is scepticism about offsetting. When large businesses offer offsetting as part of their menu selection, is it surprising? It’s another cost item in the shopping basket, being offered by a big business which may be perceived as part of the problem in the first place. The more an airline flies, the more carbon emissions it generates. How full on average an airlines’ aircraft is can provide an indication of the per passenger fuel burn, and therefore per passenger emissions. A fuller aircraft means that per passenger emissions are lower. The average age of aircraft in an airlines’ fleet provides a good proxy for how fuel efficient the aircraft themselves are. The key metric which is harder to come by, however, is the average fuel used per passenger kilometre on an airline basis. Except for the US Department of Transport, there is little requirement for airlines to report this data and while some airlines voluntarily report fuel used per passenger per kilometre, this is far from standard practice.

While airline annual reports and presentations to investors are full of what they are doing to be greener, it seems that there is a need for new industry-wide metrics which allow consumers to make informed choices that go beyond whether to fly or not, but how to choose one airline over another.

Free trial

Interested in finding out more about OAG's data solutions and analytical platforms?

We can give you trial access to a range of our tools, send you a sample file of our data or consult on the right data feed for you.

Request a free trial today and speak to an OAG representative to discuss your exact needs and requirements.

SUSTAINABILITY

Exploring a more sustainable future for aviation, including SAFs, carbon-neutral travel, and flight emission data.

MARKET ANALYSIS

Expert analysis on the most in-depth, up-to-date flight data and aviation industry news.

FUTURE OF TRAVEL

Discover the new technology shaping the future of travel for airlines, travel companies and tourists.